Chip Somodevilla

Back when Digital World Acquisition Corp (NASDAQ:DWAC) was all the hype after the former President launched Truth Social, I wrote about why I believe that the premise behind the company’s valuation was flawed and that it will, in all likelihood, garner just a fraction of the attention and support as projected.

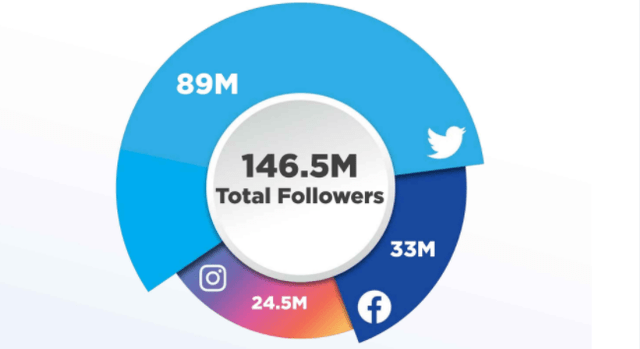

Since then, after about 6 months and multiple PR and marketing efforts, Truth Social has gotten to only 513,000 DAUs (daily active users) and the former President, who had 146 million followers on his Facebook, Instagram (META) and Twitter (TWTR) profiles has not yet reached the 4 million mark on the new platform.

Even though projecting daily monthly active user and revenue is tricky, given that Truth Social has not managed to attract any advertisement companies and has stated that it will incur significant losses well into the future, assuming a valuation at roughly the per-dMAU of Twitter still projects their value at a fraction of what it is today – at just a $62.5 million market value. (breakdown to come).

The recent breaking news about the company reportedly not making multiple payments to the tune of $1.6 million seems to confirm that the company is in a very tight financial position and that current valuation is greatly inflated.

Drastically Underperforming Expectations

One of the big selling points of Truth Social, to investors anyways, was that the former President had a total of 146 million followers across the top 3 social media platforms on Facebook, Instagram and Twitter. The thought was that if they can get a significant portion of those folks on to Truth Social, they can make some serious ad revenue.

But to date, about 6 months since it officially opened and almost a year since its launch, the former President only managed to get to around 3.9 million followers, and with only 2 million monthly active users on the entire platform, suggests that just around 2.5% of those followers ended up migrating to Truth Social and even less are active on the platform.

This has come even as recent news and headlines are referencing Truth Social as the former President uses it as a way to endorse candidates in the ongoing midterm elections, make statements following various political events and bills being passed in the Biden Administration as well as the increased reference in mainstream media.

I continue to believe that these active-users numbers are not going to increase all that much, even as they experienced a mild spike after the recent news of the top-secret document seizures at his private residence. As a result, I continue to believe that Digital World Acquisition Corp, through Truth Social, is unlikely to attract any significant advertisers in order to generate any meaningful revenue, not to mention profits, over the next few years.

It Goes Even Further

Not only is the company not destined or expected to attract any significant ad revenues for at least the next 2 to 3 quarters, its losses per quarter are accelerating. After reporting about $1 million in losses every quarter, mostly from salaries, the company reported $4.3 million in losses in the most recent quarter alone.

These losses also don’t include the now-reported $1.6 million in non-payments for web-hosting services, which increase those losses even more. As the company racks up these debts and losses, it’s going to be harder for them to sustain that environment even if they do end up getting some advertising revenues as they’ll likely be strapped with debt or other forms of payments owed.

There have also been other issues with the company’s Truth Social in the past few months which can potentially delay the incoming of potential ad revenue due to legal issues and disputes. Here’s why it matters.

Ad Revenue Vetting

Without getting political (Seeking Alpha has a politics forum for that), when an individual like the former President starts a new venture, we know that you can automatically write off about 70% of the country from participation and that includes big companies and corporations. And that includes ad revenue.

But even though there are companies who won’t want to associate themselves with the brand of politics by advertising on the platform, there are plenty of companies who all they look for is an avenue to sell more products or services, as they should. However, there are several issues which can make even these companies second guess that spending.

The first is the lawsuit from an investor against the CEO alleging fraud when it comes to the merger of DWAC with Truth Social. There is also another more serious investigation by the SEC (securities and exchange commission) related to potentially negotiating the Truth Social – DWAC deal details prior to them going public – which would be illegal and can result in serious issues.

There are obvious other issues which pertain to investors like delaying earnings, asking for extensions of the merger agreement and the weeks where potential users were left in limbo after the launch was delayed.

A Point About Recent Rumble Deal

Yes, there is a deal about having Rumble (CFIV), the video sharing platform, advertising their videos using Truth Social. However, as Manuel Paul Dipold pointed out in his article Rumble SPAC: An Estimation Of The Possible Revenues, the company as a whole made about $2 million in the most recent quarter, which means they are likely to deliver only a fraction of that on the platform as it has less monthly active users than other social media affiliates which Rumble works with as it shares about 60% of ad revenue with creators.

Even So, Valuation Is Way Too High

As I pointed out before, even if we assume these hurdles will get worked through and the company will be able to get some ad revenue in and perhaps integrate some form of paid model or subscription services (there were rumors about the company also exploring subscription models for content to take on the big streaming companies) – comparing this to existing social media companies shows the company is still heftily overvalued.

Before diving back into valuation, there’s another point worth considering: Even after a more or less equal time being live on the app stores, other social media platforms which are aimed at certain demographics, like Parler and others, have been attracting more users. This suggests that the core appetite isn’t necessarily for an individual but for socializing online outside of the traditional environments like Twitter, Facebook and other platforms, which can spell disaster for DWAC’s growth potential.

Twitter currently has 237.8 million mDAU, about 465x the amount that Truth Social has. This means that Twitter’s current market cap of a tad over $31 billion puts Truth Social’s fair value (assuming they reach Twitter’s revenue per user, which at current times is quite inflated) at just under $62.5 million.

Their current market capitalization is $1.12 billion.

Investment Conclusion

The fact that Truth Social, which is currently expected to be the main source of platform engagement for DWAC post-merger, reportedly not paying its web-hosting vendor for the past few months, alongside DWAC reporting $4.3 million in losses in this past quarter alone, seems to confirm that they have not been able to attract advertisers to the platform to generate any form of revenues.

On top of that, Truth Social, even though it’s one of the only ones with a direct presence of the former President, is not coming close to having the same engagement as other social media platforms and has thus far underperformed even the most conservative estimates of users.

Even if we assume that the company will somehow be able to get to the level of revenue-per-use that Twitter or Facebook have, a pipe dream, this still places the company’s fair value at around $62.5 million, about 6% their current market capitalization of $1.12 billion.

As a result, I remain highly bearish on the company and continue to hold the company’s shares short through equity and options.

Risks Persist

As with any short position, the number one risk is that your losses can be infinite while your gains are limited at 99% or so. That’s why I’ve been adding some minor long term options positions to mitigate some of that risk.

My timeline for holding the company’s shares short is to a price target of around $20.00 per share, or roughly 30% lower from current price, at which point ill begin covering some short to mitigate risks.

To further mitigate that risk, I use long term call options with the strike price ranging from $50 to $100, with expiration centered around January of 2023. These options positions represent a good way to hedge against the risk of what is now known as “meme trading frenzy” where retail traders look at companies with a high degree of short interest (DWAC is at around 16% of the float) and can drive up prices by hundreds of percentage points in a single day.

This means that in the worst-case scenario, I gain 30% on my short position while potentially losing a small fraction of the position by the options going to $0 but if the stock does take off, these option prices will be up 20x to 30x.

Be the first to comment