Stivog/iStock via Getty Images

It is not for me to judge another man’s life. I must judge, I must choose, I must spurn, purely for myself. For myself, alone.“― Herman Hesse

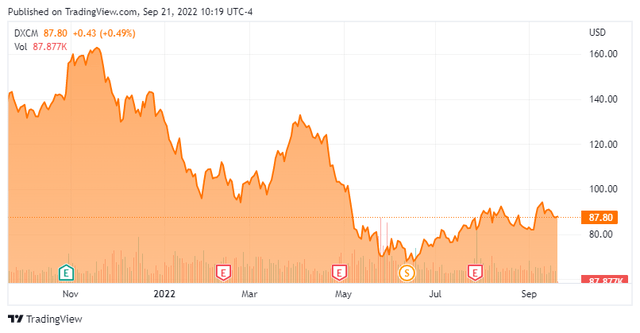

Today, we put DexCom, Inc. (NASDAQ:DXCM) in the spotlight for the first time. The stock has been under pressure in 2022 and missed expectations with its second quarter earnings results. Still, this medical device maker should continue to deliver revenue growth in the high teens. The shares have started to rebound recently, even in a shaky market. Start of a longer rebound? An analysis follows below.

Company Overview:

This medical device maker is headquartered in San Diego, CA. The company is focused on the design and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally. The company provides its systems for use by people with diabetes, as well as for use by healthcare providers and has several products on the market. These include the G6, G7 and DexCom ONE product lines. The shares trade just south of $90.00 a share and sport an approximate market cap of just under $35 billion.

January Company Presentation

Management at the company has long viewed its software as the avenue to differentiate enabling unique user experiences as well as supporting greater connectivity and enhancing the company’s ability to move more seamlessly into new markets.

January Company Presentation

Second Quarter Results:

The company disclosed second quarter numbers on July 28th. DexCom, Inc. had non-GAAP earnings per share of 17 cents, two pennies short of the consensus. Revenues rose more than 17% on year-over-year basis to $696.6 million, over $10 million under expectations. It should be noted that the company had $12 million of unfavorable foreign currency impact in the quarter. Leadership now expects $40 million of foreign currency headwinds for FY2022 relative to their prior estimate of around $15 million to $20 million. Unfortunately this is something American multi-nationals have had to deal with consistently in 2022, due to strong dollar or weak Euro, depending on your perspective. U.S. revenue accounted for $511 million of overall sales, which was up 11% from the same period a year ago.

July Company Presentation

The company also tightened forward guidance for FY2022 to now between approximately $2.86 billion – 2.91 billion (17-19% growth), which was under the existing $2.93 billion analyst consensus at the time. The stock sold off briefly on the day of the earnings release but the stock has grinded its way higher for almost two months now.

July Company Presentation

DexCom, Inc. is experiencing its fastest sales growth overseas. Sales for the second quarter were up 39% from 2Q2021 and totaled $185 million. The company recently launched DexCom ONE in both Spain and the U.K., and has secured reimbursement for key segments of the population. It also reached recently an agreement with Roche Holding (OTCQX:RHHBY) to market the device in Italy.

Analyst Commentary & Balance Sheet:

Since second quarter results were posted in late July, 13 analyst firms including JPMorgan and Oppenheimer have reissued or assigned Buy/Outperform ratings on the stock. Albeit, approximately half had mostly minor downward price target revisions contained within in them. Price targets ranged from $85 to $112 a share. Morgan Stanley reiterated its Hold rating and $83 price target on DexCom.

Several insiders have been consistent sellers of the stock in 2022, especially in the first quarter of this year. They have sold just north of $15 million worth of equity in aggregate so far this year. Less than four percent of the outstanding float is currently held short. The company ended the first half of this year with just over $2.7 billion in cash and marketable securities on its balance sheet against just under $2 billion of long-term debt. In late July, the company announced a $700 million share repurchase program which will offset the anticipated dilutive impact from their 2023 convertible notes.

Verdict:

The current analyst firm consensus has the company earning just over 75 cents a share on $2.9 billion of sales (an approximate 18% increase over FY2021) in FY2022. They expect earnings to rise to $1.10 a share in FY2023 as revenues rise 20% to nearly $3.5 billion.

It is hard to find the investment case around DexCom, Inc. compelling even after a better than 30% decline in the shares so far in 2022. Growth stocks are not in favor right now as interest rates continue to rise. Even if that weren’t the case, DXCM is selling at north of 100 times this year’s expected profits and 12 times projected sales. All for a firm that will be fortunate to produce 20% sales growth going forward. Add in the insider selling in 2022, and the stock trading above the floor of recent analyst price targets; it is hard to conclude DexCom stock is anything but an Avoid at these trading levels.

The greatest lesson in life is to know that even fools are right sometimes.”― Winston S. Churchill

Be the first to comment