Sean Anthony Eddy/E+ via Getty Images

Investment thesis

I recommend investing in Definitive Healthcare Corp. (NASDAQ:DH) at a cheaper valuation. As a health information facility that provides a comprehensive view of the whole health ecosystem, Definitive Healthcare is a major player in the field. However, the valuation today lacks the margin of safety that I seek.

Business overview

DH researches, collects, and distributes commercial intelligence in the health sector. The quality of this intelligence on healthcare providers and activities helps its clients optimize their commercial efforts from the laboratory to the markets.

Large total addressable market with its own challenges

The healthcare sector represented over 19.7% of U.S. GDP in 2020 and is expected to grow at 7% annually. According to figures cited in DH S-1, an estimated $194 billion is spent on research and development, and approximately $36 billion is spent on sales and marketing. Considering its attractive potential, the healthcare sector is a vital end-market for a wide variety of companies, involving healthcare focused companies and other diversified companies.

While the healthcare sector represents a massive market with juicy prospects, the process of selling into this industry is more complex than in other more monopolized industries. Companies are facing an entire ecosystem instead of single companies. It also involves a vast array of stakeholders, like providers, payers, government agencies, and regulators, all designated to meet the needs of potential patients in the U.S. The diverse goals and motivations of these stakeholders muddy the waters of the commercial process, making it difficult to identify and pitch the true decision-makers in the system. With the healthcare ecosystem being interwoven and a single patient consulting multiple fields, it is important to understand the relevance and affiliations of these stakeholders.

Companies are compelled to tailor their products or services to specific pain points. Definitive Healthcare plays a crucial role in helping them achieve this. Healthcare companies of all kinds need to understand these pain points while keeping up with the changes in the industry. This requires an efficiently flexible company that is able to adjust strategies based on real-time intelligence.

To sum it all up, the stakes are high, and success is a herculean task. New technologies require heavy investment and may turn out to be failures. Based on the findings by DH S-1, approximately 50% of drug launches underperform expectations. The upside means that a successful product reaps a massive return on investment.

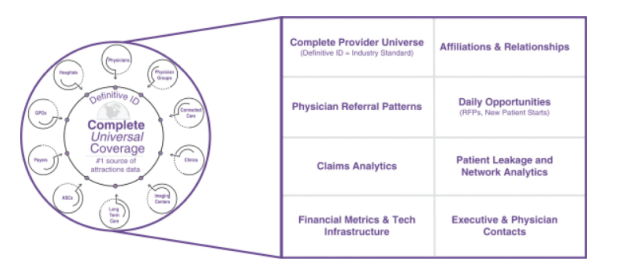

DH, the industry-leading platform

Definitive Healthcare is a platform equipped with deep analytics and data science to help customers develop data-driven strategic decisions, such as market research and strategies. By deploying these tools, one can access tactical information to help target the right stakeholders and improve win rates. Below are four vital services Definitive Healthcare provides:

- Information about hospitals, doctors, medical groups, clinics, and other parts of the health care system.

- An in-depth look at the interconnected web of companies and doctors made possible by the Definitive ID and the shared patient analytics they provide

- Knowledge of the healthcare industry, including information on daily opportunities like new patient starts and RFPs, procedure and diagnosis volumes, and healthcare stakeholder intelligence with complete contact information.

- Insights and explanations rather than just the raw data they might find elsewhere.

Proprietary intelligence and data

Hundreds of millions of data points from thousands of data sources have been incorporated into the platform. By ingesting, modifying, linking, and analyzing this data, an AI and machine learning algorithm generates new intelligence networks. The clients benefit immensely from each new source and algorithm that is implemented. The platform was built and improved over the course of 11 years. It gives a complete, long-term view of the healthcare ecosystem and shows how different parts of the ecosystem depend on each other in a way that keeps newcomers out.

An artificial intelligence and machine learning engine cleans and standardizes raw data before linking it within the platform to generate insights, and this process is ongoing as DH adds new data sources and assets. DH’s data science team is also constantly working to improve the platform and intelligence it provides to customers by incorporating new data sources and algorithms.

Prospectus

Strong marketing strategy

Coupled with its almost omniscient database, DH possesses an effective sales and marketing force comprised of the most highly trained, forward-looking executives. The customer acquisition cost (as quoted in the S-1) ratio shows how well this team is able to get the word out about how valuable Definitive Healthcare is.

Valuation

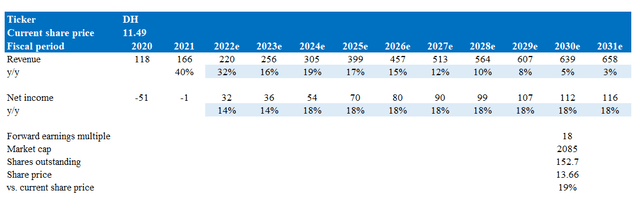

My model suggests that DH is leaning towards being overvalued at the current valuation. The model is a 2-stage model where the first stage follows consensus high growth estimates, followed by a declining growth to indicate DH maturing in its market. My assumption does not take into account any possible acquisitions or major inflections in margins.

By FY30, NVTS is very likely going to be a mature company, and it should trade at a similar level to mature healthcare software companies such as Allscripts Healthcare Solutions, Inc. (MDRX) and NextGen Healthcare, Inc. (NXGN). These peers are currently trading at 16x to 18x forward earnings, and I think Definitive Healthcare Corp. should trade in a similar range.

Based on these assumptions, I believe the DH’s stock is worth 13.66 in FY30 – which is worth much lesser today if one were to discount it at 10% rate.

Risks

Highly competitive market

Well-funded organizations in the healthcare sector are likely to come up with internal technology to create healthcare commercial intelligence. The demand for organizations like Definitive Healthcare Corp. is price sensitive, as factors like marketing, customer acquisition costs, pricing, and marketing strategies of the competition can have significant effects on its pricing strategy. It gets to a point where such competition may result in pricing pressure.

Constant innovation required to sustain lead

It was Albert Einstein that said “Life is like riding a bicycle. To keep your balance, you have to keep moving.” The same is true for Definitive Healthcare. It has to constantly innovate to sustain its lead in the market. The actions of the competition in creating a superior platform can lead to taking out a substantial share of the market from Definitive Healthcare Corp.

Conclusion

To conclude, I believe DH is overvalued today. Definitive Healthcare plays a major role in keeping companies informed about changes in the market in which they are operating. Healthcare companies will be grateful for its crucial role in their market strategies. With its top-notch technology and robust database, the number of companies Definitive Healthcare Corp. serves will only grow in the future.

Be the first to comment