Intro & Thesis

Torsten Asmus

“Alternative ETFs Finally Get Their Moment in the Sun” was the title of Bloomberg’s article published a few days ago that attracted my attention. The authors – Joel Weber and Eric Balchunas – spoke with Andrew Beer from Dynamic Beta and Bob Elliott from Unlimited to discuss the prospects of alternative exchange-traded funds (“ETFs”). Andrew manages iM DBi Managed Futures Strategy ETF (NYSEARCA:DBMF) and Bob manages Unlimited HFND Multi Strategy Return Tracker ETF (NYSEARCA:HFND) – both are alternative ETFs managed in a hedge-fund style.

According to Bob Elliott, the total package/wrapper of ETFs – how they are created – is the best strategy for investing over the long term. But from what we see in most cases, traditional ETF products underperform their underlying assets/indices/targets, while the broad range of ETF products is still under-allocated to commodities or derivatives, which alternative ETFs have enough of. So their golden era, which they have been waiting for these past 15 years, is finally here.

Members of my private marketplace service Beyond the Wall Investing are already familiar with DBMF, as it was the first component of one of our model portfolios. It has performed quite well during the recent sharp declines, but to date, it has lost a significant portion of its newly generated returns (-6.7% last month).

In today’s article, I will take a closer look at the DBMF and HFND funds for you. In my opinion, both funds are quite interesting in terms of management approaches. The presence of such ETFs in medium-term investment portfolios is a necessity today, in my opinion, as 2022 has proven in practice how traditional ETFs focused on equity and bond portfolios can eat away at the profitability of unprotected investors, even with the most theoretically sound level of diversification.

iM DBi Managed Futures Strategy ETF – why is it the best alternative ETF out there?

According to iMGP Partners, DBMF is a fund that seeks long-term capital appreciation. It employs long and short positions in derivatives, primarily futures and forward contracts, across the broad asset classes of equities, fixed income, currencies, and commodities.

From what I gleaned from the Bloomberg podcast [“Trillion”] mentioned above, the DBMF pays attention to how funds are positioning themselves at any given time: whether they are betting on crude oil, the U.S. Dollar Index (DXY), metals, risky assets, or anything else. Forward and futures contracts allow DBMF to profit from the movements of institutional market participants and help determine their direction. So, the portfolio structure of the fund is not static over time – it depends on how the broad market behaves and where the institutional money goes.

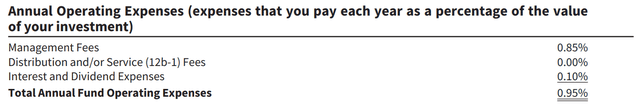

The DBMF is managed like a hedge fund but costs investors only 0.95% per year in total – that’s far less than the generally accepted 2/20 or even 1/10 cost structure of typical hedge funds.

The capital allocation between the different instruments is done with the help of a proprietary, quantitative model – the Dynamic Beta Engine (DBE):

The Dynamic Beta Engine analyzes recent (i.e., trailing 60-day) performance of CTA hedge funds in order to identify a portfolio of liquid financial instruments that closely reflects the estimated current asset allocation of the selected pool of CTA hedge funds, with the goal of simulating the performance, but not the underlying positions, of those funds. Based on this analysis, the Fund will invest in an optimized portfolio of long and short positions in domestically-traded, liquid derivative contracts.

Source: From the prospectus [link above].

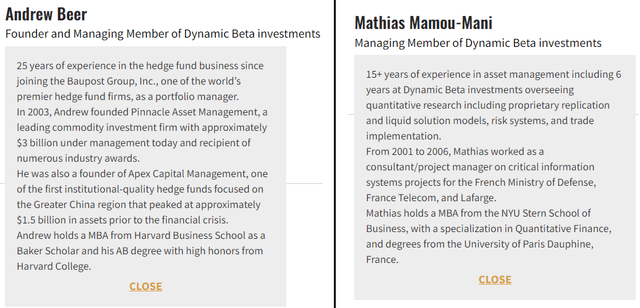

Such models are the product of Dynamic Beta investments (DBI) managers Andrew Beer and Mathias Mamou-Mani, who have over 40 years of combined experience in the hedge fund industry.

At the end of June 2022, the fund held a net short position in U.S. equities (-11%) – this was the largest part of the portfolio, and in addition, the fund was short in euros and yen. At first, I thought it looked like pure luck – bear-minded managers have benefited from the record selloff in overvalued assets in recent months, and when the stock market returns to bullish mode, this fund will not be able to deliver the previous positive returns. Although DBMF does not have a very long history (since May 2019), this fund has not been managed only bearishly from the beginning. For example, here you can see what its portfolio looked like at the end of 2021:

iMGP Funds, Annual report 2021

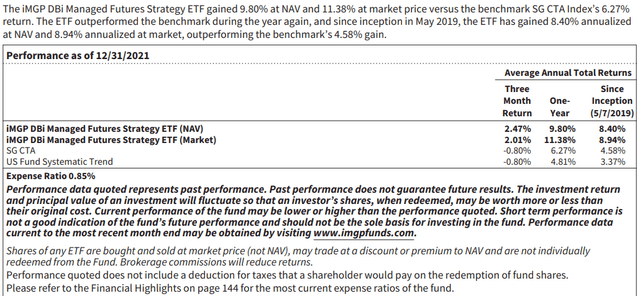

Even then, the DBMF ETF was clearly ahead of its benchmarks:

iMGP Funds, Annual report 2021

Knowing that the current success of DBMF is no accident, I would like to draw your attention to a comparison table of possible alternatives:

- Simplify Managed Futures Strategy ETF (CTA);

- KFA Mount Lucas Strategy ETF (KMLM);

- First Trust Managed Futures Strategy Fund (FMF);

- WisdomTree Managed Futures Strategy Fund (WTMF);

- Anfield Diversified Alternatives ETF (DALT);

- Franklin Liberty Systematic Style Premia ETF (FLSP).

CTA is managed by Altis Partners – a commodity trading advisor with over 20 years of experience, according to the fund’s factsheet. CTA is 0.1% cheaper than DBMF, but its portfolio structure is not that diversified from what I can see in the holdings breakdown – it “invests in a portfolio of equity, U.S. Treasury, commodity, and FX futures contracts” – no fixed income among the available instruments. It started trading on early August 2022, so most analytical platforms don’t show its beta. But it did outperform its benchmark (SG CTA Index) by a few percentage points in 3Q 2022. If you want to learn more about this particular fund, you can read Simplify’s article on Seeking Alpha – who else but the manager can tell you about the product better than anyone else?

KMLM invests in fixed income, commodity, and currency markets of the global region, resorting most often to various derivative contracts. According to the fund’s investment strategy, KMLM is benchmarked to the KFA MLM Index, which consists of a portfolio of 22 liquid futures contracts traded on U.S. and foreign exchanges. The index includes futures contracts on 11 commodities, 6 currencies, and 5 global bond markets. These 3 baskets are weighted by their relative historical volatility, and within each basket, the constituent markets are equal dollar weighted. Its total expense ratio equals 0.92% with net asset standing at over $345 million – KMLM is the second-largest alternative ETF in the sample I’m analyzing.

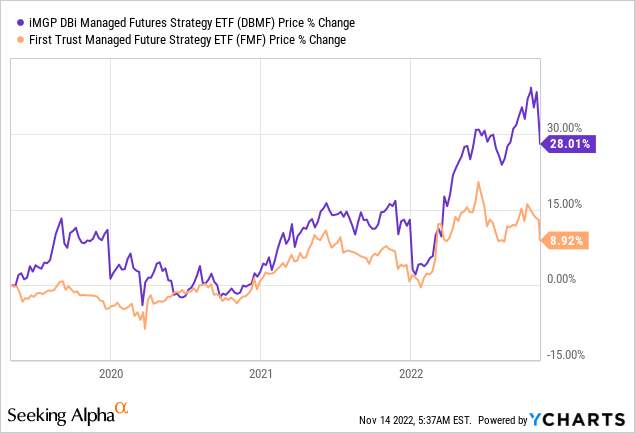

First Trust Managed Futures Strategy Fund – FMF – actively uses futures in commodity (50%), currency (25%) and equity (25%) indexes, according to etf.com. First Trust’s official website is currently not working (at least my browser cannot open it), but we can compare its performance with that of DBMF (since the latter’s inception in 2019):

Apparently, FMF is managed less efficiently than DBMF – perhaps the limited range of asset classes used by FMF has an effect, or perhaps this is solely the result of execution.

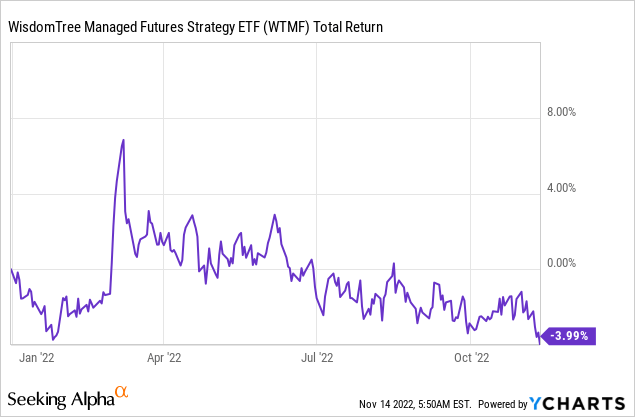

WTMF has one of the smallest expense ratios among others – 0.65% – with a little over $129M of assets under management (“AUM”) and a distribution yield of 4.42%. According to the latest quarterly fact sheet, the fund was 87.13% invested in treasuries futures. It has underperformed the SG Trend Index by almost 6% since inception and 5.73% over the past 10 years. WTMF seeks to provide investors with positive total returns in rising or falling markets, but may also invest up to 5% of its net assets in bitcoin futures contracts. I do not know about you, but for me this is too risky – the high volatility of such an underlying, especially lately, can severely affect the final return of investors – which we can observe since the beginning of this year:

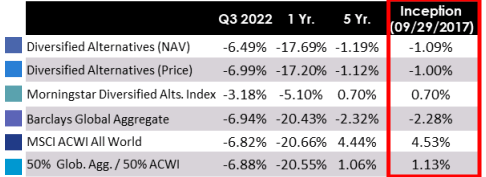

DALT was launched in late September 2017 with an objective to provide capital growth and income with positive return over full market cycles. The fund managers invest in a broad spectrum of asset classes (typically 10 different markets, sectors, and themes with a target of approximately 20 to 30 different positions), but primarily in business development companies (“BDCs”), closed-end funds (“CEFs”), and real estate investment trusts (“REITs”). The total expense ratio stands at 1.5% – the highest of the sample – with just $59M of AUM.

Since its inception, DALT, like WTMF, has been underperforming all of its benchmarks, according to the latest fact sheet:

DALT’s fact sheet

The last fund I’m looking at is FLSP – a fund designed to diversify beyond traditional asset classes, maintaining low correlation to traditional asset classes and to deliver positive returns in rising or falling markets. The net expense ratio equals 0.65%; the AUM stands at $93.62M.

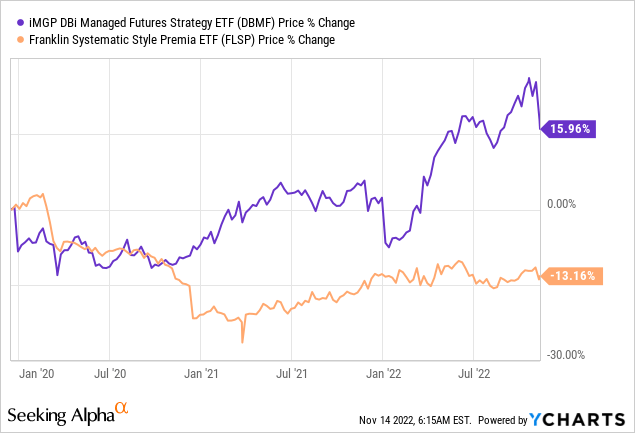

FLSP was launched in the same year as DBMF, so we can roughly compare the quality of management of both funds and see how their targeted “low correlation to traditional assets” has worked in their dynamics against the backdrop of falling (SPX) and (QQQ):

From the above comparisons, I can conclude that DBMF is the best fund of all. In my opinion, it is: 1) better managed; 2) uses a broader arsenal; and 3) has a fairly average commission level, but at the same time has the best liquidity among the peers. I believe that DBMF is performing well not because of just luck – it’s the management’s execution quality and well-timed positioning. I would recommend considering DBMF for purchase as a great diversifier for your equity portfolio.

A few things about the new Unlimited HFND Multi-Strategy Return Tracker ETF

This fund was launched on October 12, 2022, by ex-Bridgewater executive Bob Elliott [his LinkedIn profile], who has been responsible for overseeing Bridgewater’s Pure Alpha portfolio [the flagship vehicle of the whole fund] with a small group of CIOs. Prior to that, Bob was the head of Ray Dalio’s investment team for 11 years, being actually the legendary investor’s right-hand man.

Structurally, HFND is a bit different than DBMF: utilizing highly-sophisticated machine learning techniques, it’s looking “over the shoulders” of hedge funds managers trying to implement similar return patterns and fund management styles. It’s not about just reading 13-Fs – they reverse-engineer the portfolios to figure out hedge funds’ positioning through time, which helps to understand what positions they may have now.

Quite a complex approach, but the questions HFND is trying to answer are simple – “Are they [the funds] long or short bonds/stocks/commodities? What can the weights be?” When asked about what hedge funds HFND analyzes in particular, Bob said they “look at everybody” because it’s impossible to say which portfolio manager is going to be the best at a given time. So, HFND tracks 30-50 funds and looks at them like a portfolio, a basket, that is likely to outperform the benchmark over the longer run. Private investments that hedge funds like more and more recently, and which are impossible to replicate, are just skipped by HFND – it focuses on the traditional liquid markets to generate alpha.

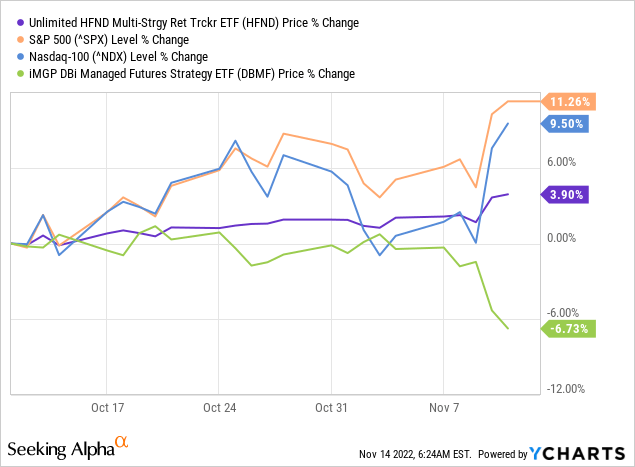

It is true that we cannot judge the actual quality of fund management from the past; there are too few observations for that. However, as far as we can see, HFND is an all-weather diversifier – it has risen during both market downturns and recent upturns:

Unlike the same DBMF I recommended above, HFND does not just add alpha due to a negative or near-zero correlation with the market – the machine-learning algorithm used inside is most likely truly capable of smoothing out various fluctuations, which should make HFND much more sustainable than most other alternative ETFs during the next impending sharp market drop (which I have no doubt is inevitable).

Thanks for reading! If you want to join my private group, write me a direct message – I have a gift for you!

Be the first to comment