TU IS

Investment Thesis

DigitalOcean (NYSE:DOCN) is a cloud computing platform specialising in infrastructure and platform tools, with a focus on serving small and medium-sized businesses (aka SMBs). This SMB segment has been largely ignored by the cloud behemoths of Amazon (AMZN), Microsoft (MSFT), and Google (GOOGL), who offer enterprise-focused solutions that are overly complex and too opaque for smaller companies.

This is where DigitalOcean differentiates itself, by offering cloud infrastructure and platform technologies that can be implemented quickly, intuitively, and independently – with extremely affordable and transparent prices.

DigitalOcean Q3’22 Earnings Presentation

Unfortunately for DigitalOcean, sharp economic downturns like the one currently emerging have a habit of disproportionately impacting smaller businesses. Whereas large enterprises have multiple levers to pull when it comes to cost-cutting, SMBs can find themselves fighting just to stay afloat – meaning that DigitalOcean faces both the risk of SMBs cutting their spend with DigitalOcean sharply and the risk of customers going out of business.

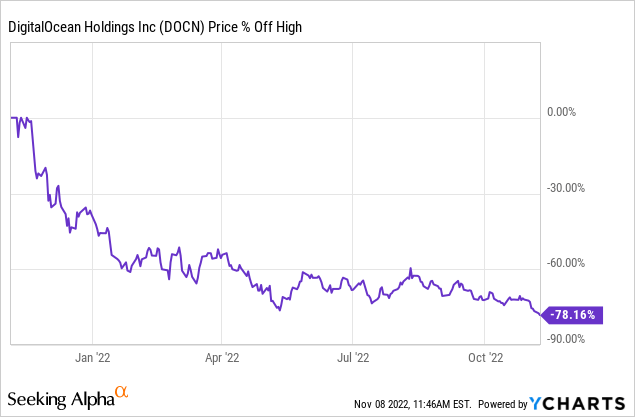

This goes some way to explaining why shares of this fast-growing business have been decimated over the past twelve months, falling an eye-popping 80% from their 52-week highs.

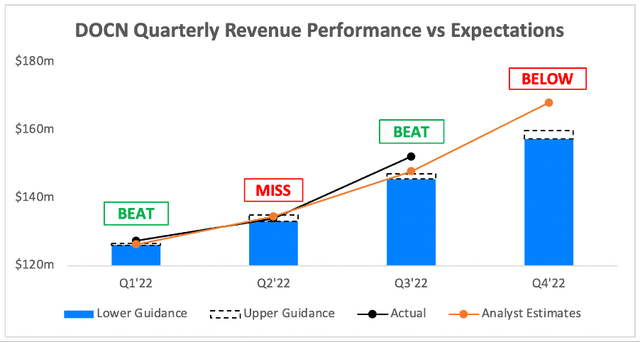

With this dramatic fall in share price, investors might assume that DigitalOcean has been struggling; but in truth, the business has coped pretty well thus far. It did miss analysts’ estimates on revenue in Q2, but only by 0.4%, and smashed expectations on the bottom line.

DigitalOcean reported its Q3 earnings earlier this week, and shareholders were hoping for some positive news.

So, did the company deliver? Let’s take a look.

DigitalOcean Q3 Earnings Overview

Starting from the top, DigitalOcean’s Q3 revenue grew an impressive 37% YoY to $152m, coming in comfortably ahead of analysts’ estimates of $148m.

It’s worth pointing out that this was the first full quarter where DigitalOcean included the results from its acquisition of Cloudways, a leading managed cloud hosting and SaaS provider for SMBs. So, this 37% growth was skewed by Cloudways, however, management noted that the organic YoY revenue growth was still an extremely strong 33%.

A good portion of that growth was driven by DigitalOcean’s new pricing initiatives, and this particularly impressed me. As CEO Yancey Spruill explained on the Q3 earnings call:

Effective July 1, we introduced our new pricing model, which we had been developing since last fall in 2021. This new framework, which we announced in May, incorporated higher prices for some of our products, including our flagship droplet, as well as the introduction of a lower-priced droplet SKU.

…Broadly speaking, after one quarter of operating under this new pricing framework, the positive impact on our business has exceeded our expectations, despite weaker macro trends that offset some of the benefits of the pricing changes.

Specifically, both customer churn and the number of customers downgrading to the lower price SKU have been less than we forecast. Pricing initiatives generated a 1,200 basis point benefit to year-over-year growth in Q3.

The fact that DigitalOcean could raise its prices in this challenging macroeconomic environment, and then see lower churn and downgrades than the company expected, speaks volumes to just how much value DigitalOcean’s customers see within the company’s offerings.

Unfortunately, these great Q3 results were somewhat marred by fourth quarter revenue guidance that came in below analysts’ expectations. Management guided to Q4 revenue of between $160-$162m, representing 35% growth at the midpoint, which fell short of analysts’ estimates of $168m.

Now perhaps I’m missing something, but the $168m that analysts expected represents YoY growth in excess of 40%; even without Cloudways, that is probably still assuming ~35% organic growth, which is incredibly high given the current environment. I’m personally not too concerned with this miss – management gave pretty strong guidance given the macroeconomic situation, and I just can’t figure out why analysts were feeling so optimistic.

Management also gave an initial idea of their expectations for DigitalOcean’s 2023 revenue. CFO Bill Sorenson said that DigitalOcean is targeting $746m in total revenue for FY23, which would represent YoY growth of ~30% based on DigitalOcean’s latest FY22 guidance. Given all the macroeconomic headwinds that DigitalOcean is facing, the ability to grow revenue at 30% in 2023 would be phenomenal.

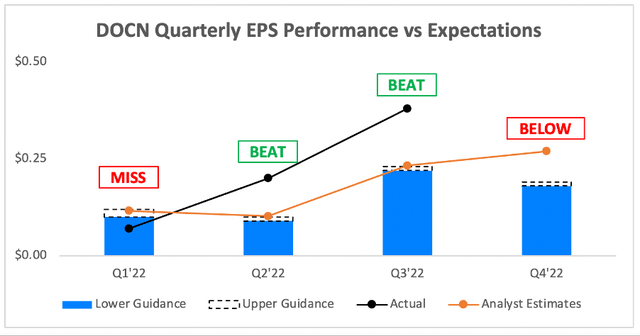

Moving onto the bottom line, DigitalOcean posted EPS of $0.38, which came in well ahead of analysts’ consensus estimates of $0.23.

Now, this was partly impacted by a one-time bonus accrual reversal, but it does not take away from DigitalOcean’s strong profitability. These one-time items unfortunately work in both directions, as DigitalOcean expects to incur a one-time charge of ~$7m in Q4 due to a change in the accounting treatment of leases combined with higher compensation levels.

That partly explains why management’s Q4 EPS guidance of $0.18-$0.19 came in below analysts’ estimates of $0.27.

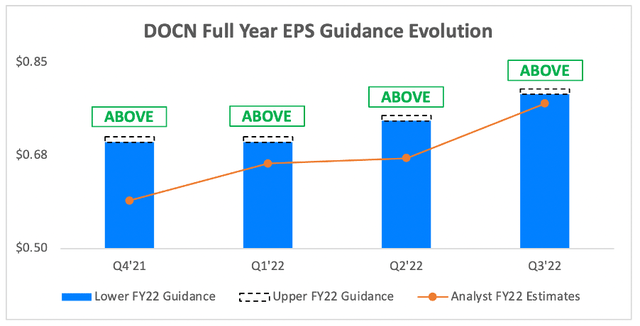

It all cancels out in truth, as the below graph shows DigitalOcean’s full year EPS guidance of $0.79-$0.80 still comes in above analysts’ estimates of $0.77.

All in all, a strong showing for DigitalOcean when it came to the headline numbers. As a shareholder, I’m personally pleased with these results, especially after I took a look at some of the underlying business metrics.

DigitalOcean Continues To Impress

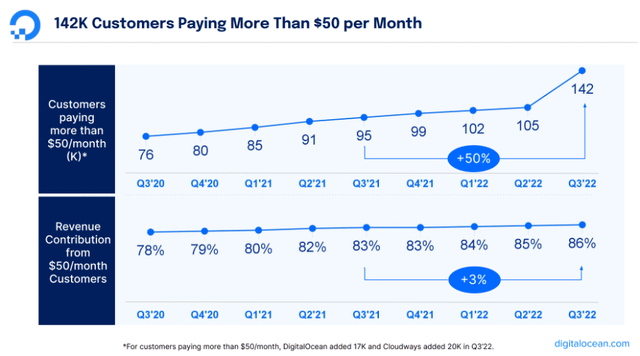

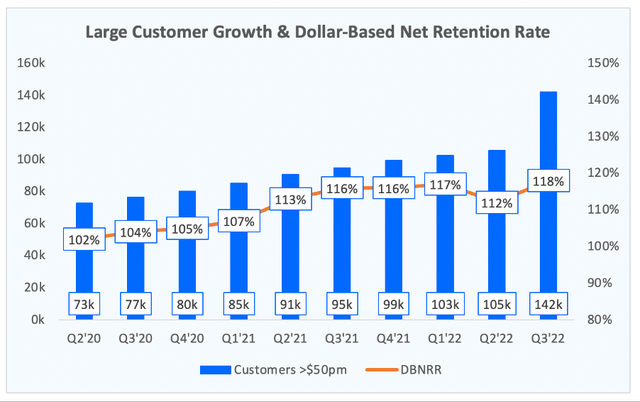

The below graph nicely sums up two of the most important metrics for DigitalOcean; the number of customers spending more than $50 per month (‘large’ customers), and its dollar-based net retention rate.

Starting with large customer numbers, investors will notice a huge spike in Q3’22. This is, in part, driven by the Cloudways acquisition; of the 37k new customers falling into this >$50pm bracket, Cloudways added 20k and DigitalOcean added 17k. But looking back at DigitalOcean’s historical figures, it’s clear that an additional 17k customers paying $50pm is the largest quarterly increase ever, and on an organic basis the number of customers paying more than $50pm increased by 29% YoY.

I’ve already touched on one of the core reasons for this; DigitalOcean’s customers were willing to pay the higher prices that the company decided to charge starting in July, which I’m sure bumped some customers up into this higher tier.

DigitalOcean Q3’22 Earnings Presentation

This price increase, combined with the lack of churn, will have also helped boost DigitalOcean’s dollar-based net retention rate up to 118% in Q3, a significant jump from the 112% it reported in Q2. In fact, this is DigitalOcean’s highest-ever DBNRR, as the company demonstrated an impressively high level of pricing power this quarter.

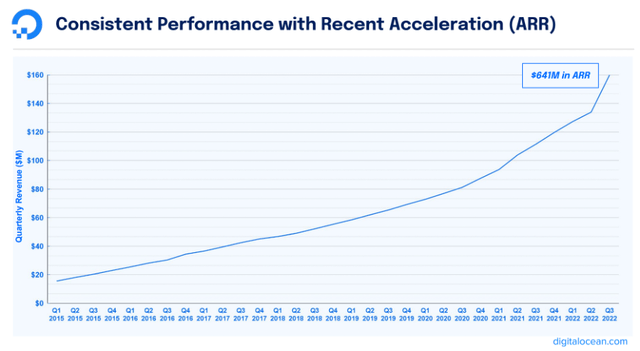

All of these business tailwinds helped to combat the macroeconomic headwinds hurting DigitalOcean, and delivered a substantial boost to the company’s annual recurring revenue. It grew 41% YoY and 18% QoQ, which was in part driven by Cloudways, but was more substantially driven by the price increases and business momentum that DigitalOcean saw in Q3.

DigitalOcean Q3’22 Earnings Presentation

From a business perspective, this was an immense quarter from DigitalOcean. The figures may have been boosted by its acquisition of Cloudways, but there was plenty of organic momentum that drove DigitalOcean onto incredible success.

This is a company that is delivering on my investment thesis, if not exceeding my expectations given the difficult economic environment. I am very, very impressed.

Quick Take: DigitalOcean’s Core Financials

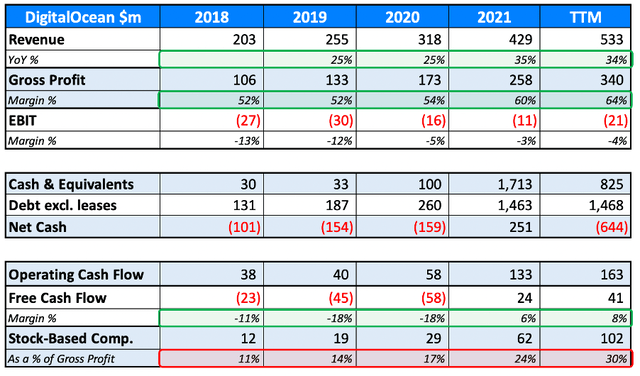

I also wanted to quickly touch on some key financials for DigitalOcean, starting with its twelve-month trends.

Perhaps the most exciting aspect of this business has been the revenue acceleration in 2021 and continued momentum over the past twelve months despite the challenging macroeconomic environment for SMBs. All margins have improved as well for DigitalOcean over that period, most notably free cash flow, which moved into positive territory in 2021 and, most importantly, remained there over the past twelve months.

One of the biggest concerns with DigitalOcean is the company’s stock-based compensation, and this concern is understandable; the company has continued to dish out more and more SBC as a percentage of its gross profit. Whilst this doesn’t impact DigitalOcean’s cash flows, it does dilute us shareholders – and that’s not fun, especially when the share price is crashing.

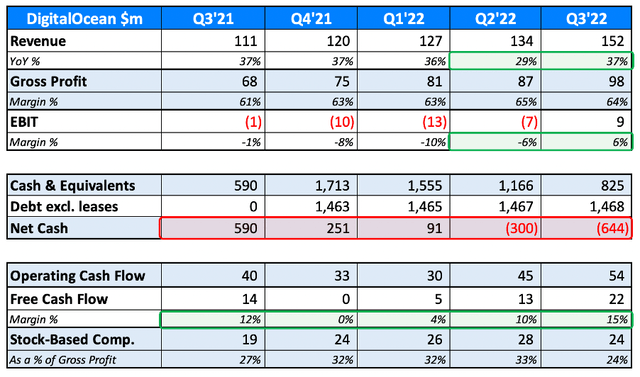

The quarterly metrics below help to understand how strong a quarter this was for DigitalOcean, especially in terms of revenue growth; yes, 37% was partly impacted by Cloudways, but the organic growth of 33% YoY showed some promising acceleration from Q2. EBIT margins also flipped, again helped by a one-off benefit, and free cash flow margins have also been improving over the last few quarters.

My biggest issue with DigitalOcean’s financials is its net cash position, which has been gradually getting worse over the past year, and now sits at a net debt position of $644m. This fall in cash is driven by two things; $600m worth of share repurchases, and $350m spent on acquiring Cloudways.

Personally, I’m happy with the use of cash to acquire Cloudways; I touched on how I feel it will help DigitalOcean in a previous article. My main issue is the use of cash to repurchase shares. This helps to offset the dilution from stock-based compensation, but I would much rather DigitalOcean held onto this cash and maintain a stronger balance sheet given the uncertainty that faces SMBs in the near future.

The balance sheet isn’t an issue yet, since DigitalOcean remains free cash flow positive, and the debt is convertible notes (so not as strict as, say, a bank loan). However, should DigitalOcean be hit hard by an economic downturn, that free cash flow could turn negative, and start eating into its net cash position.

Fortunately, CEO Yancey Spruill highlighted on the earnings call just how important free cash flow is to him:

Those that know me well can confirm that free cash flow has always been an obsession for me, not a revelation made in 2022 when the world started seeing signs of economic turmoil.

This gives me some confidence, and the business has executed phenomenally this quarter, but I would feel a bit more comfortable if DigitalOcean started trying to get back to a net cash position on its balance sheet, instead of spending its money on share repurchases.

DOCN Stock Is Attractively Valued

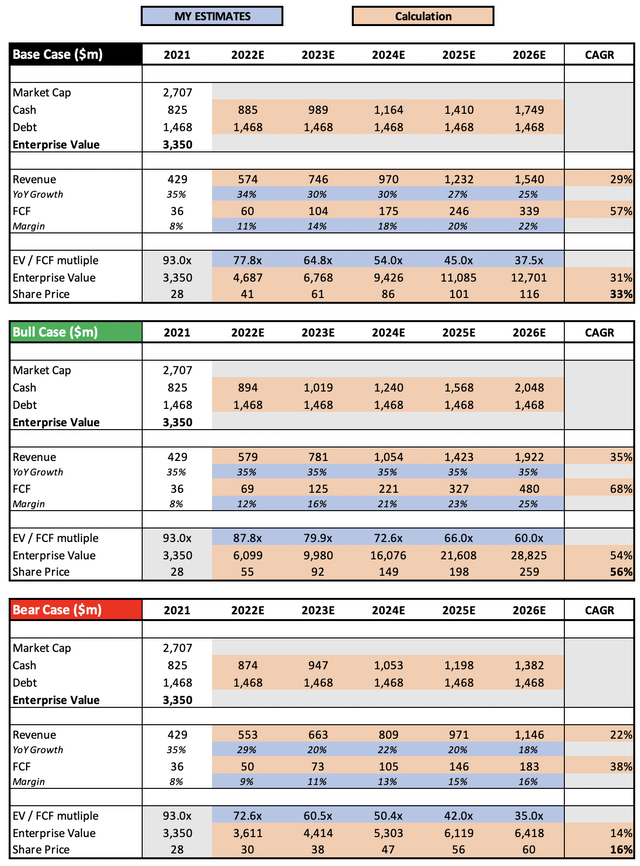

As with all high-growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether DigitalOcean is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have made quite a few changes in assumptions from my previous article, where I hadn’t included the impact of Cloudways; plus, management has given some useful forward guidance into 2023 and 2024.

Firstly, I’ve updated the base case scenario for 2023 to be in line with management’s initial guidance of $746m. It’s also worth highlighting that management is targeting $1 billion in revenue in 2024, which is reflected more so in my bull case scenario. The final substantial change is to free cash flow margins, since management noted that they expect free cash flow margins of 20% or better by 2024.

Putting all that together, I can see shares of DigitalOcean achieving a CAGR through to 2026 of 16%, 33%, and 56% in my respective bear, base, and bull case scenarios. In my eyes, it’s very difficult to call this current price anything but enticing for long-term investors.

Bottom Line

All in all, I think this was an incredibly strong earnings report from DigitalOcean. They displayed a surprising amount of pricing power, which I think demonstrates just how critical its services are for its SMB customers, as well as showing the perceived value of DigitalOcean’s offerings. Combined with a boost from its Cloudways acquisition, which I think will be accretive to DigitalOcean going forward, it was a stellar set of Q3 results.

The market appears to be taking issue with DigitalOcean’s forward guidance, but I think this is foolish. Given the enormous number of headwinds facing the economy and SMBs, I would’ve certainly understood if DigitalOcean had offered up revenue guidance of ~25% for Q4, and even less for 2023.

Yet management is still expecting rapid growth in excess of 30% for both Q4 and FY23, which makes me all the more excited to see what DigitalOcean could achieve once the macroeconomic environment starts to improve.

I’ve followed many earnings reports over the past month or two, and the double-digit percentage decline in share price following the release of DigitalOcean’s Q3 results has been the biggest head-scratcher so far. I’m not into predicting short-term market movements, and this is exactly why – because in my view, this drop makes no sense at all.

Given all this, I will reiterate my previous ‘Strong Buy’ rating on DigitalOcean shares, as this business continues to execute, has an incredibly attractive share price, and should be a long-term winner for investors.

Be the first to comment