SeventyFour/iStock via Getty Images

Investment Thesis

I’m sure there are plenty of Datadog (NASDAQ:DDOG) articles out there with a plethora of canine-related puns – I’ll do my best to avoid them here.

Datadog is leading the pack thanks to its cloud-native observability platform, and its rapid growth has seen this pup grow into a top dog. There is so much to like about the company: founder-led with skin in the game, strong gross margins, and incredibly high switching costs.

Whilst the share price falling 40% from recent highs has been rough, investors should remain positive about the future. If you’re uncomfortable investing in high growth businesses that are tough to value, then you’re barking up the wrong tree, but if you’re happy to pay the current price, Datadog could find a forever home in your portfolio.

How did I do?

Business Overview

Datadog is a SaaS company that operates a monitoring and security platform for cloud applications, providing unified, real-time observability of its customers’ entire technology stack. The company was founded with an aim to break down silos between developers and operations, since in many cases these two integral business departments were struggling to communicate & were often not seeing the same data – Datadog later went on to expand into security offerings.

Datadog May 2022 Investor Presentation

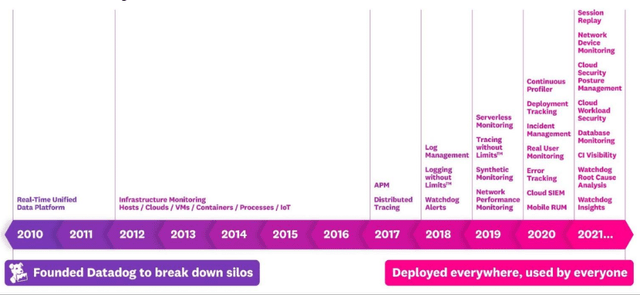

In a dynamic, cloud-based environment, the ability for different areas of any corporation to communicate effectively is becoming mission critical – as is the ability for departments to work together and resolve any potential problems. Datadog has continually rolled out more and more solutions to help drive collaboration among all the different business teams, resulting in an accelerated time to market for applications, a reduction in problem resolution times, increased security in applications and infrastructure, as well as the ability to understand user behavior and track key business metrics. The number of solutions offered by Datadog has rapidly expanded in recent years, with one highlight being the 2021 launch of its Cloud Security Platform.

Datadog May 2022 Investor Presentation

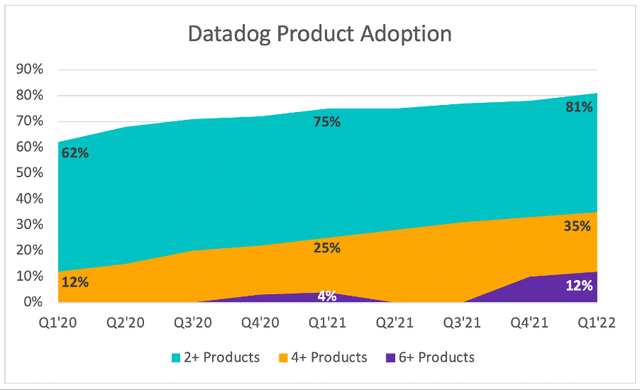

It’s all well and good rolling out these products, but is anyone actually using them? Short answer – yes. Over the past two years, Datadog has seen the number of customers using 2+ products increase from 62% to 81%, the number of customers using 4+ products increase from 12% to 35%, and although it wasn’t reported in Q1’20, the number of customers now using more than 6 products stands at 12%.

Datadog Investor Presentation / Excel

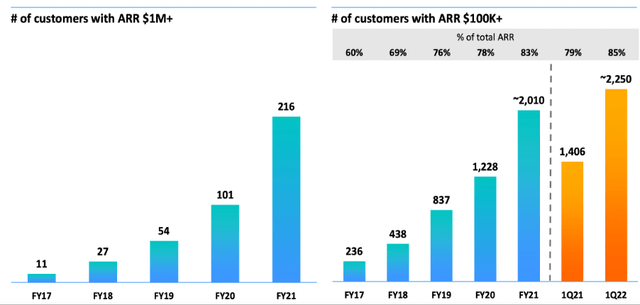

Given this, it’s no surprise to see that the number of customers using Datadog’s platform has increased rapidly. Perhaps even more importantly, both the number of customers with ARR (annual recurring revenue) over $100k and over $1m accelerated in 2021 – so these additional solutions are being adopted, and are enabling Datadog to continue in hyper-growth mode.

Datadog May 2022 Investor Presentation

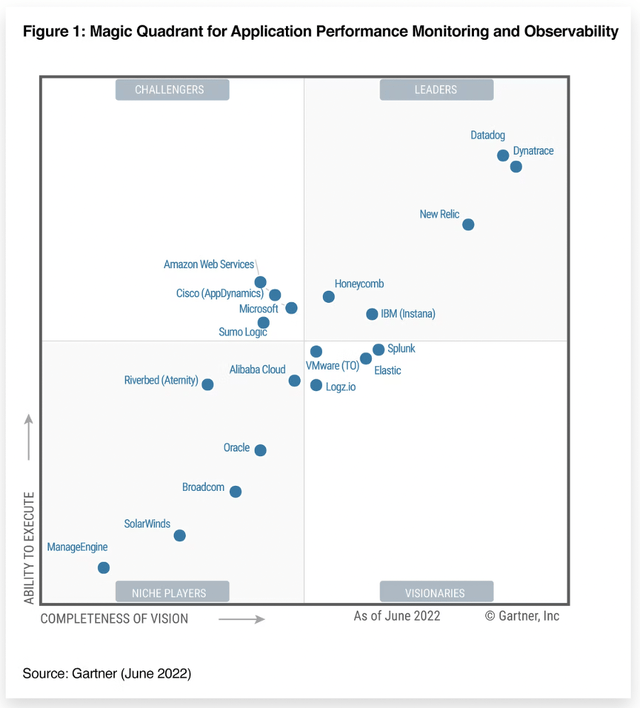

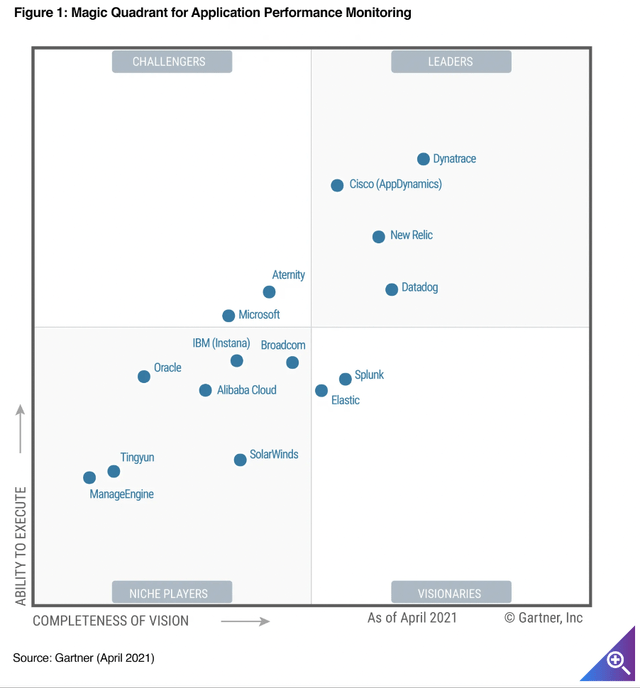

I’ll be the first to admit that I’m no tech expert, but you don’t have to be in order to invest in a company like Datadog – if you know where to look. Firstly, there are the clear trends above that demonstrate both the importance of Datadog’s platform to customers and the fact that it clearly has a great product, since customers continually adopt more offerings & increase their spend on the platform. I also look at independent industry research, and in this case Gartner’s 2022 Magic Quadrant for APM and Observability – where Datadog and competitor Dynatrace (DT) are truly in a league of their own.

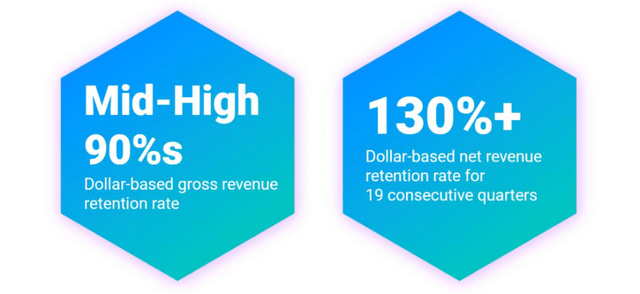

Looking at this might make investors concerned about the competition from Dynatrace, and they are right to think this! But when I look at the two companies, Datadog has clearly done a better job of retaining and upselling its customers, boasting a net retention rate consistently above 130% whereas Dynatrace only talks of a 120% net EXPANSION rate in its February 2022 Investor Presentation. It’s worth highlighting that the net expansion rate ignores the negative impact of customers leaving, but the net retention rate includes it – so if Dynatrace had a 130% net expansion rate, Datadog’s 130% net retention rate would still be more impressive.

Furthermore, if we take a look at the 2021 Gartner Magic Quadrant for APM, it’s clear that Datadog has done a fantastic job over the past year – and Dynatrace has lost a clear lead.

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

If you haven’t already guessed, there is one powerful economic moat that Datadog possesses which blows any other out of the water – switching costs. Once a company decides to use Datadog, its platform then becomes critical for the day-to-day running of said company, meaning that any decision to switch away from Datadog would be onerous.

But this is only if a business has one product. What we have seen over time is Datadog’s customers taking up more and more solutions – with 81% of customers now having two or more products, 35% with 4+ products, and 12% with 6+ products. Not only are those customers with multiple products bringing in more money for Datadog, but it also makes switching even more difficult with every new product that is added.

We see this in the numbers; not only does Datadog’s net retention rate above 130% demonstrate that customers are staying and spending more, but the company also highlights a gross revenue retention rate of the mid-to-high 90%. If I take a proxy of ~97%, it means that Datadog would be retaining 97% of its customers each year – flip that round, and it implies that the average Datadog customer will remain on the platform for more than 30 years!

Datadog May 2022 Investor Presentation

I also think that Datadog’s technological advantage and brand provide it with an additional moat, and it’s worth highlighting that the technological advantage feeds the Datadog brand recognition within the industry. As we saw from the 2021 to the 2022 Gartner Magic Quadrant, Datadog has improved its offering to become a true industry leader. This brand power is critical in order to land customers, with whom it can then expand spend with thanks to its high switching costs.

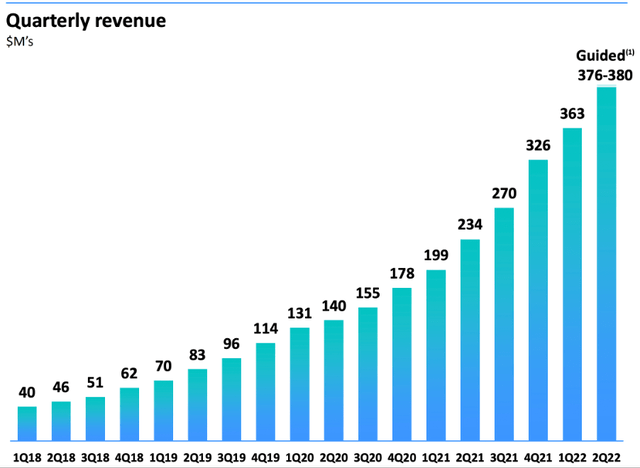

Datadog has built a powerful business model with strong moats; use the brand and technological advantage to land the customers, and use switching costs whilst continually rolling out new products to get customers to remain on the platform whilst spending more and more money. It’s the type of business model that gets a company’s revenue trend looking like this:

Datadog May 2022 Investor Presentation

Outlook

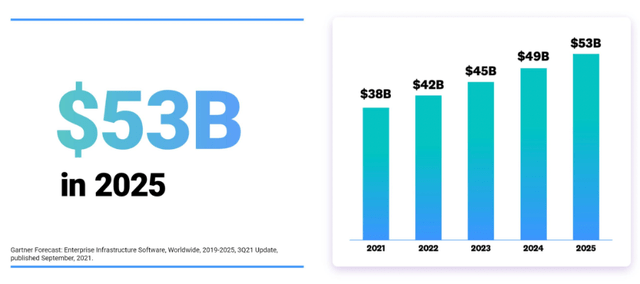

As per Datadog’s latest investor presentation, the Observability market is expected to grow from a size of $38 billion in 2021 to $53 billion in 2025 – representing a ~9% CAGR over the next few years. It’s worth highlighting that Observability it Datadog’s core offering, but the company has shown its ability to broaden its products and potentially expand that market opportunity.

Datadog May 2022 Investor Presentation

Datadog’s revenue for the past 12 months was $1,193m, and represents approximately 2% of this 2025 revenue opportunity. So despite Datadog already being a leader in this space, the opportunity for expansion still lies very much ahead of it.

Datadog also believes that a large portion of the current spend in this market relates to legacy on-premise and private cloud environments, but does not fully include the opportunity in modern multi-cloud and hybrid cloud environments. Datadog’s platform is designed to address both legacy and modern environments, and given its cloud-based specialization, the shift from legacy to cloud within this market should be a huge tailwind for Datadog.

Management

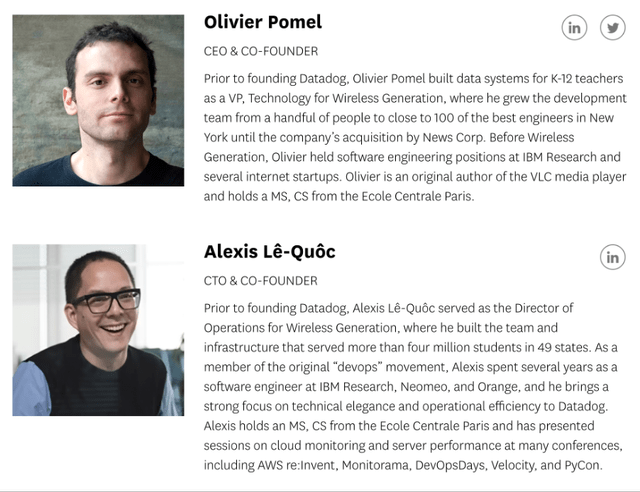

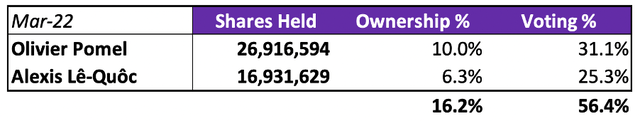

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where inside ownership is high. I’m happy to say that we get not one, but two co-founders in the leadership team of Datadog – CEO Olivier Pomel and CTO Alexis Lê-Quôc.

CEO Olivier Pomel and CTO Alexis Lê-Quôc (Datadog)

I want to invest in companies where leadership has skin-in-the-game, and Datadog ticks this box massively. The two co-founders are the largest insider owners, with Pomel owning ~10% of shares and Lê-Quôc owning ~6%. They also hold a combined ~56% of voting rights – this may be a yellow or red flag to some investors, but I personally do not mind founders having substantial voting rights when it comes to fast growing companies.

Datadog 2022 Proxy Statement / Excel

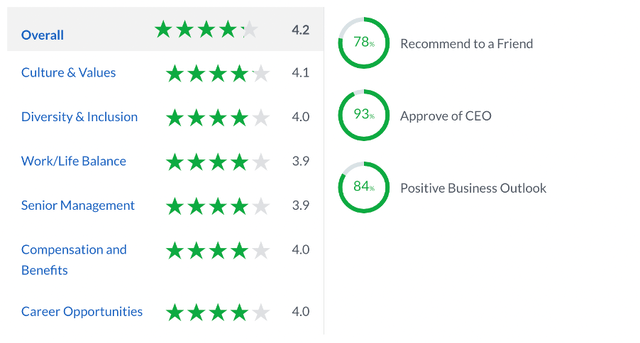

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Datadog gets some strong scores from the 548 reviews left by employees. Any score over 4.0 is impressive, and Datadog achieves this in virtually all categories, with the lowest scores being 3.9

In fact there isn’t anything specific to highlight, as the company’s scores have a very narrow range between 3.9 and 4.1 across the board; so, it’s all pretty good! CEO Pomel gets an impressive 93% approval rating, and 84% of employees think the outlook is positive for Datadog. All in all, Datadog looks like a good place to work & employees seem to be happy with the business as a whole.

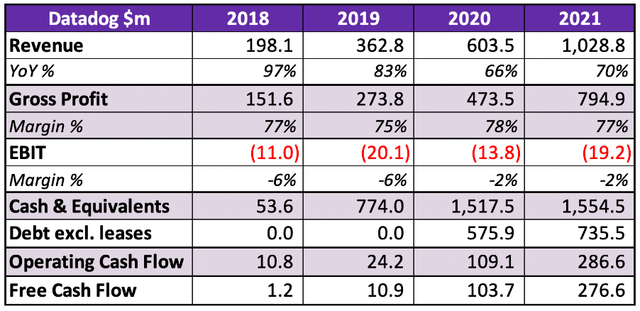

Financials

Datadog is a financially sound business, and has been growing revenues at a rapid clip. From 2018 through to 2021, revenue grow at a staggering 73% CAGR – all while generating gross profit margins in excess of 75%! It might still be seeing slightly negative EBIT, but that doesn’t concern me when a company is free cash flow positive, has a strong balance sheet, and is reinvesting in itself to grow. Datadog ticks the box for all of these points, and in truth there’s not much more to say – these are very impressive financials, and the consistently high growth of Datadog is nothing short of astonishing.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Datadog is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

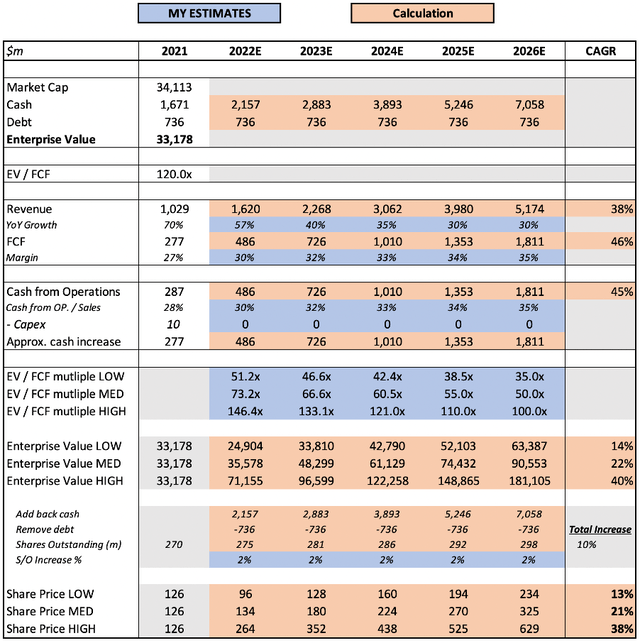

For my 2022 revenue estimate, I have used the guidance provided by management in Datadog’s Q1’22 results press release of $1.6-$1.62 billion. I have assumed that Datadog will hit the top end, although this company has a habit of beating their guidance & I would not expect this trend to change. Given this, I think Datadog will exceed their 2022 guidance & therefore my assumption is likely to be conservative. I have also prudently forecast a slowdown in revenue growth through to 2026, although the company has shown an ability to continually grow revenues at a rapid rate.

I have forecast an expectation for Datadog’s free cash flow margins to expand gradually to 35% in 2026. The company still has room for these to improve, and the trailing-twelve-month FCF margin is already at 30% (vs 27% for 2021). Management also expect Datadog’s adjusted net income margin to improve substantially in 2022, so I think an expectation of gradual FCF margin expansion is also justified.

I have taken a range of different EV / FCF multiples that I believe to be appropriate for Datadog when compared to both others in the industry as well as similar, more established businesses, all whilst taking into account Datadog’s rapid growth rate. I’ve also assumed minimal shareholder dilution in line with the company’s history, forecasting a total increase in shares outstanding of 10%.

Put all that together, and I can see Datadog’s shares growing at a 21% CAGR in my mid-range scenario from now through to 2026.

Risks

In truth, there are very few serious risks that I see for Datadog’s business model; I’ll speak to a couple, but I still think investors can rest easy.

The first risk is that Datadog fails to maintain its industry leadership, or fails to roll out new products that are useful for customers. If this happens, then Datadog will struggle to acquire new customers & will also find itself unable to upsell its existing customers at its current rate. I don’t see any evidence of this whatsoever right now, but investors should be aware of this potential risk – keeping an eye on Datadog’s net retention rate, gross retention rate, and how independent researchers like Gartner rate Datadog will be a good way to check for this risk.

The other risk that is currently facing all businesses is that of a recession. Thankfully, Datadog operates a critical service for businesses & as such, it should be less impacted by a recession than other. However, if its customers are impacted, then they could potentially slow down either their adoption of new services from Datadog, or Datadog might see a slowdown in customer acquisition. Again, I think that the nature of this business makes it fairly recession-resistant, so the risk is not huge.

Summary

Datadog is a company that I’ve had my eyes on for a while. The growth rates have always impressed me, but the valuation over the past year has put me off. Now, I believe the current valuation to offer a very attractive opportunity investors – this company has created a business model that should continue to be very sticky, and there is no sign of growth being anything other than rapid.

So if you want a founder-led, fast-growing, industry-leading company at an attractive price, look no further than Datadog.

Be the first to comment