ollo/iStock Unreleased via Getty Images

Investment Thesis: While Deutsche Post has seen downside due to pressures on global supply chains and inflationary concerns, continued revenue growth in the second half of the year could mean a rebound in upside.

In a previous article back in October, I made the argument that Deutsche Post (OTCPK:DPSGY) could see longer-term upside going forward – on the basis of strong growth across the Post & Parcel and Express segments – along with continued growth in eCommerce solutions.

With that being said, my previous analysis could not have taken the subsequent effects of the ongoing situation in Ukraine and the broader inflationary environment we have seen since – which is being driven by higher fuel prices.

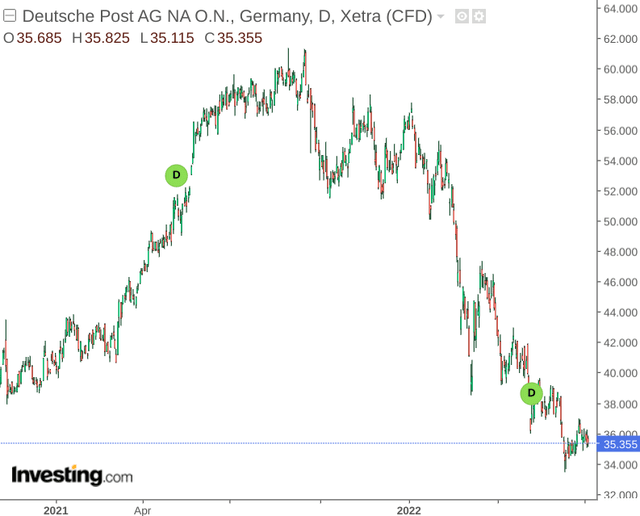

As a result, Deutsche Post has seen a big decline over the last year:

investing.com

The purpose of this article is to examine whether there is a disconnect between increasingly bearish market performance and the performance of Deutsche Post specifically, in order to determine whether the stock could see a strong rebound in upside once market conditions improve.

Performance

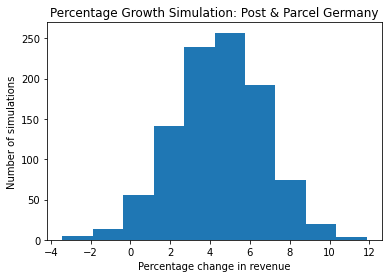

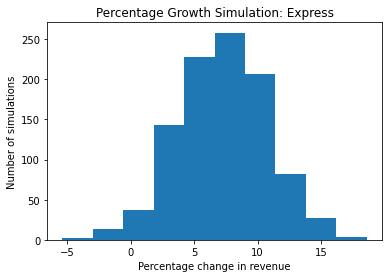

In my last article, I noted that the average yearly growth for Post & Parcel Germany from 2013 to 2020 was 4.37%, while growth for the Express segment was 7.18%.

Taking the average growth as well as the standard deviation over the years in question, I determined that the Post & Parcel Germany segment could see a maximum potential growth of 12%, while the Express segment could see maximum potential growth of 15%.

Monte Carlo Simulation: Post & Parcel Germany

Author’s calculations using Python

Monte Carlo Simulation: Express

Author’s calculations using Python

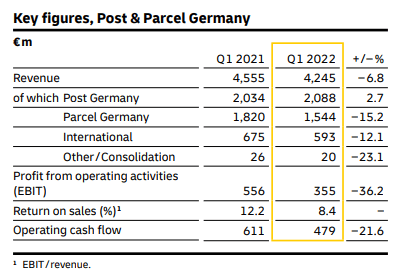

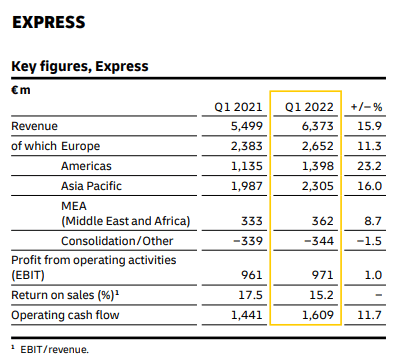

When looking at Q1 2022 revenue data (which could differ significantly from revenue data for the year as a whole) – we can see that Post & Parcel Germany is down by nearly 7% while Express is up by almost 16% – which exceeds the limits of the anticipated growth extremes given by the prior simulations.

Post & Parcel Germany

Deutsche Post Quarterly Statement March 2022

Express

Deutsche Post Quarterly Statement March 2022

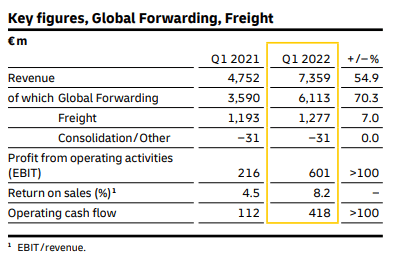

While the above two segments were previously the largest two for Deutsche Post by revenue – we can see that the Global Forwarding, Freight saw sharp growth of over 50%.

Global Forwarding, Freight

Deutsche Post Quarterly Statement March 2022

As a caveat, the effects of inflation and logistical supply chain issues exacerbated by the ongoing situation in Ukraine have likely not been accounted for fully in Q1 2022 – and thus the overall revenue figures across these segments for the year could differ.

However, the drop in revenue that we are seeing in Post & Parcel could be due to a drop in demand as COVID restrictions in Germany have abated and demand for online shopping starts to consolidate. Moreover, with Deutsche Post recently taking the decision to raise parcel delivery prices as a result of inflation, we could potentially see a further drop in demand going forward.

As regards Express and Global Forwarding, Freight, revenue growth across this segment has continued strongly over the past year – driven by a recovery in global trade from 2021 onwards.

Growth of over 34% in air freight volumes in the third quarter of 2021 was attributed in large part to a rebound in trade between Asia and the United States. With that said, there is a significant risk that we could see downside in the segment – or at least a strong moderating of revenue growth – as subsequent COVID lockdowns in China are expected to have caused significant disruption to supply chains between Asia and the United States – which could become evident in half-year results and subsequent quarters for this year.

Moreover, with mass testing currently taking place in Shanghai over concerns of a recent outbreak – further COVID lockdowns cannot be ruled out and would cause further disruption to supply chains.

Looking Forward

Going forward, a combination of inflation, higher fuel prices and the effects of COVID lockdowns as well as airspace closures related to the ongoing situation between Russia and Ukraine are expected to continue adding pressure to the global freight industry as a whole.

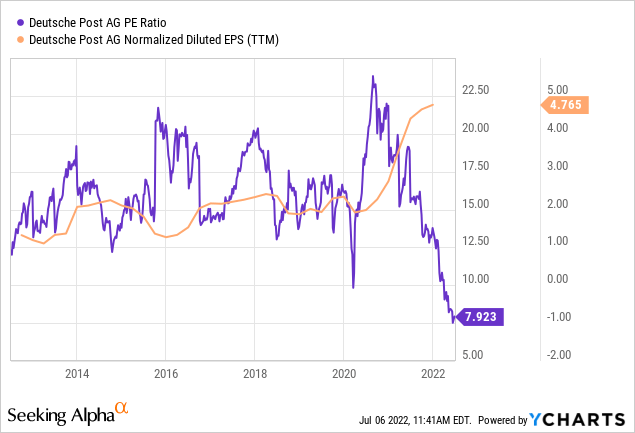

When looking at earnings from a 10-year standpoint, we can see that Deutsche Post is trading at a 10-year low, while earnings (on a normalized diluted basis) are near a 10-year high.

ycharts.com

As such, while we could see further supply chain disruptions and inflationary concerns – there is a possibility that such disruptions are already “baked into” the price and the stock might start to stabilize from here.

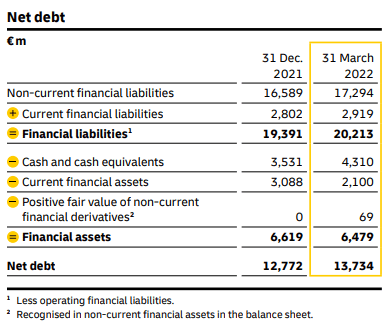

However, one potential concern for investors could be if net debt continues to rise relative to cash.

Over the past quarter, we have seen the ratio of cash and cash equivalents to net debt rise from 27% to 31%.

Deutsche Post: Quarterly Statement March 2022

Given the revenue gains we have seen across Express and Global Forwarding, Freight, investors might be concerned if debt rises faster than cash levels, which is increasingly a risk in an inflationary environment.

While the stock looks like it could be undervalued on an earnings standpoint, investors will likely want to see evidence of stronger cash growth and lower debt levels resulting from the revenue growth we have seen so far.

Conclusion

To conclude, Deutsche Post is not without risk considering the pressure on global supply chains and inflationary concerns.

However, I take the view that if revenue growth can continue to remain strong in the second half, then Deutsche Post could stand to see a rebound in upside.

Be the first to comment