Vera_Petrunina

Dillard’s, Inc. (NYSE:DDS) operates retail department stores in the southeastern, southwestern, and midwestern areas of the United States. Its stores offer merchandise, including fashion apparel for women, men, and children; and accessories, cosmetics, home furnishings, and other consumer goods.

Recently we have published articles on Seeking Alpha, discussing the financial performance and the impact of the current macroeconomic environment on Dillard’s peers/competitors, namely Macy’s (M) and Nordstrom (JWN). These articles were titled:

- Macy’s: Likely To Struggle In The Near Term, But Buyback Program Seems Attractive

- Nordstrom Is A Hold For Now

In both of these articles we have elaborated on the latest financial results of the companies along with the impact of the poor consumer sentiment, the elevated energy prices, the continuing supply chain issues and the inventory management hurdles.

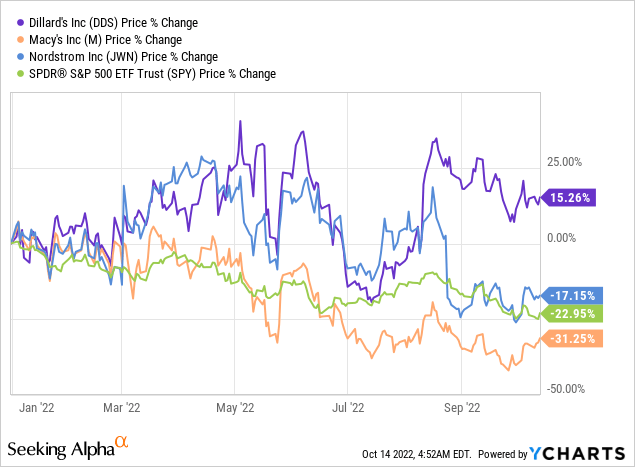

We have decided to take a look at DDS’s business as well, because year-to-date, the company has substantially outperformed both its peers and the broader market. While the firm’s share price has been volatile in the period, it has increased by 15%, compared to the 23% decline of the broader market.

Today, we will take a look at the firm’s latest financial results, and compare DDS to its peers, in terms of profitability, valuation and liquidity. Our aim is to assess whether this outperformance is likely to continue in the near term.

Select Q2 financial results

Net sales

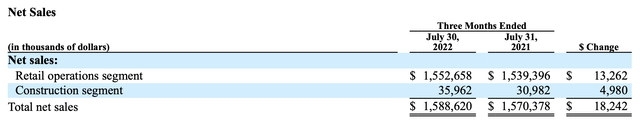

The net sales of DDS have increased slightly year-over-year, reaching a total of $1.553 billion, compared to the $1.539 billion in the same period a year ago.

Compared to its peers, this is not an outstanding growth. While M’s net sales in the same period have slightly decreased, by about 1%, Nordstrom’s net sales have increased by 12%.

At this point, important to see, how the demand for each retailer’s products has developed.

The demand for DDS’s products seems to have been declining:

For the three months ended July 30, 2022 compared to the three months ended July 31, 2021, the number of sales transactions decreased by 8% while the average dollars per sales transaction increased by 8%.

At the same time, Macy’s has also adjusted their outlook based on their expectation of deteriorating consumer spending:

The company’s lower outlook for the remainder of the year incorporates the risk it sees in the continued deterioration of consumer discretionary spending in some of its categories and the level of inventory within the industry, as well as risks associated with a more pronounced macro downturn. This outlook reflects a careful view of the impacts of the pressures faced by the consumer and those placed on the business given the weakening macroenvironment.

On the other hand, JWN’s figures appear much more attractive and promising:

Nordstrom net sales reflected an increase in both the average selling price per item sold and the number of items sold for the second quarter and six months ended July 30, 2022, compared with the same periods in 2021.

By looking at the net sales figures only, we believe that DDS’s outperformance is not likely to last in the near term, as it faces similar macroeconomic headwinds as its competitors, and they do not seem to be addressing these headwinds any better.

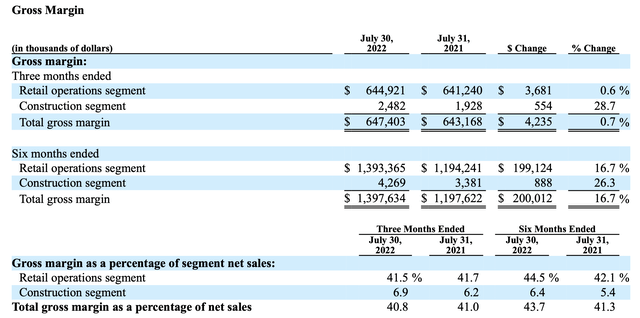

Gross margin

Dillard’s total gross margin as a percentage of net sales has decline by about 0.2% year-over-year in the second quarter.

Gross margin from retail operations, as a percentage of sales, decreased to 41.5% from 41.7% during the three months ended July 30, 2022 compared to the three months ended July 31, 2021, respectively. Gross margin decreased moderately in home and furniture, shoes and juniors’ and children’s apparel. Gross margin decreased slightly ladies’ accessories and lingerie and ladies’ apparel. Gross margin increased slightly in cosmetics, while increasing moderately in men’s apparel and accessories.

Also M’s gross margin as a percentage of net sales has decreased, by about 0.7%, which has been driven by an increase in clearance markdowns in pandemic-related categories and seasonal merchandise and an increase in promotional markdowns as a result of the increasingly competitive pricing environment.

On the other hand, JWN’s gross margin as a percentage of net sales has increased by about 0.6%, reaching 35.2% in Q2.

At this point, we also have to take a look at inventory management. The type of products available for sales can have a large impact on whether discounting is really needed or not.

Inventory management

Dillard’s inventory has increased by about 7%, year-over-year.

This increase is about in-line with the inventory increase of the firm’s peers.

M’s inventory in the same period has increased by also about 7%, while JWN’s inventory has increased by about 10%.

Dillard’s management has attributed their improving gross margins in the first six months to their successful inventory management.

Gross margin from retail operations, as a percentage of sales, increased to 44.5% from 42.1% during the six months ended July 30, 2022 compared to the six months ended July 31, 2021, respectively. Management attributes the improvement in gross margin to positive customer response to the company’s merchandise assortment combined with continued inventory management leading to decreased markdowns in the first six months of 2022.

We believe that compared to its peers, Dillard’s inventory management is not outstanding. While the lack of markdowns and promotions can indeed lead to improving margins, but it also hurts the demand and sales, as we have seen earlier. As stated by Macy’s, the pricing environment is also getting increasingly competitive, therefore if DDS does not react, their sales may be further negatively impacted.

To sum up: Despite the declining gross margin in Q2, Dillard’s gross margin still compares favourably to its peers. However, if they do not introduce markdowns and promotions, most likely they will not be able to increase demand for their products, which may keep hurting their top line results in the quarters to come. If they do decide to use discounting to improve their top line, their gross margin advantage is likely to be substantially reduced. For these reasons, we believe that the firm’s outperformance based on the gross margin advantage is also not likely to be sustainable.

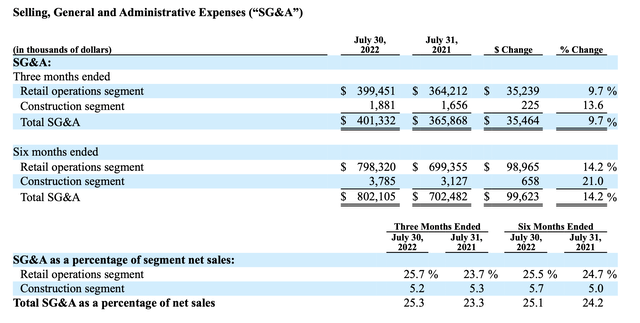

SG&A

SG&A expenses of the firm have substantially increased.

At the same time, SG&A expenses of Macy’s have also increased by about the same extent, while JWN’s SG&A expenses have decreased slightly.

As a percentage of net sales, DDS still shows the most attractive figures in the second quarter: 25.3%, compared with M’s 35.4% and JWN’s 32.8%.

While the firm’s SG&A expenses compare favourably to those of its competitors, we again believe that this does not justify a sustainable outperformance in the near term.

Select financial ratios

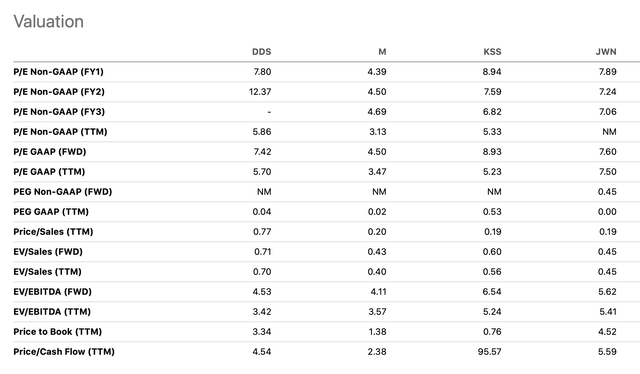

Valuation

Let us take a brief look at some of the traditional price multiples to see, whether DDS appears more attractive from a valuation point of view than its peers.

According to most metrics, Dillard’s does not appear to be more attractive than any of its peers. Based on these multiples, we do not believe that there is substantial further upside for Dillard’s stock, especially if we take into account the potential for contracting margins in the near term.

What may however make DDS more attractive than its peers in the near future is the firm’s advantage in terms of financial flexibility.

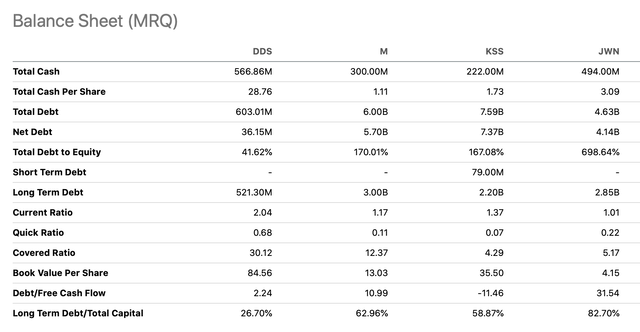

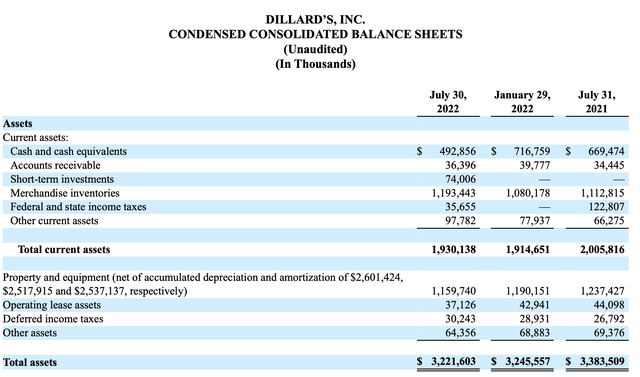

Liquidity

Liquidity ratios like the current ratio or the quick ratio indicate, how well the firm can cover its current liabilities with its current assets. If these ratios are below one, it can be an indication that the financial flexibility of the firm is somewhat limited.

Balance sheet (MRQ) (Seeking Alpha)

Despite the quick ratio being below 1, both of the above-mentioned ratios compare favourably to those of its peers. This may be an indication that during a longer downturn, DDS may be more flexible financially and may be able to better deal with the potential headwinds. We also have to underline that the overall debt level of DDS is substantially lower than that of its peers.

From this perspective, the valuation and the outperformance may be justified.

Before concluding our writing, we will take a brief look at the firm’s strategy to return value to its shareholders.

Return to shareholders

DDS has been paying dividends to its shareholders for the past 24 years consecutively and they have even managed to increase the dividend each year in the last 11 years.

The dividend yield of DDS, 0.28%, is significantly lower than of its competitors, Macy’s: 3.46% and Nordstrom: 3.04%.

On the other hand, due to the low yield, and extremely low payout ratio of 1.7%, it is highly unlikely that this dividend will need to be cut. This can be beneficial for several reasons:

- News about dividend cuts can negatively influence the share price. If no dividend cut needed, no negative influences on the share price.

- Greater financial flexibility. The management is not under pressure to pay out significant amount of dividends, which could jeopardise the firm’s operations during a downturn.

- It is not uncommon that DDS pays special dividends to return excess cash to shareholders, if possible. Announcement of special dividends can cause positive sentiment around the stock, which may positively impact the share price.

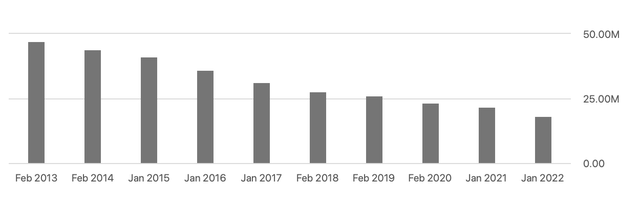

- DDS has been committed to return value to its shareholders through share buyback programs. In the last decade, DDS has reduced its number of shares outstanding by more than 60%. Buying back shares instead of paying dividends also gives the company financial flexibility.

Shares outstanding (Seeking Alpha)

Key takeaways

All in all, we believe that the business of DDS is not substantially better than the business of its peers/competitors. While the liquidity of DDS and its way of returning value to its shareholders may appear more attractive in the current market environment, we do not believe that it would result in sustainable outperformance in the near term.

We currently rate the stock of DDS as “hold”, just like we rated M’s and JWN’s.

Be the first to comment