Nigel Harris /iStock Editorial via Getty Images

Introduction

Darktrace (OTCPK:DRKTF) (OTCPK:DRKTY) is a leading cybersecurity company, headquartered in Cambridge, England, that provides artificial intelligence-based solutions to protect enterprises.

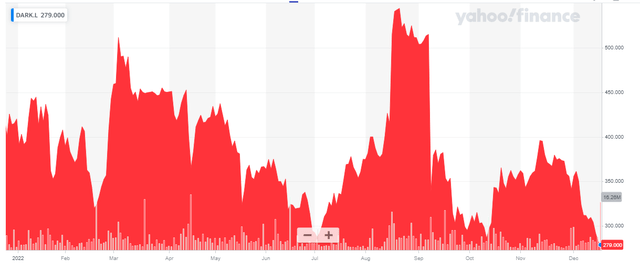

Yahoo Finance

Founded in 2013 and listed on the London Stock Exchange (LSE) with DARK as its ticker symbol as part of the FTSE 250, Darktrace has a strong track record of developing innovative products and services. We suggest trading Darktrace on the LSE because it has the most liquidity, with an average daily volume of 3.2 million shares. There are currently 702M shares outstanding, giving Darktrace a market capitalisation of just over 2B GBP which equals just over 2.4B USD. As Darktrace reports its financial results in US Dollars, I will use the USD as base currency throughout this article.

Unfortunately Darktrace’s website mainly contains download-only links, but you will be able to find all relevant information and financial documentation on this link.

What does Darktrace do?

In particular, the company is known for its AI-powered cybersecurity platform, which helps enterprises defend against cyber threats in real-time. In addition to its core cybersecurity offering, Darktrace has also forged strategic partnerships with companies in a variety of industries.

For example, in 2020 the company announced a partnership with the McLaren F1 team to enhance their cyber protection. Not only does this also allow Darktrace to showcase its high profile clients, it also allowed the brand to gain more name recognition.

McLaren Website

These partnerships demonstrate Darktrace’s commitment to staying at the forefront of the cybersecurity industry and positioning itself for long-term growth.

The company’s focus on AI-powered cybersecurity solutions positions it well to benefit from the growing demand for advanced cyber protection, and its partnerships with leading companies in various industries demonstrate its potential for future growth.

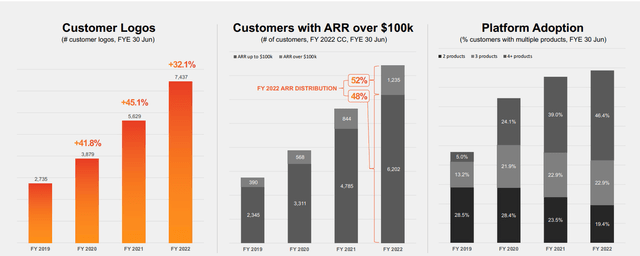

Currently, Darktrace has over 7,700 clients in more than 110 countries.

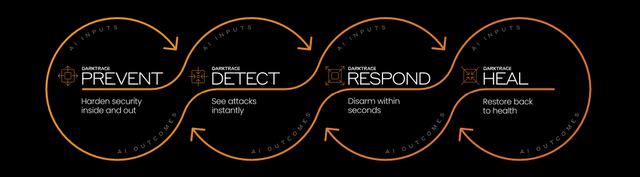

Darktrace’s software model is built around the Cyber AI Loop, a continuous feedback system that uses artificial intelligence to understand and protect an enterprise’s networks and systems. Through the Cyber AI Loop, Darktrace is able to provide a comprehensive and constantly evolving cyber security solution that helps organizations to prevent, detect, respond to, and heal from cyber threats.

The Cyber AI Loop is composed out of 4 pillars:

Darktrace Investor Relations

- Darktrace Prevent is a real-time cyber threat monitoring and mitigation system that uses artificial intelligence to identify and prioritize potential threats, such as malware and phishing attacks. It continuously monitors an organization’s networks and systems for any suspicious activity and provides actionable insights, including the type and criticality of detected risks, to help prioritize and address them.

- Darktrace Detect is a tool that analyzes various metrics to identify deviations from normal behavior that may indicate the presence of a threat. It can identify attacks that might go unnoticed by other security systems. The information gathered by Darktrace Detect serves as the foundation for Darktrace Respond, which is activated when a breach is detected.

- Darktrace Respond is a system that is able to autonomously contain and disarm in-progress attacks across an entire digital estate. It uses self-learning artificial intelligence to identify and stop threats as they occur, and can be customized to meet the specific needs of an organization.

- Darktrace Heal is a tool that restores assets after a cyber attack, without disrupting business operations. It ensures that systems are brought back to an operational state in a seamless and efficient manner.

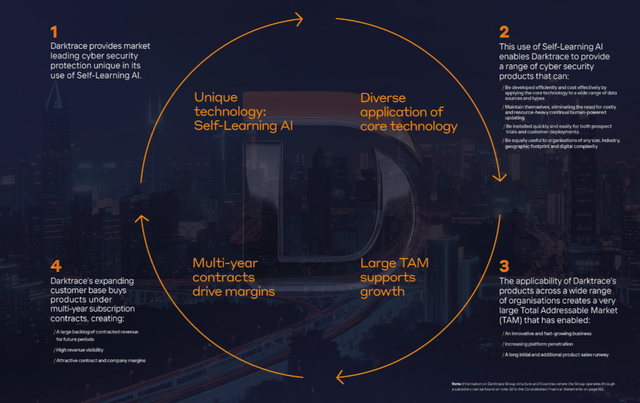

Darktrace Investor Relations

Darktrace has a straightforward business model: it provides a solution to a problem (security) using modern technology (AI). With a wide range of offerings, it has a large total addressable market. It attracts customers by offering multi-year subscription contracts, creating a large backlog of contracted revenue for future periods and high visibility of revenue, as well as attractive margins for the company.

Darktrace Investor Relations

Does this translate into free cash flow?

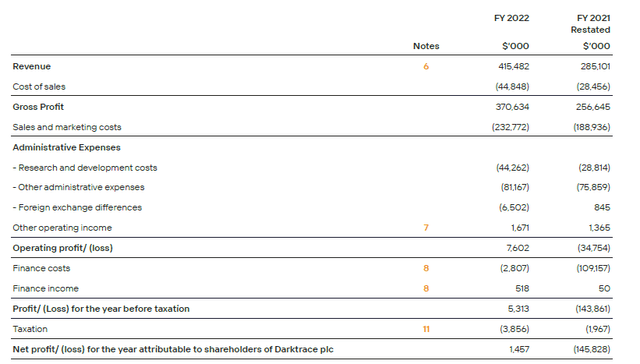

Looking at the company’s income statement, the revenue growth is very impressive: while the revenue came in at $285M in FY 2021, this jumped by almost 50% in FY 2022 to just over $415M. As the underlying cost of sales is virtually nothing, the gross profit came in at $370.6M.

The main operating expense for Darktrace are the sales and marketing costs but the revenue is growing at a much faster pace than the marketing costs, which increased by ‘just’ 25%).

Darktrace Investor Relations

While Darktrace reported an operating loss of almost $35M in FY 2021, it was able to convert this to an operating profit of $7.6M in FY 2022, resulting in a net profit of $1.5M.

While that indeed shows the company is just breaking even, there’s more than meets the eye here. A very large portion of the G&A expenses consists of share-based payments. While that indeed is an expense, it is a non-cash expense and has no impact on Darktrace’s ability to generate cash flows.

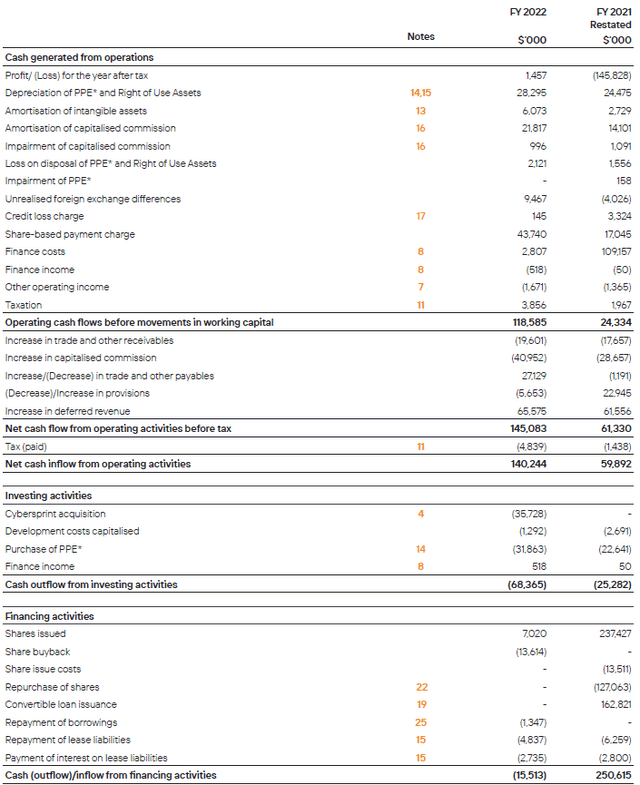

As you can see below, Darktrace reported an operating cash flow of $118.6M before changes in the working capital and before taxes. After deducting the $3.9M in taxes owed and the $7M on lease payments and interest payments on these leases, the adjusted operating cash flow was approximately $108M.

Darktrace Investor Relations

The total capex was $33M, resulting in an adjusted free cash flow result of $75M, clearly an improvement from the negative free cash flow in the previous financial year. The free cash flow per share was approximately 6 pence.

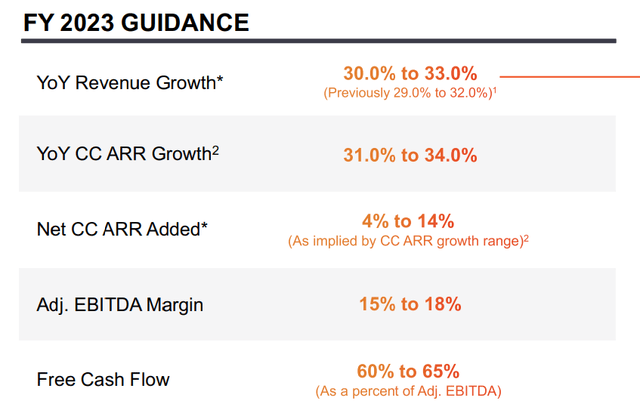

I anticipate another strong result this year. The FY 2023 guidance calls for a 30-33% revenue increase with an adjusted EBITDA margin of 15-18%.

Darktrace Investor Relations

Applying a 31% revenue increase on the $415M FY 2022 revenue would result in an anticipated FY 2023 revenue of $545M. Applying a 15-18% EBITDA margin would result in a $81-$98M adjusted EBITDA. That’s perhaps a bit disappointing considering last year’s adjusted EBITDA was already $91.4M while I am also taking the 60-65% EBITDA conversion rate with a grain of salt, as it includes investments in the working capital.

It looks like 2023 will be a transition year as the average analyst consensus estimates are calling for the EBITDA to almost double from its 2022 performance.

Investment thesis

Although the company is trading at about 22 times its FY 2022 and 2023 EBITDA, I think the company is slowly heading into my ‘buy’ zone. The revenue and EBITDA growth should accelerate from 2024 on and the net cash position (currently estimated at $390M or 46 pence per share) will likely increase on the back of the anticipated free cash flow.

I understand Retirement Pot’s disappointment after a possible bid for the company did not materialize but I think Darktrace is worth an initial look at its current share price. I am considering writing put options and a P250 for February at 22 pence (midpoint between bid and ask) and/or a P200 for January at 13 pence (midpoint) seem to be attractive.

Be the first to comment