kldy/iStock via Getty Images

Investment Thesis

Diamond Offshore Drilling (NYSE:DO) is a Texas-based global drilling services contractor for the energy industry, with a fleet of 14 floater rigs, including 6 drillships and 8 semisubmersibles, spread across the globe.

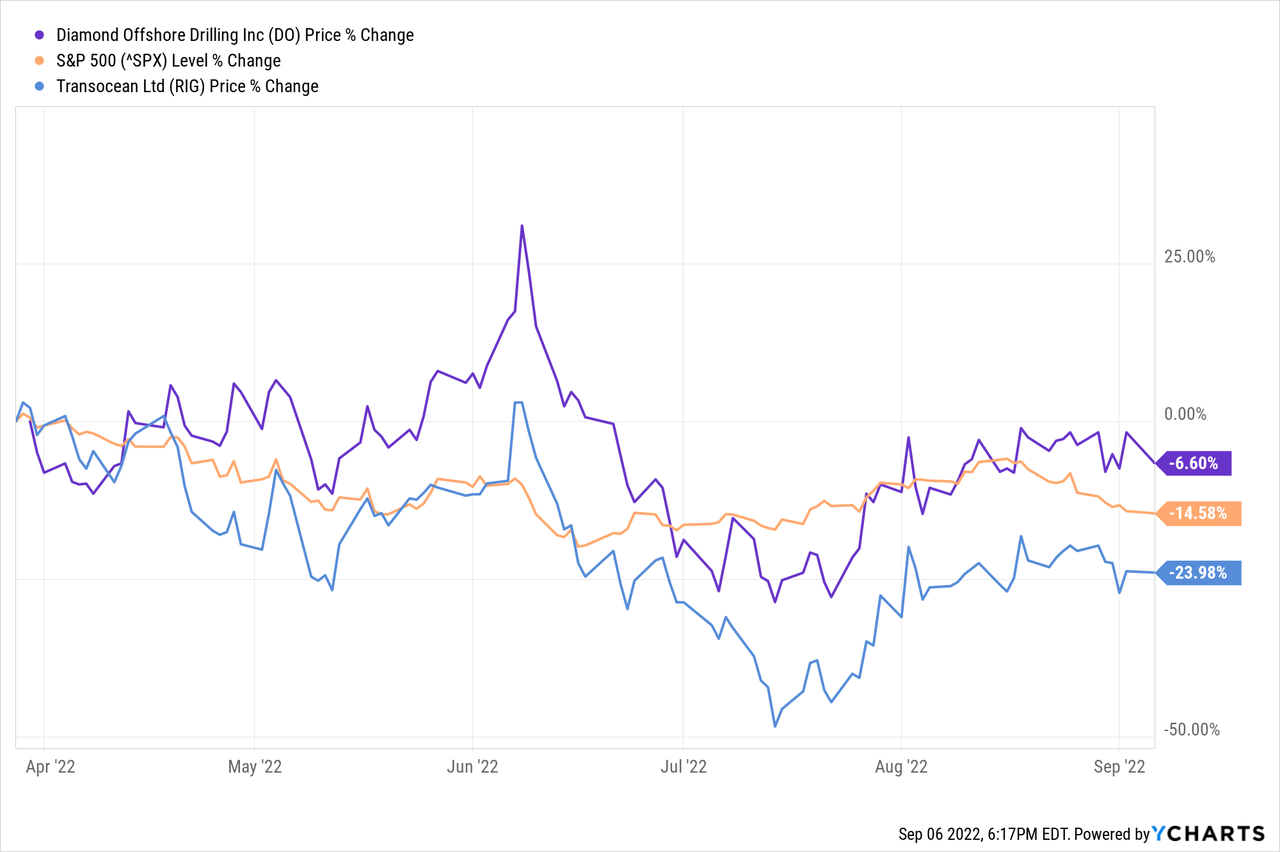

It was delisted in 2020 pertaining to a Chapter 11 bankruptcy, resulting in its creditors becoming its shareholders and providing the company with over $625 million of newly available capital. The company was recently relisted on the NYSE in March and has since been trading well, with an average daily trading volume of over 1.2 million shares. Since then, it has outperformed the market by double digits.

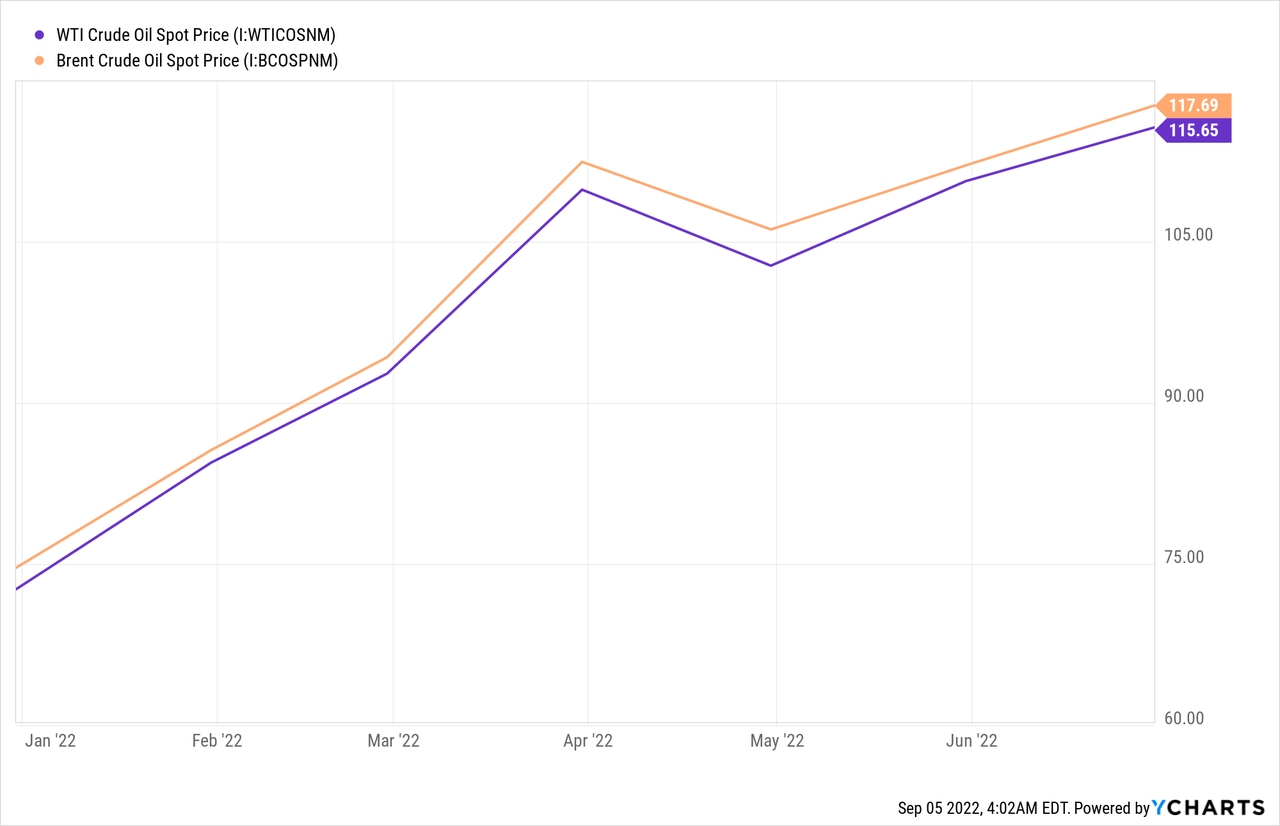

This upsurge is likely fueled by favorable macroeconomic factors following the Russia-Ukraine conflict, which has caused an energy crisis around the globe, pushing the oil market fundamentals upward. Europe is severely squeezed for energy resources and is actively looking to be independent of Russia, which naturally turns it toward other western countries, especially the United States.

This demand vacuum has created a significant incentive for US-based energy companies, especially in the oil and gas sector, to expand their operations and increase production. The inflated oil prices show no signs of imminent reversal and create a highly lucrative opportunity for these companies, uniquely poised to take advantage of the energy market boom.

Investing in an upstream company like Diamond Offshore, concurrent to the inflated CapEx budgets of oil and gas companies in light of this bullish market, reconciles investors with the world’s energy giants.

A Bullish Market

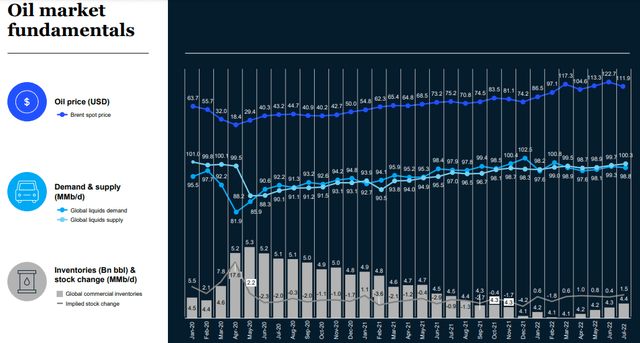

The recent upsurge in the energy market in response to aggressive global industrialization and urbanization has propelled investors into increased oil & gas sector investments. The high demand growth in transportation, power production, manufacturing industry, infrastructures, etc., is unsustainable solely on renewables and alternative energy sources and will most certainly need to be supported through the fossil fuel industry.

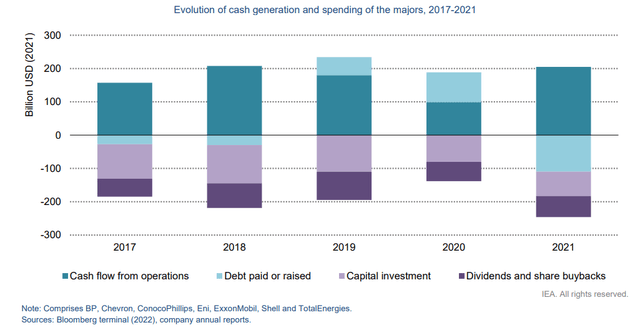

Along with shareholder returns, these companies’ historically rising cash flows have played an integral role in ramping up the CapEx spending. Following the same pattern, the EIA estimates the net income for global oil & gas producers to double in 2022 due to rising fuel prices, resulting in an unprecedented net income of about $4 trillion.

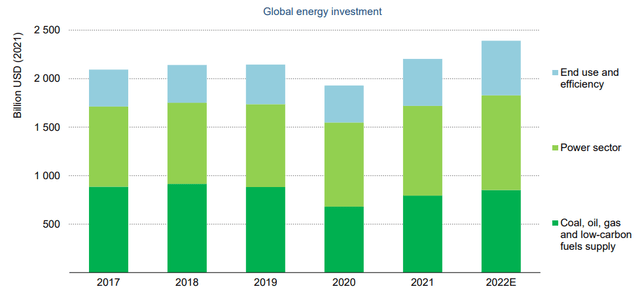

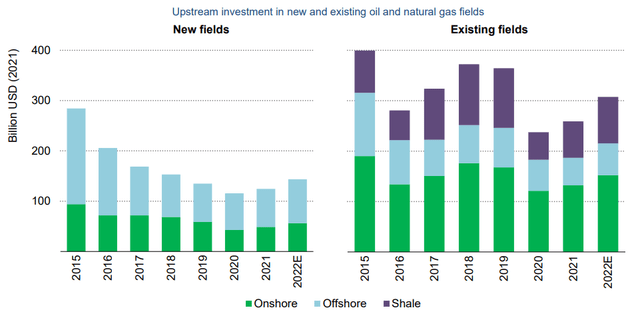

Subsequently, investments in upstream onshore and offshore oil and gas endeavors are expected to rise, in line with the post-pandemic trend and concurrent with the rising demand.

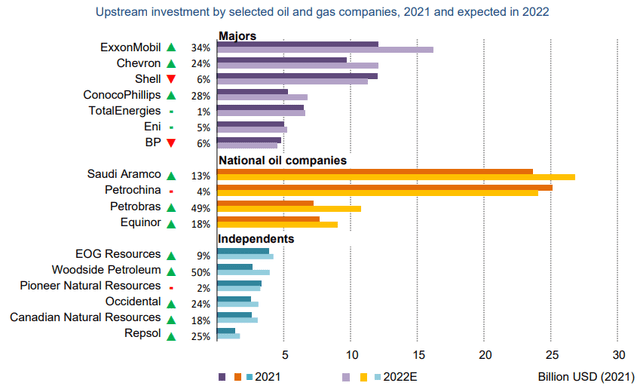

The largest increase in these investments in the western world is expected to come from major US companies that plan to increase their spending by over 30% in 2022. Similarly, Middle Eastern national oil companies’ CapEx spending has now exceeded the pre-pandemic levels, with Saudi Aramco and ADNOC announcing plans to increase their investments by about 15% to 30% in 2022.

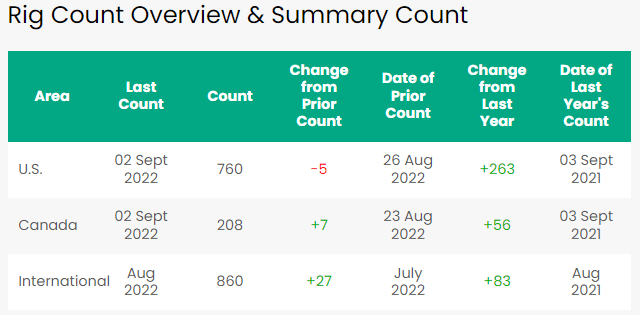

This is a great opportunity for upstream companies like Diamond Offshore, as the demand for drilling services is seeing significant growth, with the total rig count in the US exhibiting an almost 53% YoY growth from 497 rigs in 2021 to 760 rigs in September 2022. This increase is almost exclusively driven by the increase in crude oil rigs, which increased 51.2% YoY from 394 to 596.

Baker Hughes

This bullish sentiment is evident from Diamond Offshore’s increasing backlog of over $1.5 billion, including the $610 million in new contracts since July 1st and about 75% of its 2023 marketed capacity already contracted.

Profitability Expected In Mid-2023

The company’s recent emergence from a Chapter 11 bankruptcy makes it prone to investor doubts, with the market pricing in significant execution risks into its share price. If Diamond Offshore successfully achieves its targets, the market will likely start pricing in the upside potential, realizing material price returns.

The company’s 2022 guidance has been revised with lower profitability than expected because it has undertaken reactivation and contract preparation activities associated with one of its rigs earlier than anticipated. The activities were planned for 2023 but have been moved up to Q4 2022, adding about $35 to $40 million in costs for 2022.

This has inflated the estimated CapEx from $57 million at the midpoint to $77 million and negatively affected the EBITDA guidance from $59 million at the midpoint to $29 million and the free cash flow guidance from negative $75 million at the midpoint to negative $110 million.

The revision is primarily because of the mistiming and will result in significant future benefits, as the contract in question will generate about $80 million in revenue, mostly recognizable in 2023.

Even though the current year is expected to be loss-making, the company’s recently acquired contracts are averaged at higher daily rates. With most of its 2023 capacity contracted out, the company is expected to be profitable from Q2 2023, when its newer contracts start materializing.

The company’s current revenue under the previous contracts is recorded with average daily revenue of $227,800 per day in the MRQ, up 1.3%. However, its new contracts are substantially lucrative, with daily rates of around $400,000.

In addition to higher revenues, the new contracts are also more profitable in terms of the estimated average EBITDA margin, with an about 10% increase from its current contracts in absolute terms. If we exclude the 2 managed rigs, the aggregate percentage point doubles to 20%.

These substantial revenue and profitability bumps will be reflected in the interim financial statements in the middle of the next year, when the new contracts materialize, ascertaining the optimistic estimates.

Conclusion

As a recent emergent from Chapter 11, the company is being priced as an underdog with significant execution risks. The stock is being traded at a discount to its 2023 revenue and book value because the market sees it as high-risk security with an unproven track record.

However, investing in DO is concurrent with investing in the bullish upstream oil & gas market, which has recently become a focal point of the world, despite the massive ongoing transition toward renewable sources. The stock will have substantiated significant investor returns long before the offshore drilling market starts deteriorating.

The company is trading with a strong volume, and with profitable quarters around the corner, the market will likely start charging a premium to its book value, pushing the share price upward.

For investors looking for medium-term capital appreciation, DO offers a great opportunity as an upstream oil and gas company. In light of all this, I rate the stock as a buy.

Be the first to comment