FrozenShutter

(This article was in the newsletter September 1, 2022 and has been updated as needed.)

The news that a hedge fund took a position in The Walt Disney Company (NYSE:DIS) was greeted with at least some temporary cheers from the market. But a lot of these large investors that agitate are no friend of long-term shareholders. The reason is that they often see a chance for immediate profits without the analysis of the benefits or pain to the company long run strategy to build value. The end result to buy-and-hold investors is often mixed.

Sure enough, that same hedge fund now has reached an agreement with Disney management, has reversed course (somewhat) in the demands, and there is now another board member. The main concern here was an old acquisition where the company never was able to take advantage of the acquisition before the covid challenges arrived. Instead, the company, complete with acquisition debt, slugged through those challenges and now, finally, can think about debt reduction. Mr. Market, on the other hand, is concerned about debt (period).

A little background is that Disney acquired Twentieth Century Fox. It was complicated and it took time, and then covid hit. This is prime territory for an activist that will tell you about “mistakes” when really no one in their right mind would have engaged in an acquisition discussion knowing what 2020 was going to entail. Occidental Petroleum (OXY) had exactly the same thing complete with activist investor.

In this case, Disney, like many companies, is recovering from the effects of the pandemic. So, cash flow and free cash flow are nothing close to optimal, as there are parts of the company still ramping up. In line with the ramping up comes news of a “Marvel Shuffle” and subsequent delay. That will impact future cash flows as those movies tend to be blockbusters.

Even so, the current fiscal year, which ends in the current quarter, almost has to be better than what came before it. On the other hand, there still needs to be more profits than what the current year and possibly future fiscal year is likely to report to justify the assets on the balance sheet.

When it comes to movies, probably at least as much action can be expected through December as we have seen so far. There appears to be enough for general release as well as streaming to allow for more blockbusters. More importantly, the next fiscal year should allow for a return to a normal release schedule.

For much of the company, cash has been invested to ramp up operations. As that completes, there will be profits to offset continuing business challenges and potential expansions. Fiscal years 2021 and 2022 largely showed expenses to enable future profits. It was a situation no one saw before all the pandemic challenges hit. There may also be cost reductions as the bottlenecks in the economy from the surprisingly fast recovery fade.

When it comes to streaming, the streaming market battles are very likely to heat up. That is going to cost some serious money from all participants. Everyone at this stage is promising to either decrease losses or increase cash flow. Yet this is not a segment at the current time known for either cash flow or profits. That is not unusual for something relatively new like streaming. However, survivors will have to show a justifiable return, or they will leave the business. That will be much easier for a diversified company like Disney which will likely to be able to show benefits in other divisions from streaming. Under GAAP, those benefits can be used for the other divisions to share some of the streaming costs should that be the case.

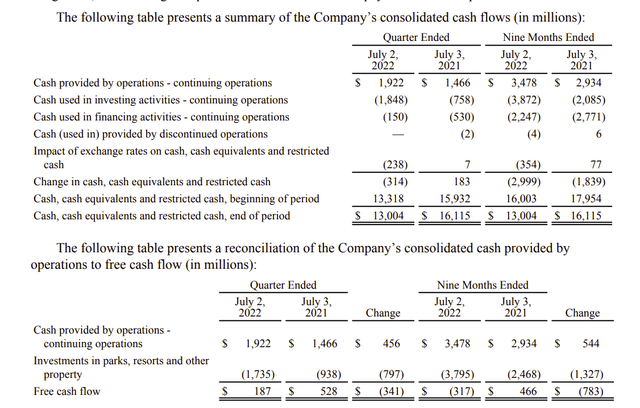

Disney Cash Flow Reconciliation Third Quarter 2022. (Disney Reconciliation Reference On The Company Website Third Quarter 2022)

Probably the larger concern is that cash provided by operations did not increase as much as did reported profits. That sometimes happens in a recovery as current expenses to continue the ramp-up of operations will slow cash flow build. That means that investors should expect cash flow increases in excess of earnings in future quarters.

After that, the cash investments into the company businesses will need to decline. There are still some shutdowns due to the pandemic. That means repeated ramp-up expenses that would delay cash flow build as well as resulting in more current expenses in the earnings calculations. Overall though the coming fiscal year should show a major decline in that category.

The movie business in fiscal year 2023 alone should provide a significant cash flow boost to the amounts shown above. Even the “Marvel shuffle and delays” are unlikely to slow that cash flow build down. The company is known for producing blockbusters periodically. An almost regular full schedule without the pandemic restrictions should be a big boost to results in the coming fiscal year.

It does appear that management is beginning to repay some of the debt that was taken on to maintain a robust cash balance during the challenges of the pandemic. The clamor to rush to spin off ESPN is evidently related to those debt considerations along with a hope that two separate parts would be a lot better than one combined.

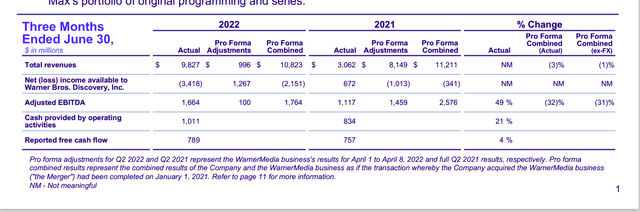

This feeds on the same fears that led to AT&T (T) selling a division to the now combined company that became Warner Bros Discovery (WBD). In this case though, the fears appeared justified because the newly merged company barely reported a cash flow budge in the right direction from the combined companies.

Warner Bros Discovery Second Quarter 2022, Results (Warner Bros Second Quarter 2022, Earnings Press Release)

As shown above, the combined cash flow, even considering one-time expenses for the merger (and house cleaning), is far too low for the combined company. It is even worse when one considers the cash flow for the standalone company before the merger (also shown above for last year). Obviously, if something like this is not quickly corrected, it leads to untenable finances fast. The net result is that AT&T did get far more value for the division than the combined cash flow would indicate it is worth. So, it was a net benefit to AT&T shareholders.

With Disney, it is not yet clear that shareholders would benefit from the spinoff of ESPN. Maybe improvements or ventures into new markets need to happen. Then again, the company is in the entertainment business. Management needs to be given the time to demonstrate whether or not the division can be properly handled. Disney management “know the territory” and has not been known to neglect any part of the business. Now they may take longer to do due diligence than some would like. But that is not the same as neglection.

Anytime someone suggests a spinoff, there is also an underlying hint of potential mismanagement or at least management that is not in the best interest of the division which would also hurt future company consolidated performance. That is an awful big stance for an outsider to take.

As a result, there is really no need for management to move quickly on such a suggestion. It would probably be better for shareholders to defer to management short of abundant evidence that such a spinoff is really needed.

Disney itself has long had an outstanding track record. The last few years have interrupted some significant progress that the company made in the decades before now.

Because of the pandemic, management probably has a full plate of unusual challenges that may last another year or two. So, any outside suggestions are best deferred until there is a few years of normal activity. As much as most of us want things to be normal, not being patient is the one thing that can cost some solid long-term results. Rather than insist upon one or two things, as outsiders frequently do, it is probably far better to let management make decisions from a “big picture” viewpoint where the priorities are set.

Be the first to comment