Nastco/iStock via Getty Images

Investment Thesis

Datadog (NASDAQ:DDOG) has largely been spared the worst of this tech bear market. And for good reasons too, after all, the pockets of this market that got hit first were consumer-discretionary facing businesses.

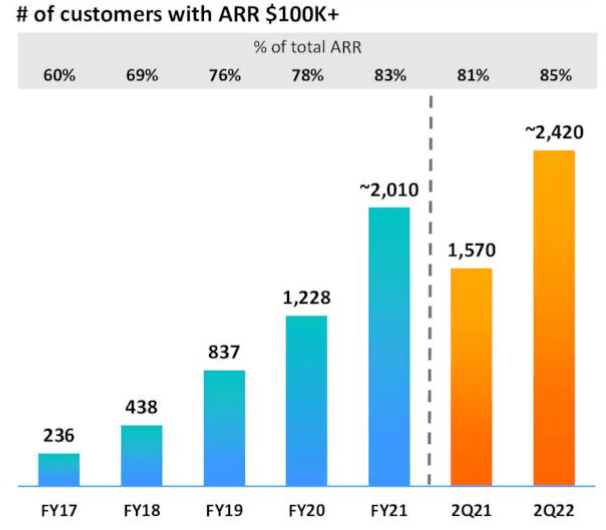

And as you can see in the table that follows, Datadog’s customers are anything but small businesses.

DDOG investor presentation Q2 2022

As you can see above, large business spending more than $100K in ARR make up 85% of Datadog’s total ARR. This means that Datadog has reasons to have stood strong in this bull market.

And while this still holds true, looking ahead, I’m starting to have my doubts about whether paying up 12x next year’s revenues is all that compelling. This is an update from my previous bullish stance.

And before we go any further, let’s be honest, I know the mantra well, that if you buy an amazing business there’s nearly no valuation that’s too high, that it’s better to pay a fair price for a great business.

And while I continue to find plenty of great reasons to be bullish on Datadog, a part of me today starts to be increasingly mindful of TIAA (There is an Alternative).

I highlight both positive and negative considerations that investors should think about, but ultimately I assert a hold on this stock.

Post-Interest Rates Hikes, A Brave New World

In a world of 0% interest rates, anyone that was not seriously backing high-growth names was onto a losing strategy. After all, we were in a period marked by TINA (There is no Alternative).

Right now, after Fed has raised rates at breakneck speed, for the first time in more than a decade investors have a real chance of reaching for TIAA (There is an Alternative).

And while investors understand these implications in practical terms, I don’t believe that investors are seriously thinking through how this different setup can affect Datadog’s valuation.

Yet, before we dig into Datadog’s valuation, I want to spend a moment adding a little more context to my analysis.

Datadog the Next Salesforce?

Salesforce (CRM) was the first OG when it came to selling the SAAS business model. And I know that Datadog and Salesforce are totally different businesses.

One allows businesses to connect with customers. While the other has a broad portfolio of infrastructure product offerings, ranging from observability to cybersecurity, and analytics. But bear with me.

Allow me to bring you up to date with Salesforce. Without getting too academic, I believe that investors can generally agree that Salesforce pioneered the SaaS business model at scale. And that for all intents and purposes, it’s a huge success.

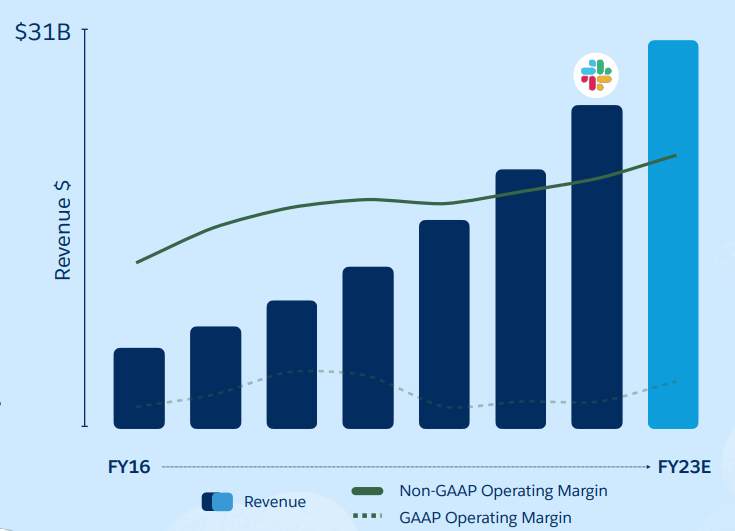

What’s more, unlike countless other SaaS companies, it showed investors that it could be GAAP profitable and has guided for greater GAAP profitability over the next 3 years:

Salesforce Investor Day

And while Datadog is clearly much ahead of Salesforce in terms of reaching GAAP profitability on the back of its own prospects, we have to come back to the core of the argument, could Datadog become the next Salesforce?

DDOG Stock Valuation – 12x Sales

There are two headwinds that I believe investors should consider when it comes to Datadog’s valuation.

The impact of what SaaS stocks will ultimately go for as they approach terminal value. And the impact of interest rates. I’ll take these in turn.

In the first case, keep in mind that looking out to next year, Salesforce is priced at 4x next year’s revenues. Yes, I understand that Salesforce is now barely growing at 18% CAGR.

And even though Datadog is growing significantly faster, perhaps as much at +40% CAGR, its valuation is around 12x forward sales.

And that in time, Datadog will also end up being priced at 4x to 5x sales.

The other aspect to consider, as discussed already, is that paying 12x forward sales when there was no alternative for investors, is not the same as paying 12x sales when investors can get US 2-year government bonds with a +4% coupon.

Those bonds are virtually guaranteed to get investors’ money back. And 4% per year over the next two years isn’t such a terrible proposition in the current state of affairs.

Limitation to This Thought

The counter-argument to this line of thinking is that Salesforce has been incredibly acquisitive from the beginning. In fact, it sought to acquire customers inorganically as much as organically. Something that investors have frowned upon for some time now.

While for its part, Datadog has not embarked on any needle-moving acquisitions. Yes, there have been some minor bolt-on acquisitions over time, but nothing coming close to Salesforce’s serial acquirer strategy.

The Bottom Line

I believe that investing is all about trying one’s best to get a risk-reward balance where the outcome is generally favorable to the investor. There are always going to be uncertainties and unknowns.

However, as it stands right now, given the remarkably different interest rate environment, it doesn’t make as much sense to underwrite a bullish assessment for Datadog.

There was a time when this stock offered investors an attractive investment opportunity, on the back of TINA. But today there are viable alternatives that offer investors compelling dividends.

And to close one’s eyes and pretend that what’s happening isn’t happening, is akin to ostrich investing.

Be the first to comment