Joe Raedle

Online used car dealership Carvana (NYSE:CVNA) has lost half its value over the past five days after its Q3 earnings showed signs of sales deceleration and weak GPU, among other items, as Morgan Stanley also hit shares with a $0.10 price target. Carvana’s woes have continued to mount, as the used car vending machine operator faces tough macro headwinds and an inability to manage costs effectively. Bonds have slumped significantly, signaling what may be the final nail in the coffin for heavily-indebted Carvana as interest expenses rise.

Macro Headwinds Aplenty

Carvana is succumbing to a whirlwind of headwinds arising in the used car market as used vehicle prices plunge and rates rise.

Auto retailer AutoNation (AN) warned that “used-vehicle prices are softening as rising interest rates curb demand from more price-sensitive buyers” as it reported weaker-than-expected Q3 results. CEO Mike Manley said the retailer was “beginning to see used-car prices mitigate with faster depreciation.” CarMax (KMX) also signaled “affordability challenges” in the used car market.

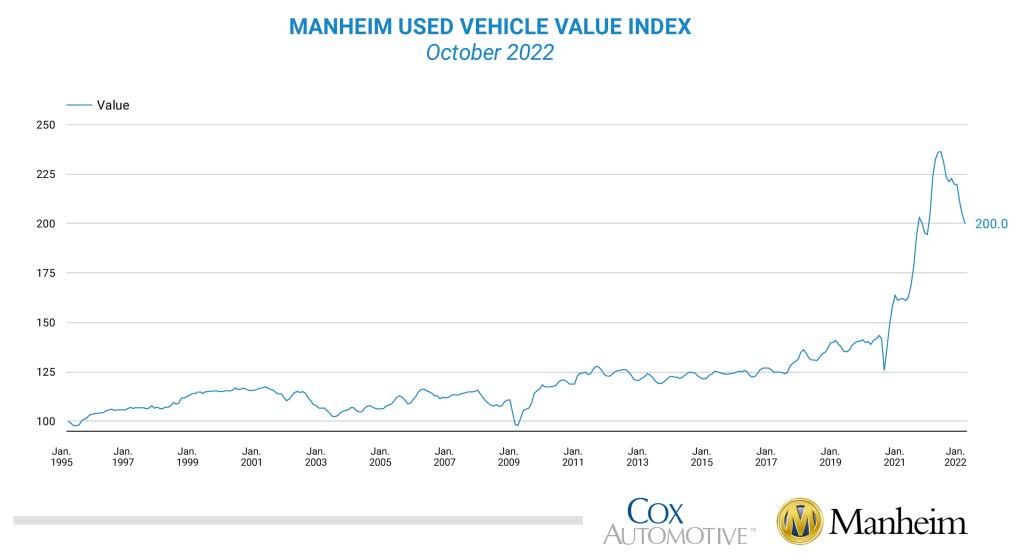

Manheim Used Vehicle Index (Cox Auto)

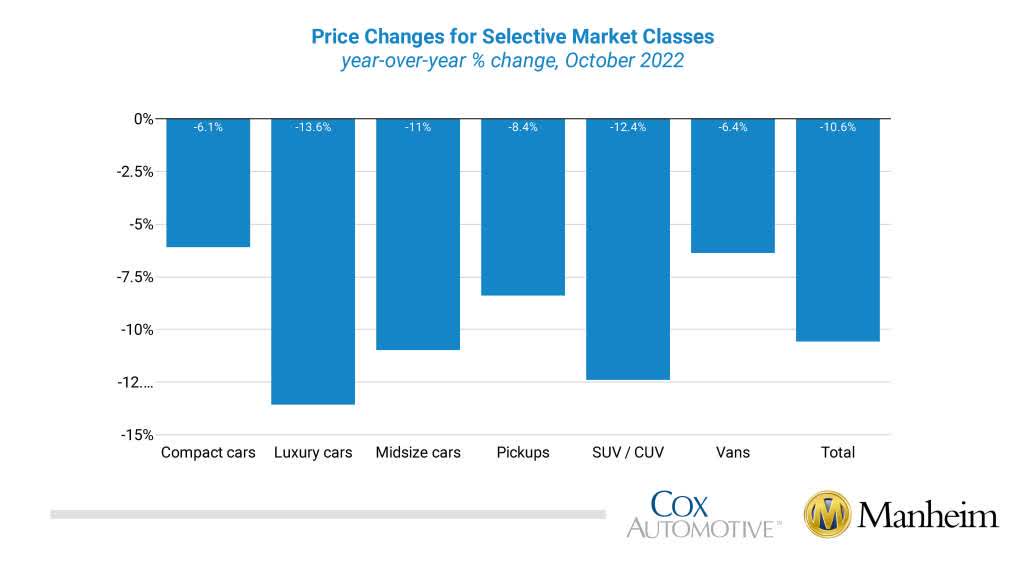

Used vehicle prices are “falling off a cliff,” down 10.6% y/y for October, marking a 2.2% m/m decline from September, according to the Manheim Used Vehicle Index. As seen below, all of the different market classes witnessed declines greater than 5% during October, with SUVs, midsize, and luxury cars record double-digit declines.

Manheim Used Vehicle Index (Cox Auto)

The index surged through 2021 as tight supply stemming from chip shortages led to rapidly rising prices. However, interest rate hikes leading to increasing auto loan rates even as easing supply chain issues have aided used vehicle inventory.

Auto loan rates have risen dramatically, reflecting the affordability challenges pointed out by CarMax. Through October, the “weighted average auto loan rate across all loan types has increased by 2.8 percentage points to 10.6%.” Subprime borrowers, with credit scores below 580, could see used vehicle loan rates as high as 21.8%. Cox Auto pointed out that used vehicle loan rates in early October rose 2 pp to 11%. Future rate hikes may continue to push loan rates higher, further straining affordability for millions of prospective buyers.

Market Seriously Doubts Carvana’s Survival

Aside from the freefall in shares following earnings, Carvana’s debt fell swiftly lower as confidence in the used car dealer is eroding rapidly. All of Carvana’s bonds shed value as the recent earnings report highlighted GPU weakness, continuing losses, and high interest expenses due to these high-yield bonds.

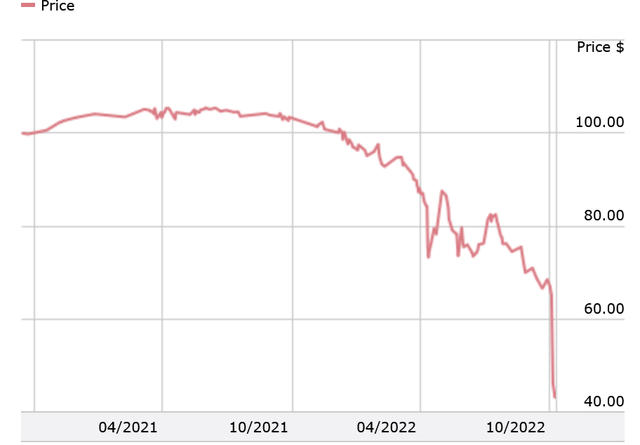

Take Carvana’s senior unsecured notes due 2025:

FINRA

The note traded between 73.5 to 87.5 from March to late September, signaling that the market still held a firm belief that Carvana would continue upon its disruptor journey, that headwinds would ease, and positive cash flow and EBITDA would return and allow the $500 million note to be paid off in full.

After Q3 earnings, the note slumped dramatically from $65.25 to $44.5, a swift and sharp 31% decline nearly mirroring the 39% decline in shares post-earnings. The rest of Carvana’s noted trudged downwards as well:

- 2027 ($600mm): $53 to $36.75

- 2028 ($600mm): $44.5 to $34.45

- 2029 ($750mm): $44.75 to $32

- 2030 ($3,275mm): $61 to $46.25

In total, Carvana has $5.725 billion in total debt, with all of that debt trading less than half of par value, with the 2029 notes trading less than one-third of par. Trading at such distressed levels suggests that the debt market has lost substantial confidence in Carvana’s ability to continue as a going concern past 2025 if it cannot raise a substantial amount of cash or quickly reverse course to generating positive cash flow amidst mounting headwinds.

Earnings Corroborate The Lack Of Confidence

Carvana reported a 3% decline in revenue as retail units sold dipped 8%. However, bottom-line figures sunk, as gross profit dropped 31% as GPU pulled back significantly, while net margin widened to (15.0%).

Carvana signaled that the “rapidly rising interest rate environment is creating a headwind to conversion and total GPU” — no surprise here. In addition, Carvana said “lower conversion and total GPU reduce the number of profitable sales, other things being equal, leading us to further reduce sales volume.” Sales volume did not drop dramatically, with markets in the central US posting slight growth.

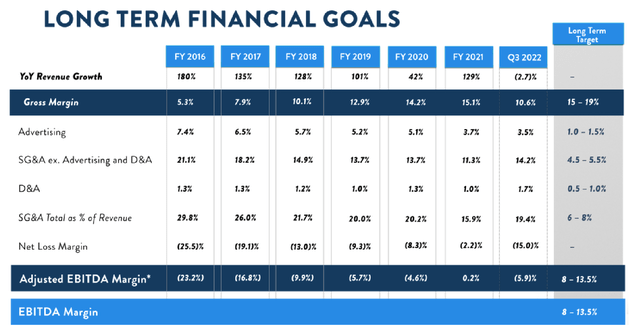

Carvana also is a far cry from reaching its EBITDA targets:

Carvana

Carvana barely eked out a positive EBITDA margin in FY21 when revenue growth rates were >100% y/y each quarter. Gross margin dipped back below its long-term targeted range, but Carvana still significantly overspends in SG&A; it only managed to decrease SG&A by $90 million in Q3. With SG&A at nearly 20% of revenues, the highest since FY18, Carvana is still very far from reaching its targeted single-digit range.

On a per unit basis, Carvana’s consolidated SG&A of $6,396 totaled ~183% of GPU of $3,500 per unit. Compensation/benefits and advertising alone accounted for $3,315 in per unit costs, or 94.7% of GPU. Carvana would have to cut down on these two cost categories substantially, but that’s near impossible — advertising is quite necessary to drive customers to the site and drive purchases, while compensation can’t just be slashed 30% easily.

Carvana posted GPU of $4,671 in Q3 2021, again during a boom in the used vehicle market when revenue growth topped 125%. Even if Carvana manages to grow current GPU of $3,500 by 20% to $4,200 in two to three quarters, while facing higher recondition costs due to parts shortages and potential impacts from transport costs (alongside sliding used vehicle prices), SG&A would have to be cut by over 30% to bring to help put Carvana on a path to profitability.

Interest Expenses To Jump 220%

While not highlighted in the earnings report, Carvana’s net interest expenses on its debt are surging — as of November 1, the company just began paying a semi-annual coupon on its 10.125% $3.275 billion notes pursuant to its acquisition of ADESA.

The interest expenses on those notes comes out to about $336 million per year. That will now be added to an Carvana’s $153 million in interest expenses — taking Carvana’s total interest expenses up $489 million during FY23.

Carvana’s cash, equivalents and restricted cash totaled $477 million at the end of Q3, not even enough to service its debt with a little to spare. Adding short term investments to the mix, cash rises to $827 million, adding an ounce of leverage to Carvana’s ability to service its debt. As shares remain depressed, Carvana is likely to have to tap into existing credit facilities to service debt, issue more debt, or dilute shares to a substantial degree to raise cash to be able to manage its indebtedness. Servicing debt by issuing debt is a death spiral, as the new debt will come at higher rates, and higher coupon payments; given these factors, it is clear why Carvana’s notes have shed value rapidly to trade deep in distress.

Outlook

Carvana’s outlook remains negative following its latest earnings report, which shed light on macro headwinds negatively affecting GPU as SG&A has yet to recede. Carvana is likely to find difficulty reaching a path to positive EBITDA as its main expenditures are concentrated in core areas of compensation, benefits, and advertising, while a declining trend in used vehicle prices and higher auto loan rates looms over upcoming results in Q4. Carvana’s notes plunged deep in distress following earnings as the company’s survival now lies in serious doubt, compounded by net interest expenses jumping by 220% next year to just below $500 million as coupon payments on the $3.275 billion notes to fund ADESA’s acquisition begin.

Be the first to comment