ollo

In our initiation of coverage, we emphasized how the Global Forwarding & Freight division was DHL’s new cash cow. In our Q1 result analysis, we explained how “DHL will sustain this new normal and how the management has always been very cautious, and we were setting up new and above target expectations”.

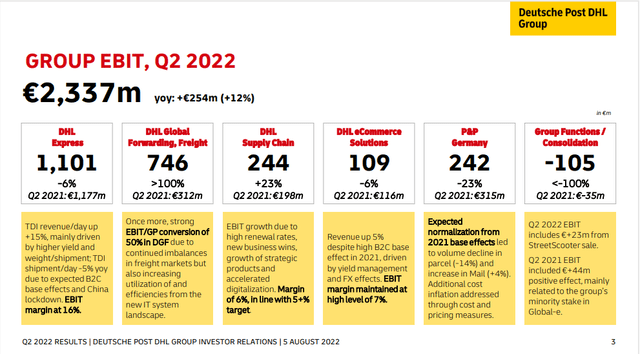

Last week, the world’s leading logistics group Deutsche Post (OTCPK:DPSTF) reported its half-year numbers and after having analyzed the quarterly results, we are even more confident in our investment thesis. Just by looking at the snap below, we do note a strong performance from the DHL Global Forwarding & Freight segment. Let’s now deep-dive into the accounts.

Deutsche Post EBIT at the divisional level

Half-year results

In the second quarter, the German logistic operator increased its sales by almost a quarter to a good €24 billion. Of this, €2.3 billion remained as operating earnings before interest and taxes signings a plus 12% compared to a year earlier. EPS also reached €1.2 in the period. Cross-checking with Wall Street analyst estimates, the average consensus was forecasting €21.8 billion in sales, an EBIT of €2 billion and an EPS of 1.01. It was a broad-based-beats for Deutsche Post AG. Looking at the divisional performance, as already noted in the first quarter, the lion’s share of earnings came from the freight division. At the same time, private customer business, which is determined by online shopping, has normalized because people no longer ordered as many goods on the Internet as they used to do a year ago when COVID-19 measures restricted our life. This is not coming as a surprise and also the management was expecting this. During the Q&A call, the group underlines that higher energy costs are well under controlled, even if the EBIT margin was down to 9.7% from 10.7%. Despite that, going down to the bottom line, Deutsche Post delivered a net profit of almost €1.5 billion, up by 15% more than in the same period last year.

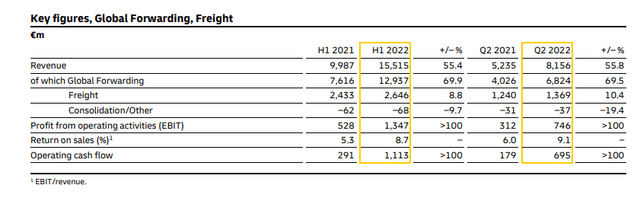

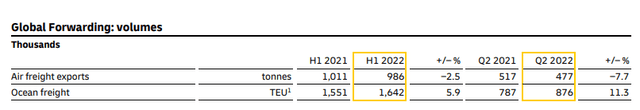

DHL Global Forwarding & Freight division performance was even more remarkable by the fact that volumes were lower compared to the same period one year ago. This was due to the high transport prices in international business with corporate customers.

Global Forwarding & Freight EBIT Global Forwarding & Freight volumes

Conclusion and Valuation

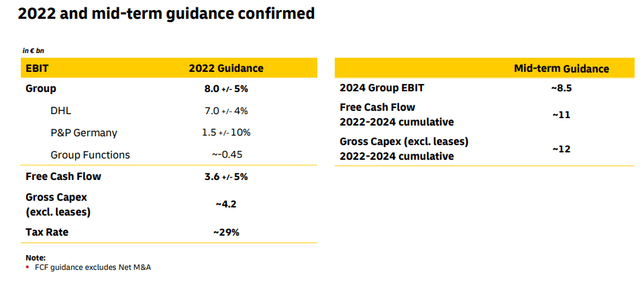

The company’s business seems to be hardly or not at all affected by the economic concerns. After six months, EBIT already stood at €4.5 billion. For the current year, the management confirmed its forecasts and also the 2024 outlook. Results were better than analysts had expected.

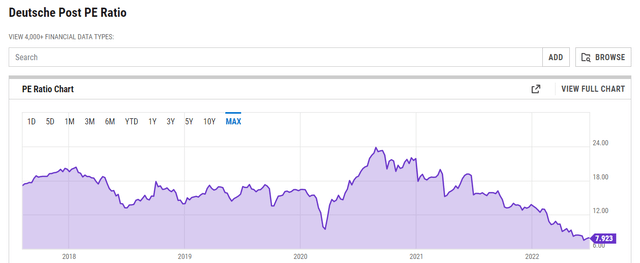

Concerning the valuation, as we can see below, Deutsche Post is trading at the lowest P/E ratio multiple in its history. In the freight business, this positive result was also confirmed by Deutsche Lufthansa and Air France-KLM results. Once again, we are reaffirming our buy target valuing Deutsche Post with a DCF model using a long-term EBIT margin of 11% and a WACC of 7.6%. Thus, we derive a target price of €62 per share. The risk paragraph is also included in our previous publication.

Be the first to comment