FG Trade

Delivery Hero (OTCPK:DLVHF) remains well positioned in its core online food delivery markets – despite a macro-driven slowdown in industry volumes, the company sustained robust GMV growth in its latest quarter and maintained its FCF break-even guidance for H2 2023. Over the long term, investments in building out its own-delivery capabilities have also put it well ahead of the competition, complementing the quality and scale of its footprint. Unit economics are key here, and Delivery Hero’s superior scale places it in a pole position to reach break-even ahead of its peers. Another key lever is the rationalization of its portfolio, which comprises many loss-making assets, either through disposals or operational improvements, to unlock profitability from here. Delivery Hero stock trades well below historical levels at ~1x fwd revenue and one turn below peer DoorDash (DASH).

On Track for Positive Adj. EBITDA by 2023

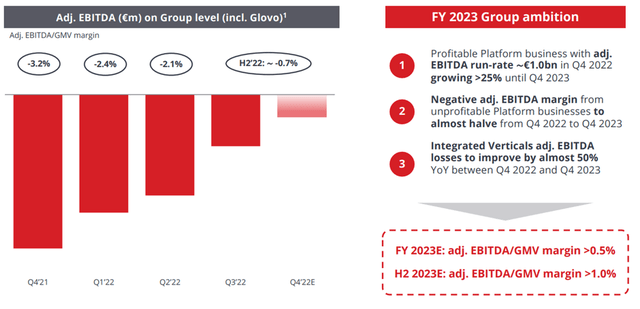

Alongside a solid Q3 update, Delivery Hero has revised guidance modestly lower, with the GMV guide for this year now pegged at the lower end of the EUR44.7bn-EUR46.9bn range and its segment revenue guide also at the lower end of the EUR9.8bn-EUR 10.4bn range (new mid-point of EUR9.95bn). More importantly, however, the prior guidance for the group achieving adj. EBITDA profitability remains intact. Management has provided more color on this target as well, quantifying the adj. EBITDA/GMV margin as 0.5%. Given the ongoing macro and industry concerns amid global rate hikes, the confirmation of Delivery Hero’s underlying earnings growth trajectory will be well-received by investors.

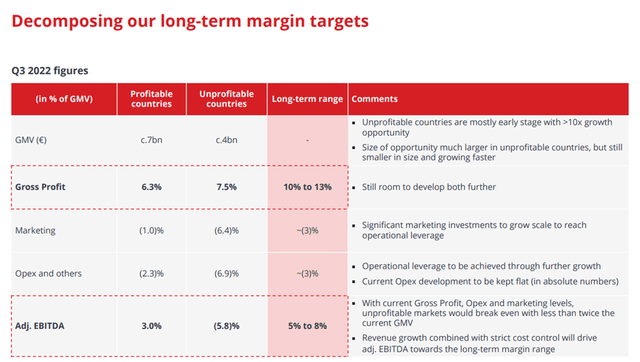

Going forward, Delivery Hero remains on track to achieve profitability – this is a business that has built the required scale throughout the years, and with its unit economics becoming more attractive, the long-term guidance for 5-8% adj. EBITDA/GMV seems well within reach. Even in the near term, assuming the current GMV growth trajectory continues to >EUR50bn next year, the implied >EUR250m of EBITDA generation (at a >0.5% adj. EBITDA/GMV margin) seems conservative. Thus, the near-term setup for more beats-and-raises is compelling, in my view, and I wouldn’t be surprised to see more upgrades to the profit guidance in the coming quarters. Expect additional near-term upside to the GMV guidance from the World Cup as well, given current numbers assume no material benefit.

Lessons Learnt

Perhaps the most encouraging signal of intent from management to deliver on its profitability targets was the recent commentary from CEO Ostberg, acknowledging the need for the group to regain investor trust after a series of missteps. For context, investors had been disappointed by the company’s decision to execute pricey acquisitions like Spanish delivery startup Glovo in the face of rising rates globally. In addition, the scale of investments proposed earlier this year was also disappointing, given the lack of balance sheet capacity and the need for cash preservation heading into a macro slowdown. From this quarter’s transcript:

We really hope that today’s presentation also makes it clear that we always have our investors at heart. We may push hard and aggressively to pursue product and market leadership. But we do that because we strongly believe this is a strategy that has put us in an incredibly strong position today. And we will be great [sic] to reward our shareholders in the long term for the strategy.

Having said that, I also hope that you’ve seen by our development that we listen to your feedback and we care for you, especially in times like these. The profitability improvements that [we] have made is unseen by any other players. So I hope that says it. We also know that we need to earn your trust and deserve you as a long-term partner. And that your support is for that reason, very important. And again, thanks for putting your trust in our hands. We will fight day and night to not disappoint.

The bit about acknowledging the need for greater accountability and color on the path to profitability, in particular, is a positive step. This and the increased FY23 guidance visibility (earlier than usual) bodes well for the governance going forward. From here, the formal FY23 guidance numbers will be the key next step, along with the health of the upcoming Q1 2023 print, where a combination of challenging YoY comps and a weaker consumer should help to establish a floor for the GMV growth trajectory. Setting an FCF break-even target in H2 2023 (a first for Delivery Hero) also signals that management is listening to shareholders’ call for the company to accelerate its path to long-term P&L sustainability.

Optionality from the Asset Portfolio

Delivery Hero also has a wide-ranging portfolio of assets at its disposal. A significant portion of these assets comprises leaders in their respective markets with strong competitive advantages and a clear path to profitability (e.g., Korea and Saudi). That said, the portfolio also has early-stage companies that are non-core or remain a long way from profitability (mainly emerging markets like Peru and Cambodia). Here, management has the option to sell some of these assets (per management, there has been interest from other market participants) at a reasonable price to reinvest into further building out the competitive advantage in its core business. Alternatively, smaller bolt-ons could also be considered, although major acquisitions are unlikely, given the limited balance sheet capacity.

On the Path to Profitability

Following a strong Q3 trading update and an explicit commitment to “reach free cash flow break-even during H2 2023,” I suspect we may be nearing a turning point in the Delivery Hero story. Not only is the core GMV staying resilient against the macro headwinds, but the Asian and Middle East/North Africa (MENA) businesses are already EBITDA profitable, accelerating the path to profitability ahead. The loss-making assets within the portfolio also present an opportunity to unlock incremental value, either through disposals or operational improvements, to unlock more profitability from here. Given the quality and scale advantage of the Delivery Hero franchise, the discounted ~1x fwd revenue valuation (well below DASH at ~2x fwd revenue) offers investors an attractive entry point.

Be the first to comment