I have to admit that I was a bit nervous going into Deere’s (DE) first-quarter earnings of the 2020 fiscal year. I considered the stock to be a good dividend stock for 2020 as I discussed in this article and was eager to hear what the company had to say. Bad news first, the company reported ugly sales contraction and weakness across all segments. The good news is that margins improved significantly. On a full-year basis, the company expects further structural weakness but will further improve its margins. While we are currently dealing with unfavorable volatility and uncertainties regarding the coronavirus, I think the company is on track to deliver strong results in 2020 and beyond.

Source: John Deere

Here’s What Happened In Q1

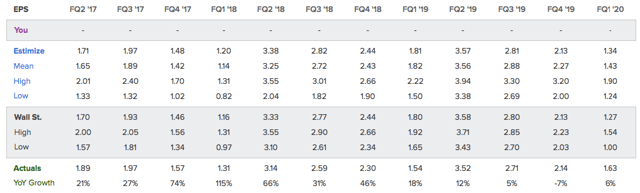

As always, let’s start by looking at the company’s adjusted bottom line. In the first quarter of the 2020 fiscal year, the company generated adjusted EPS worth $1.63. This is way above expectations as the market was looking for an EPS decline from $1.54 in the prior-year quarter to $1.27. The most optimistic expectations were at $1.54, which implies zero growth. Actual results came in much stronger. The company’s $1.63 is 6% higher compared to the prior-year quarter. Since the economic peak of Q4/2018, the company has reported just one quarter with negative growth and one quarter of single-digit growth. All other quarters saw double-digit EPS growth.

Source: Estimize

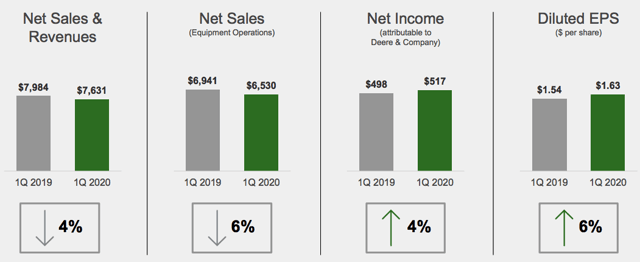

The screenshot from the company’s presentation is a perfect summarization of the situation. Net sales were down 4% to $7.6 billion. Net sales from equipment operations were down 6% to $6.4 billion. Net income, however, accelerated by 4% while a lower share count pushed this growth rate to 6% on a per-share basis.

Source: Deere & Co. Q1/2020 Earnings Presentation

The company’s biggest segment worldwide agriculture and turf sales saw a sales decline of 4% to $4.5 billion. Operating profit in this segment, however, improved from $348 million to $373 million. This 7.2% improvement was provided by strong pricing as higher pricing more than offset losses due to worse volume/mix. On top of that, operating income got a $13 million tailwind from currency translations and a $65 million boost due to lower production costs.

Sales benefited from higher US farm cash receipts, which got support from the market facilitation program from the US Department of Agriculture. Used equipment pricing and inventory continue to be stable while the Canadian industry remains weak. Deere’s inventory is below industry levels. With regard to the market, in general, the company is positive due to the signed phase I trade deal and the passage of USMCA that provides clarity. While trade barriers with Canada persist, farmers should expect tailwinds when soybean exports to China accelerate during harvest season this year.

Unfortunately, Deere expects sales to be flat in all regions but North America. In North America, sales are expected to be down for another year. In this case, management expects sales to be down 5%. However, margins are expected to remain strong as the full-year operating margin is expected to come in between 10.5% and 11.5% compared to 10.6% in 2019.

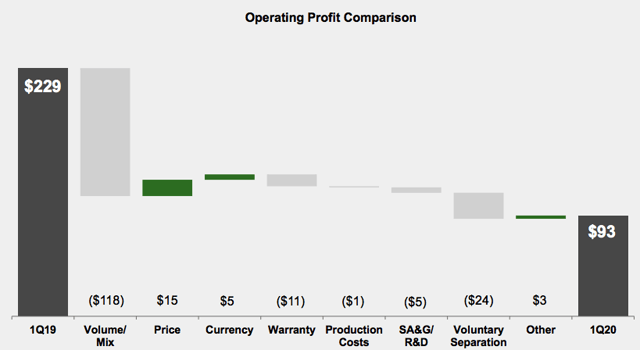

With all of this in mind, let’s look at the company’s worldwide construction and forestry sales. As most of you might know by now, the global economy peaked in Q1 of 2018 while the US peaked in Q4 of 2018. Since then, cyclical industries have witnessed slowing sales and even contraction in some cases. Almost needless to say, this segment saw sales decline by 10% to $2.0 billion. Operating profit dropped by 59.4% to a mere $93 million. Volume/mix erased $118 million of last year’s result while better pricing was only able to partially offset this decline by $15 million. Currency tailwinds accounted for $5 million and production costs were fairly unchanged (-$1 million).

Source: Deere & Co. Q1/2020 Earnings Presentation

Unfortunately, the full-year industry outlook is bad as both North American construction and Global forestry markets are expected to be down between 5% and 10%. Adding to that, the operating margin in this segment is expected to be down from 10.8% in 2019 to 9.5% to 10.5%.

When combining all segments, the company expects to generate a net income of $2.7 billion to $3.1 billion based on an effective tax rate of 22% to 24% and a net operating cash flow of $3.1 billion to $3.5 billion.

Finally, The Breakout Is Here

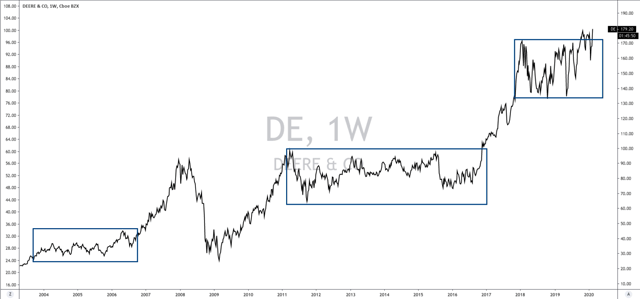

While I am writing this, Deere is up more than 8% after earnings. The company is once again attempting to break out from the trading range that has kept capital gains limited since 2018. Weirdly enough, the company is breaking out of the trading range that started when the global economy peaked after expecting to operate three more quarters in a business year that will likely result in lower sales. A perfect bull case certainly sounds a bit differently.

Source: TradingView

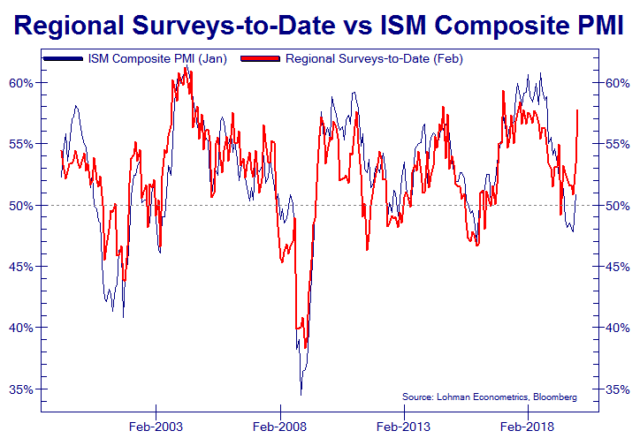

However, while it definitely makes sense to be a bit skeptical, I fully understand why traders are buying. While the coronavirus could technically escalate, the first regional manufacturing surveys came in rock solid and are pointing to a strong ISM manufacturing rebound in February (graph below).

Source: Twitter (@Not_Jim_Cramer)

While an escalating coronavirus could delay a rebound or even worsen the situation, this is definitely the biggest bull case right now in addition to an easing trade war.

Moreover, the P/E ratio is at multi-year lows as I discussed in my previous article as well. While earnings further improved, the stock price went nowhere. While I am writing this, the stock is trading at 16.7x earnings and 15.0x next year’s expected earnings.

Source: FINVIZ

Takeaway

As my in-depth dividend article is just four weeks old, I can say that I still back my conclusion.

John Deere is one of my favorite stocks right now. The dividend yield is low but there are a ton of factors making it still an interesting investment. First of all, I am excited about the first signs indicating an economic bottom. Right off the bat, this means the company should be able to further support earnings and free cash flow growth. Besides that, we are seeing growing strength in the agricultural industry and an increasing focus on agricultural high-tech. That said, the company is increasingly raising its dividend and using excess cash to reduce its share count.

Economic growth is bottoming and the company’s biggest segment is partially offsetting current weakness in construction industries. Unfortunately, this breakout might be a bit messier as the coronavirus is an unpredictable force right now. If you are a dividend investor, I think you should stay long. If you are not long yet, I believe it is best by starting a small position and adding if the bull case strengthens further. Having a conservative exposure in cyclical industries is the way to go right now as too many uncertainties could still damage one’s portfolio in this fragile stage.

Stay tuned!

Thank you very much for reading my article. Feel free to click on the “Like” button and don’t forget to share your opinion in the comment section down below! My long-term investments are stated in my Seeking Alpha biography.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.

Be the first to comment