Anastasiia Shavshyna

Lack of Vision

When my last article about Datadog (NASDAQ:DDOG) was published on October 30, 2019, the stock finished the day at $34.81. I wrote bullishly about the company back then. But, I must concede: despite having worked in the application monitoring space myself for several years and recognizing DDOG’s potential, I nonetheless suffered from a lack of vision with respect to just how far the firm – and especially its stock which has traded at nearly $200/share – would go.

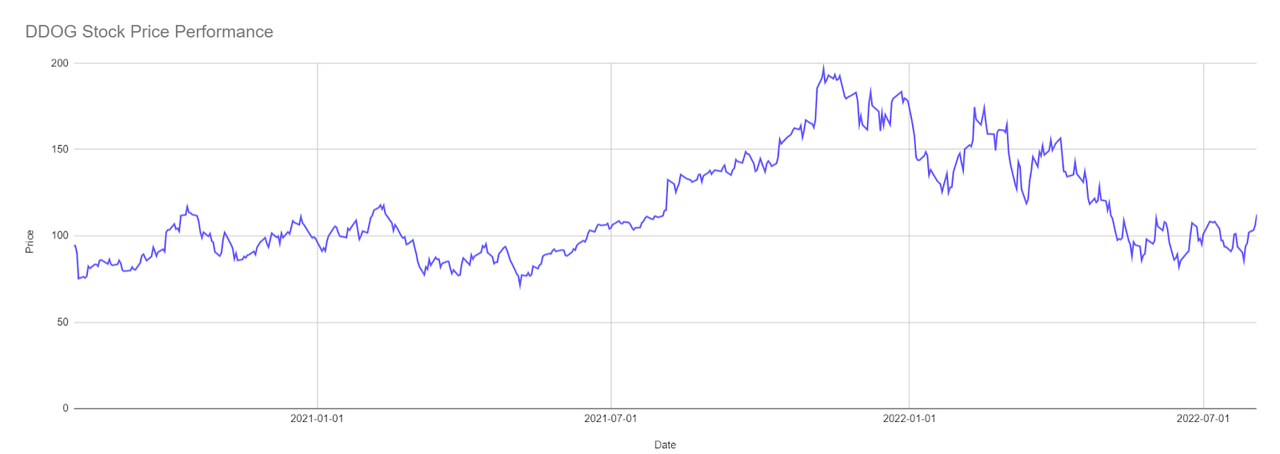

Figure 1: DDOG Stock Price Performance (Yves Sukhu)

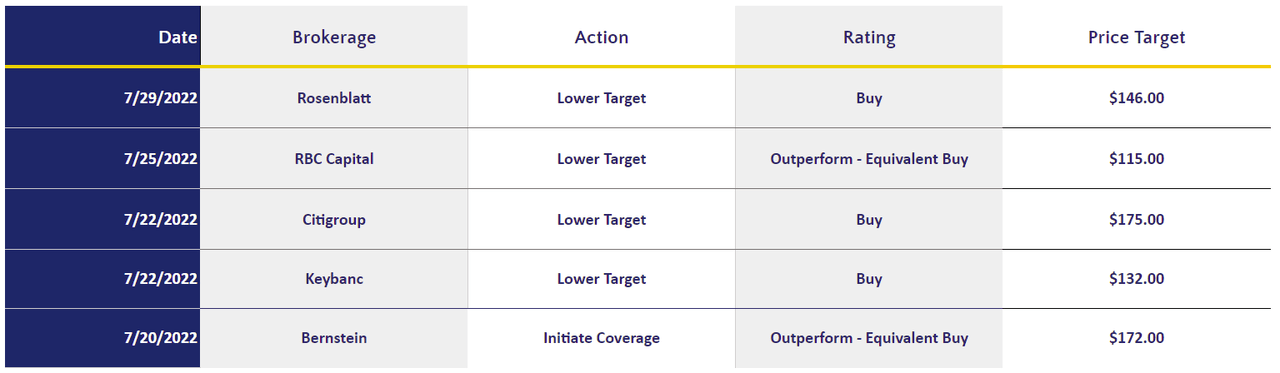

Obviously, the stock has broadly retreated from its high over the last few months; and it is trading slightly lower as I write this due to a conservative outlook for 2H FY ‘22 offered during today’s Q2 FY ‘22 earnings call. Indeed, the firm’s forecast has led to ratings downgrades from a handful of analysts, which stand in contrast to the largely bullish sentiment heading into Q2 earnings.

Figure 2: DDOG Selected Analyst Rating Pre-Q2 FY ‘22 Earnings Results (Benzinga)

As I scanned some investor forums following today’s results, my impression is that quite a few long DDOG investors are puzzled as to what their next move should be given that “the ‘cautious’ guidance for the third-quarter may be just the start of things to come.”

Post-Mortem Review of Datadog’s Q2 FY ‘22 Earnings and 2H FY ‘22 Forecast

Let us table the company’s tepid 2H FY ‘22 forecast for a moment and briefly review Q2 FY ‘22 results – which contained a number of financial and business highlights.

-

Net revenue of $406.1M and $769.2M recorded for Q2 FY ‘22 and 1H FY ‘22 respectively. Revenues were $233.5M and $432.1M in Q1 FY ‘21 and 1H FY ‘22 respectively, representing 74% and 78% growth versus the prior periods.

-

Improvement in GAAP year-over-year (“YoY”) operating loss which stood at ($3.1)M during the quarter versus ($9.9)M in Q2 FY ‘21. While DDOG’s GAAP operating loss improved when compared to the prior period, particularly noting the firm realized a loss of less than ($0.01) per dollar of sales during the quarter versus a loss ($0.04) per dollar of sales in Q2 FY ‘21, we should keep in mind the loss comes against GAAP operating income of $8.5M in Q1 FY ‘21 and $10.4M in Q1 FY ‘22.

-

Non-GAAP operating income and operating margin of $84.7 million and 21% respectively. Non-GAAP operating margin, which largely excludes stock-based compensation expense, has been trending higher since FY’ 20, with the firm recording non-GAAP operating margin of 11% for that annual fiscal period.

-

Operating cash flow and free cash flow of $73M and $60.2M respectively during the quarter. Operating cash flow and free cash flow stood at $51.7M and $42.3M, respectively, for Q2 FY ‘21.

-

Cash, cash equivalents, restricted cash, and marketable securities of $1.7B as of June 30, 2022. For comparison, total debt was ~$800M at the end of the quarter.

-

21,200 total customers at the end of Q2 FY ‘22. The total customer base grew by ~29% versus the prior period’s total customer count of 16,400.

-

2,420 customers with annual recurring revenue (“ARR”) of $100K or more, generating 85% of the company’s total ARR . When I first wrote about the company back in late 2019, this metric stood at 590 customers, thus reflecting a to-date ~300% gain in this important customer category.

-

Net retention rate during the quarter above 130%. Management noted during the earnings call that the net retention rate has remained above 130% for 20 consecutive quarters.

Superficially, Q2 FY ‘22 results seem to suggest DDOG will continue to perform well; although, as already mentioned, it is management’s outlook for the remainder of the year that has some investors and analysts alike “spooked”:

-

Q3 FY ‘22 revenue between $410M and $414M. With respect to Q3 FY ‘21 revenue of $270.5M, this range would reflect sales growth between ~52% and 53% for the coming quarter versus the prior period. For reference, revenues grew by ~75% in Q3 FY ‘21 versus Q3 FY ‘20.

-

Q3 non-GAAP operating income between $51M and $55M. Non-GAAP operating income in Q3 FY ‘21 was ~$44M. Thus, this forecast would reflect an increase of ~16% to 25%. Q3 FY ‘21 non-GAAP operating income increased 219% versus Q3 FY ‘20.

-

Q3 non-GAAP net income per share between $0.15 and $0.17. Net income per share estimates assume approximately 347M weighted average diluted shares outstanding.

-

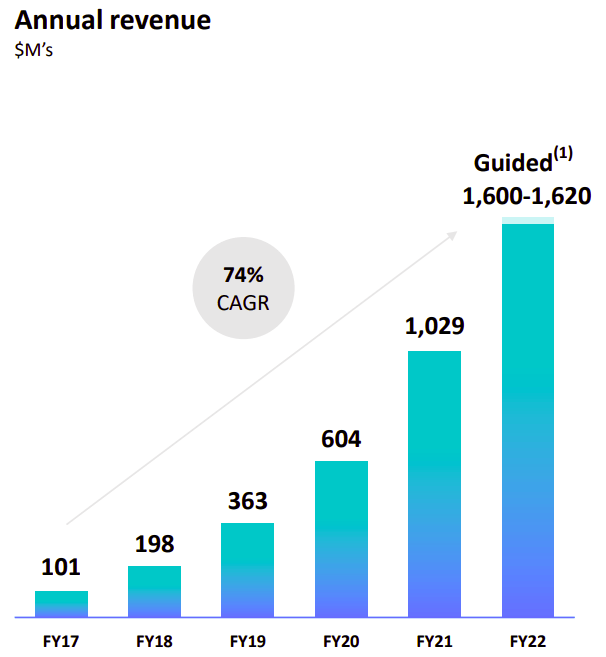

FY ‘22 revenue between $1.61B and $1.63B. Management’s full-year forecast suggests full-year sales growth in the range of ~56% to 58% with consideration of FY ‘21 revenue of ~$1.03B, and maintains the firm’s strong upward trajectory on its top-line.

Figure 3: DDOG Annual Revenue Data FY ‘17 – FY ‘22(e) (Datadog Investor Presentation)

-

FY ‘22 non-GAAP operating income between $255M and $275M. Non-GAAP operating income in FY ’21 was $165M.

-

FY ‘22 non-GAAP net income per share between $0.74 and $0.81. Non-GAAP net income per share was $0.48 in FY ‘21 and FY ‘22 net income per share estimates assume approximately 347M weighted average diluted shares outstanding.

Clearly, the forecast for the remainder of the fiscal year suggests a looming slowdown in the business. Yet, is it possible that some investors and analysts are over-reacting to management’s outlook?

Execution, Resilience and Conservatism

One certainly can’t ignore what DDOG management had to say on today’s earnings call. However, I offer 3 bullish arguments in support of continued strength in the company, and ultimately the stock.

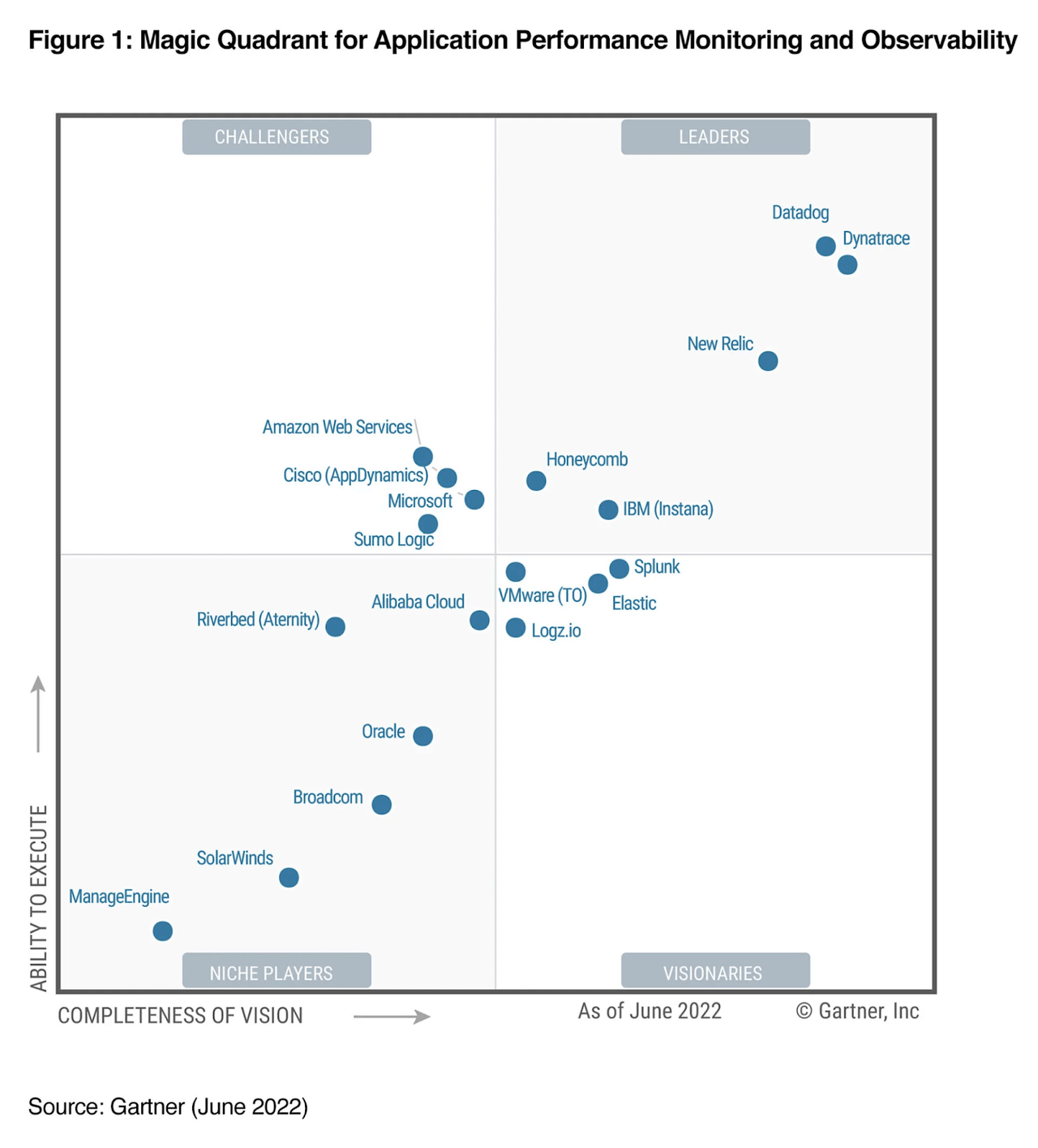

1. Datadog’s position at the top of the (crowded) application performance monitoring (“APM”) space suggests management is “firing on all cylinders”. As I imagine most DDOG investors already know, the company’s product suite has been and continues to be recognized as a leading offering within the APM market. In fact, as seen in Gartner’s Magic Quadrant for Application Performance Monitoring and Observability below, only Dynatrace (DT) is identified as being in the same “league” as Datadog.

Figure 4: Gartner Magic Quadrant for Application Performance Monitoring and Observability (Gartner)

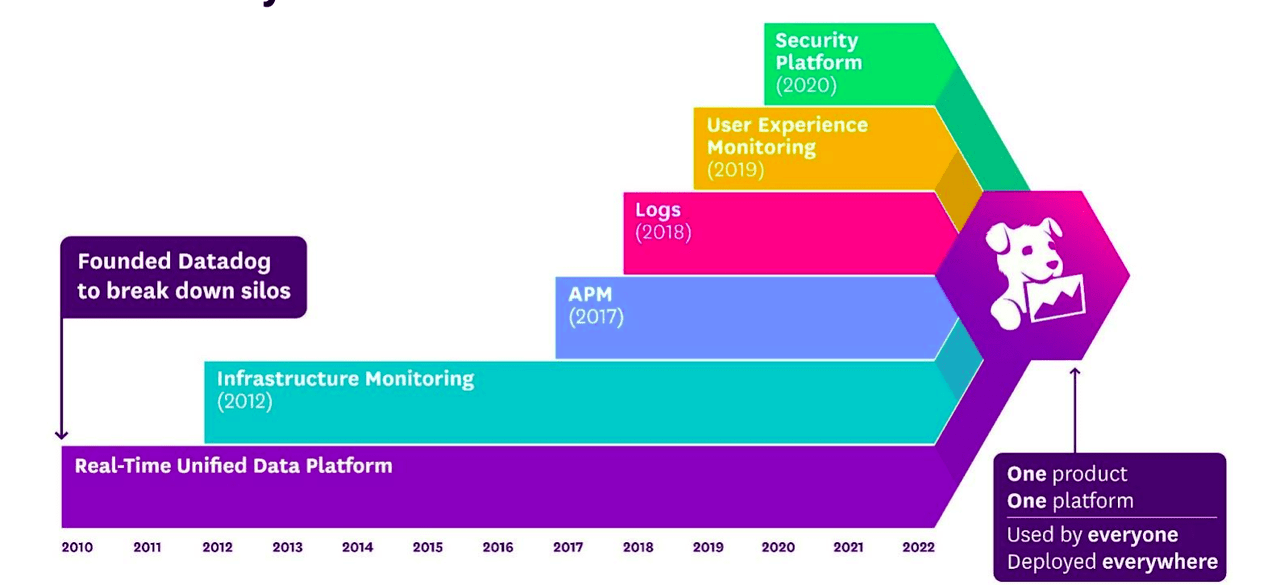

This is a remarkable feat considering that DDOG, with its founding in 2010, is still relatively young and has managed to “blow the doors off” legacy providers in the IT operations management space like IBM (IBM) and SolarWinds (SWI). Even DT is older, having been founded in 2005. This, of course, is suggestive of a strong management team that is executing extremely well.

2. Datadog’s market opportunity could be somewhat insulated from deteriorating macroeconomic conditions. As noted in the introduction, at least one analyst speculates that DDOG’s cagey 2H FY ‘22 forecast “…may be just the start of things to come”, implying that deteriorating macroeconomic conditions may drag on the business heading into FY ‘23. Of course, few, if any, firms are wholly immune from economic downturns. However, while organizations may seek to reduce their spend on new application development under such conditions, they may – paradoxically – increase their spend on their existing applications as they seek to build out new functionalities that improve efficiencies and offer new products/services to their internal and/or external customers. As such, while DDOG might see reduced uptake for management and monitoring of new applications/systems, they could nonetheless recognize increased usage with existing systems and new projects associated with those systems. Moreover, the architecture of modern applications is radically different from even just 10 years ago – they are far more complex with many “moving parts” that may reside in one or more clouds, and/or in on-premise environments. DDOG was purposefully designed from the start for this “new” complexity, which helps explain the firm’s leading position over legacy players. Thus, even if an economic downturn were to result in a dearth of new application opportunities, the modernization of existing applications may provide DDOG with plenty of fertile ground from which to grow the business while the macroeconomic picture remains bleak. This is to say, the company could act as a harbor of safety in an otherwise turbulent market.

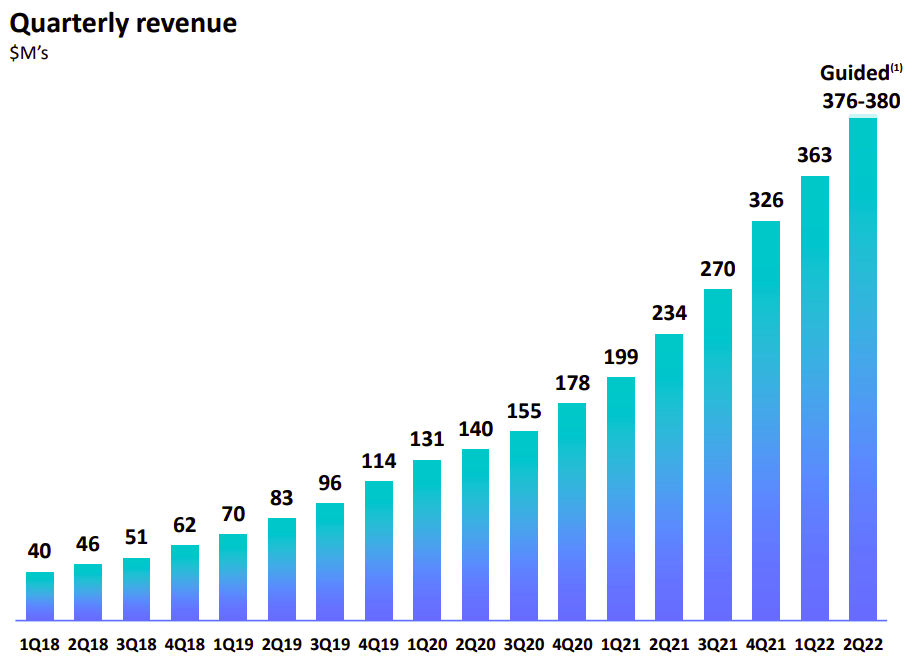

3. Management tends to be conservative with their guidance. Management’s guide in May for Q2 FY ‘22 was $376M – $380M.

Figure 5: DDOG Quarterly Revenue Data and Q2 FY ’22 Forecast (Datadog Investor Presentation)

They obviously beat the high-end of their own May estimate, as noted in the previous section. Further, referencing Figure 3, management is already guiding slightly above their May FY ‘22 forecast – albeit not by much. The point, however, is that DDOG management tends to be conservative with their outlook, but has a history of surprises on the top and bottom lines.

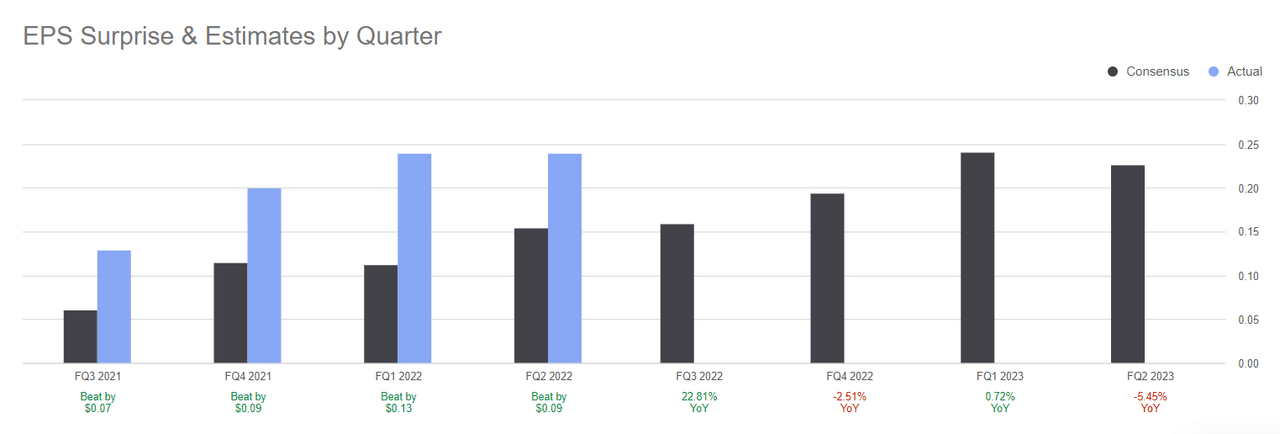

Figure 6: DDOG EPS Surprises (Seeking Alpha)

That being said, the tone of today’s earnings call was noted to be “darker”. Therefore, investors should certainly heed the cautious perspective presented by management. But, it is still worthwhile to note their past “leanings” toward offering the market more conservative forecasts.

And the Bearish Side of Things

Of course, I would be remiss not to present counter-arguments against an investment in DDOG, particularly for those investors eying the stock from the sidelines.

1. The application performance monitoring space is already very crowded, and “point” players may drive increasing price pressure on DDOG. Gartner’s Magic Quadrant in Figure 4 captures the “heavyweights” in the APM and observability space, but hardly reflects the myriad of smaller, “point-product” players. Datadog, for one, has been on an acquisition spree lately – most recently purchasing API management tool Seekret – snatching up point-solutions to address gaps in their own portfolio and build out their overall offering. To reiterate an earlier point, the company has done an amazing job in a relatively short amount of time to “outpace the pack”. However, we should note that a part of Datadog’s value proposition is the comprehensiveness of its monitoring suite.

Figure 7: DDOG Main Portfolio Offerings (Datadog Investor Presentation)

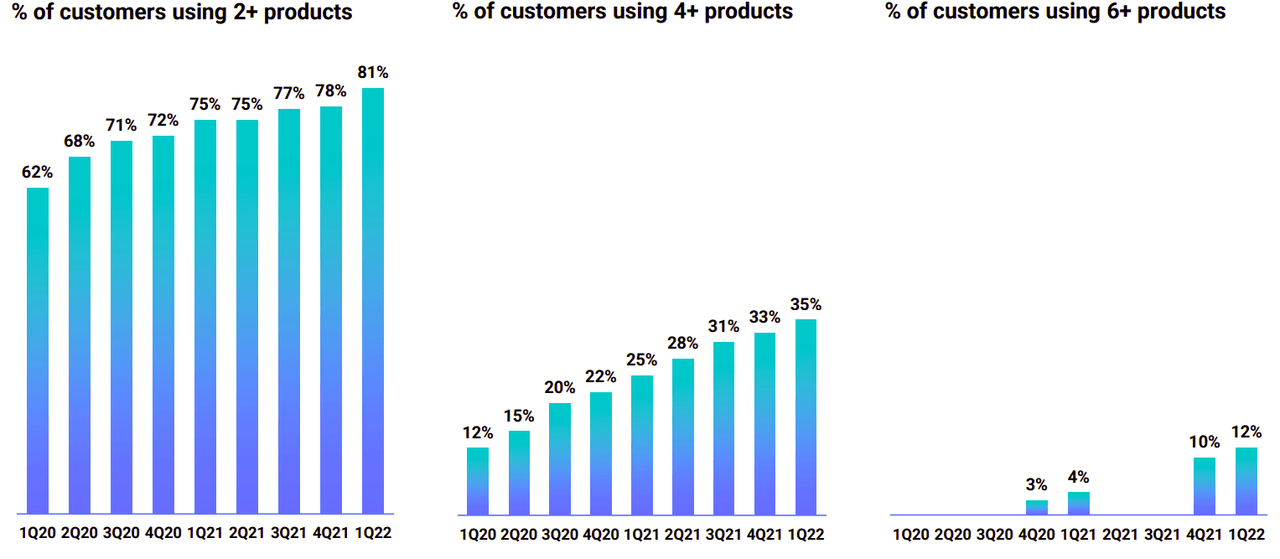

The fact that a large organization can deploy Datadog across its entire organization is why DDOG enjoyed 216 customers at the end of FY ‘21 with an ARR of $1M+. However, most DDOG customers do not use Datadog as an enterprise solution; but rather they use components of the portfolio as point solutions.

Figure 8: DDOG Percentage of Customers by Number of Products (Datadog Investor Presentation)

Certainly, there is nothing wrong with customers only using one or two DDOG products, as opposed to standardizing on its portfolio. In fact, a core element of Datadog’s strategy is to “land and expand”: penetrate an account with one or perhaps two products and grow the implementation from there. The problem, particularly within a lousy macroeconomic environment and particularly with customers who have not standardized on Datadog, is that they may look to cheaper alternatives. Indeed, open source solutions may pose an increasing threat to Datadog against the backdrop of a deteriorating economy. This may force the company to offer discounts to maintain its customer base, but with obvious risk to its gross retention rate, which has historically been in the mid-to-high 90s. Although, cheap or even free solutions can come with their own “hidden” costs with Datadog CEO Olivier Pomel noting during today’s earnings call, specifically with respect to open-source technologies, that “…free is actually the most expensive [solution] typically because you have to build it yourself.” Moreover, poor economic conditions may actually incentivize larger customers to consolidate their tooling. Accordingly, such a scenario might actually result in more standardization opportunities for DDOG.

2. An over-reliance on inorganic growth could inhibit growth of the overall business by spreading resources “too thin”. As mentioned, Datadog has acquired a number of companies recently, including Seekret, Hdiv Security, and CoScreen. Each of these solutions enhances the firm’s overall portfolio and thus makes the “sum of the parts” stronger. DDOG will expectedly make more acquisitions in the future to expand its offerings. In fact, they have to. Application architectures – as well as operating environments – continue to evolve, driving new monitoring, management, and security requirements. Yet, investors should be wary of an over-reliance on inorganic growth as such purchases must naturally divert capital and resources away from existing functions, such as sales and R&D. Obviously, if organizations are tasked to “do more with less”, they may – in fact – wind up doing less.

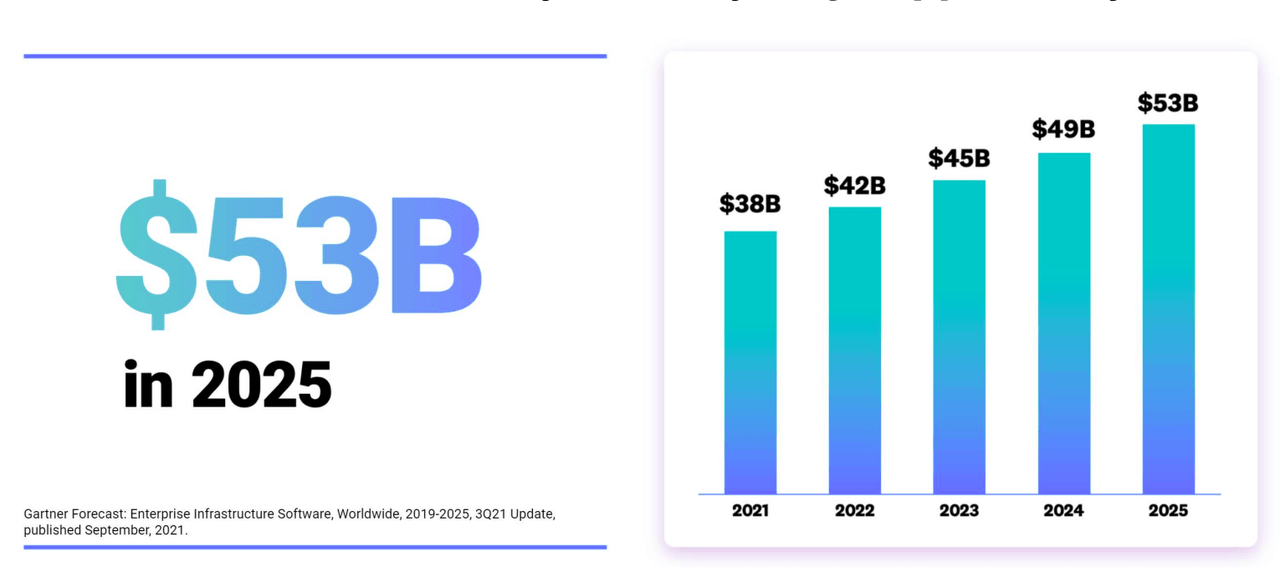

3. By any traditional measure Datadog is wildly expensive. I am, of course, not telling investors something they don’t already know with this point. Using data from Yahoo Finance, DDOG presently has an EV/S ratio of 24.55 versus 11.44 for DT, the latter itself a pricey stock. Indeed, DDOG’s current market capitalization of ~$35B is more than 80% of their suggested TAM opportunity in 2022.

Figure 9: DDOG Total Addressable Market (Datadog Investor Presentation)

Next Move

I proposed DDOG as a speculative buy in my last article on the firm. With hindsight being 20/20, buying the stock at those levels in the low $30s was, in retrospect, a “no-brainer”.

But, revisiting my comment from the introduction that some long DDOG investors seem puzzled with respect to their “next move” given the cautious outlook for the remainder of the year, I would note that since I began writing this analysis, DDOG stock recovered much of its loss following the Q2 FY ‘22 earnings announcement, closing today at $110.49. On that point, I surmise the bullish leanings of investors may include some conclusions that are similar to those points outlined in the third section of the analysis:

- Management has done, and presumably will continue to do, an excellent job in terms of execution.

- While not immune from a downturn, Datadog may be able to continue to demonstrate strong growth within a poor macroeconomic environment.

- Management may be “…embedding a more conservative view [into] the back half”.

With these 3 general ideas in mind, I lean toward a hold recommendation on DDOG. Broadly, I think the raw mechanics of the company, coupled with market enthusiasm for the stock, is likely to continue to drive the price higher through the end of the year. And, bear in mind, Q4 is often the strongest quarter for enterprise software companies. So, it wouldn’t surprise me if the stock rallies heading into FY ‘23.

Yet, DDOG must necessarily be viewed as speculative. As I have worked in the APM space, I find it difficult to imagine a scenario where APM spending “falls off a cliff” because these technologies are ever more vital in modern computing environments. While TAM figures tend to be a lot of “hot air” in my opinion, DDOG’s TAM estimates in Figure 9 may prove to be spot on. But, with a number of smaller and larger competitive players in the space pressuring deal sizes and stealing/capturing market share, the future dynamics of DDOG’s business will always remain uncertain, especially as Olivier Pomel noted today that “[customer standardization on Datadog is] still not the majority of what we do.”

Still, I remain bullish about the firm’s long-term prospects; although I don’t think shares at their current levels present new buyers with any kind of grand bargain. Investors looking at initiating a new position in the APM market might consider investigating DT as an alternative to DDOG. That firm is also no bargain, but at least offers a lower EV/S ratio as discussed earlier and is an APM market leader with similar capability and “stature” to DDOG as per Figure 4.

Be the first to comment