CloudVisual/iStock via Getty Images

Last week, leading dry bulk carrier Diana Shipping (NYSE:DSX) reported respectable third quarter results and declared a $0.175 cash dividend per common share.

Thanks to the company’s focus on medium- and long-term charters, average daily time charter equivalent (“TCE”) was down just slightly from Q2 despite the Baltic Dry Index (“BDI”) continuing its slump from year-to-date highs reached in May.

Rapidly easing port congestion and weak Chinese commodity demand have been the main drivers behind the ongoing charter rate deterioration and with no near-term catalysts in sight, dry bulk shipping stocks have lost much of their appeal with investors in recent months.

In the current environment, Diana Shipping is benefiting from its conservative chartering strategy with many vessels still employed on above-market time charters thus protecting the majority of earnings and cash flows well into next year.

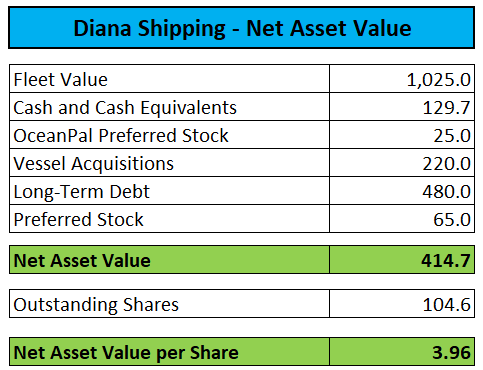

That said, weak industry conditions have resulted in second hand vessel prices pulling back from multi-year highs thus impacting net asset values (“NAV”).

Company Press Release / MarineTraffic.com

As an example:

Three months ago, Diana Shipping announced the acquisition of nine modern ultramax carriers for an aggregate purchase price of $330 million, of which $220 million will be paid in cash and $110 million in the form of 18,487,395 newly issued common shares at a price of $5.95 per share.

Even when taking into account the company’s substantially reduced share price, the aggregate consideration still calculates to $300 million as compared to an estimated market value of approximately $235 million for the vessels today.

Company Press Releases and SEC-Filings / MarineTraffic.com

Assuming full delivery of the above-discussed Ultramax fleet, Diana Shipping’s charter-free NAV calculates to slightly below $4 but this number does not account for the company’s above-market charters which I would estimate to add approximately $0.50 to NAV.

That said, the cash dividend, even considering the 36% sequential reduction, is still generous but likely to decline going forward as more and more lucrative legacy charters are replaced by depressed market rates.

Proposed Special Dividend of OceanPal Preferred Shares

In addition, Diana Shipping has committed to distribute all 7% Series D Convertible Preferred Shares (“the Series D Shares”) of former subsidiary OceanPal Inc. (NASDAQ:OP) with an aggregate $25 million liquidation preference held by the company in the form of a special dividend.

The Series D Shares were issued earlier this year as partial consideration for OceanPal’s purchase of the Capesize vessel Baltimore and are convertible into common shares at any time at the holder’s option at a conversion price equal to the 10-trading day trailing VWAP of OceanPal’s common shares.

Because no public market exists or is expected to develop for the Series D Convertible Preferred Shares, as an accommodation to common shareholders, the Company will automatically convert the Series D Convertible Preferred Shares into OceanPal Inc. common shares on or around the Stock Dividend payment date and distribute such common shares to each common shareholder. Common shareholders, in their sole discretion, may elect to opt out, in whole but not in part, of the conversion of the Series D Convertible Preferred Shares and instead receive Series D Convertible Preferred Shares in connection with the Stock Dividend.

Shareholders electing to receive Series D Convertible Preferred Shares by opting out of the automatic conversion will receive a number of Series D Convertible Preferred Shares equal to such common shareholder’s pro-rata portion of all Series D Convertible Preferred Shares, rounded down to the nearest whole number. Any fractional Series D Convertible Preferred Shares that would otherwise be distributed will be converted into OceanPal Inc. common shares at the applicable conversion rate and sold, and the net proceeds therefrom will be delivered to such common shareholder.

Assuming a $0.20 conversion price, OceanPal would be required to issue up to 125 million new common shares. Under this scenario, Diana Shipping common equity holders would receive approximately 1.2 common shares of OceanPal for every Diana Shipping common share owned. The calculated value of the special dividend would be around $0.24 per Diana Shipping common share.

That said, investors should carefully weigh their options as the upcoming distribution of up to 125 million new shares will almost certainly result in OceanPal’s share price to decrease substantially which in turn would reduce the value of the special dividend for shareholders of Diana Shipping.

Given this issue, I would advise Diana Shipping shareholders to opt out of the conversion and elect to receive the Series D Shares which remain dilution-protected and are convertible into new OceanPal common shares at any time at the option of the holder.

Investors still holding OceanPal’s common shares at this point should consider selling before the December 15 distribution date given the looming up to 400% increase in outstanding common shares.

Please note also that OceanPal will be required to conduct a reverse stock split until March 6, 2023 to regain compliance with Nasdaq’s $1 minimum bid price requirement.

Bottom Line

In the current market environment, Diana Shipping’s conservative chartering strategy is bearing fruit with the majority of earnings and cash flows protected well into next year.

That said, with more and more legacy charters coming up for renewal, quarterly dividends are likely to be reduced further going forward.

With regards to the announced special dividend of OceanPal’s Series D Shares, investors should consider opting out of the proposed conversion into OceanPal common shares and rather receive the dilution-protected Series D Shares which can be converted at any time at the option of the holder.

With Diana Shipping’s shares trading near net asset value and quarterly dividends likely to decrease over the next couple of quarters, I am downgrading the stock to “Hold” from “Buy“.

Be the first to comment