Stadtratte

Introduction

How convenient that the Diamondback Energy (NASDAQ:FANG) ticker is “FANG” as it allows me to make a pun in the title that incorporates a changing secular trend in the oil and gas industry, and what is poised to become outperformance of oil stocks on a long-term basis. Diamondback is one of America’s largest onshore oil producers with a low breakeven price, a changing hedging strategy thanks to quickly falling debt levels, allowing for a higher price realization, and a focus on shareholder returns. Given the company’s developments and energy market fundamentals, in general, I believe FANG will be a source of high shareholder returns for years to come, offering investors a great tool to add high-quality exposure to their portfolios.

So, without further ado, let’s look at the details!

The New Era For Energy

I’ve been on top of energy since 2020 as the post-pandemic (referring to the first global lockdowns) offered tremendous opportunities across many industries. The demand came back, companies restarted production, and demand for energy returned.

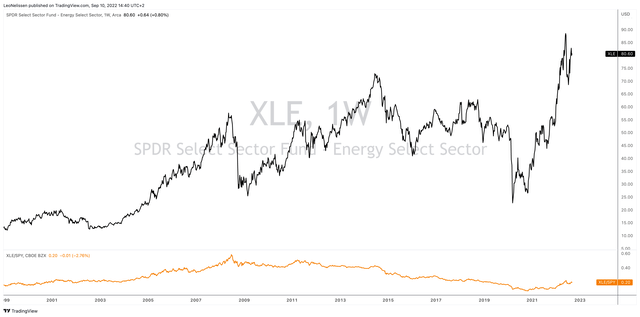

Little did most people know back then, it was also the start of a new secular bull market for energy companies. As the chart below shows, energy stocks as displayed by the SPDR Energy Select Sector ETF (XLE) have gone nowhere between 2008 and 2021. This includes dividends as it’s on a total return basis.

During this period, energy stocks significantly underperformed the market as the orange ratio in the lower part of the chart below shows.

TradingView (Black = FANG, Orange = XLE/SPY Ratio)

However, prior to 2007, energy stocks were a tremendous source of wealth. The same goes for the two years after the pandemic started – and the coming years, I think.

In 2020, I became bullish on Exxon Mobil (XOM) as discussed in this article. Back then, my bull case was mainly based on the fact that market participants underestimated the future demand for oil and the fact that the market was only looking at “tech” and “growth” stocks, leaving energy companies in the dirt with ridiculously low valuations.

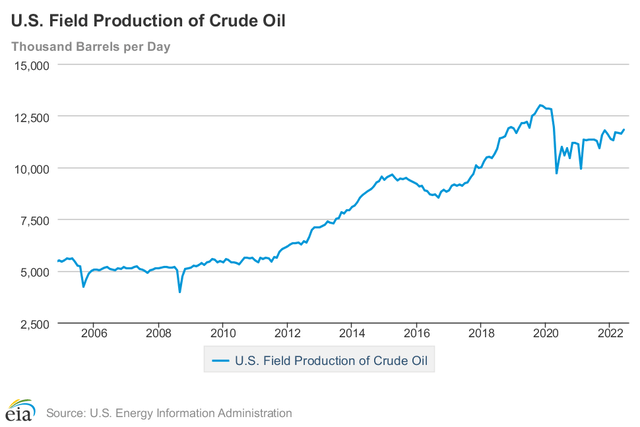

Then, in 2021, something changed. As demand came back, oil companies did not increase output. For the first time since the start of the shale revolution in the US, onshore oil production did not accelerate. At 11.8 million barrels of oil per day, production is well-below pre-pandemic levels and the uptrend in production is the slowest since the years prior to 2012.

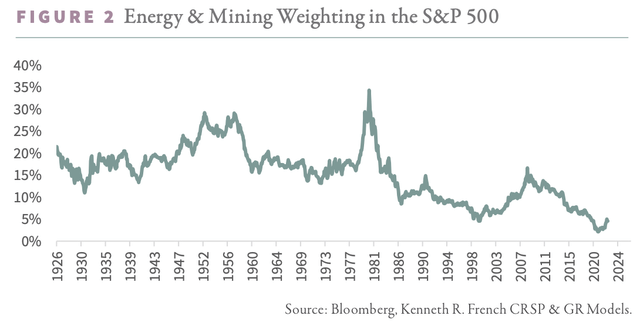

What’s interesting – and very important – is that we’re now on the verge of a new long-term secular uptrend in oil prices. As the chart below shows, energy and mining stocks have an extremely low weighting in the S&P 500. Even lower than during the bottom in the late 1990s before commodity stocks took off.

Almost always, cycles are driven by the dance between supply and demand. The poor relative performance of energy stocks after 2007 was driven by accelerating investments in low-cost oil and gas projects. Both onshore and offshore.

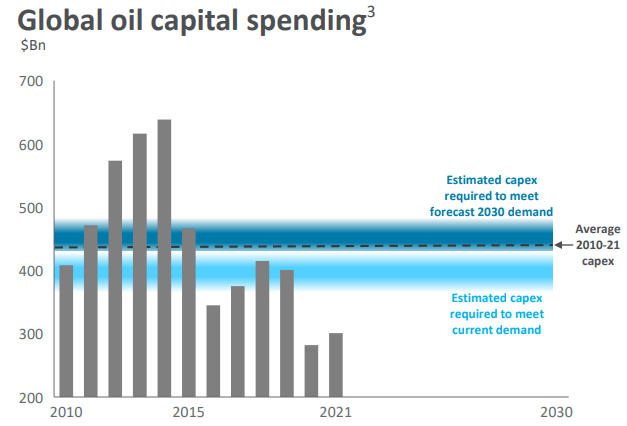

This changed after the pandemic. Global oil capital spending was at roughly $640 billion prior to the 2014 oil crash. This caused supply to accelerate. After 2015, CapEx rallied again as companies needed higher supply growth to repair their balance sheets. It once again resulted in more supply, making oil prone to the impact of the pandemic, which caused prices to crash again.

Seeking Alpha

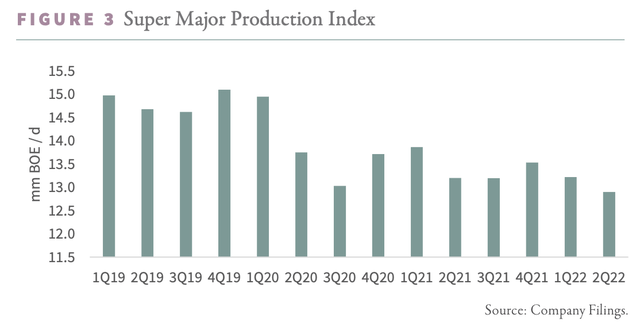

In order to satisfy the expected oil demand in 2030, CapEx needs to accelerate, which is not happening as the updated chart below shows. The super-majors are not boosting production. If anything, production has come down for three straight quarters.

Even if CapEx were to accelerate again, it would take years to get supply to levels that satisfy demand.

Yet, that may not happen for one major reason: oil companies aren’t willing to. Oil companies prefer to protect themselves against new periods of weakening demand as none of them expect to get support when times become tough again.

After all, the global push for net zero is making one thing clear: “we” don’t want fossil fuels anymore. Treasury Secretary Janet Yellen doubled down on this.

According to The Hill:

“We will rid ourselves from our current dependence on fossil fuels,” Yellen’s prepared remarks say.

“Our plan — powered by the Inflation Reduction Act — represents the largest investment in fighting climate change in our country’s history. It will put us well on our way toward a future where we depend on the wind, sun, and other clean sources for our energy,” her remarks continue.

I could go on and on on this topic and I’m sure that most readers are familiar with my articles on this matter. Hence, I believe that the following comments from Bloomberg hit the nail on the head:

“They got castrated in 2016, they got slaughtered in 2020, and then they got demonized for ruining the environment after that,” said Smead, who is Continental Resources Inc.’s largest independent investor and a top-20 shareholder in Occidental Petroleum Corp. “Why would you do anything to help the people that hate you?”

Shale explorers also are unwilling to invest beyond current drilling plans because of “deteriorating efficiencies” amid cost inflation, said Noah Barrett, lead energy analyst at Janus Henderson, which manages about $350 billion.

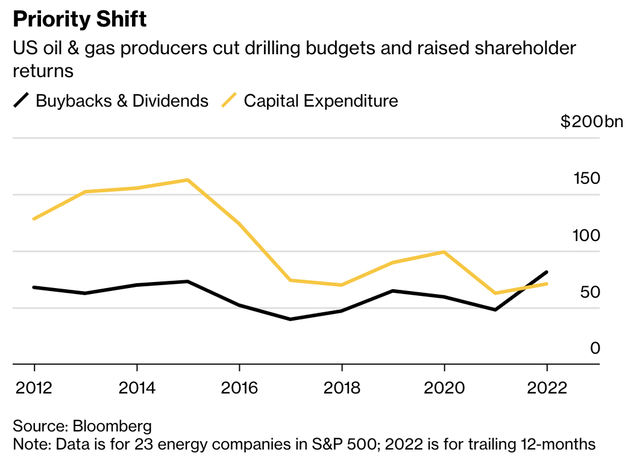

One chart I have shared in a number of articles is the one below. It shows that the 23 S&P 500 energy companies (FANG is one of them) are now prioritizing shareholder distributions over CapEx, which is a huge move that perfectly visualizes the shift in priorities in this sector.

To quote Goehring & Rozencwajg:

As depletion takes hold, supply falters, demand grows, and inventory gluts eventually get worked off. The stage is set for the next bullish cycle to start.

With all of this said, there are many ways to benefit from undervalued energy stocks and a shift from production growth to shareholder distributions. I prefer drilling companies that have at least some (or all) of the characteristics below:

- Low breakeven production prices – to generate more free cash flow-

- A healthy or quickly improving balance sheet – to allow the company to focus on shareholders instead of debt holders.

- A fair valuation. After all, we don’t want to overpay.

- Other factors.

Diamondback Energy is a terrific place to be as I will explain now.

Quality Oil Exposure – Giving Diamondback Energy A Shot

As I’ve never covered FANG, let’s start at the very beginning. Headquartered in Midland, Texas, Diamondback is one of America’s largest onshore producers of oil and gas with a current market cap of $24.0 billion. In 2021, the company produced roughly 2.3 GJ of energy. That’s roughly 18% of the total energy demand of a country like Germany.

To give you a more common number, FANG produced 375 MBOE/d (thousand barrels of oil equivalent per day). Roughly 60% of this was oil. Natural gas liquids and natural gas accounted for 20%, each.

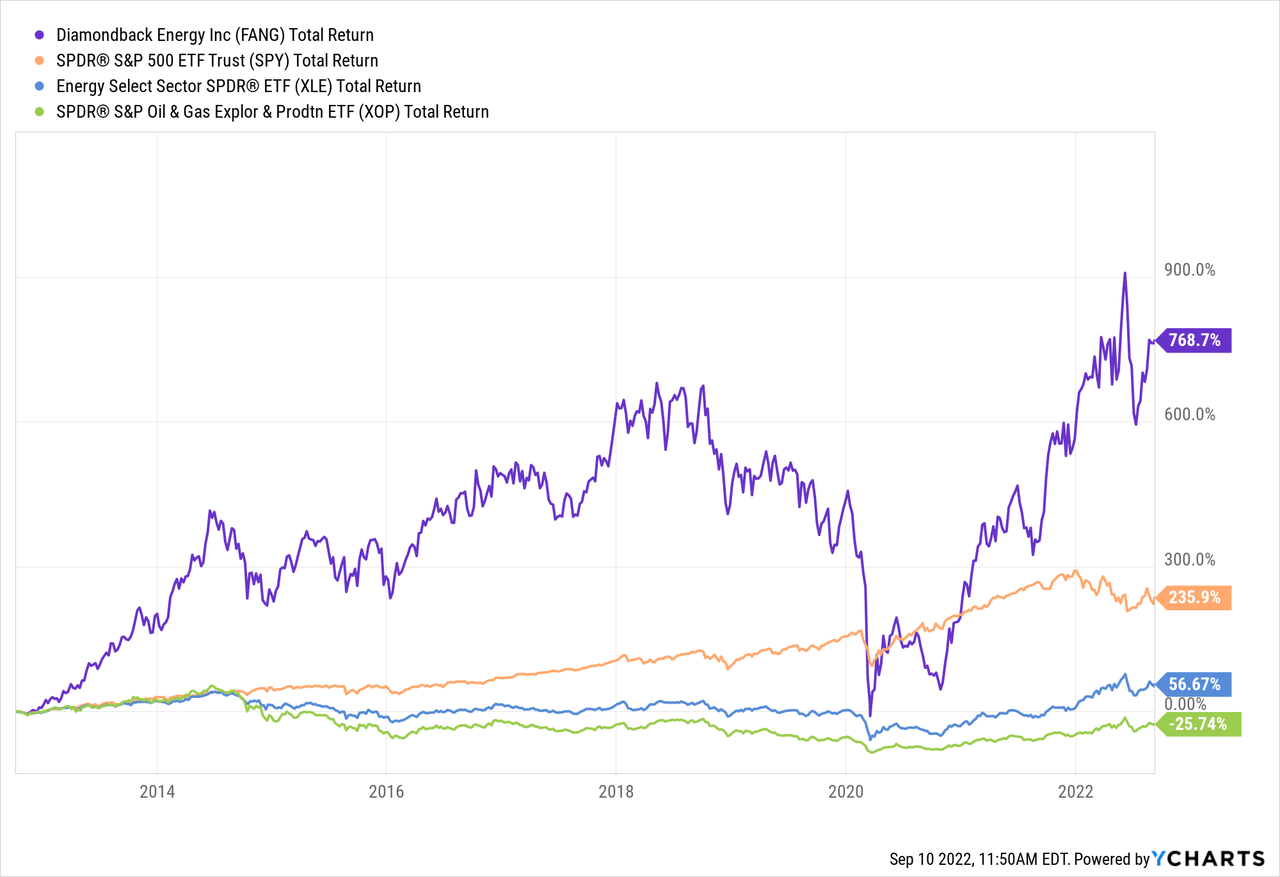

Founded in 2007 with the acquisition of 4,174 net acres in the high-margin Permian Basin, the company went public in 2012. Since then, the company has outperformed the S&P 500, energy stocks, and the drilling & exploration industry, of which it is obviously a part.

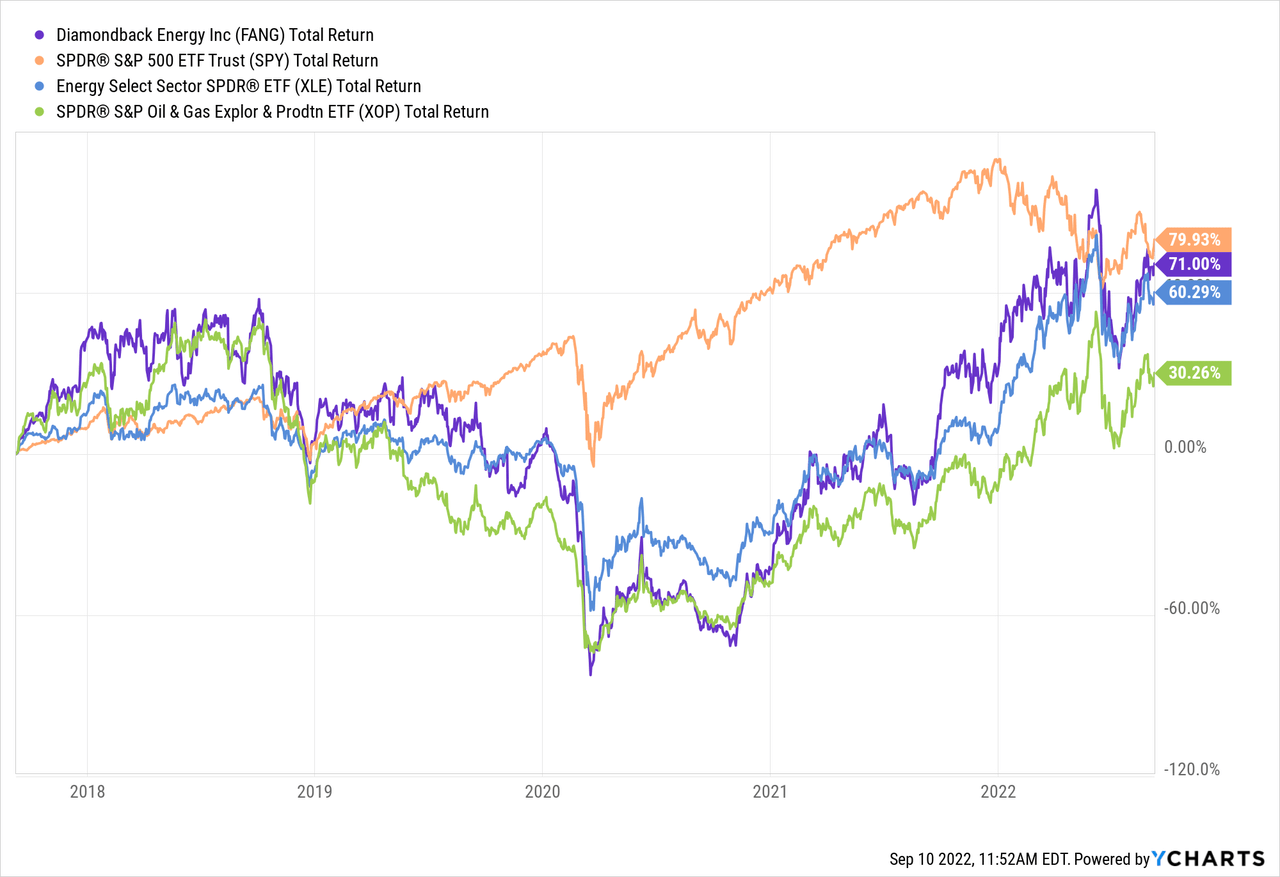

If we ignore the hugely successful first years after the IPO, we see that FANG still did very well, trailing the market by only 900 basis points over the past five years while beating its energy peers by a wider margin.

Before we dive into financial numbers, it is important to mention that Diamondback has large stakes in two other energy companies.

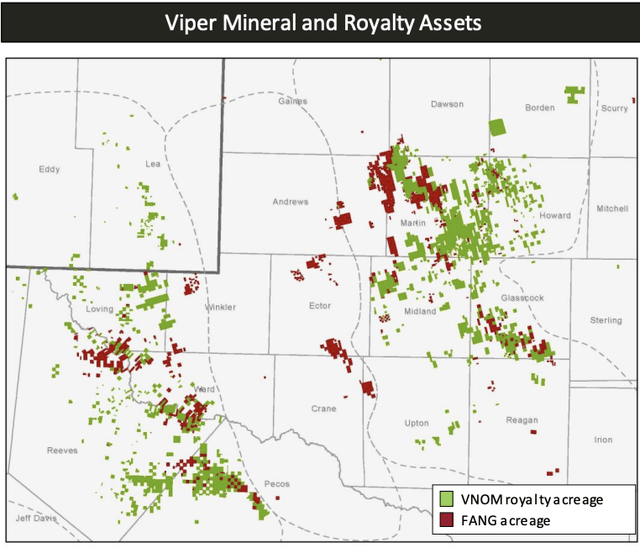

FANG owns Viper Energy Partners GP LLC, the general partner of Viper Energy (VNOM) as well as 54% of the limited partner interest.

VNOM owns close to 27 thousand net royalty acres, 55% of which are operated by FANG.

Further, FANG’s publicly traded subsidiary Rattler Midstream LP is focused on the ownership, operation, development, and acquisition of midstream infrastructure assets in the Midland and Delaware Basins of the Permian Basin. Diamondback owns Rattler Midstream GP LLC, the general partner of Rattler and approximately 74% of the limited partner interests in Rattler.

Because of its operations in the Permian Basin, the company’s cash flow breakeven in the mid-30s per barrel, which is great news.

Moreover, the company is about 60% hedged, with relatively low hedging costs. The company expects to roll forward its existing hedges. According to the company:

[…] protecting for a rainy day, trying to spend around $1.50 to $2 a barrel to buy those puts, and we want to be about 60% hedged going into a particular quarter. So if you look at our hedge book, about 60% hedged for Q3, going down to about 0% by Q2, Q3 of 2023. And we’ll just continue to keep rolling that forward for rainy day insurance.

It’s also interesting to mention that Diamondback expects a 2023 recession, which is becoming the base case. However, the company says that the world appears to be chronically short physical barrels with not a lot of spare capacity to fill that gap. This means the company is not changing its hedging strategy.

With all of this in mind, FANG is not expected to significantly grow output.

I think it’s a little premature to do much forecasting into 2023. But I can tell you kind of our base case is looking at something at the same activity level, probably generating something in the low single digits in terms of the growth rate. But again, it’s more of an output.

Between 2Q22 and 1Q22, oil production remained flat. This is not expected to change in the current third quarter. The realized cash margin improved to 83% of the unhedged oil price thanks to a record low reinvestment rate of 26% and subdued cash CapEx. This allowed free cash flow to rise by 37% to $7.46 per share.

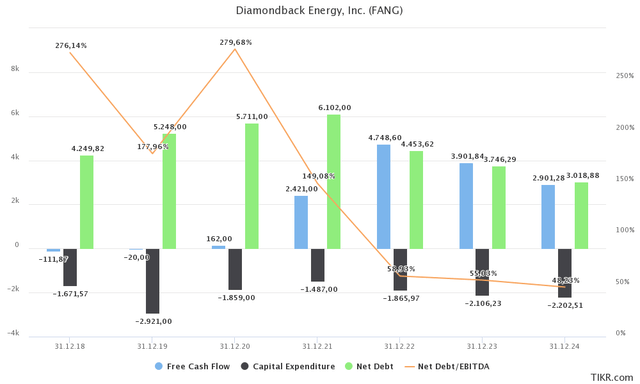

On a full-year basis, FANG is expected to maintain annual CapEx close to $1.9 billion with minimal growth to $2.2 billion by 2024. As a result of high oil prices, the company is in a good spot to do $4.7 billion in free cash flow this year. That’s 31% of the company’s $24.0 billion market cap. It’s one of the highest free cash flow yields I have encountered this year among energy companies. Even next year, the implied FCF yield is still 16.5%.

What this does is it allows the company to reduce debt and reward investors.

This year, net debt is expected to fall to $4.5 billion, or less than 0.6x EBITDA. That’s very healthy. Even prior to the pandemic, the company had a sub-3x net leverage ratio. It is, therefore, no surprise that the company has a BBB credit rating. Also, FANG has no major maturities until 2025, which gives the company a lot of room to deal with the elevated rate environment.

And it opens up so many opportunities to distribute cash.

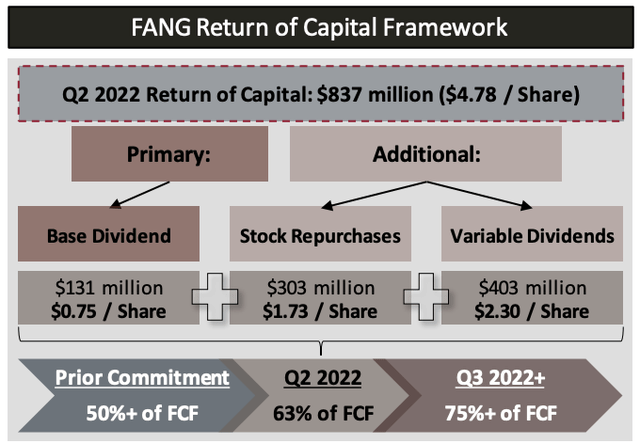

Using 2Q22 numbers, we see that the company is looking at three ways to distribute cash: a base dividend, stock repurchases, and a variable dividend.

The company returned $4.78 per share. $3.05 came from dividends. This gives FANG an annualized yield of 9.0% between the base and variable dividends.

The FANG board approved $4.0 billion worth of buybacks with a commitment to return at least 75% of FCF to shareholders beginning 3Q22. That’s up from 50% previously. That’s a huge deal and it makes the company’s current dividend yield of roughly 2.2% look much better than it actually is. After all, FANG now has buybacks and variable dividends.

In other words, people can do the math themselves. If the company can maintain close to $4.0 billion in FCF next year (I think it will be higher), investors receive 75% of that. That’s $3.0 billion and it implies a distribution yield of 12.5%. Again, that’s total dividends and buybacks.

Unlike the oil majors Exxon Mobil (XOM) and Chevron (CVX), the dividend will be extremely volatile as it’s driven by variable dividends. Yet, the company is in a good spot to return money more aggressively than some of its larger peers. That’s a big win for both income-oriented investors and investors looking to ride the long-term oil bull case – and anyone in between.

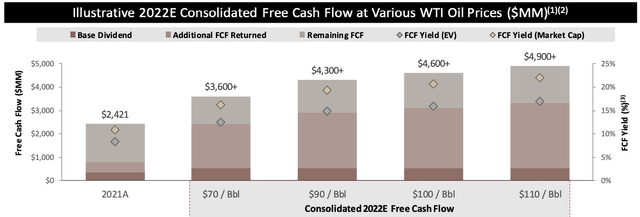

To give you a few additional numbers. At $90 WTI, the company expects to do $4.3 billion in free cash flow. In other words, sell-side analysts are betting on moderation in oil prices back to $65ish WTI.

If oil prices remain steadily elevated above $80 (or rise back to triple-digits when demand comes back), investors receive high, double-digit distributions and a much better valuation as buyers will have to adjust to a “higher for longer” oil environment.

So, what about the valuation?

FANG Stock Valuation

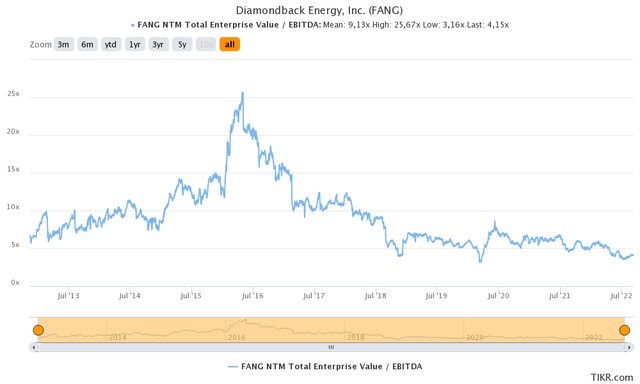

FANG has an implied enterprise value of $28.8 billion consisting of its $24.0 billion market cap, $3.75 billion in 2023E net debt, and $1.07 billion in minority interest. This EV is roughly 4.2x next year’s expected EBITDA of $6.8 billion.

This valuation is way too low and it is based on roughly $80 per barrel WTI. If oil prices rise above that, the valuation becomes even more attractive. Needless to say, the longer oil stays elevated, the more attractive FANG becomes. It continuously reduces debt, which benefits the enterprise value. Higher free cash flow boost dividends and buybacks make earnings PER SHARE more attractive.

What this means is that if my long-term oil outlook is even remotely correct, FANG will continue to outperform the market and deliver very high shareholder returns.

Hence, what FANG stocks (the beloved tech stocks) did prior to the pandemic, I believe FANG can do in the years ahead: deliver consistently outperforming returns. This time, however, it comes with high dividends, something the “traditional” FANGs couldn’t compete with – or at least decided not to as most reinvested their free cash flow.

Takeaway

We’re in a new era for oil. The secular bull market has started, fueled by subdued supply and rebounding demand after the pandemic. Moreover, government-driven net zero initiatives are expected to keep a lid on supply as oil companies are simply not willing to increase the financial risks for themselves. Also, many western politicians have been pretty clear when making anti-fossil fuel statements.

Diamondback Energy is in a terrific position to benefit from this on a long-term basis. The company has efficient operations in America’s shale hotspot, the Permian Basin. This allows for high free cash flow generation despite a conservative hedging strategy.

Investors are poised to benefit from strong, double-digit distributions consisting of a base dividend, special dividends, and buybacks.

It also helps that FANG is extremely undervalued.

The biggest risk is demand destruction, which could prevent the stock from breaking out for the remainder of this year. Yet, I don’t suggest trading FANG anyway. The best way to play this is to buy a small position and gradually add on dips.

With this strategy, I have little doubt that FANG will generate outperforming returns for its shareholders for many years to come.

(Dis)agree? Let me know in the comments!

Be the first to comment