LordHenriVoton

Thesis

Delaware Enhanced Global Dividend and Income Fund (NYSE:DEX) is an equity CEF from the Delaware/Macquarie asset management family. As per its literature:

The Fund invests globally in dividend-paying or income-generating securities across multiple asset classes, including but not limited to: equity securities of large, well-established companies, securities issued by real estate companies (including real estate investment trusts and real estate industry operating companies), debt securities (such as government bonds, investment grade and high risk, high yield corporate bonds, and convertible bonds), and emerging market securities. The Fund also utilizes enhanced income strategies by engaging in dividend capture trading, option overwriting, and realization of gains on the sale of securities, dividend growth, and currency forwards.

The fund is down -13% this year on a total return basis, in line with the S&P 500 as of the writing of this article. What is particular regarding this small CEF from Delaware/Macquarie is the fact that the vehicle is supposed to be merged into AGD. The way the process works is via an initial vote by AGD’s board of directors regarding the merger. That step was successfully completed back in August. The next items on the agenda here are shareholder votes of approval for the merger from both AGD and DEX. It seems that this is where a snafu was hit, with the DEX shareholders unhappy with what was put forward.

DEX Shareholders

One of the largest shareholders in DEX is Bulldog Investors. As per their own investor update from September 2022:

Bulldog currently owns over 5% of Delaware Enhanced Global Dividend and Income Fund (“DEX”). DEX recently announced that it intended to merge into abrdn Global Dynamic Dividend Fund (“AGD”). However, both CEFs trade at wide discounts (of about 11%) so this merger presents no apparent benefit to shareholders. In fact, shareholders of DEX will be worse off in our opinion, because DEX conducts a small self-tender offer each year at 98% of NAV, which tends to keep the discount from blowing out. AGD has no similar policy to control its discount. Promptly after the announcement, we submitted a shareholder proposal to DEX and may actively oppose the proposed merger unless management agrees to provide for a liquidity event prior to consummating it.

Bulldog is an active investor that demands accountability and a “quid pro quo” in terms of their vote for the merger. Delaware/Macquarie are pressed to ensure the merger succeeds because they are winding down their CEF business. They cannot have stragglers left behind. Therefore, in order to appease Bulldog, the fund managers are putting forward a share repurchase program that will monetize the large discount to NAV present for the fund:

PHILADELPHIA–(BUSINESS WIRE)– Today, Delaware Enhanced Global Dividend and Income Fund (the “Fund”), a New York Stock Exchange-listed closed-end fund trading under the symbol “DEX”, announced that its Board of Trustees (the “Board”) has authorized an issuer tender offer to purchase for cash up to 30% (or 3,186,291) of its issued and outstanding common shares, without par value (the “tender offer”). The tender offer is contingent on the shareholder approval of Proposal 1, the reorganization of the Fund into arbdn Global Dynamic Dividend Fund (the “Acquiring Fund”), a New York Stock Exchange-listed closed-end fund trading under the symbol “AGD” (the “Reorganization”), at the Fund’s upcoming adjourned Special Meeting of Shareholders that will take place on December 12, 2022 (the “Special Shareholder Meeting”).

The commencement of the tender offer is pursuant to an agreement between the Fund and Bulldog Investors, LLP (“Bulldog”) and certain associated parties. Pursuant to the agreement, Bulldog has agreed to be bound by certain standstill covenants. The Fund has been advised that Bulldog will file copies of the relevant standstill agreement with the U.S. Securities and Exchange Commission (“SEC”) as exhibits to its Schedule 13D.

The DEX shares rallied substantially on the back of the announcement, despite the wider equity markets being fairly flat or down:

Ultimately the DEX shareholders have a 3% to 4% net bump-up from the announcement (given a 30% tender offer amount that gives holders a 10% narrowing of the discount).

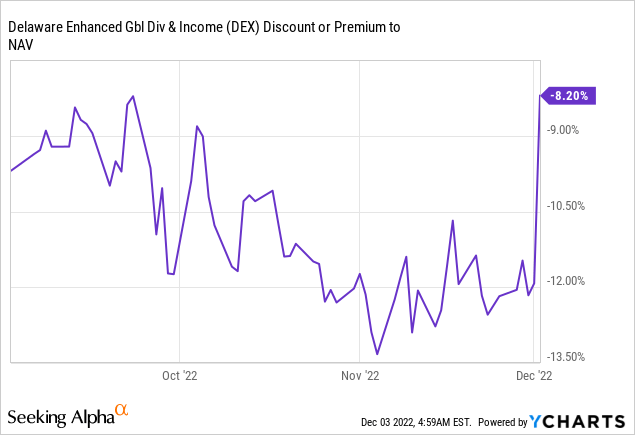

The discount to NAV drove most of the move up in DEX, with the fund experiencing a 4% narrowing of the difference between market value and net asset value:

We can see the sudden narrowing in the discount once the announcement came through.

Outcome for CEF Holders

Existing shareholders in the CEF have gotten a bump-up in price on Friday driven by the share-repurchase news. We feel the corporate action and the vote to merge into AGD will move forward. This will result in a soft bottom for the discount to NAV until the share repurchase is completed. Subsequently any substantial divergences in discounts to NAV between DEX and AGD should be bought.

Conclusion

DEX is an equity CEF from the Delaware/Macquarie asset management family. Delaware/Macquarie are winding down their CEF business and trying to merge their funds into Aberdeen CEFs. DEX is set to merge with AGD, subject to shareholder approvals. One of the largest investors in DEX, namely Bulldog Investors, did not want to move forward with the approval unless the CEF management created some value for shareholders through a corporate action. We have now seen a share repurchase proposal put forward that is set to repurchase up to 30% of outstanding shares at par, contingent on the merger being approved. With the fund trading at a 12% discount to NAV prior to the announcement, there is a healthy 3% to 4% bump-up that was realized yesterday in the market post the announcement. It is interesting to note that the two CEFs were trading at similar discounts after the August merger announcement, hence there was no scope for a merger arbitrage trade here. However, through their large positioning in DEX, Bulldog Investors has managed to persuade the CEF management team to create shareholder value via par share repurchases in exchange for a merger approval. A true shareholder revolt with a constructive outcome.

Be the first to comment