gremlin

Though many investors have backed off of risk-taking and growth stocks amid current volatility, I find it to be a fantastic opportunity to pile into heavily discounted former high-flyers that have executed tremendously well amid the downturn. Though it may take several quarters for us to see a full recovery and while we may never see 2021-style revenue multiples again, I think there’s plenty of room for these underwater stocks to regain a lot of lost ground in 2023.

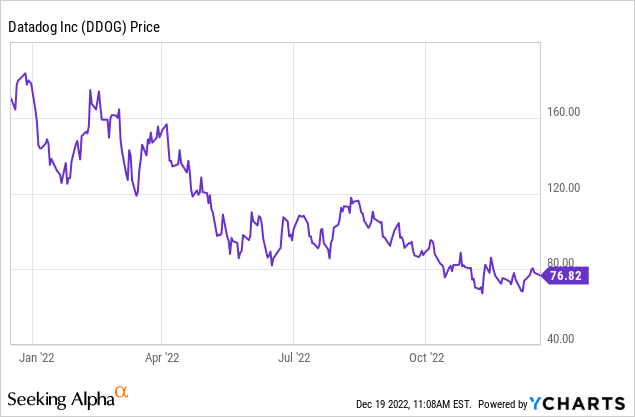

Datadog (NASDAQ:DDOG), in particular, has reached my buy point after sinking below $80. This infrastructure monitoring software stock – which helps IT departments assess the health, performance, and security of underlying systems – was once one of the hottest trades in tech. But mostly due to growing pessimism for tech and macro factors impacting the whole market, Datadog shares are down more than 50% this year:

I am now bullish on Datadog and think we have an incredible opportunity to buy at current prices. Datadog showcases a lot of the fundamental qualities that are essential for a “safe” software rebound play: growth at scale that so far hasn’t been tremendously dented by macro conditions, rich gross margins and an underlying operating structure that is conducive to profitability scaling, and a well-padded balance sheet. It’s worth noting as well that Datadog is true “horizontal” software – which is technology that can be broadly applied across all industries and has countless use cases – and that once installed, it becomes a core piece of its customers’ IT stack, making it incredibly difficult to rip out and shielding its ARR base.

Here is the full bull case on Datadog:

- Incredible execution and growth at scale. There are very few companies that can reach a nearly $2 billion annual revenue run rate and still be growing at >70% y/y. This is a testament both to the largesse of Datadog’s infrastructure monitoring market (a crown it stole from incumbent New Relic in a rapid amount of time) as well as the company’s own sales execution.

- Huge $62 billion market opportunity. Datadog recently sized the observability market as a $62 billion total opportunity by 2026 (its prior sizing was $53 billion by 2025), which means that Datadog is still only single-digit penetrated into this overall market opportunity.

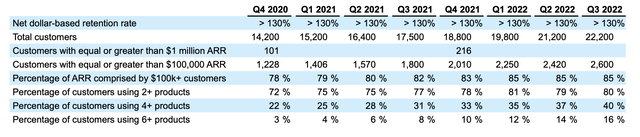

- Mission critical, recurring revenue software. Once installed, Datadog becomes a fixture of a company’s IT stack, necessary to maintain performance and security. This gives Datadog a rich, reliable stream of recurring revenue to build on. Its expansion rates and number of customers using multiple products is also quite high.

- High customer expansion rates. Datadog has consistently clocked in net expansion rates above 130%, indicating that the average customer increases their spend by 30% in the following year. Rich expansion rates are the key to profitable growth – as it costs software companies much less in sales dollars to upsell an existing customer than it does to land a new one.

- Already profitable. Very few companies growing as quickly as Datadog are able to achieve meaningful profitability. Datadog has 20%+ pro forma operating margins. On top of 60%+ revenue growth, this puts Datadog into a stratospheric “Rule of 80” club, whereas most software companies struggle to even meet the “Rule of 40”.

A quick check on valuation: at current share prices near $77, Datadog trades at a market cap of $24.52 billion. After we net off the $1.77 billion of cash and $738.0 million of convertible debt not he company’s most recent balance sheet, Datadog’s resulting enterprise value is $23.49 billion.

Meanwhile, for next fiscal year FY23, Wall Street analysts are expecting Datadog to generate $2.22 billion in revenue, representing 34% y/y growth (data from Yahoo Finance). This puts Datadog’s valuation multiple at 10.6x EV/FY23 revenue: not exactly a bargain stock, but compared to the height of the pandemic when Datadog traded at a mid-20s multiple of revenue, I consider this quite an opportunistic buy considering Datadog is still achieving growth north of >60% y/y. Recall as well during the peaks of 2020-2021, ~10x valuation multiples were commonplace for enterprise software stocks growing revenue in the mid-20s.

The bottom line here: if you’ve been waiting on the right opportunity to buy Datadog, this is it.

Q3 download

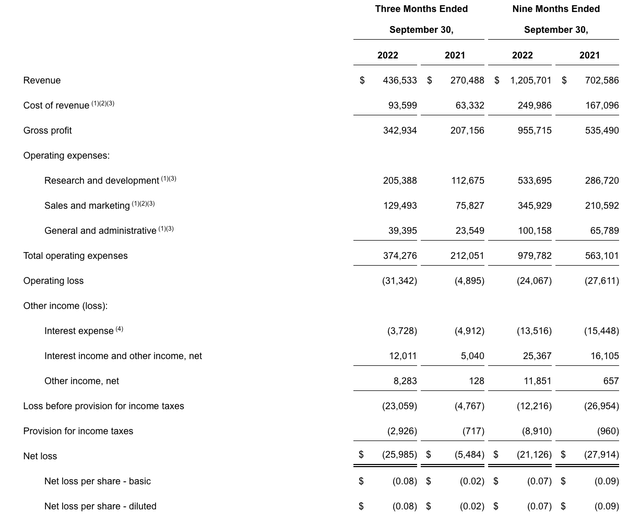

Let’s now go through some highlights from Datadog’s most recent quarterly earnings to demonstrate that the company continues to perform resiliently, despite pessimism for its stock. The Q3 earnings summary is shown below:

Datadog Q3 results (Datadog Q3 earnings release)

Datadog’s revenue grew at 61% y/y to $436.5 million in Q3, smashing Wall Street’s expectations of $414.2 million (+53% y/y) by a massive eight-point margin. Note that Datadog is accustomed to large earnings beats, but in a quarter where many tech companies have started missing expectations and blaming macro conditions on sales shortfalls, Datadog’s large beat stands out even more.

The company added 1k net-new total customers in the quarter, roughly at the same pace as last year’s Q3, while maintaining net dollar-based retention rates above 130%. The company’s proportion of customers using 6 or more Datadog products also hit an all-time high 16%:

Datadog customer metrics (Datadog Q3 earnings release)

Management isn’t ignoring the macro crunch that is impacting Datadog’s peers, but reiterates that its customers’ long-term digital transformation strategies are remaining intact. Datadog is also entering into Q4 with a robust sales pipeline. Per CEO Olivier Pomel’s remarks on the Q3 earnings call:

All that said, we are pleased with our Q3 strong performance. Revenue in Q3 grew 61% year-over-year and 7% quarter-over-quarter, with all of our products meaningfully outperforming the growth of the large cloud providers. While the macroeconomic environment is likely to remain a headwind in the near-term, we continue to see positive trends underpinning our business and remain bullish about the long-term opportunities and aggressive with our investment plan.

First, we continue to see strong growth in new logo ARR, including some large wins in traditional industries. We’ll talk about some of those in a bit.

Second, our sales pipeline is strong heading into Q4 for both new logos and new products. And we’re seeing great opportunities across customer sizes, geography and industry.”

From a profitability standpoint, Datadog also stands out within the software sector in that its pro forma operating margin grew one point to 17% this year (whereas many peers are suffering under the weight of wage inflation). Year to date pro forma operating margins of 20% are also seven points richer than 13% in the year-ago period.

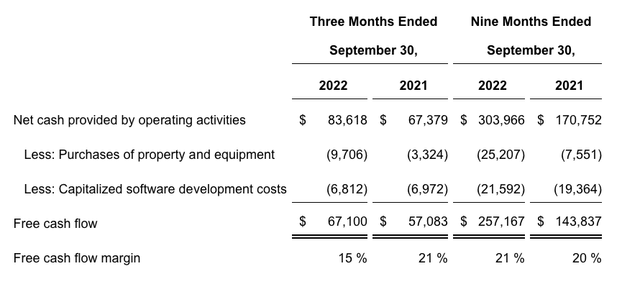

Free cash flow is also tracking closely in-line with pro forma operating margins, with YTD FCF at $257.2 million (+79% y/y), representing a 21% margin:

Datadog FCF (Datadog Q3 earnings release)

Key takeaways

I used to describe Datadog as a stock that traded at a “high price for high quality.” Nothing has changed about Datadog’s fundamental quality – but it is substantially cheaper now, after shedding 50% of its market value this year. But with 80%+ pro forma gross margins and 20%+ pro forma/FCF margins on top of robust growth for a ~$2 billion annual revenue company, it’s hard to see Datadog not rebounding. The answer is simple: buy the dip here.

Be the first to comment