mbortolino/E+ via Getty Images

Investment Thesis

DecisionPoint Systems (NYSE:DPSI) runs a generally profitable business but the revenue has been consolidating for the last 10 years. However, since the 2nd half of the last consolidating decade, the revenue trend has been observed to be rising consistently which implies a reasonable possibility that the business has been doing well and is likely to break out of this consolidating revenue trend.

While not always profitable in accounting terms over the last decade, the company consistently maintains a positive amount of liquid assets consisting of cash and other short-term equivalents. These liquid assets have also been increasing mildly suggesting overall prudent management of cash.

The company’s free cash flow has been increasing consistently which contributes to a favorable valuation using the Discounted Free Cash (“DCF”) Flow model.

Company Overview

Enterprise mobility systems integrator DecisionPoint Systems offers and sets up wireless and mobile computing systems that can be utilized both within a business’s buildings on wireless networks and outside on carrier-based wireless networks.

The system consists of mobile PCs, mobile application software, and related data capture tools such as radio frequency identification readers and barcode scanners. In addition to providing professional services, in-house and third-party software, and customized software, it also offers bespoke solutions for its clients. Retail, transportation logistics, management consulting, warehousing, and field service management are just a few of the businesses that use its software.

From the company’s website, it operates in the following industries:

Industry Category (Company Website)

Income Statement Analysis

Let’s look at how the company fares in terms of generating top and bottom-line profits.

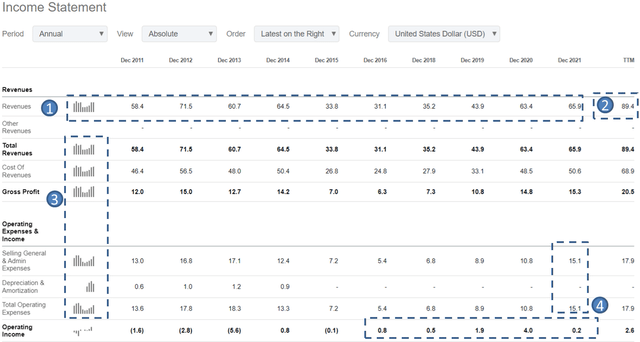

Income Statement (Seeking Alpha)

From Seeking Alpha’s Income Statement, we can infer that:

- The revenue of the company has been largely consolidating for the last 10 years. The company reported the highest revenue of $71.5M in 2012. After that, revenue has fallen to a low of $31.1M in 2016. The last financial year of 2021 saw the company report an encouraging revenue of $65.9M but this figure is still shy of the previous high achieved in 2012.

- The silver lining to this consolidating revenue trend can be observed in the TTM period, which reported revenue of $89.4M. If the revenue for the full fiscal year of 2022 can end with a similar revenue figure, this would be the first time since 2012 that the company has reported a new high in revenue.

- Cost of revenue and operating costs have largely fluctuated somewhat in tandem with the rise and fall in revenue. Additional Depreciation & Amortization costs were reported from 2011 to 2014 but the amount is relatively minuscule compared to other expenses.

- If we drill down to the bottom line of Operating Income, the company is generally profitable since 2016 but experienced a sharp drop in profits in 2021, largely due to the sharp increase in General and Administrative (G&A) Expenses.

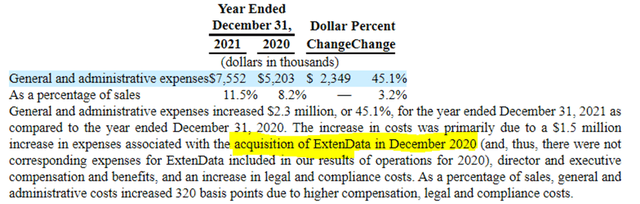

Investors need to know whether this sharp increase in G&A is persistent in the long run. To find out, we can infer from the company’s latest 2021 annual report:

G&A Expense (2021 annual report)

From the company’s annual report, we can understand that this sharp increase in G&A expenses is due to the inheritance of costs associated with ExtenData, which the company recently acquired. Hence, the increase in this category of costs is expected to be a one-off and should not become a recurring trend over the next few years.

Balance Sheet Analysis

Let’s take a look at the company’s balance sheet.

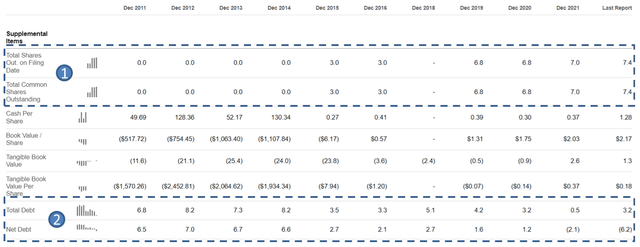

From Seeking Alpha’s balance sheet, we can infer that:

- The company volume of shares outstanding has remained flat since 2019 which implies shareholders’ value in the company’s stock has not been diluted in recent years.

- Debt figures are also generally on a downward trend since 2018. In an environment of rising interest rates, this means the company is not burdened with rising interest expenses on its debt.

The above 2 observations are generally positive for the company.

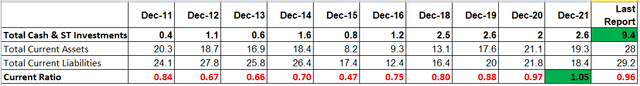

Looking at the most liquid current assets of ‘Total Cash & ST Investments’ on the balance sheet, the company is also maintaining a positive cash profile that is mildly increasing. In the ‘last reported’ figure, this figure even increased more than 3 times to $9.4M.

However, the company’s current ratio is less than 1 indicating that it has lesser current assets compared to its liabilities, suggesting questionable short-term financial health. DPSI’s current ratio has been lesser than 1 since 2011 and only become favorable (greater than 1) in the last financial year of 2021.

The last reported figure shows the current ratio to be 0.96, which is very close to a favorable figure of 1. Investors should monitor whether this ratio will eventually stay above 1 at the end of 2022 and persist in the long run.

Cash Flow Analysis

DPSI might have a profitable bottom line but at the end of the day, ‘Cash Flow’ pays the bills. Let’s check out how the company fares in terms of managing its cash flow.

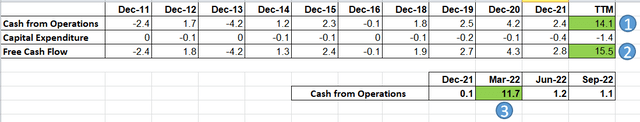

If we infer from Seeking Alpha’s cash flow statements of DPSI, these are the notable observations:

- The company has been generating positive cash flow from operations since 2018 consistently.

- Capital expenditures have been comparably low with respect to cash flow from operations allowing the company to maintain an overall positive free cash flow, which is good for DPSI’s valuations.

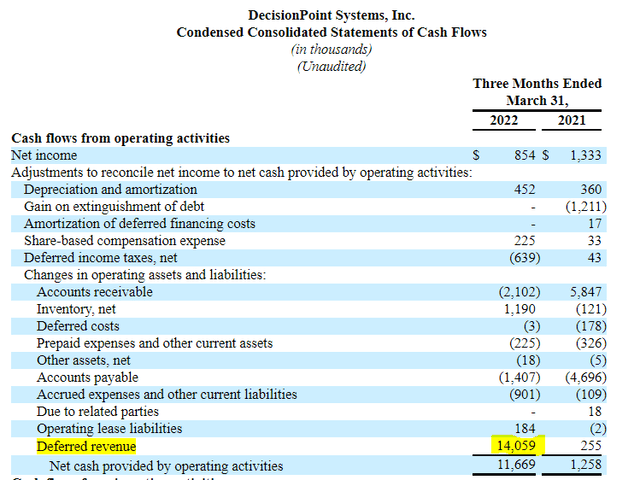

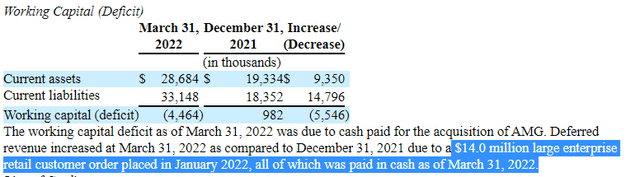

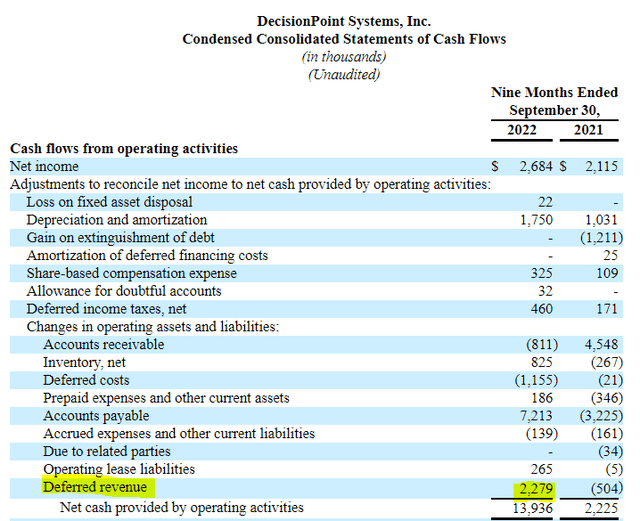

- There is an unusual spike in the company’s cash flow in the TTM period and this is mostly contributed in Q1 2022 due to deferred revenue:

Cash Flow Statements (Q1 10-Q)

In the same report, it was explained that the deferred revenue was due to the payment of one particular customer:

As of the latest quarter of Q3 2022, this deferred revenue has decreased to just $2.3M, suggesting that the services have been progressively delivered to the customer and realized as earned revenue:

Overall the company has exhibited a healthy cash flow profile of generally positively increasing free cash flow that is sustainable in the long run.

Valuation

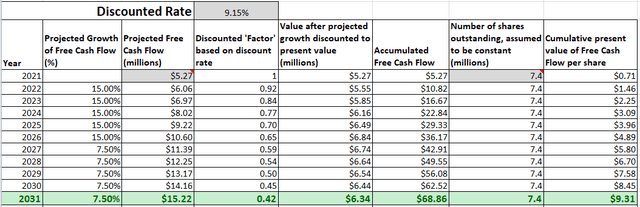

DPSI is a profitable company generating positive free cash flow which appears to be sustainable in the long run. This allows us to use a Discounted Free Cash Flow (“DCF”) model over the next 10 years to value the business.

CEO Steve Smith explicitly stated his opinion on the company’s forwarding looking growth in the latest earnings call:

We’re bullish on our ability to maintain significant percentage year-over-year growth there, and we’ve categorized that at 15% or more.

We include this 15% growth projection in our DCF calculation.

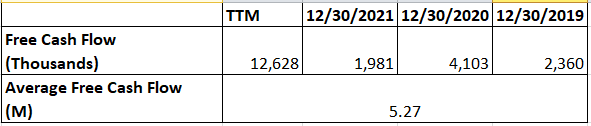

As noted in earlier sections, we also observed DPSI has an unusually high amount of cash in the TTM period due to deferred revenue. As such we will project the company’s free cash flow using the average of the last 4 periods as referenced from Yahoo Finance, which works out to be $5.27M:

Free Cash Flow (Yahoo Finance)

Additionally, we made the following assumptions in inputs:

- The company will grow its Free Cash Flow by 15% for the first 5 years.

- The company will grow its Free Cash Flow by 7.5% (half of 15%) for the next 5 years.

- The last reported ‘Total Common Shares Outstanding‘ is $7.4M.

- The last reported ‘Total Cash & ST Investments’ is $9.4M.

- The last reported ‘Total Debt’ is $3.2M.

- The discount rate is estimated to be 9.15%, taken from the WACC value.

Intrinsic Value (Author’s Calculation)

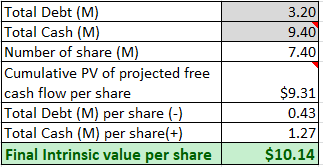

Based on the above inputs, the present value (“PV”) of the projected Free Cash Flow per share for DPSI is $9.31.

Intrinsic Value (Author’s Calculations)

Taking into account the total debt and cash that the company is holding, the final intrinsic value is about $10.14.

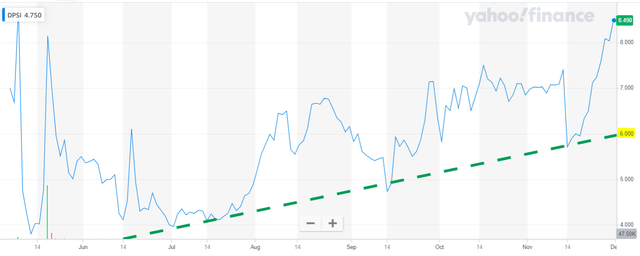

At the current price of $8.49, DPSI’s share price is currently undervalued and selling at a discount of -16.30% (8.49/10.14-1).

Investment Risks

As discussed earlier, DPSI is mostly operating with a current ratio of less than 1. This means the current liabilities outstripped the current assets resulting in an overall negative working capital.

According to Investopedia, although a high working capital is not always ideal:

High working capital isn’t always a good thing. It might indicate that the business has too much inventory, not investing its excess cash, or not capitalizing on low-expense debt opportunities.

At the same time, it also suggests some possible risks:

When a working capital calculation is negative, this means the company’s current assets are not enough to pay for all of its current liabilities.

The silver lining is that while lesser than 1, the current ratio value has been on an increasing trend and already went above 1 for the first time in the last financial year of 2021.

Investors should observe whether this favorable value is able to sustain by the end of 2022.

Conclusion

DPSI is a profitable company with a business model that has generated positive free cash flow over the last 5 years and based on earlier discussions, the growth of free cash flow appears to be sustainable in the future.

The company is currently undervalued by fundamental criteria alone.

Looking at the technical chart, the price action shows that DPSI is more likely to retrace to the trending support of $6 before continuing on its current uptrend pattern.

Investors who are aggressive can enter right now since the stock is currently undervalued.

Investors who are patient and more conservative should wait for the price to retrace nearer to $6 before entering a position.

Be the first to comment