viper-zero/iStock Editorial via Getty Images

Delta Air Lines (NYSE:DAL) shocked the market with very bullish comments regarding recapturing higher fuel costs in the June quarter. The airline sector remains primed for a full recovery in passengers this summer. My investment thesis remains very Bullish on the stock still trading at levels far below prior highs and even recovery highs in 2021.

Big Quarter Ahead

For a market concerned about dire outcomes for the airline sector due to higher oil prices, Delta Air Lines quelled those concerns. The company forecasts strong operating margins in the June quarter and is already starting to repay debt due to the easy ability to recapture high fuel costs.

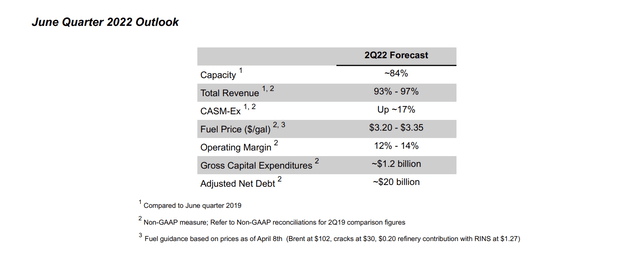

Delta beat Q1’22 revenue estimates by a solid $360 million and guided to Q2’22 revenues approaching 2019 levels. The key here is that guidance is for capacity to only reach ~84% of 2019 levels suggesting strong unit economics.

Source: Delta Air Lines Q1’22 earnings release

The company guided to Q2’22 operating margins at very impressive 13% levels. Delta forecasts fuel prices at $3.20 per gallon, up from $2.79 in the March quarter. Importantly, the guidance assumes strong margins despite the large surge in fuel prices included in the guidance. The guidance confirms the airlines are able to easily absorb higher fuel costs into fares charged to passengers, theoretically wiping out any future fears.

Delta even generated $197 million in free cash flow during the tough March quarter with Omicron raging. A big part of the cash flow generation was the $2.8 billion boost in the Air Traffic Liability to $9.1 billion. Regardless though, Delta generated positive cash flows when revenues were only 79% of 2019 levels.

The revenue environment has become rather strong due to business travel returning to 70% of 2019 levels in March and strength in loyalty and cargo revenues. American Express remuneration was 25% higher than 2019 levels at an impressive $1.2 billion and on the path to $5.0 billion for the year. These non-passenger revenues are helping to overcome weaker passenger revenues in international routes.

Deep Discount

The Delta earnings report changed the whole narrative around valuation in the airline sector. Geopolitical issues and oil prices were supposed to disrupt the rebounding profit picture as economies reopen from COVID lockdowns and the large legacy airline outlined a scenario where the picture is still very strong.

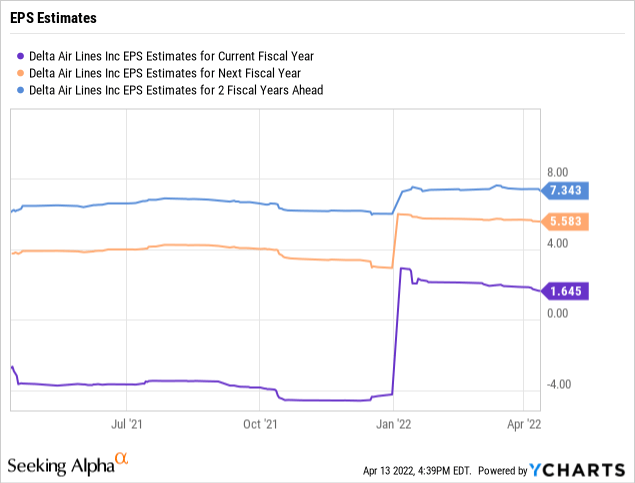

As discussed in prior research, Delta was on a strong path to return to the $7+ EPS target pre-COVID, yet the stock only trades at $41 the day after reporting strong earnings. The consensus EPS targets for 2023 still forecast the airline earning $7+, but analyst targets for 2022 had dipped to only $1.65.

A strong operating margin in the June quarter surely supports an EPS for the year topping these meager levels. Operating income in the $1.5 billion range on $11.4+ billion in revenue for Q2’22 should easily generate a $1+ EPS with 637 million shares outstanding.

The airline had $274 million in Q1’22 net interest expenses with an average debt cost of 4.3%. As the company cuts net debt from $20.9 billion to end March to $15.0 billion by the end of 2024, Delta will clearly cut some of these interest costs out of the equation depending on the actual portion of debt repaid compared to the outstanding debt balance due to cash.

Based on the $41 stock price, the market is pricing in the major risks to the airline sector. Fuel prices could surge higher based on future military actions by Russia eventually shutting off their oil supplies. And of course, a more dangerous variant of COVID could always cause passengers to pull back from traveling after a period during 2022 where domestic passengers catch up on pent up demand.

Takeaway

The key investor takeaway is that Delta Air Lines has shown that airlines can survive and thrive despite numerous events holding back business and boosting costs. The stock only trades at 6x more normalized EPS targets set to be achieved by no later than 2023. Other industrial transport stocks trade at 2x to 4x this PE multiple level suggesting the $69 price target from JPMorgan analyst Jamie Baker is just the start.

Investors shouldn’t hesitate to load up on Delta even after the 6% gain following earnings.

Be the first to comment