Kichigin/iStock via Getty Images

Investment Thesis

Datadog (NASDAQ:DDOG) separates itself in the SaaS space through a more diverse product offering and greater focus on value-creating growth. The firm’s sticky platform was highlighted by strong performance in Q1 of 2022. The Digital Transformation and increasing reliance on Cloud infrastructure are tailwinds for Datadog’s long-term potential. These are enhanced by the company’s ability to cross-sell, upsell and onboard new customers. CEO and Co-Founder Oliver Pomel continues to steer Datadog in the right direction. DDOG is still an expensive stock even after a rough first half of 2022 but remains a long-term buy in my view.

Industry and Business Strategy

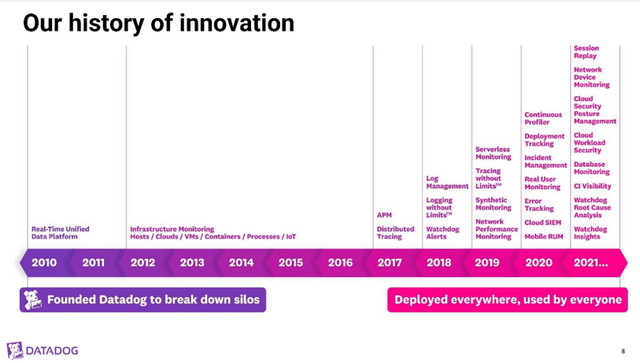

Datadog operates in several SaaS categories but can be classified as a full-stack monitoring and analysis (FSMA) platform. Their strategy has been to build new products into one unified platform, thus breaking down developer silos across their customers’ organizations. This strategy creates high optionality, diversifies the company’s revenue, and greatly expands its total addressable market (TAM). Driven by the Digital Transformation and Cloud Migration, Global Enterprise Infrastructure Software is expected to be a $515.8 billion market by 2025, representing 11.5% annual growth according to Gartner. With about $1.2 billion in TTM revenue, Datadog has plenty of room to expand.

Datadog employs a three-pronged approach for sustained business growth:

1. Expand customer base by acquiring new customers

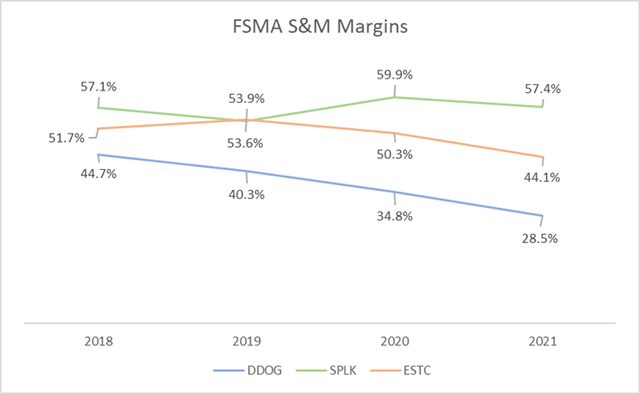

Like many software companies, Datadog uses a ‘land and expand’ sales and marketing strategy. A large part of Datadog’s Sales & Marketing (S&M) domain is dedicated to ‘landing’ new customers. With low market penetration and the increasing importance of data analytics, the opportunity is huge. Datadog’s extensive product offering allows new customers to start with just one product, lowering the cost barriers to entry. Compared to peers, Datadog’s S&M expense is much less burdensome but still drove new customer growth of 28.3% annually from 2017 to 2021.

2. Expand within existing customer base through broader deployments, new use cases and new product adoption

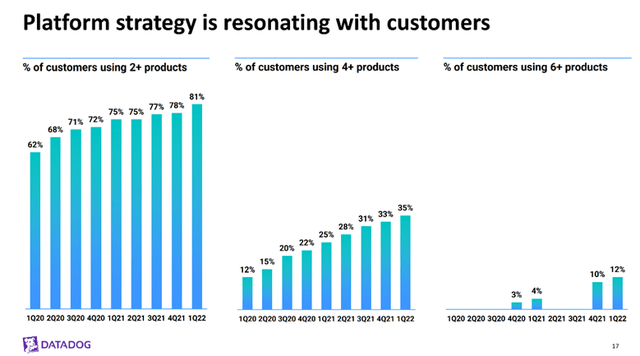

The second prong of Datadog’s strategy is to ‘expand’. With nearly 20,000 as of Q1 2022, Datadog’s customer base is a huge potential area for further topline growth. The company has already proven its ability to cross and upsell with strong historical trends of customers adopting additional products as they continue doing business.

On top of this, Datadog has boasted 130%+ net revenue retention rates (NRR) for 19 consecutive quarters. Meaning they have derived an extra 30% of recurring revenue from their existing customer base after accounting for churn. With the median SaaS NRR being about 100%, Datadog sits in the top 5 highest NRRs.

3. Expand technology leadership through continued investment and new products

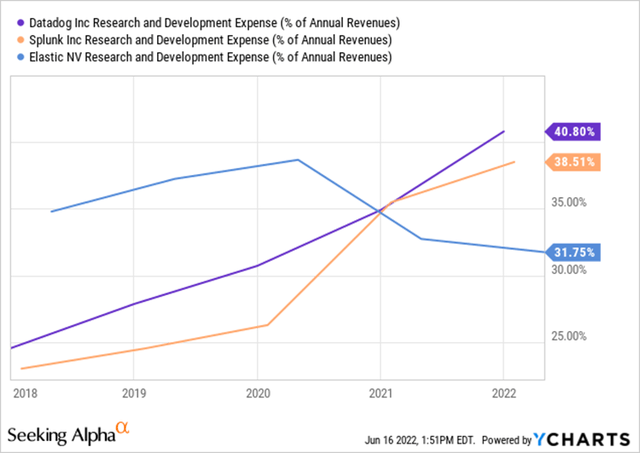

The SaaS industry is characterized by rapid product development and technological competition. In order to maintain growth, firms must have a sizeable and effective R&D strategy. Datadog’s cost-effective S&M approach and capital light structure free up extra funds for greater R&D investment.

Datadog has been focused on existing and new product development since its founding. They have added several new capabilities to their platform every year, creating a comprehensive and sticky software stack for their customers.

Competitive Moats

As demand for data monitoring and real-time analytics rises, so does the industry’s level of competition. Datadog competes with several large companies across its product offering:

| Category | Largest Competitors | Est. DDOG Market Share | Rank | Source |

| Infrastructure Monitoring | ServiceNow, Microsoft, SolarWinds | 26.28% | 2 | Slintel |

| Application Performance Management (APM) | Cisco, New Relic, Dynatrace | 20.45% | 1 | Slintel |

| Log Management | Splunk, Elastic N.V. | 27.29% | 1 | Slintel |

| Cloud Monitoring | Amazon, Microsoft, Google | 11.16% | 3 | Enlyft |

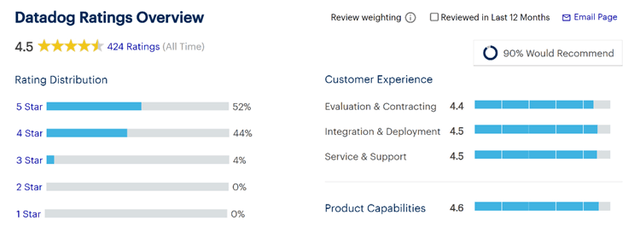

As shown above, Datadog is a top-3 competitor in all categories of its business; two of which Datadog is the leading firm by a significant margin. Much of the company’s competitive strength can be attributed to their high-quality, feature-rich platform. Datadog rates highly across every area of its platform’s functionalities, averaging 4.5 stars out of 5 on Gartner.

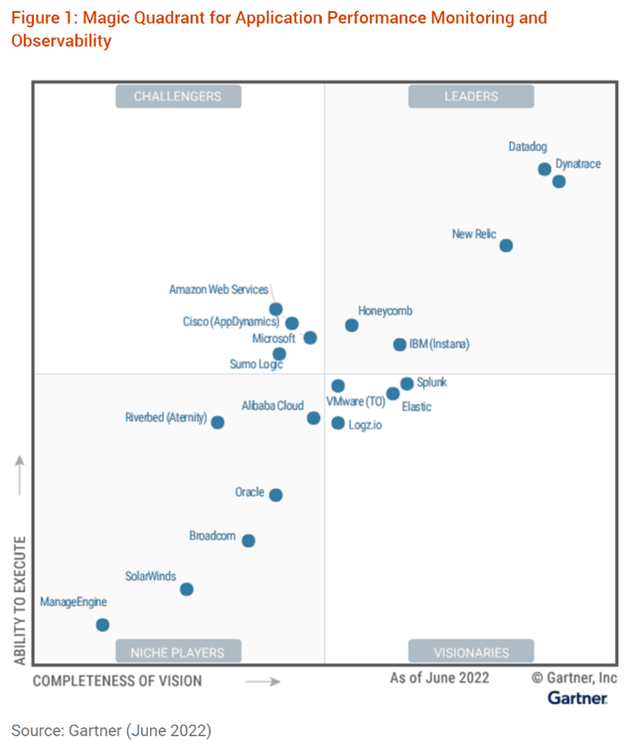

In addition, Gartner releases an annual “Magic Quadrant” Report showing the best firms within a particular industry. For APM and Observability, Datadog was a top-2 leading firm with strengths in platform portfolio offering, analytics usability, and funnel analysis.

Datadog then separates itself further by offering an all-in-one software solution for customers. This full-stack method is inherently cheaper for enterprises as it allows them to forego having contracts with several different vendors for each area of need. It also allows teams across an organization to more effectively share data and make decisions. Customers get the best products for each area of need, at the best prices, all in one singular platform.

In addition to product advantages, Datadog possesses two competitive moats varying in degree: switching costs and network effects. Switching costs are inherent to Datadog’s full-stack model. The more customers integrate Datadog’s products into their business operations, the stickier their platform becomes. Retraining employees and replacing enterprise software is tedious and complicated. This customer lock-in begins with strong customer acquisition and providing a high-quality platform. Datadog’s platform also carries slight network effects as a result of customers adopting several products across varying business domains. As Datadog adds features, they are able to penetrate other areas within an enterprise; thereby strengthening both switching costs and network effects.

One last area of strength is Datadog’s leadership. CEO Oliver Pomel and CTO Alexis Lê-Quôc are co-founders of the company and continue to execute the firm’s vision with a focus on the long-term. Insiders own nearly 15% of outstanding stock, showing an alignment of long-term incentives.

Financial Outlook

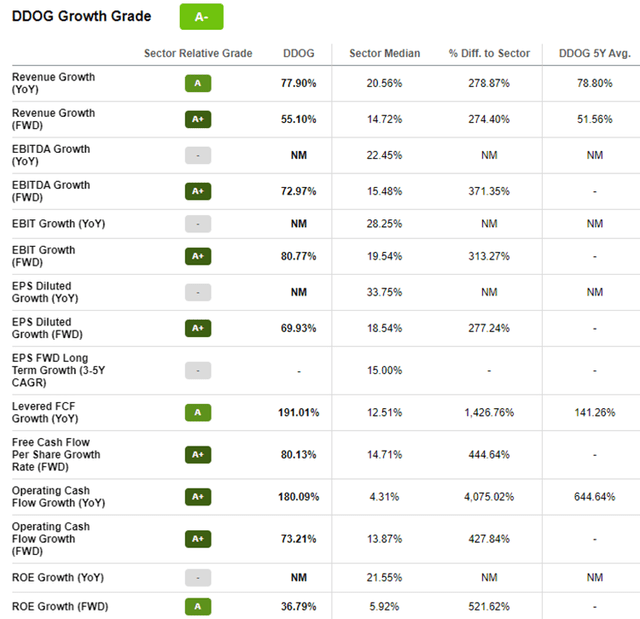

It’s no secret that Datadog has been a growth machine. Revenue has grown an average of 79% each year for the past 5 years. Operating income and cash flow growth have also been climbing rapidly, giving Datadog an A- growth rating on Seeking Alpha.

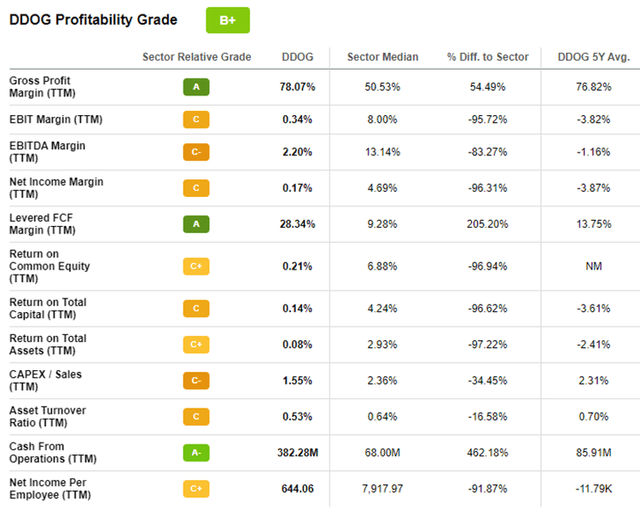

Datadog differentiates itself financially from other hyper-growth tech companies by focusing on disciplined investment and value-creating growth that doesn’t sacrifice profitability. Though they invest heavily in R&D, they are comparatively capital-light with positive margins down the income statement. Strong gross and free cash flow margins give them an impressive B+ profitability rating.

Datadog reports Q2 on August 4th, with a quarterly revenue estimate of $381.28M (51% YoY growth) and FY2022 revenue estimate of 1.62B (57% growth). While many other software companies see estimate downgrades due to a tough macroeconomic picture, Datadog has seen only positive revisions. Investors prefer profitable companies during times of slower growth and economic woe.

Valuation

Absolute Valuation

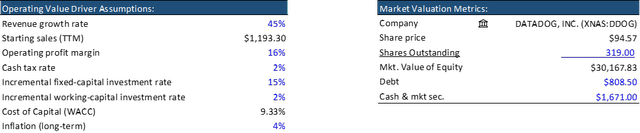

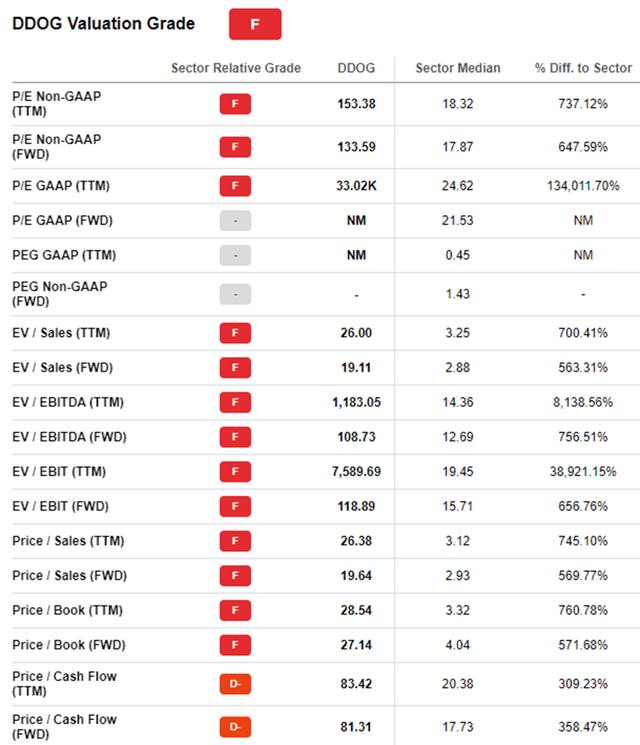

The absolute valuation method I like to use is price-implied expectations (PIE), an alternative to traditional discounted cash flow (DCF). Price-implied expectations analysis estimates the level of expected performance embedded in the current stock price. Instead of relying on multiple assumptions to forecast cash flows like a traditional DCF, expectations investing captures the expectations implied by the current stock price by inverting/reversing the DCF. To do this, we use the market’s consensus forecast for Datadog’s sales growth, operating profit margin, and incremental investment rate and then assess their reasonableness using Datadog’s historical figures. In addition, we calculate the cost of capital (WACC). Here are the consensus figures and other inputs.

These are then used to calculate the present value (PV) of expected free cash flows, PV of residual value, and shareholder value per share. Lastly, the model finds the market-implied forecast period (MIFP): how long the market expects a company to generate returns on investments above the cost of capital. This is found by lengthening the forecast period as many years as it takes to arrive at today’s stock price.

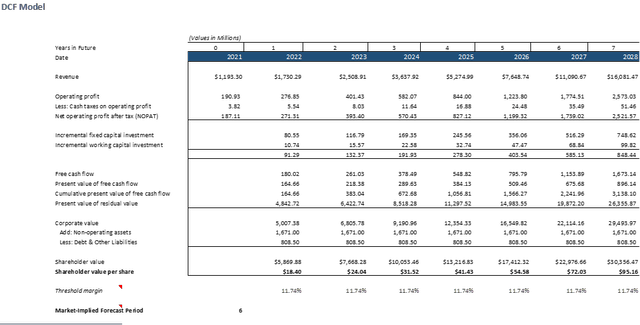

For DDOG, this results in a MIFP of 6 years. Next, we test a high and low scenario for sales growth on the output of the model, then estimate the probabilities of each scenario occurring. This gives us an expected value and margin of safety estimate.

In my view, DDOG will exceed the market’s PIE and MIFP based on a few factors. First, Datadog is led by visionary and long-term focused management with a proven ability to create new avenues of growth. Leadership is investing heavily for the future while keeping an eye on profitability, giving them a leg-up on other non-profitable SaaS companies. This, combined with strong competitive moats, will enable Datadog to continue generating returns above the cost of capital for more than 6 years (market-implied forecast period) in my view. Therefore, I gave Datadog’s upside case a 50% probability, resulting in an expected value of $99.42 and modest margin of safety at 5%.

Relative Valuation

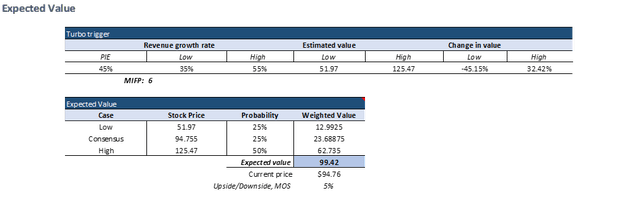

Though Datadog’s value in terms of future free-cash flows looks to be close to the current market price, the stock is by no means cheap when compared to its sector.

DDOG’s multiples have cooled in the last 6 months but still present a risk for investors.

Risks & Uncertainties

A few other risks investors should be aware of are a struggling economy and competition. Rising interest rates increase the cost of capital and investment for Datadog, which decreases the present value of future free cash flows. Most companies are also affected by rising input costs and inflation. Datadog is generally able to handle these price increases as SaaS companies tend to have a capital-light structure. But some of Datadog’s customers may be impacted to a greater extent and must cut their budgets for SaaS products like DDOG’s platform. Other software companies are seeing slower growth because of this. Q2 should give investors more insight into how this is affecting Datadog. Competition is another risk for Datadog as rivalry from larger firms picks up.

Summary

I rate Datadog a short-term hold but long-term buy. Investors should be patient when adding to Datadog in the near term given the cloudy economic outlook and DDOG’s heavily extended multiples. However, Datadog is a great long-term investment in my view based on its potential free-cash flow, the quality of its product, its strong competitive moats, and management’s focus on profitability and sustainable growth.

Be the first to comment