code6d

Thesis

Deutsche Bank Aktiengesellschaft (NYSE:DB) stock is up approximately 25% since I initiated coverage on the German bank with a “Buy” recommendation in July. But against the backdrop of a much stronger than expected Q3 quarter, and rapidly rising interest rates, I turn more and more bullish on DB shares.

Assuming that interest rates in Europe continue to rise, I believe that an expanding NIM will likely add EUR 2 to 3 billion of net income to Deutsche Bank’s bottom line. For reference, Deutsche Bank’s market capitalization is currently at around $21 billion only.

Reflecting on an enormous interest rate tailwind, I strongly believe that for the next few years lots of value is going to accrue in the financial services industry. And anchored on a residual earnings valuation framework, I estimate that DB stock could triple by 2025.

Deutsche Bank’s Q3 Results

After multiple years of challenged fundamentals and restructuring, Deutsche Bank in October reported its second highest Q3 profit since before the financial crisis.

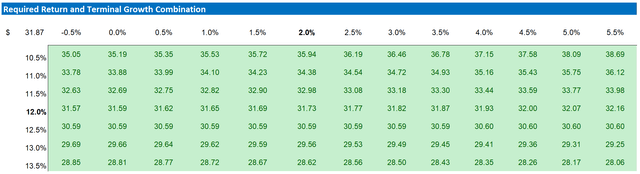

During the period from July to the end of September, DB generated about EUR 6.9 billion of revenues, which reflects a 15% year-over-year growth versus Q3 2021. Pre-tax profitability expanded by 192% year-over-year, respectively, to EUR 1.6 billion.

For reference, analyst consensus at mid-point had expected Deutsche Bank to report revenues of approximately EUR 6.4 billion (EUR 530 million beat) and EPS of about EUR 0.32 (EUR 0.25 beat).

The strong performance was driven by expanding NIM on the backdrop of rising rates, as well as a strong performance from macro trading (fixed income and currency). But notably, all major segments – including corporate bank, investment bank, private bank, and asset management – performed better than in 2021.

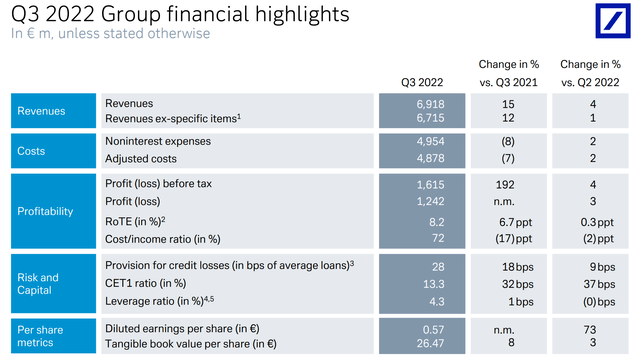

Reflecting on a strong September quarter, and an attractive outlook anchored on NIM expansion, DB CEO Christian Sewing confirmed that the bank …

‘[is] well on track to meet 2022 goals’

… which would indicate a greater-than-10% post-tax RoTE, 3.5-4.5 % revenue CAGR, and less than 62.5% cost/income ratio.

Rising Interest Rates Could Add More than EUR 2 Billion to 2025 Net Income

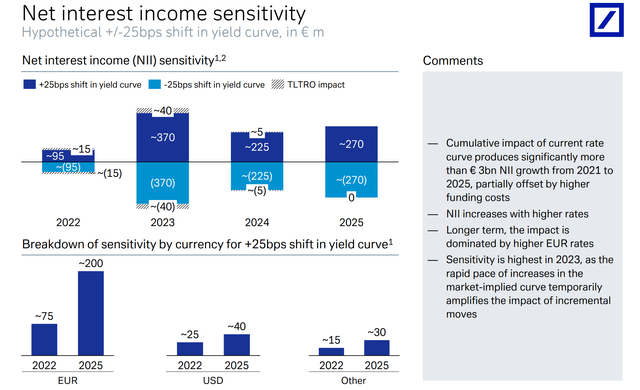

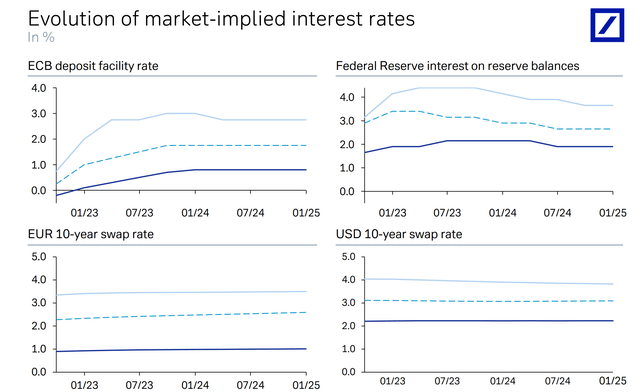

One of the key investment arguments for Deutsche Bank is anchored on rapidly rising interest rates, which could support incremental net earnings of more than EUR 2 billion by 2025. And this might be a conservative assumption.

According to Deutsche Bank CFO James Von Moltke, the accreditive effects of NIM expansion might already materialize in 2023. According to his analysis, Deutsche might add EUR 2 billion of incremental revenues in 2023, while costs increase by only about EUR 400 million (emphasis added):

Underlying that though, just from the interest rate environment, there’s huge tailwind coming through at this point. If I give you the gross number of the current interest rate curve running through our balance sheet, sequentially, that is, 2023 relative to 2022, you’d see probably a € 2 billion revenue upside coming from the current rate curve on an equivalent balance sheet.

If you layer higher funding costs into that, that might take away € 400 million and perhaps the same amount at risk as I mentioned on TLTRO.

In addition, DB management calculates that by 2025, NIM expansion might support “significantly more than EUR 3 billion” of incremental revenues versus 2021, which is only “partially offset by higher funding costs,” because “NII increases with higher rates.”

If the bank’s analysis is correct, then a 25 basis point increase in interest rates will cause a EUR 200 million increase in revenues.

For reference, the yield curve in Europe has shifted up by approximately 250 basis points.

DB Stock Could Triple By 2025

As of mid-November 2022, DB stock is trading at a TTM P/B of about 0.32. Such a multiple is ridiculously low – in my opinion. And anchored on rising interest rates, I believe this multiple will trend towards approximately x1 by 2025.

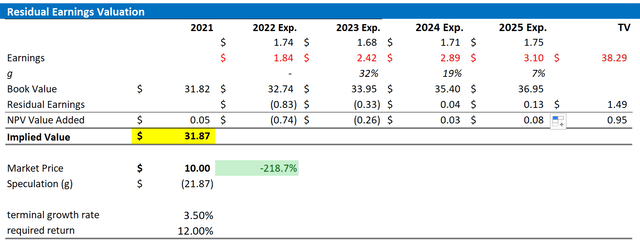

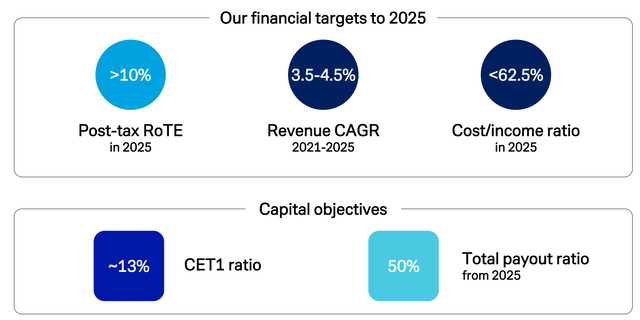

I am updating my EPS expectation for DB through 2025. I am increasing my terminal growth outlook for the bank to 3.5% (I am accepting the lower end of the bank’s management guidance). However, I continue to anchor on a 12% cost of equity.

Given the EPS updates as highlighted below, I now calculate a fair implied share price for DB of $31.87, as compared to $16.17 previously.

Analyst Consensus Estimates; Author’s Calculation

Below is also the updated sensitivity table.

Analyst Consensus Estimates; Author’s Calculation

Risks

With regards to risks related to investments in banks, I would like to highlight what I have written before:

While I believe that investments in banks are less risky than the market implies, the tail-risk exposure is still elevated and if materialized this might depreciate DB’s share price significantly. For reference, the company has still not recovered the share price levels seen before the great financial crisis.

In any case, Deutsche Bank’s 13.2% CET1 ratio should buffer the company for most market stress scenarios, even severe ones

I would like to add that Deutsche only expects a small increase in credit loss provisions in 2023 versus 2022. Moreover, in Q3 2022 the bank’s CET1 ratio has expanded to 13.3%.

Conclusion

Trading at a TTM P/B of about x0.32, Deutsche Bank stock is deeply undervalued – in my opinion. But this discount won’t persist, I argue: reflecting on an enormous interest rate tailwind, I strongly believe that for the next few years, lots of value is going to accrue in the financial services industry. And DB’s Q3 results – supported by strong management commentary – have proven that the thesis is very likely correct.

I estimate that DB stock could triple by 2025. I now calculate a fair implied share price for it of $31.87, as compared to $16.17 prior. Deutsche Bank is a Strong Buy.

Be the first to comment