Weedezign/iStock via Getty Images

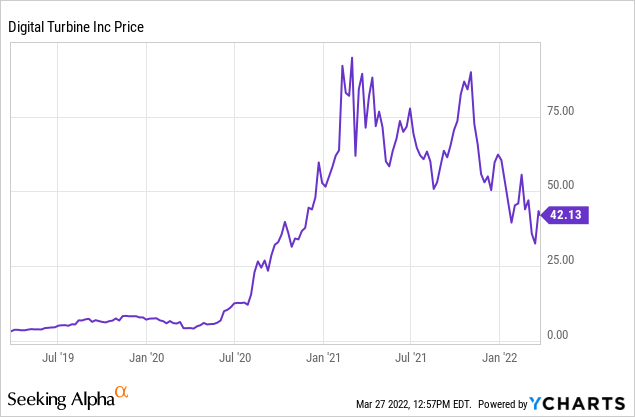

I first came across Digital Turbine (NASDAQ:APPS) about a year ago when the stock was trading at $70-80. At the time, I didn’t really understand the business model or see a moat. A few months later, I stumbled upon the company again and the stock had corrected significantly. I dug deeper, got an even better understanding of the business model and built an initial position. Just two weeks ago I took advantage of the setback and almost doubled my position. If the price remains this favorable, I will continue to buy, as I see APPS very well positioned to participate in the growing advertising market. In addition, the company is protected by some moats, which I would like to explain in more detail below.

By the way, I also see a very good buying opportunity in Meta (FB), which I described in another recent article. Since then, the share price has already risen by almost 20%.

Why the share price has fallen

Let’s start with a brief review: why has the share price fallen so sharply in recent months?

The latest quarterly numbers should not be the main reason. APPS reported third-quarter fiscal 2022 non-GAAP earnings of 49 cents per share that surpassed the Zacks Consensus Estimate of 43 cents. Revenues of $375.5 million beat the consensus mark by 6.34%.

So, what could have been the reason then? The decline of the share price could have to do with Apple’s (AAPL) change to iOS privacy features, and the fear that Alphabet (GOOG/GOOGL) – an important partner for APPS, could do the same. This could have an impact on Digital Turbine’s business. After all, the change of Apple’s iOS has significantly limited the ability of Meta, one of the advertising kings of the industry, to exploit user data.

In addition, there is of course the uncertainty on the stock markets due to the Ukraine conflict and the sharp rise in inflation, which would make further interest rate hikes by the Fed more likely and thus burden growth companies in particular.

Perhaps it was also a necessary correction after the share price has increased by a factor of about twenty within one year or because the business model seems difficult to understand at first glance. It is likely that all of the above factors contributed to this decline. Anyway, let’s turn to a much more important question:

Is the decline in the share price justified?

I think not. APPS is not Meta. The business models differ significantly. However, I admit that it is not so easy to understand APPS business model. So let’s take a quick look at it:

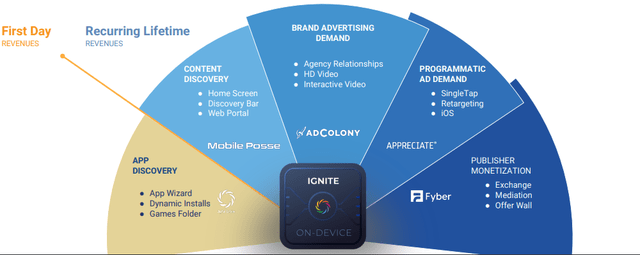

Illustration 1: Digital Turbine Business Model (Digital Turbine Investor Presentation May 2021)

You can divide Digital Turbine’s revenue streams into first day revenue and recurring revenue (which are generally more popular with investors). With the acquisitions of Mobile Posse in 2020 and AdColony, Appreciate and Fyber in 2021, the business model has been significantly diversified. I also see many opportunities for synergies:

- App Discovery: This includes APPS core platform Ignite. It practically pre-installs apps onto new smartphones. As example: Meta wants WhatsApp to be pre-installed when a cell phone is purchased. For this, FB pays money to APPS, which pre-installs WhatsApp and shares the money with the OEM (Original Equipment Manufacturer, e.g. Samsung) and/or the provider/carrier (e.g. Verizon).

- Mobile Posse: The feature is integrated into carrier or OEM devices and simplifies discovery of new content (e.g. on the Home Screen) that might be of interest to the user, e.g. apps.

- AdColony: As far as I know, AdColony makes sure that app developers have the necessary software to deliver videos and pop-up ads in their app. Many apps in their raw form do not have the ability to integrate outside content, which is why they have to use platforms like AdColony to monetize the app.

- Appreciate: Appreciate is a Demand Side Platform (DSP). A DSP is an intermediary platform that helps companies select the best possible apps for their advertising, determine a suitable price for the advertising, and reach the end user as efficiently as possible. The sales process itself is similar to eBay (EBAY), and companies can bid for certain services such as in-app videos, small ads, or pop-ups when the app is opened. According to the website, the company runs 60bn daily auctions, which I find really impressive.

- Fyber: Fyber is also a platform, but on the supply side. That means Fyber enables app developers to implement intelligent strategies for advertising monetization on mobile devices.

With the acquisitions, I think APPS has laid a good foundation for further growth and offering unbiased, conflict-free, independent solutions as a fully verticalized, fully integrated platform (which I think is important for their moats – more on that later).

Valuation

Much has already been written about valuation in other articles. I would therefore like to be brief and focus on a few multiples based on the FY2022 guidance:

- Revenue: $1,225mn-$1,240mn

- Non-GAAP adjusted EBITDA: $195mn-$197mn

- Adjusted EPS: $1.66-$1.68 (~97mn shares outstanding)

Given APPS current market cap of ~4bn we obtain the following multiples:

- P/S ratio of ~3.3x

- P/E ratio of ~25x

You don’t need to be an expert to recognize that this seems cheap for a profitable growth company, which targets a top line of $4 billion and an EBITDA of $1 billion at the minimum in three to five years (according to the Presentation from the Analyst Day in November 2021). This would also mean an EBITDA margin expansion to ~25% (from 13% in FY2021).

The basis for growth is definitely there. Currently, the company serves about 800mn devices worldwide. About 60mn are added every quarter. The company outlined its goal of generating +25%-30% revenue CAGR and +25% EBITDA CAGR for the next years.

Assuming an EBITDA of $1bn by 2025, generously subtracting $200mn for D&A, $20mn for interest expense and a 35% tax rate, we get net income of about $500mn, which would imply a P/E ratio of 8x. This is what a real bargain looks like.

I consider the growth assumptions and margin expansion realistic due to economies of scale and the company’s moats, which I would like to explain in the following.

Digital Turbine’s Moats

Moat No. 1: The Technology

I had already written a bit about Digital Turbine’s technology. I don’t know of any other company that is so well positioned in this market. And the technology makes it very difficult for competitors as Bill Stone points out:

And once we put our software into device, whether it’s a Verizon device, a Samsung device, an AT&T device, or what have you, there’s no competition. We have a moat around that device. It’s just us that then decides what’s going on that device. And we partner with obviously Verizon, AT&T to what’s consistent with their strategies. But the point being is that we’re in control of that.

So a lot of things in Ad Tech are highly, highly competitive. There’s a lot of people real time bidding to do all these different things. We have that technology on device that gives us a unique advantage. That’s a moat around it, and that’s a really important point.

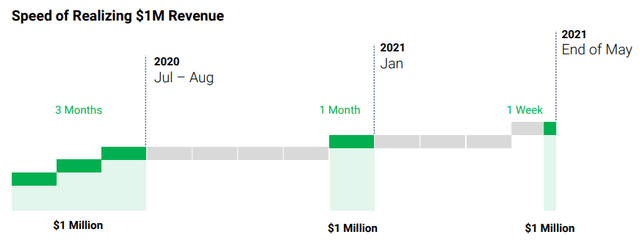

I would also like to explicitly highlight the SingleTap function (which is part of Appreciate) in the context of technologic advantages. The patented function enables app installs from any mobile ad placement in just one tap. This significantly increases the probability of installation and therefore the return on advertising.

It is therefore not surprising that growth is extremely high for SingleTap as can be seen in Illustration 2 below.

Illustration 2: Speed of Realizing $1mn Revenue from SingleTap (Digital Turbine Investor Presentation May 2021)

SingleTap now generates sales of 100mn per year. Given this growth path I think it’s very probable that this can accelerate into a $1 billion-plus business over the next few years. If you now also consider that Appreciate cost just 22.5mn, then this also confirms my good impression of the management.

However, now many will say: …but the technology is also dependent on the goodwill of Alphabet.

Let’s take a look at Bill Stone’s response to this:

[…] but there’s been some investor concern that the identifier that Apple uses is called IDFA. And the identifier that Google uses is called Google ad ID. Some people might call it Android ID. One of the things about our business is we actually have our own identifiers on the device, and that’s on 800 million devices that we’ve put that on around the world, and 60 plus million each quarter that we add.

So the risk due to changes from Alphabet seem to be very limited. Oppenheimer even sees APPS on the winning side if Google were to make this move.

Moat No. 2: The Network Effect

The network effect is a phenomenon whereby increased numbers of people or participants improve the value of a good or service. And this is exactly the effect I see with APPS. The more partnerships the company enters into with large OEMs or providers, the larger and thus the more useful the network becomes. What advertiser will then still go to a potential competitor?

Let’s take a look at how much profit Digital Turbine is already generating for OEMs and providers, according to Bill Stone:

And then for a company like a Verizon, it’s been — you know, we’ve paid them nine figures of free cash flow over the years. I mean, it’s just — so it’s a great business for them, because it’s all at a 100% gross margin.

I therefore assume that the willingness to switch from Digital Turbine will remain very low. This, in turn, should enable APPS to significantly increase their margins in the medium term.

Moat No. 3: The Independence

Let’s move on to the third moat: Independence. Independence applies here in two respects:

1. Technological / data Independence, which means that Digital Turbine does not rely on buying third-party data. The company only uses the data it collects from the device.

2. Independent in offering services, i.e. a client’s product or solution is promoted in the best possible way and without conflicts of interest. Look at how CEO Bill Stone explained it at a recent conference:

For example, there may be a gaming Ad Tech company that is working with a gaming studio like a Zynga, EA […]. And they may have their own games. And what they’re trying to do is basically get the data from a Zynga or EA, so they can market across, sell their own games, right. So if you are now Zynga or EA or those kinds of companies, well, why do I want to have somebody else trying to get my customers? […] We’re independent. So when we go out, we don’t have anything other than to help the advertiser and help the publisher try to make more money. So the independence and the on device point really allow us a lot of differentiation.

I think Meta, Alphabet, TikTok (BDNCE) and much more prefer to do business with APPS than with each other. And so will many companies that distrust the big tech companies. This is a clear advantage in customer relations.

It is therefore highly unlikely that the aforementioned competitors could achieve a similar market position like APPS in this area. Not because they do not have the money and the technology, but because they would not be completely independent and would therefore be viewed with suspicion.

Conclusion

In my opinion, Digital Turbine’s stock has been unfairly punished in recent months. However, this offers a great buying opportunity as the company is growing strongly, is already profitable, has several moats and is currently trading as a bargain. I therefore strongly expect the share price to recover visibly soon. The results of the coming quarters will help the broader market to better understand the business model and therefore will act as a catalyst.

Be the first to comment