hapabapa/iStock via Getty Images

Investment thesis

Datadog, Inc.’s (NASDAQ:DDOG) shares have seen a 51% correction YTD, but we rate the shares as a sell. A sustained profile of growth deceleration and expensive valuations mean that we do not view the current share price as an attractive entry point.

Quick primer

Datadog provides a SaaS monitoring and security platform for cloud applications. The key selling point is to simplify the ‘observability’ of numerous different technology standards and solutions in a typical technology stack. In Q2 FY12/2022 there were 21,200 customers, with about 2,420 customers (around 11%) with ARR of $100,000 or more. The dollar-based gross retention rate (the ability of a business to retain its existing customers) is said to be in the mid-high 90s (%) (page 19), and the dollar-based net retention rate (the total value of your renewed contracts as well as the revenue gained through upsells and cross-sells) is 130%+ for the last 20 consecutive quarters.

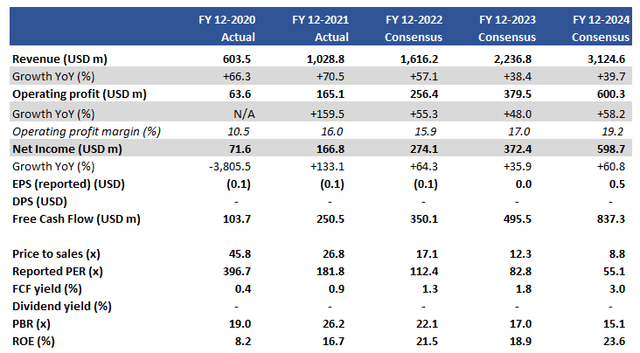

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

With the shares correcting 51% YTD, we want to assess whether this is an attractive entry point for the shares. Recent filings indicate that 8 of the top 10 shareholders have reduced their holdings, including CEO Olivier Pomel. The backdrop to our analysis focuses on the following:

- Datadog’s strong track record of growth is well-known and sets a high bar for future projections. In essence, high double-digit growth is perceived as a given by the market.

- Taking a closer look at management comments made in Q2 FY12/2022 results about some negative changes in customer behavior.

We will take each one in turn.

High hurdles point to marked growth deceleration

We start with the conclusion that Datadog is essentially a victim of its success. Q2 FY12/2022 results highlighted robust growth, with revenue growth at 74% YoY and up 12 % QoQ. These are positive performance metrics, but on the other hand, are in line with current market expectations. The unfortunate situation is that for Datadog to surprise on the upside, the business has to perform even better, which in fairness does not look realistic given rising hurdles YoY.

We view billings as an indication of future growth as it reflects current cash collection trends. Q2 billings were $397 million, up 47% YoY, which is impressive but likely to point to a deceleration in future sales growth. Although we are aware that billings growth YoY can be slightly bumpy depending on timing, we are not anticipating a major re-acceleration in H2 FY12/2022 to maintain sales growth into FY12/2023 on an even keel YoY.

Another way to see the outlook for growth for the next 12 months is the current RPO (Remaining Performance Obligations) – this measures the performance obligations arising from contractual relationships for the period in question. A similar picture presents itself, with the current RPO growing at mid-50% YoY.

The market does not like a decelerating growth profile in growth stocks. Datadog is demonstrating slowing growth YoY in FY12/2022, and we do not see this trend changing in the medium term. Consensus forecasts show a continued deceleration in FY12/2023 which we believe is partly priced in – the mild reversal forecast in FY12/2024 is difficult to justify given current trading conditions where there are already visible pockets of weakness. We will look at these next.

Signs of problems ahead

Whilst management highlights a high dollar-based net retention ratio (NRR) of 130%+, we believe this is misleading as this is a current snapshot in time of business performance. With the revenue model being primarily annual subscriptions, there is a risk that NRR metrics suddenly begin to drop off into FY12/2023 as customers begin to proactively manage costs in a downturn. This could come in the form of cancellations (churn) to lower success rates of cross-selling into the new financial year. Management may already be notified that annual contracts may not be renewed or downsized, but this negative trend will not be visible with NRR until next FY.

Datadog believes that it has a diversified customer base with exposure to multiple industries and segments. However, management has highlighted weakness in the consumer discretionary sector (page 6, before a recession has been declared). Customers appear also to be cutting back on using Datadog services themselves to save costs, with some subscriptions based on system usage rates witnessing a fall in activity. Larger clients are said to be cutting back on spending versus smaller clients – usually, in an economic downturn, the trend is the opposite with the smaller businesses cutting back first – we expect this negative wave to hit into FY12/2023.

Geographically, revenue is concentrated in North America for Datadog, with around 30% (page 78) of total revenues from International Markets in FY12/2021. Whilst management was clear to state that Europe was not weak in Q2 FY12/2022, the combination of inflationary pressure, rising borrowing costs, and macro uncertainty with continued Russian aggression in Ukraine we believe will result in slowing growth for the company.

Overall, we do not see any triggers to be positive on the growth front for the company.

Valuation

According to consensus forecasts (see table above in Key Financials) Datadog is experiencing a deceleration in revenue growth into FY12/2023 and limited improvement in operating margins. Free cash flow is expected to continue growing YoY, although with ROE expected to decline slightly YoY one could argue that capital allocation (bar M&A) could be more efficient.

The shares are trading on reported PER FY12/2023 82.8x even after a 51% correction YTD, and the free cash flow yield of 1.8% is low. On these metrics, we do not feel the shares are attractively priced.

Risks

Upside risks come from: 1) a sudden re-acceleration in customer demand, and 2) although unlikely to be a major deal, earnings accretive M&A that will help Datadog to maintain a high growth profile.

Downside risks appear to be: 1) a higher-than-expected deceleration in growth metrics YoY, and 2) limited control over Datadog’s operating expenses leading to lower-than-expected margin expansion.

Conclusion

Whilst we believe that the market has priced in Datadog’s decelerating growth profile to a certain extent, we believe the shares are still priced on the expensive side. We conclude that there is no reason to buy the shares, and have a sell rating.

Be the first to comment