curraheeshutter/iStock via Getty Images

Thesis

Diamond Offshore Drilling (NYSE:DO) is an offshore drilling company that had a Chapter 11 restructuring in 2020 that saw its stock delisted and its old equity holders wiped out. The company restructured its liabilities and the debenture holders saw themselves as equity holders in the new company. The new stock was re-listed on the NYSE in March of this year and has rallied as the energy super-cycle has raged. A lot has changed since we last looked at DO – energy prices have doubled, the stock is no longer illiquid and impossible to buy and sell, and other energy assets have reached historic high valuation levels. As the Russia/Ukraine conflict flared up we saw a historic shift away from Russian oil & gas which has acted as a major positive catalyst for offshore drillers. In a nutshell, western governments will want to rely more on energy sources from other countries, which has as a direct result more cash allocated to offshore drilling budgets. Offshore drilling day-rates are set to increase substantially, and the offshore drilling sector, which has lagged tremendously the energy rally in the past year, is set to benefit. Diamond Offshore Drilling is a macro play with a restructured balance sheet and one of the last dominoes to fall as the macro energy super-cycle sweeps all related sub-sectors. We view the current company valuation as attractive, and an investor interested in picking up an energy asset at an attractive level to bet on higher oil prices for the next years would be well served to buy the stock outright or via its options chain.

Russia Macro Impact

One of the most important events in our mind that will provide a backwind to the offshore drilling sector is the Russia/Ukraine conflict. With substantial bans of Russian oil taking hold in Europe and an embargo on oil & gas technology exports to Russia, it is only a matter of time before we see substantial declines in the oil output from the jurisdiction. The Oil & Gas sector has seen substantial innovations in terms of extraction and processing methodologies in the past decade at an ever decreasing cost. Without the western know-how, Russia will see a rise in extraction costs, which is going to translate in a more attractive proposition and break-evens for offshore drillers. Just like the shale revolution in the U.S. forced offshore drillers to lower costs, the Russia/Ukraine conflict will help the sector’s break-evens and charge rates:

The cliff-drop in the oil price has forced both onshore and offshore producers to focus on significantly cutting development and production cost, in order to lower their break-even price to below the current market oil price level. Technologies for development and for operation excellence are the key contributors for both Deepwater and Unconventionals when facing the long term stagnant low oil price. This paper will present the findings of the study.

Source: US Shale Revolution Impacts on Deepwater and Global Energy Landscape by Doreen Chin & Terren Roark

Moreover, as we are seeing currently happening, the EU & U.S. are going to look at securing Oil & Gas reserves from their own or “friendly” jurisdictions. There is a cost to the EU & U.S. from embargoing Russian oil, and that cost is going to translate into subsidies and lower break-evens for projects that before the Russian invasion seemed uneconomical.

The industry has already seen a surge in demand and a substantial increase in day-rates:

With a surge in demand, particularly in the wake of Russia’ invasion of Ukraine, day-rates are increasing and operators are reactivating cold-stacked rigs in order to accommodate long-term demand.

“As more of these inactive units enter the fleet – and this will be the case – the committed utilization rate will continue to increase and day-rates will inevitably follow,” said Teresa Wilkie, research director for Westwood’s RigLogix platform.

[…]

However, taking into account the number of cold-stacked rigs, currently idle but now entering the market, “true rig availability is much tighter”.

On that basis, drillship utilization is “nearly sold-out” at 92%, while jack-ups are at 89% and semi-subs are sitting at 82%, both of the latter being up 10% or more over the other metric

Source: Energy Voice

Balance Sheet And Income Statement

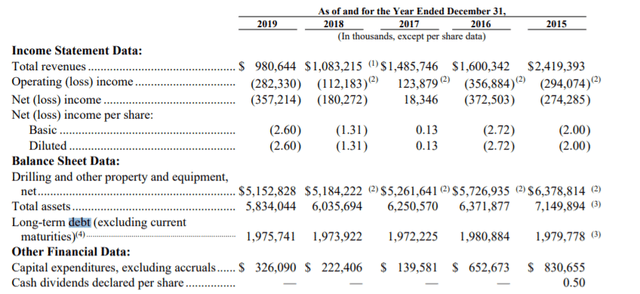

Before the April 2020 Chapter 11 filing, Diamond Offshore had approximately $1.975 billion notional in long-term debt that generated over $122 mm in yearly interest expenses:

Old Balance Sheet (SEC Filing)

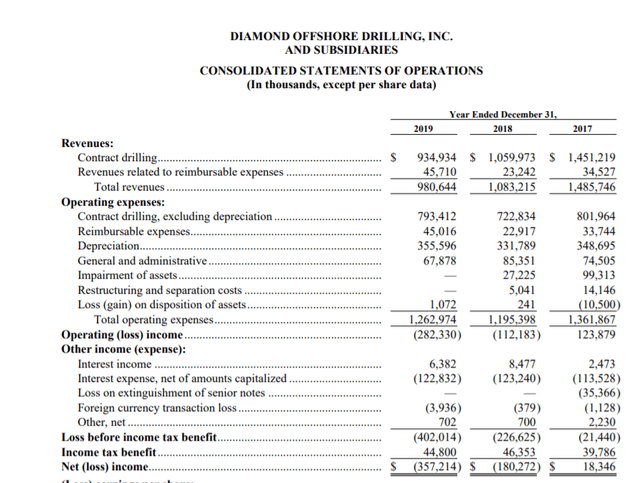

Old Income Statement (SEC Filing)

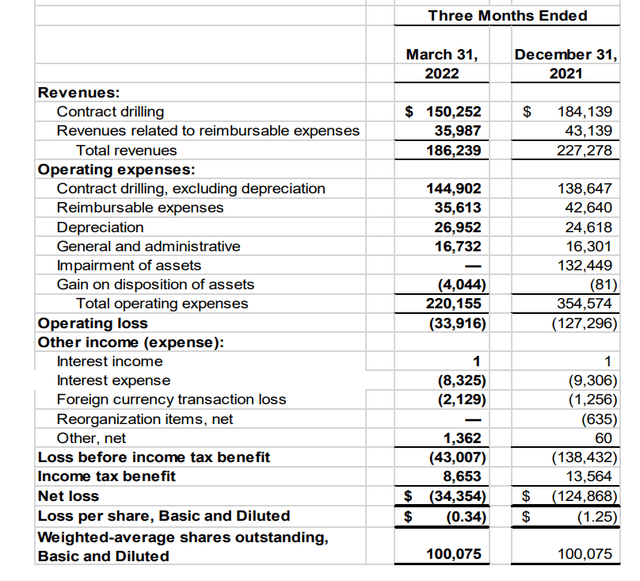

Long-term debt has been now reduced to $286 mm and the annual interest expense is now somewhere close to $33 mm per year:

Current Balance Sheet (SEC Filing)

You will notice that the company is still unprofitable, having an operating loss of -$33 mm per quarter as of March 2022.

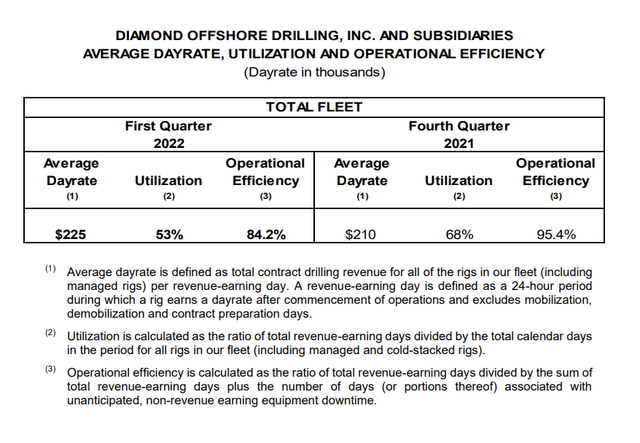

The key to the current operating loss and the future profitability potential lies in the company’s day-rates for its rigs and its utilization:

Utilization & Day-Rates (SEC Filing)

We can notice that the current average day-rate currently sits at a paltry $225k and the fleet utilization is at 53%. We expect these to change as activity picks up, and the macro scenario described above fully unfolds. Ultimately, DO is a macro play at this stage – the company was pushed into bankruptcy by macro factors (the shale revolution, major oil companies cutting costs via exploration budgets and Covid) and will be pushed back into profitability by its restructured balance sheet and the energy super-cycle macro picture. One of its competitors, Transocean (RIG) offered us a flavor of what is to come:

If we look at the income statement, and we double the contract drilling number (without assuming utilization will be up) we can get a sense of how profitability can shape up for DO in the future.

Performance

Utilizing Transocean (RIG) as a proxy for offshore drillers (because the company did not experience a restructuring thus the common stock has traded continuously in the past years) we can see how the Offshore Drilling sub-sector has underperformed:

1-Year Performance (Seeking Alpha)

In the past year, the E&P companies as reflected in the XOP ETF have rallied the most, followed by Oil & Gas majors. The reason for this performance is represented by cash-flows, balance sheet repair and starting valuation points. While both Oil & Gas majors and E&P producers have seen substantial improvements in profitability and cash-flows, many of the E&P companies experienced near-death events during Covid when their share levels were priced for bankruptcy. Hence, the larger recovery. We are expecting something similar in the Offshore Drilling sector. The only difference is that most of the Offshore drillers actually went bankrupt:

- Noble Corporation – 2020 Chapter 11 bankruptcy

- Seadrill – 2020 Chapter 11 bankruptcy

- Valaris – 2020 Chapter 11 bankruptcy (Valaris is the resulting entity from the Ensco Plc & Rowan Companies merger)

- Diamond Offshore – 2020 Chapter 11 bankruptcy

A successful Chapter 11 restructuring is an actual positive for the new equity because it achieves a number of items:

- Re-setting the debt burden to accommodate operating cash-flows: most of pre-petition debt is wiped out or transformed into equity in the new company

- Wipe-out of the old equity holders: most of the equity holders in the old entities were wiped out

- Restructuring of uneconomical contracts for the old entities

On a 5-year basis, the graph paints an even clearer picture of where the Offshore Drilling sector is headed:

5-Year Performance (Seeking Alpha)

We can see the close correlation among the various Energy sub-sectors up to 2021. Oil Majors and E&P producers subsequently rallied, while Offshore Drillers lagged.

Conclusion

Diamond Offshore Drilling went through a painful restructuring that saw the old equity holders completely wiped out and the debenture holders in the old company becoming the NewCo stock owners. While currently still producing an operating loss, the company is set to benefit from soaring day-rates in the industry and an improved utilization percentage. Offshore drilling has been the laggard in the energy super-cycle due to its inability so far to generate the type of positive free cash flow levels we have seen for E&P producers and large oil companies. We feel the Russia/Ukraine conflict is acting as a major positive catalyst for the offshore drilling industry for the years to come, and DO is an attractive macro play in the sector.

Be the first to comment