g-miner/iStock via Getty Images

A Quick Take On Demesne Resources Ltd.

Demesne Resources Ltd. (DMSE:CA) has filed to raise $370,000 in a Canadian IPO of its common shares, according to a SEDAR registration statement.

The firm is a development-stage mineral exploration company with a focus on magnetite minerals located in the British Columbia province of Canada.

Given the risks facing the company and its early stage of development, I’m on Hold for the IPO.

Demesne Overview

Kelowna, Canada,-based Demesne Resources Ltd. was founded to develop the Star Project area consisting of “five contiguous mineral titles covering an area of approximately 4,615.75 hectares located in the Skeena Mining Division, British Columbia, Canada.”

Management is headed by Chief Executive Officer, Brennan Direnfeld, who has been with the firm since November 2018 and is a CPA and CA with start-up advisory experience.

In the near term, the company aims to complete various phases of its analysis and exploration of the Star Project plan.

As of June 30, 2022, Demesne has booked a fair market value investment of approximately $174,000 from investors.

Demesne’s Market and Competition

According to a 2021 market research report by Research and Markets, the global market for magnetite metals is forecast to reach $130.8 billion by 2026.

This represents a forecast CAGR of 5.0% from 2020 to 2026.

The main drivers for this expected growth are a rising demand for high-grade iron ore used in the production of iron and steel products as major global regions continue to industrialize and urbanize.

Also, the Asia Pacific region will remain the largest region by demand, “as China, India and Japan are the major producers of steel.”

The Chinese government is expected to continue to prioritize investment in building and infrastructure markets.

Major competitive or other industry participants include:

-

Rio Tinto

-

BHP Billiton

-

Vale S.A.

-

Atlas Iron Limited

-

Fortescue Metals Group

-

Cap-Ex Ventures

-

Labrador Iron Mines

-

Champion Minerals

-

Cliffs Natural Resources

-

Cathay industries

-

Others

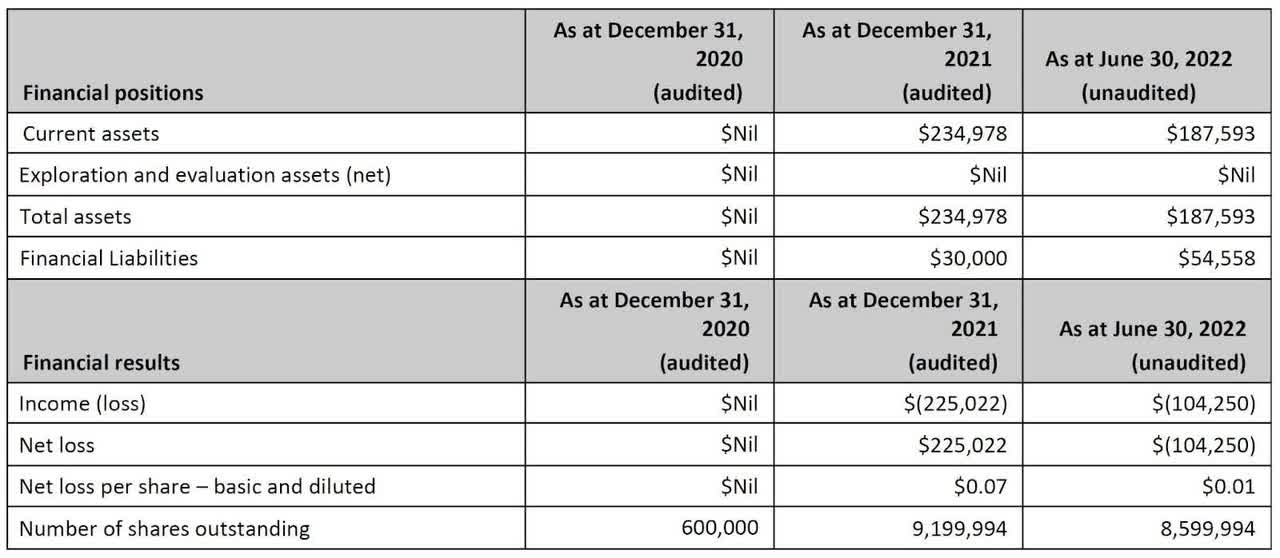

Demesne Resources Ltd.’s Financial Performance

The company’s recent financial results can be summarized as follows:

-

No revenue

-

Net loss

-

Cash used in operations

Below are relevant financial results derived from the firm’s registration statement (amounts are in CAD$):

Financial Results (SEDAR)

As of June 30, 2022, Demesne had $116,619 in cash and $40,373 in total liabilities.

Operating cash flow during the six months ended June 30, 2022, was negative ($77,379).

Demesne Resources Ltd.’s IPO Details

Demesne intends to raise $370,000 in gross proceeds from a Canadian IPO of its common shares, offering 5 million shares at a proposed price of $0.074 per share.

The IPO is not being marketed to investors outside of Canada. No U.S. SEC filings have been made.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $649,281, excluding the effects of agent over-allotment options.

The float to outstanding shares ratio (excluding agent over-allotments) will be approximately 36.1%. A figure under 10% is generally considered a “low float” stock, which can be subject to significant price volatility.

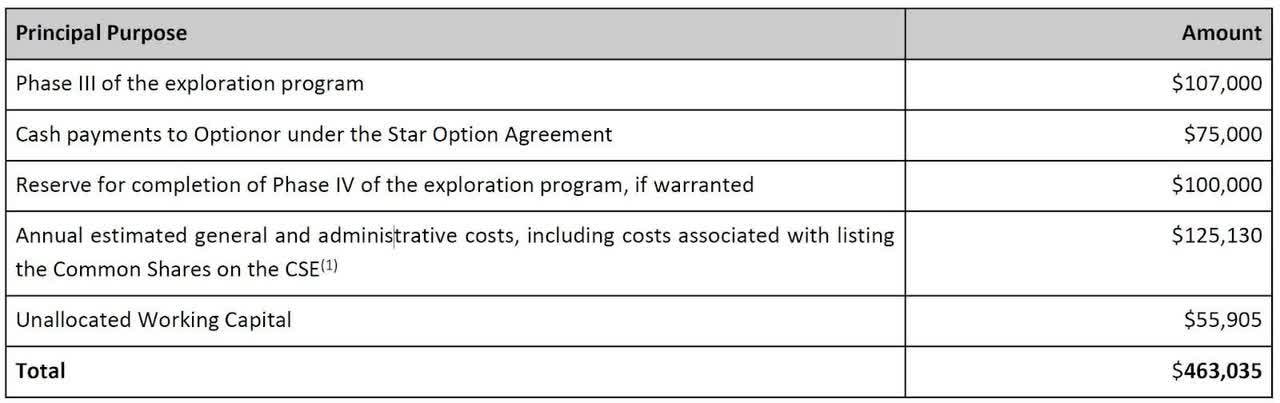

Management says it will use the net proceeds from the IPO and its existing cash as follows (amounts are in CAD$):

Proposed Expenditures (SEDAR)

(Source – SEDAR)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says there are no legal proceedings in existence or to its knowledge contemplated against the company.

The listed agent of the IPO is PI Financial Corp.

Commentary About Demesne’s IPO

DMSE:CA is seeking investment from Canadian qualified investors to continue its early-stage exploration efforts for magnetite metals in the Star Project region of British Columbia.

The company’s financials have shown zero revenue, only net loss and material cash used in its operations so far.

The firm currently plans to pay no dividends and to use any future earnings to reinvest back into the company’s growth plans.

The market opportunity for magnetite metals is large and expected to grow at a moderate rate of growth in the coming years, with the Asia Pacific region accounting for significant demand.

The primary risks to the company’s outlook are its tiny size and thin capitalization as well as its unproven ability to successfully commercialize magnetite resources.

While the company enjoys a positive market environment for its potential products, management appears to have little or no industry experience.

Given the risks facing the company and its early stage of development, I’m on Hold for the IPO.

Expected IPO Pricing Date: To be announced.

Be the first to comment