Wirestock/iStock Editorial via Getty Images

Investors are understandably nervous about 2023, as more and more companies are pointing to weakening trends and a more sober outlook for the next year. Heavy machinery is no exception, with investors concerned that strong backlogs will give way to weaker order trends and that a recent run of outperformance over other industrials will come to an end.

Deere & Company (NYSE:DE) has been stronger than most over the last two years, driven not only by strong demand for agricultural and construction machinery, but also self-help like growing precision ag and tech-driven ag businesses and margin improvement/efficiency efforts that have led to higher full-cycle margin projections. Valuation is not particularly cheap here, but if Deere can provide a strong beat-and-raise quarter with guidance to double-digit growth in FY’23, Deere could continue to outperform a while longer on the basis of its differentiated growth profile.

The Quarter Setup – Mixed Machinery Trends, But Healthy Ag

Through third quarter earnings, agriculture has remained a relatively stronger space within the machinery sector. AGCO Corporation (AGCO) and CNH Industrial N.V. (CNHI) have both traded up since reporting September quarter results, and both mentioned healthy ongoing trends through 2023 on healthy farmer budgets and weak used equipment inventories.

Earnings estimate evolution for Deere (expected to report 11/23 before the open) has been interesting since the last report, where Deere posted miss-and-lower results due to supply chain issues. Estimates have ticked down slightly since, with most analysts generally bullish on the growth and order outlook, but concerned about Deere’s margin leverage given ongoing cost inflation and component limitations.

The Street is now looking for 29% year-over-year growth in equipment sales (or around $13.4B), and I see a decent chance of a small beat. I’m more bullish on the outlook for 2023, though, and I think Deere will guide above the current 9% Street expectation for equipment growth in ’23 (something in the 12%-14% range), with mid-teens Agriculture & Turf growth and high single-digit to low-double-digit Construction & Forestry growth.

I’m less confident about the margin outlook given mixed price/cost performances in the machinery space this quarter. I think 19% equipment margin is attainable, but I would expect earnings upside to be more likely to come from the financing operations or corporate expenses than core machinery. Guidance for the next year’s margins is definitely a key watch item – I think there could be some modest upside, but I don’t think there will be any major transformation in equipment margins in 2023.

Will Ag Strength Last?

I think there are several tailwinds that can continue to push strong ag sales in 2023.

For starters, used equipment inventory is still weak – standing at around a high single-digit percentage of new equipment sales versus an historical average in the 20% to 30% range. Likewise, the fleet is still overaged relative to historical norms. Order books and production constraints being what they are, Deere doesn’t believe that dealers will be able to rebuild inventories until FY’24, and I think that’s a credible outlook.

Second, the outlook for corn and soy is still positive, with ending stocks pointing to very low levels for corn going into the next year. Corn prices are well off their early 2022 highs (around $6.60 versus $8.25 in late April), but still quite high relative to long-term norms (bouncing between $3 and $4.50). Likewise with soy, with current prices around $14.40, down from over $17 earlier in 2022, but well above long-term pre-pandemic norms (around $8 to $11).

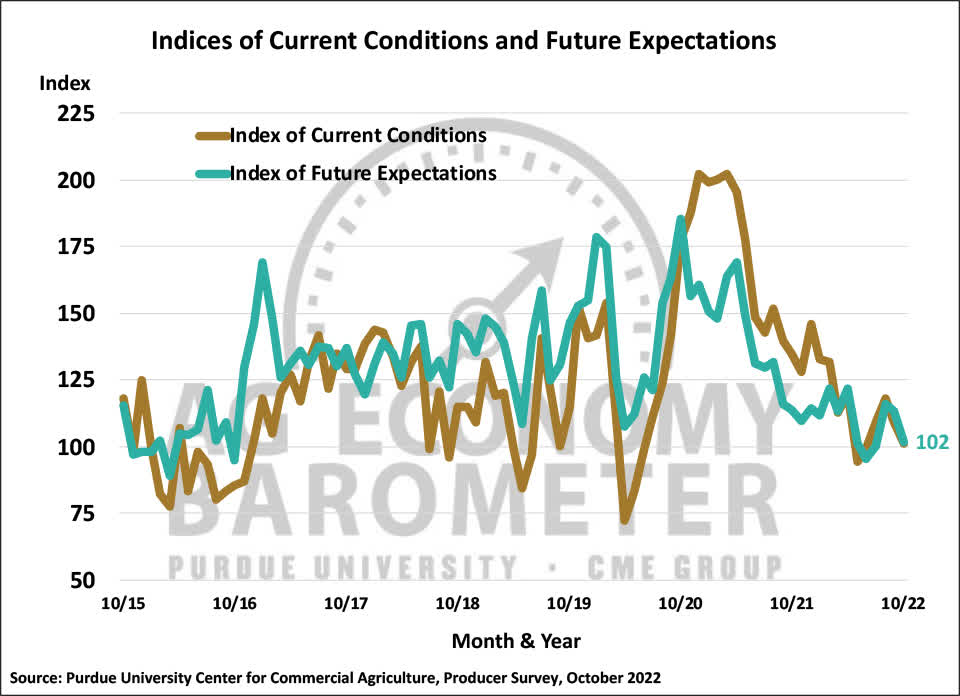

That said, there are some warning signs. The most recent AEM report showed a 15% year-over-year decline in small farm equipment sales (down 15% year-to-date), while large equipment sales were up 20% (up 20% year-to-date). I’d also note weakness in the Purdue Ag Economy Barometer, which has recently fallen to 102, with farmers citing high input/machinery prices and interest rates as meaningful concerns.

Purdue University Center for Commercial Agriculture

While I can understand the shift in sentiment, I expect strong ag prices to persist, and I think farmers will also benefit from decreasing input costs (fertilizer, et al) in 2023. On top of that, Deere (as well as AGCO and CNH) continue to push their cases that adopting more technology (like precision agriculture) can meaningfully improve farmer incomes.

In the near term, I do see some risk that higher rates and higher machinery prices (up 10% to 15% YOY in the fiscal third quarter) will destroy some demand. I also see a risk that improving component supply will benefit AGCO and CNH more than Deere, allowing these rivals to regain some share that Deere took through better product availability.

Longer term, I’m bullish on the prospects for precision ag and autonomy, as farmers look to decrease inputs (fertilizer, water, et al) or at least maximize their value, and offset shortages in skilled labor. I’m also concerned about long-term demand given growth in electric vehicles (ethanol accounts for about 30% of the U.S. corn crop) and cultured meat products (reducing demand for feed products), but these drivers are likely a decade or more away from making a noticeable impact.

Construction Is A Bigger Question Market

I’ll be very curious to hear what Deere has to say about the outlook for the construction market. Housing is clearly slowing, and I’ve written recently about my believe that non-residential activity will be weaker than the Street expects in 2023. I’d also note that the recent used equipment price data from Ritchie Brothers (RBA) points to significant deceleration in used equipment prices for multiple construction equipment types.

The ”but” is Deere’s leverage to roadbuilding and infrastructure. I believe federally-subsidized projects will start ramping up in 2023 (and beyond), and the support from demand there could offer an important offset to weakness in demand from the housing and non-resi sectors ahead of recoveries there in 2024/25. I’d also note healthy oil/gas demand – not a huge driver for Deere, but not trivial either.

The Outlook

I expect another strong performance for Deere next year on the back of its agriculture business, and I think this strength can persist into 2024. Long term, I think mid-single-digit revenue growth is plausible on the basis of ongoing growth in tech-driven revenue like precision agriculture (Sense & Act) and autonomy, as well as the possibility of growing recurring revenue – autonomous farming equipment is likely be marketed to farmers on a per-use service model (reducing the upfront costs), and the 13yr old in me desperately hopes it ends up being called Agriculture-As-A-Service.

Margins are a tougher call. I find the Leap Ambitions target of 20% equipment margins to be plausible, but not certain. Long term, I think mid-teens adjusted equipment free cash flow margins are attainable, driving mid-to-high single-digit free cash flow (“FCF”) growth, and I could see some upside here over the longer term if recurring/service revenue really does become a meaningful part of the business.

Valuation is challenging. The shares don’t look that cheap on discounted cash flow, but that’s not too surprising. Looking at the margins and returns (ROIC, et al), I expect over the next 12-24 months, I believe a 12.5x forward multiple is fair, supporting a fair value a little above $430.

The Bottom Line

I don’t believe Deere is at its peak yet, but it’s closer to the peak than not, and that definitely complicates the stock call today. I don’t see a lot of upside from fundamental valuation, but I do believe sentiment could still support a higher share price – if Deere can generate double-digit revenue growth and margin expansion at a time when other machinery companies are struggling, I could see the shares outperforming.

By the same token, though, the market will be shifting to questioning when the good times will end (some sell-side analysts already are), and that could lead to share price weakness even in the face of good reported results (given that the Street looks/projects ahead). All in all, I think this is a tricky time to buy the shares and I don’t see huge upside; I like Deere and I like the long-term trends in agriculture, but I’d rather revisit the name after the next pullback.

Be the first to comment