VR_Studio/iStock Editorial via Getty Images

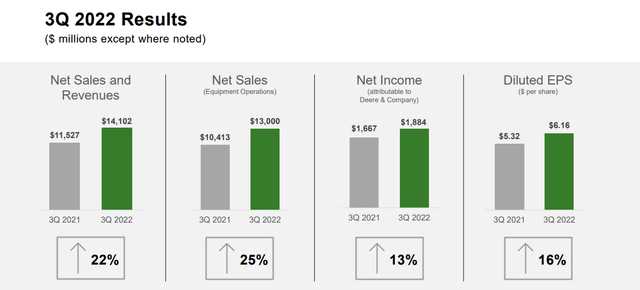

Deere’s (NYSE:DE) quarterly results for the third quarter of 2022 were just reported and with that everyone is rushing towards the appropriate narrative to explain the recent movement in the share price. From the lower guidance for full-year net earnings, to more persistent supply chain disruptions and external macroeconomic factors, there are plenty of reasons why the company share price is not performing well today.

But as the title suggests, none of this is that important when investors fall for an exciting narrative and momentum trade hijacks a company’s valuation. To begin with, today’s results were nothing short of spectacular.

But of course, every sane analyst will point out to the fact that the market is forward looking and the share price was already pricing in even stronger results and here lies the problem that many market participants do not fully comprehend. It is not actual business performance that matters, it is the assumptions about the future that the share price is already pricing in.

The Rosy Expectations About Deere’s Future

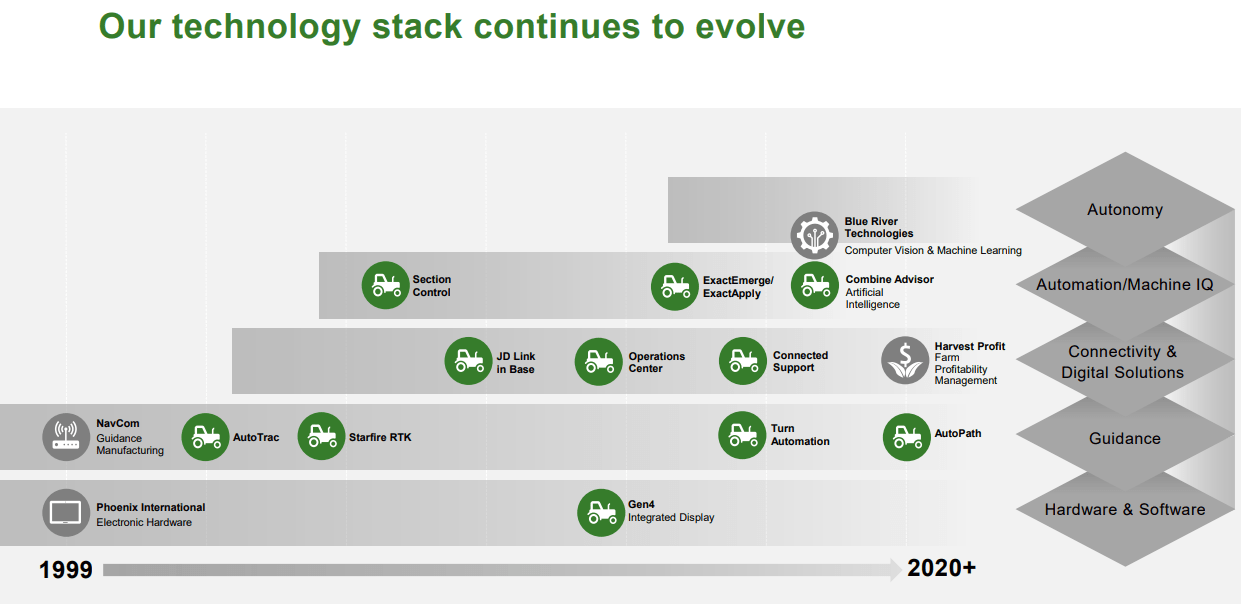

As we all know, the narrative around Deere has been on an exceptionally high note as of late. The company was touted as the “Tesla of the agriculture” and inexperienced investors suddenly flocked in, lured by videos of autonomous tractors. The company even ended up being included in the ARK Space Exploration & Innovation ETF (ARKX), an ETF that invests in companies that should be engaged in the investment theme of Space Exploration and Innovation.

Contrary to all that, back in March of 2021, I first laid out my investment thesis on Deere and showed why the share price faces poor expected returns even as the business continues to deliver. Back then, the share price was trading at $372, which is still above the current levels.

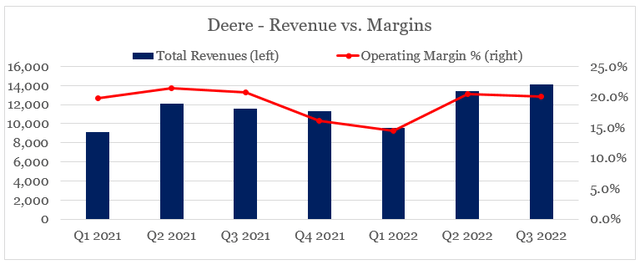

Although there is a clear seasonality in Deere’s sales, current results are significantly above those last reported when I was first writing about Deere.

prepared by the author, using data from SEC Filings

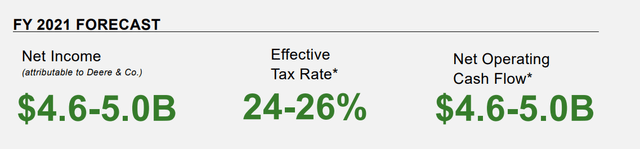

At the same time, the full year guidance (i.e. future expected results) for the fiscal year 2021 were as follows at the time of writing.

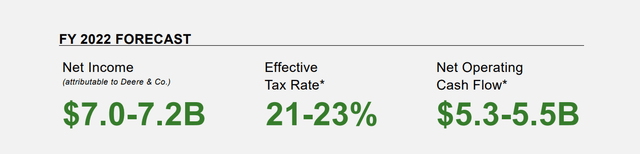

Now compare this to Deere’s current guidance for the current fiscal year.

These are significantly higher across the board, even though the high-end of the net income guidance was slightly trimmed during the last quarter and net operating cash flow is also expected to be lower. This, however, still represents a meaningful improvement over the previously expected results (as of March 2021).

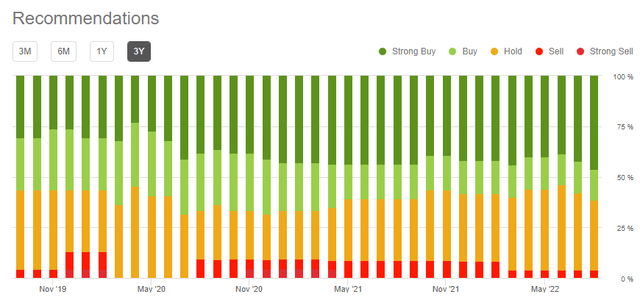

On top of that, since my initial thought piece Wall Street analysts became even more bullish on Deere, thus providing yet another tailwind for its share price.

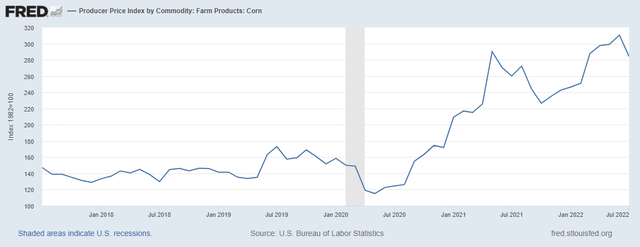

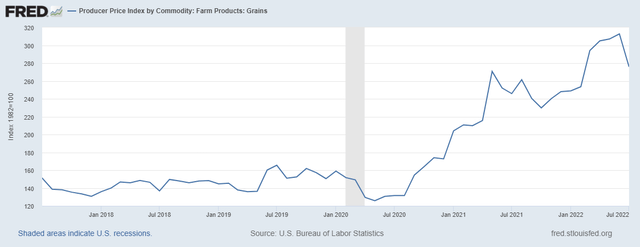

Agricultural commodity prices also continued their upward trajectory and were thus supposed to provide a macroeconomic tailwind for Deere’s products that we haven’t seen in many years.

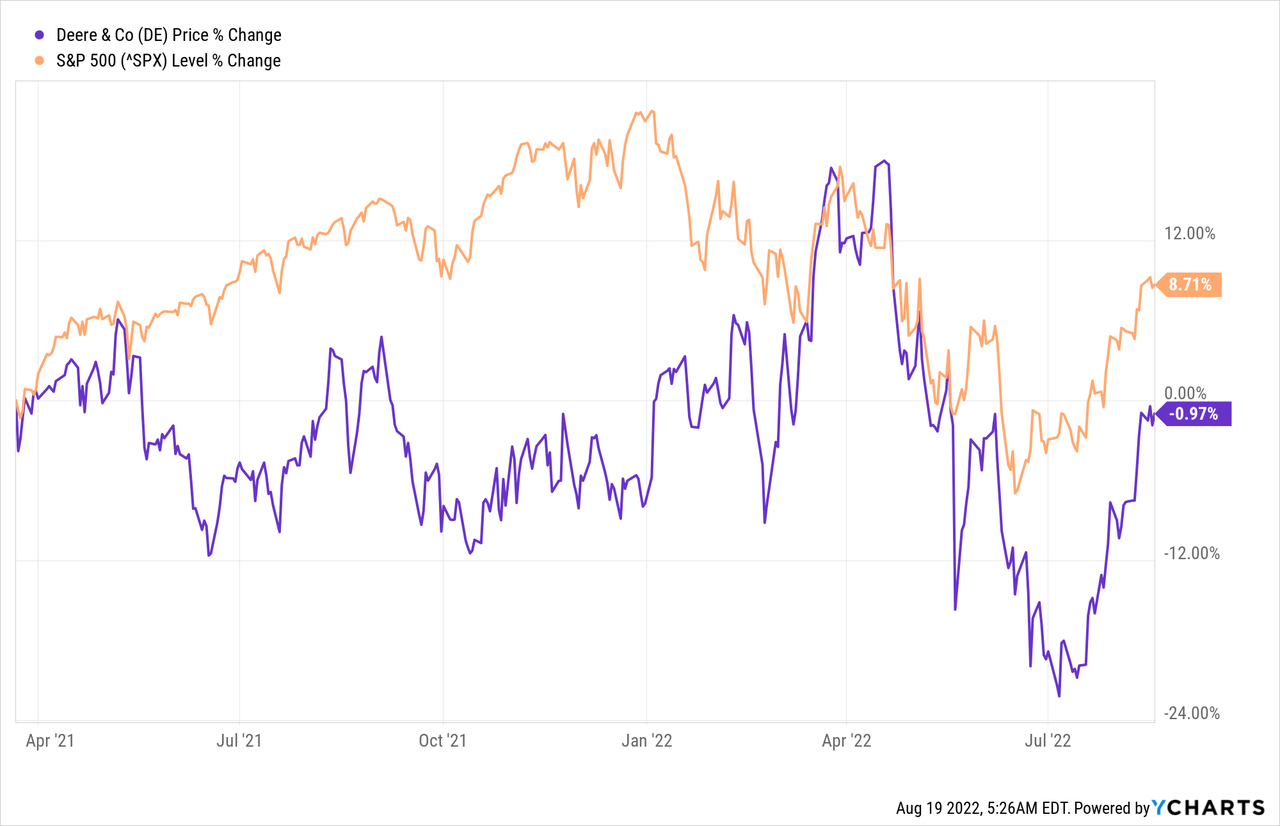

Even the broader equity market returned high-single digits since March of 2021 and yet Deere’s share price fell.

All that is a perfect example of how all everything could be going well for a business and at the same time the share price could continue to disappoint once investors drive valuations to extreme levels, based on their rosy expectations about the future.

A Sober Look At Free Cash Flow

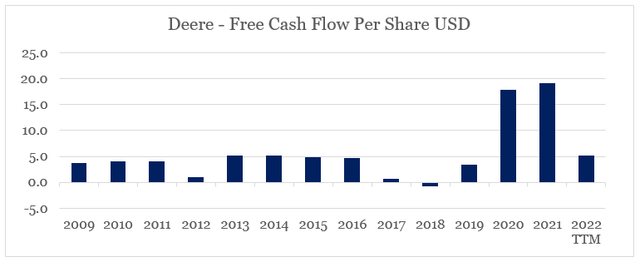

Following the third quarter results released today, Deere’s free cash flow per share now stands roughly in-line with the company’s historical results and in hindsight the 2020/2021 increase was indeed unsustainable.

prepared by the author, using data from Seeking Alpha

We should note, that the calculation above is done based on the company’s total cash flow from operations less purchases of property and equipment. It excludes the cost of equipment on operating leases acquired, which varies significantly over the years and is related to the company’s financing operations.

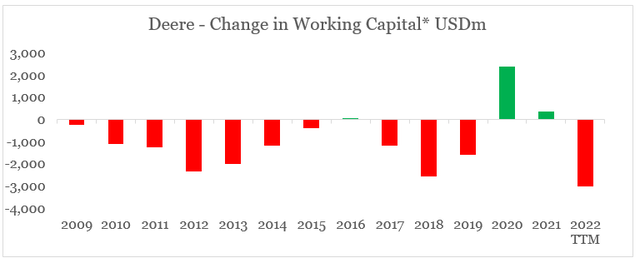

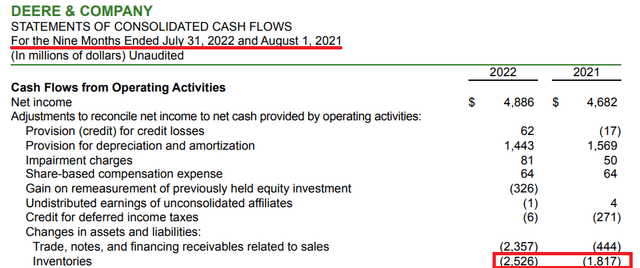

These huge swings in Deere’s free cash flow were due to movements in the company’s working capital (see the graph below).

prepared by the author, using data from Seeking Alpha

* based on accounts payable, inventories and trade, notes, and financing receivables

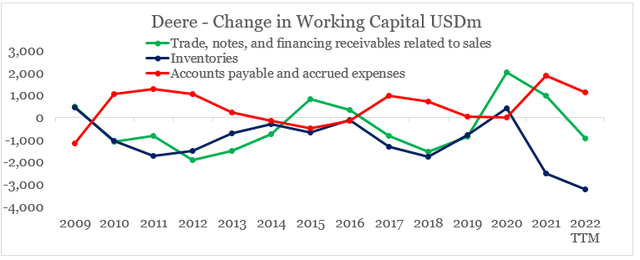

Breaking this down by its three main components and we could see that over the years, receivables and payables usually move in opposite directions as management uses these to smooth any rapid changes in cash flow that are beyond the company’s control.

prepared by the author, using data from Seeking Alpha

This dynamic, however, has changed dramatically during the pandemic, when Deere’s cash flow benefited from both lower receivables (positive impact on cash flow) and higher accounts payable (positive impact on cash flow).

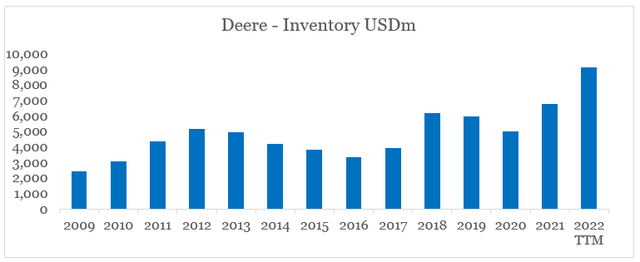

Changes in inventory levels were, however, by far the largest contributor to cash outflows in recent months.

Supply chain issues were largely to blame as inventory levels reached new all-time highs during the last quarter.

prepared by the author, using data from Seeking Alpha

Although these should be resolved over the coming years, the future working capital benefit will be far lower as Deere would need to retain a high level of working capital to sustain its sales momentum.

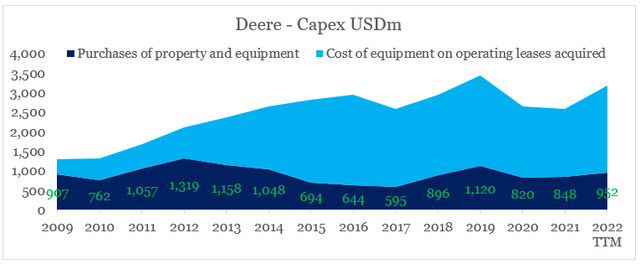

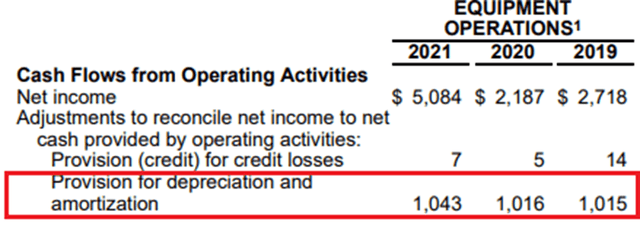

Moving on to capital expenditure, Deere continues to spend record low levels on purchases of property and equipment, while purchases of off-lease equipment remains high.

prepared by the author, using data from Seeking Alpha

As a matter of fact, the amount spent on property and equipment over the past year is still below the company’s depreciation and amortization expense, which is unsustainable especially if the current sales momentum is expected to remain.

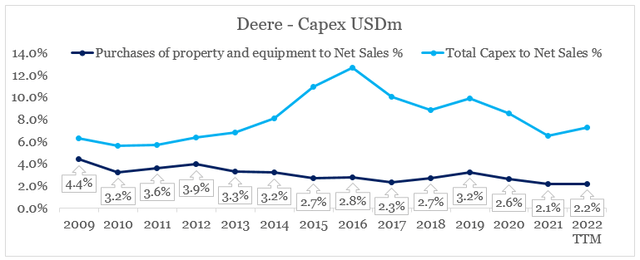

Relative to sales, capital expenditure is also at record low levels which suggests that either Deere is underinvesting in its business or the management expects a drop-off in sales over the coming years.

prepared by the author, using data from Seeking Alpha

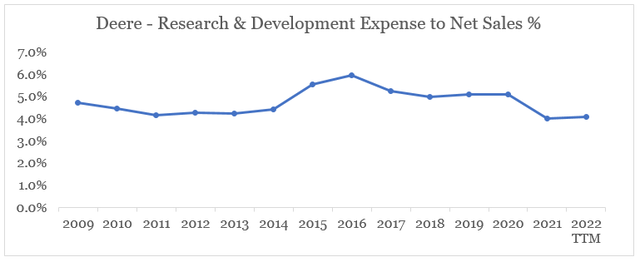

As far as business reinvestment is concerned, the amount spent on research & development relative to sales is also at record low levels (see below), which is at odds with the company’s strategy based on accelerating innovation.

prepared by the author, using data from Seeking Alpha

Conclusion

Deere is without a doubt an absolute leader in the agriculture machinery space, that is also solidifying its existing competitive advantages and strengthening its brand by adding more valued added services to its portfolio.

Deere Investor Presentation

All that, however, does not necessarily translate into superior shareholder returns given Deere’s valuation that relies on highly optimistic assumptions about the future. At the same time the company faces a growing number risks related to the normal business cycle and significant pressure on free cash flow.

Be the first to comment