Editor’s note: Seeking Alpha is proud to welcome Benjamin Halliburton as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Razvan/iStock Editorial via Getty Images

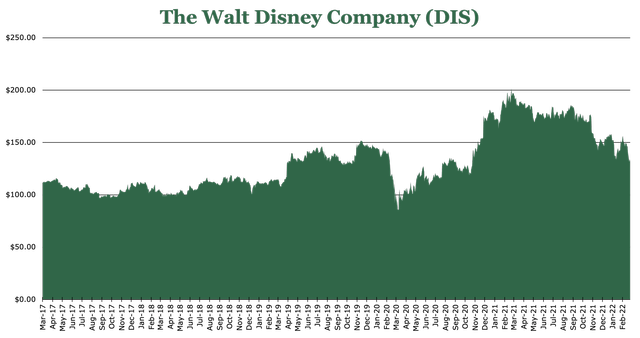

The Walt Disney Company (NYSE:DIS) is poised for the future with the launch of Disney+ and the recovery of theme parks. This multinational media conglomerate, most famous for its theme parks and movies, is expanding into the direct-to-consumer streaming model with great early success with its new Disney+ family of products. With COVID-19 lockdowns ending, parks and cruises are reopening and seeing surging numbers, increasing revenues. Despite all this, coverage remains heavily focused on the value of Disney+ and its family of products in the direct-to-consumer segment, which we believe has caused people to miss the forest for the trees. Disney is still a massive, multinational entertainment giant and the primary focus is still the continued expansion and operation of its theme parks and related experiences.

Here’s the estimated value of the core business (excluding direct-to-consumer):

- Normalized earnings power of Disney: $8.00

- Normalized PE of Disney: 20

- Core Disney = $8.00 * 20 = $160

- Direct to Consumer (Disney+, ESPN+, etc.): $30 to $46 per share (detailed below vs. NFLX)

- DIS total $190 to $206 per share

However, we believe that the embedded value of Disney’s direct-to-consumer streaming options with their massive subscriber growth adds incremental value to the stock and the existing business. The streaming business is not yet profitable but has a value which we detail below. As a result, we give Disney a buy rating, especially for long-term growth investors at a price point below $145.

|

Walt Disney Company |

E2022 |

E2023 |

E2024 |

|

Price-to-Sales |

2.8 |

2.5 |

2.4 |

|

Price-to-Earnings |

29.8 |

23.3 |

19.7 |

|

EV/EBITDA |

18.3 |

15.5 |

13.7 |

Pricing in Direct-To-Consumer

Direct-to-Consumer (D2C) domestically includes Disney+, ESPN+, and Hulu. This is one of the newest streaming options available to consumers but proves popular as its growth increases. However, it is difficult to precisely price in separately from Disney and determine its ultimate success with other streaming choices like Netflix (NFLX) and Amazon (AMZN) Prime Video. Disney+ includes 33,000 episodes and 1,850 movies from Disney and its subsidiaries’ television and film library, including 75 original series and 40 original movies.

ESPN+ is a subscription service that offers subscribers live sporting events and on-demand sports content, including replays and original programming. Formed from the former spin-off BAMTech, ESPN+ is currently the exclusive distributor for UFC pay-per-view events in the U.S.

Hulu is a subscription service that offers live TV, original content, and licensed content. Hulu also includes bundling, allowing subscribers access to HBO, Cinemax, Starz, and Showtime. Hulu is owned 66% by Disney and 33% by NBC Universal. While it is difficult to price out the value of direct-to-consumer streaming exactly has for Disney shareholders, the revenues for the segment are increasing quickly, rising by 38% quarter over quarter.

During the 1Q22 presentation, Disney announced its intent to add an ad-supported subscription to launch in late 2022, similar to Hulu. This will cost less than the present $7.99 a month and bring more families looking to save money into the addressable market, particularly during this high-inflation environment.

Disney+ has a monthly ARPU (Average Revenue Per User) of $4.12. Less than Netflix, the value of exclusive shows and additional programming coming to Disney+ could provide pricing power and allow Disney to raise its price.

(Note: ARPU is not provided by the company. “Premium” add-ons are not included in the price. Therefore the base price is used as ARPU.)

Disney is reporting higher losses at Disney+ and ESPN+ related to higher programming and production budgets. The direct-to-consumer segment operated at a loss of $1.6 billion in 2021. In 2022, Disney expects to spend about $8 billion more on licensing and producing content.

Originally, Disney+ was started as a service to simply give consumers access to the expansive Disney catalog of movies and shows, expecting to gain 60-80 million subscribers by 2024, launching in tandem with ESPN+, after the acquisition of BAMTech. Instead, Disney found itself a massive opportunity to break into a market dominated by Netflix and Amazon, to which it quickly embarked on a campaign of expansion, acquiring 20th Century Fox in 2019 (giving it a large share of Hulu), and purchasing NHL’s 10% remaining stake in BAMTech for $350 million, renaming the company to Disney Streaming Services. This leaves MLB’s remaining stake of 15%, which Disney can purchase for $752 million should the MLB exercise its option to sell. Additionally, Disney has the opportunity to purchase the remaining 33% stake NBC Universal has in Hulu as early as 2024.

Disney+ across all markets saw a 37% increase in subscriber count, from 95 million in 1Q21 to 130 million in 1Q22. We have produced an estimate of what Disney+ and other Disney streaming properties might be worth based on Netflix as a comparable if they expanded to a global audience through subscriber-based and revenue-based valuation.

To establish a baseline, Netflix has a price-to-sales ratio of 4.5x, which we will use to value based on revenues. Additionally, across its 222 million subscribers, its revenues are nearly $30 billion: giving it a value per subscriber of $675.54, which we will use for the subscriber valuation.

First is subscriber-based valuation. Disney+ globally has 130 million subscribers with an ARPU of $4.12, bringing a realistic revenue estimate to roughly $6.4 billion per year. To better factor in churn, customer loyalty, and other intangible factors, we will count the average Disney+ subscriber as worth one-third of a Netflix subscriber. We will do this across all of the D2C segments to better provide a conservative estimate.

ESPN+, Hulu, and Hulu+Live TV are only available in the United States, but they have 45 million, 21 million, and 4 million subscribers, respectively. ESPN+ has an ARPU of $5.16, giving us a realistic revenue estimate of $1.3 billion – just as we did Disney+, we will factor ESPN+ subscribers as one-third of a Netflix subscriber. Hulu has an ARPU of $12.96, giving a revenue estimate of $6.9 billion, and we will count a Hulu subscriber as one-half of a Netflix subscriber. Finally, Hulu+ Live TV with a large ARPU of $84.89 and an estimated $4 billion in revenue – because of the relatively high ARPU, we will count a Hulu + Live TV subscriber as two Netflix subscribers.

This brings us to our implied value table, based on subscriber count.

|

Service |

Implied Value |

|

Disney+ |

29,273,400,000 |

|

Hulu |

15,199,650,000 |

|

ESPN+ |

4,728,780,000 |

|

Hulu + Live TV |

5,404,320,000 |

|

Total Implied Value (subscribers): |

54,606,150,000 |

Dividing this by Disney’s outstanding share count, we arrive at the lower end of our fair value estimate of $30 per share of value-added because of the D2C consumer segment.

Next is revenue-based valuation. Recall that we stated that we estimated the revenue already by multiplying the ARPU by the subscriber numbers, arriving at $6.4 billion for Disney+, $6.9 billion for Hulu, and $1.3 billion for ESPN+, and $4 billion for Hulu + Live TV. Multiplying these revenue estimates by Netflix’s price-to-sales ratio gives us the following:

|

Service |

Implied Value |

|

Disney+ |

28,922,400,000 |

|

Hulu |

31,492,800,000 |

|

ESPN+ |

5,851,440,000 |

|

Hulu + Live TV |

18,336,240,000 |

|

Total Implied Value (revenue): |

84,602,880,000 |

Dividing this by Disney’s outstanding share count, we arrive at the upper end of our fair value estimate of $46.49 per share of value-added because of the D2C segment.

Therefore, our value range for the D2C segment is $30 to $46 per Disney share. A summary table is presented below.

|

Netflix |

|

|

Market Capitalization |

$149,970,000,000 |

|

Revenues |

$29,515,496,000 |

|

Subscribers |

222,000,000 |

|

Price to Sales |

4.5 |

|

Value Per Subscriber |

$675.54 |

|

Disney+ & Streaming Implied Valuation based on Netflix |

|

|

Revenues |

$18,800,640,000 |

|

Implied Value from Revenues |

$84,602,880,000 |

|

Implied Value per Share |

$46.49 |

|

Subscribers |

80,833,333 |

|

Implied Value from Subscribers |

$54,606,150,000 |

|

Implied Value per Share |

$30.00 |

Disney Parks, Experiences, and Products

With so much news and coverage surrounding the D2C segment, it is easy to miss the forest for the trees; Disney is a powerhouse of experiences with a globally recognizable brand.

Parks and Experiences (P&E) includes all of the park properties in Florida, California, Paris, Hong Kong (48% ownership), Shanghai (43% ownership), and Tokyo (licensed out operation). Across all park properties, Disney owns approximately 40,000 rooms in hotel space and tens of thousands of square feet in leasable convention space across all park properties. In addition, there are around 25 independent hotels that lease land from Disney, offering approximately 8500 rooms on various properties. Already Disney has seen a massive recovery, an >100% increase in attendance to the parks and hotels sitting at approximately 68% occupancy (pandemic low of 24%). This translates to a 243% increase in theme park revenues (ticket sales and concessions) and a 234% increase in resort and vacation revenues.

Not all parks are fully open without restrictions or open at all, especially overseas. There is still a recovery to be made internationally, with December’s revenue still down nearly 20% compared to pre-pandemic numbers.

|

Segment |

Change since 4Q19 |

Change since 4Q20 |

|

Domestic Parks |

5.4% |

>100% |

|

International Parks |

(18.7%) |

46% |

Additionally, P&E includes the Disney Cruise Line, Disney Vacation Club, National Geographic Expeditions (73% ownership), and Disney properties in Hawaii (Adventures and Aulani Resort and Spa).

Disney Cruise Line operates four ships, operating out of North American and European Ports. Disney Magic and Disney Wonder are 875 room ships, and Disney Dream and Disney Fantasy are 1,250 room ships. Disney Cruise Line also manages Castaway Cay, a 1,000-acre private Bahamian island.

Disney is seeking to expand the Disney Cruise Line business, to include three more ships, with the first being launched in June 2022, with the others being delivered in 2024 and 2025. The new ships are slightly larger than the Disney Dream and Disney Fantasy – but hold the same 1,250 room layout. In addition, these ships are liquid natural gas powered. Disney has an ongoing agreement with the Government of the Bahamas to create a new resort at “Lighthouse Point” on the island of Eleuthera, which is scheduled to open in 2024 as a new Disney Cruise Line experience.

Altogether these show strong recovery; though internationally Disney has not recovered to pre-pandemic levels of revenue, the signs of growth are there. With hotels still only sitting at roughly 68% occupancy, and 3 new cruise ships with 1,250 rooms each, it is clear that there is still significant room for revenue growth and opportunity for expansion.

Disney Media and Entertainment Distribution

Disney Media and Entertainment Distribution (DMED) is a wide-ranging segment that includes Disney’s film and television production studios and distribution activities. The DMED segment is split into 3 lines of business for simplicity, Linear Networks, Direct-to-Consumer (which was already talked about), and Content Sales/Licensing.

Linear Networks (LN) includes the ABC television network and its subsidiary networks, Disney Channels, ESPN (and all affiliated brands, other than ESPN+), Freeform, FX, and National Geographic primarily. Internationally, LN also operates the Star network outside of the US. Additionally, LN owns a 50% stake in A&E television networks, including A&E, History Channel, and Lifetime.

|

Channel |

Millions of Domestic Subscribers |

|

Disney Channel, Disney Junior, and Disney XD |

189 |

|

ESPN |

283 |

|

FX |

196 |

|

National Geographic |

127 |

Not included in these rankings are ABC and its affiliates, of which there are 240 local television stations reaching nearly 100% of U.S. households.

|

Station |

Target Market |

Total US Market Ranking |

|

WABC |

New York, NY |

1 |

|

KABC |

Los Angeles, CA |

2 |

|

WLS |

Chicago, IL |

3 |

|

WPVI |

Philadelphia, PA |

4 |

|

KGO |

San Francisco, CA |

6 |

|

KTRK |

Houston, TX |

8 |

|

WTVD |

Raleigh-Durham, NC |

24 |

|

KFSN |

Fresno, CA |

55 |

Outside of the U.S., LN operates 245 television channels in 180 countries which range in content, primarily through Fox, National Geographic, and Star brands.

|

Channel |

Millions of International Subscribers |

|

Disney Channel, Disney Junior, Disney XD |

399 |

|

ESPN |

64 |

|

Fox |

184 |

|

National Geographic |

320 |

|

Star |

216 |

Most of the revenue from the LN segment comes from advertising revenue, but higher production costs have begun to eat at the margins, in particular during large events like the College Football Playoffs.

Licensing has seen revenue tradeoffs in recent quarters, shifting into operating at a loss in 1Q22 after theatrical distribution of movies has not fully recovered. In addition, marketing material and production are expensed in the quarter it is used, while the bulk of revenue for a film is often spread over a full year or longer. However, we do not expect this segment to recover in any significant fashion as Disney (and many other streaming competitors) have made it clear that they will continue to release movies both in theaters and on streaming services in parallel. In turn, this will shift revenues from licensing toward D2C during theatrical distribution.

Risk

Disney faces a wide variety of risks across its many businesses. The most consistent risk is intellectual property. Many of the most successful IPs (such as Mickey and Minnie Mouse) are leaving copyright and entering the public domain in 2024 unless a further copyright extension is passed by congress. Historically, Disney has lobbied heavily for continuous copyright extensions for its IPs.

The FCC heavily regulates networks, and there are numerous rules and guidelines associated with children’s programming including limits on advertising and limits on the length of programming. At the present time, Disney is unable to acquire any other “major network” as the FCC prohibits ABC, CBS, NBC, or Fox from being under the same ownership or majority control. The FCC also restricts the ability to own more than a single non-cable television station in a market, depending on the nature of the market, and prohibits the aggregate reach of non-cable audiences of 39% per company. At this time, Disney estimates its reach is approximately 20% of the national non-cable audience.

Conclusion

With significant recovery on the horizon and the advent of D2C as a viable business model, it is clear that Disney remains a powerhouse in entertainment and should not be discounted for long-term growth. We believe that the increased coverage of D2C has warped investors’ views and expectations of the stock as a whole, missing the forest for the trees in many cases. Disney has a global physical footprint with significant revenue-generating power, which is only strengthened by the advent and growth of the D2C sector. Disney is a buy, in our opinion, especially for long-term growth investors at a price point below $145.

Be the first to comment