Brandon Bell/Getty Images News

Investment Thesis

In our estimation, the risk and reward of a Delta Air Lines (NYSE:DAL) investment do not favour the common shareholder. In this article, we will analyze how the world has changed for the airlines, what the risk of bankruptcy is, and what the reward is should Delta survive.

Why Buffett Sold

Warren Buffett sold his stake in Delta Air Lines in the depths of the pandemic, Q2 2020, and has since received criticism for selling at the bottom. Asked why he sold at the 2020 Berkshire Hathaway Annual Meeting, Warren Buffett referenced a change in consumer behaviour that could last beyond the pandemic. He did not say that the airlines would immediately go bankrupt, but it seemed his probabilities had changed. Along with the economics of the industry, Buffett changed his mind. But should you?

The Operating Environment

2019 was a fantastic year for airlines, the price of jet fuel was low, employee wages were low, business travel was in abundance, flight restrictions were limited, and international travel was booming. Delta Air Lines reported a profit of $4.8 billion. If the company should ever return to this level of profit, it would represent a PE ratio of just four (on the current market cap).

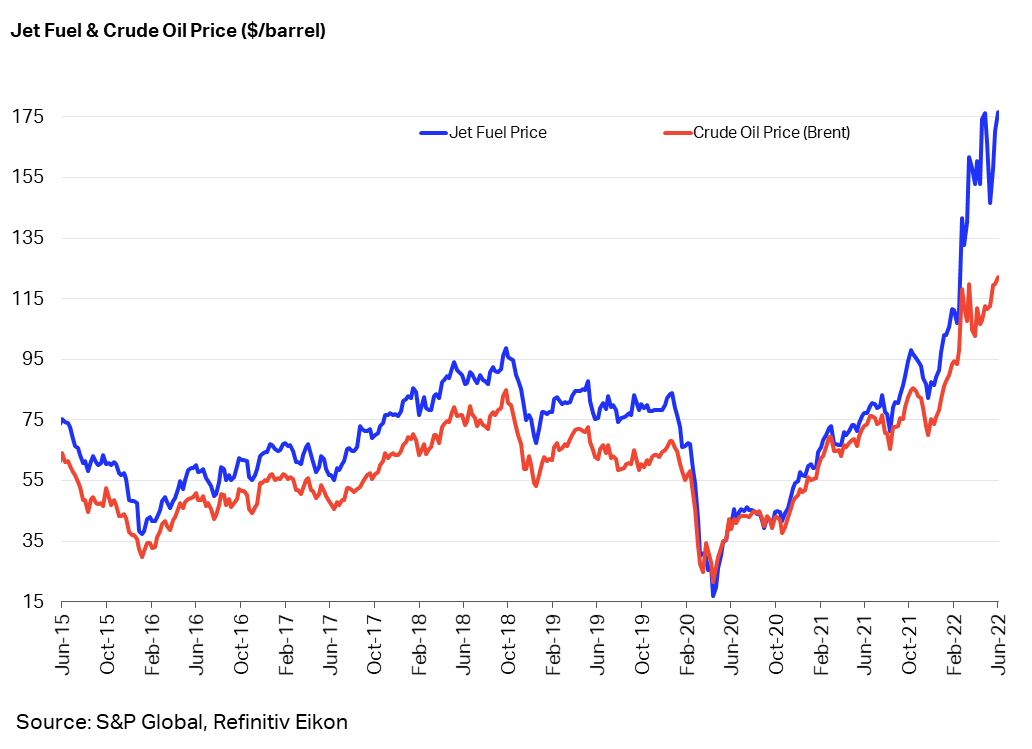

Today, Delta Air Lines faces a less favourable macro environment. Employee wages have risen. International flights are hampered by the war in Ukraine. And, the price of oil and jet fuel is high:

Jet Fuel And Crude Oil Price (IATA)

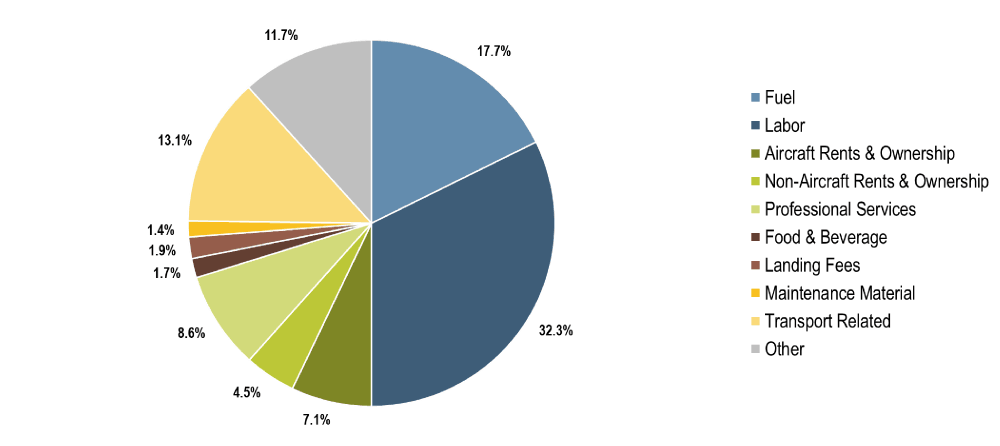

Labour and fuel make up a huge portion of airline costs, and this was the case even before the recent changes took shape.

Airline operating costs in 2019:

Airline Operating Costs – 2019 (The Geography of Transport Systems)

Going forward, we would expect international travel to rebound, especially if there is peace in Europe. However, if the war in Ukraine should spill over and involve NATO, there could be further restrictions in the years ahead.

A large portion of the business travel we once saw is likely gone. Many employees now work remotely, and corporations have realized the efficiencies of video communication. Zoom (ZM) calls have become a more efficient way to do business, as opposed to spending thousands of dollars on business travel.

The risk of a recession cannot be ignored. Earlier this year, the yield curve inverted, which indicates a coming recession more often than not.

Bankruptcy Risk

Airlines are notorious for going bankrupt. Over the past four decades, more than 100 U.S. airlines have filed for bankruptcy. The last time Delta Air Lines filed for Chapter 11 bankruptcy was in 2005.

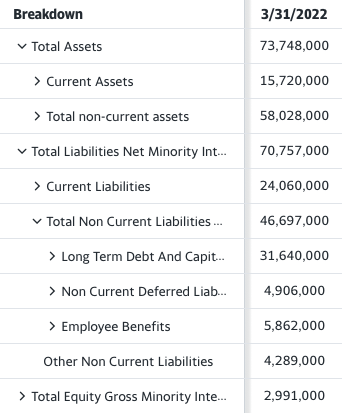

That said, let’s take a look at Delta’s balance sheet:

Delta Air Lines’ Balance Sheet 01/31/2022 (Yahoo Finance)

The company has just a sliver of shareholders’ equity at $2.991 billion and is clearly worth less than it was in 2019 when it had $15.358 billion of equity. Facing negative free cash flow, companies often take on long-term debt to survive. Delta’s long-term debt has nearly tripled since 2019.

Now, let’s check the working capital. Or in other words, this year’s current assets minus current liabilities. The company has negative working capital of $8.34 billion. To make up for this, the company will have to produce an equivalent profit, issue more shares, or take on additional long-term debt. The issue is, Delta is not making $8.34 billion of profit. The company is projected to make less than $2 billion this year.

The debt spiral could still lead Delta into bankruptcy down the road. Even if the company returns to 2019 levels of net income, long-term debt is uncomfortably high. It could take a decade of loan payments to get back to financial strength.

Valuation

There are two scenarios for Delta Air Lines:

- The company goes bankrupt

- The company survives

It is the investor’s job to assign probabilities to each scenario. Using the information laid out above and one’s own knowledge, conclusions can be drawn.

For this valuation, we will focus on what happens if the company survives. Delta has a terrific reputation in the airline industry and should thrive if it can shore up its balance sheet.

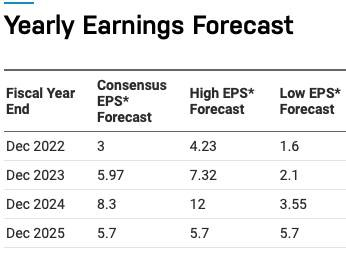

Analyst EPS Estimates – Delta Air Lines (Nasdaq)

Over the next four years, analysts are projecting an average EPS of $5.74, indicating a profit of $3.68 billion per year. This is the average of consensus 2022, 2023, 2024, and 2025. Despite the challenges, Delta should be capable of reaching the high end of that range in 2032, $8.3 per share.

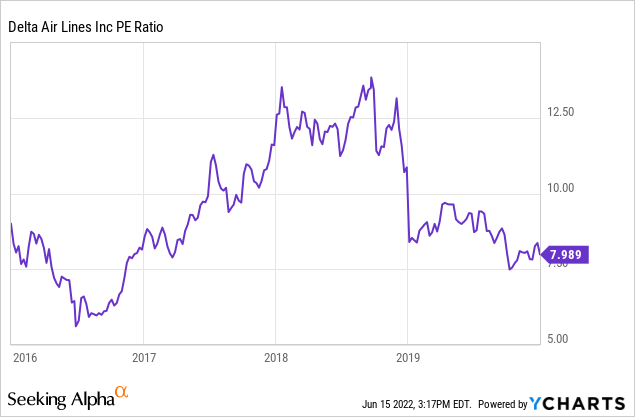

Over the next decade, Delta will have to focus on paying down its debts, rather than buying back shares. If management is responsible, the company should be in a better financial position in a decade’s time. We have assigned a 2032 terminal multiple of 9. This is appropriate for this type of business and relevant on a historical basis:

In the case that Delta survives and shores up its balance sheet, our 2032 price target is $75 per share. If the company pays out an average dividend of $1.50 per share over that time, investors would make a return of 13% per annum with dividends reinvested.

At a 13% annual return, the investor is presented with 3x upside over the next decade. However, there is also 1x downside in the event of bankruptcy.

Conclusion

Delta Air Lines has a terrific reputation, but it is facing enormous challenges in a difficult industry. On the upside, Delta could return 13% per annum over the decade ahead, but the risk of bankruptcy looms large. We have a “sell” rating on the stock because we do not like the risk/reward given the change in consumer behaviour, poor balance sheet, and difficult macro environment. Others may reach the opposite conclusion, but only the future knows what will come to pass.

Be the first to comment