JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

Darden Restaurants’ sales have largely recovered to pre-COVID levels. It is facing margin pressure due to high commodity and labor price inflation. However, the company still expects EBITDA margin growth from pre-COVID levels, despite inflation. It is consistently opening new restaurants every year and plans to continue doing so. Finally, the stock looks attractively valued compared to its peers.

Overview

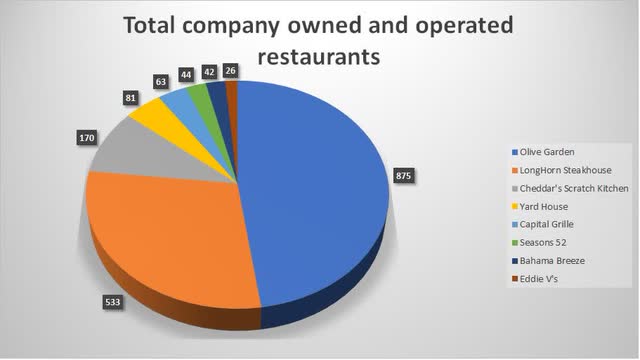

Darden Restaurants (NYSE:DRI) is a full-service restaurant company. It operates through several subsidiaries in the U.S. and Canada. Along with that, it has franchise in the U.S. and Latin America. Roughly 97% of its restaurants are company owned and operated.

The company has four segments:

- Olive Garden

- LongHorn Steakhouse

- Fine Dining (Includes The capital Grille and Eddie V’s)

- Other Business (includes Cheddar’s Scratch Kitchen, Yard House, Bahama Breeze, and Seasons 52 along with franchise operations)

All the subsidiaries have differing entrée price range for dinner and lunch, average check amount per person, and contribution of alcoholic beverages to sales. This can be better seen in the table below. The average check amount per person ranges from $16 for Cheddar’s Scratch Kitchen to $101 for Eddie V’s. Thus, the restaurant caters to various price point customers and has a good variety in the alcoholic beverages’ contribution percentages too.

Financials

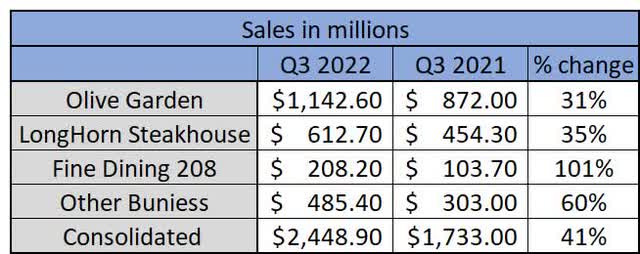

In its fiscal third quarter of 2022, Darden reported:

- Total sales for the quarter of $2.45 billion showing an increase of 41.3%. This was achieved through a blend of same-restaurant sales increase of 38.1% along with addition of 33 net new restaurants.

- Table below shows the segment wise sales along with the Year-on-Year growth.

- Net earnings from continuing operations for the quarter stood at $247 million.

- Digital transactions accounted for 63% of all off-premises sales. This translates into 12% of Darden’s total sales.

Longer-term performance

Over the period 2017- 2021, sales showed a muted growth of just 0.09%. Sales for 2021 stood at $7,196 million as against $7,170 million in 2017. Total operating costs and expenses also showed a flattish growth of just 0.21%. For 2021, the operating expenses and costs were $6,547 million as against $6,492 million in 2017. Operating income for 2021 stood at $648.7 million against $677.5 million in 2017, showing a CAGR fall of 1.08%.

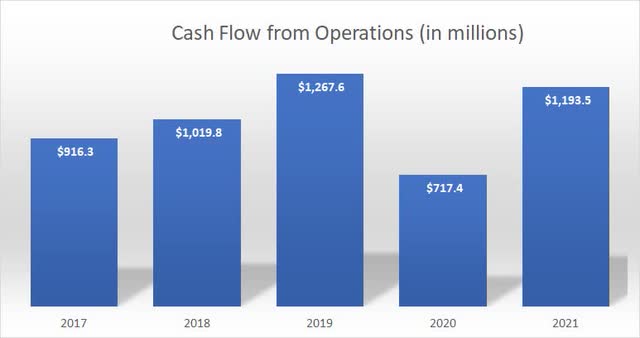

Cash flow from Operations showed an increase of 6.83% CAGR in the period 2017-2021.

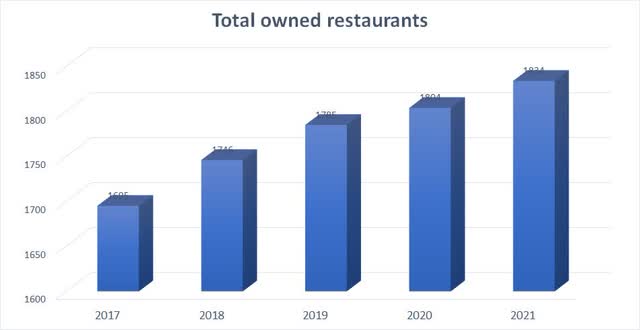

At the same time, company owned and operated restaurants grew from 2017 to 2021.

Sales have recovered to pre-COVID levels

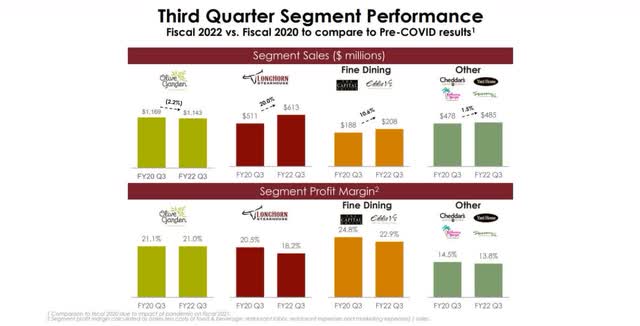

As the below slide shows, Darden Restaurants saw its sales recovering to pre-COVID levels for most of its segment. The profit margins, however, remained stretched, due to higher costs.

Overall, Darden Restaurants is returning to healthy sales growth as customers are coming back to restaurants. Moreover, the company expects 2% growth in EBITDA margin, despite higher inflation.

Guidance

Here is the guidance for fiscal year 2022 and 2023 provided by the management:

- Total sales for 2022 is expected to be in the range of $9.55 billion to $9.62 billion. This will be driven by same-restaurant sales growth of 29% to 30% and approximately 35 new restaurants.

- The management expects inflation for 2022 to be in the range of 6%. Thereby, the management expects pricing to be up by 3% for the full fiscal year of 2022.

- Labor inflation for 2022 is expected to be in the range 6% to 6.5%.

- Effective tax rate for 2022 is expected to be around 13.5 %

- For the fiscal 2022, the company expects a capex of $425 million to build new restaurants, remodel and maintain existing restaurants, and technology initiatives.

As for fiscal 2023, the management has given a preliminary guidance to open 60 new units. They expect the capex for 2023 to be between $500 million to $550 million. Out of this, $300 million to $325 million will go towards new restaurants and the rest will go towards maintenance, refresh, technology, and other.

Risks

Key risks relate to labor and commodity price inflation, as Darden may not be able to pass the higher costs fully to the customers. Notably, total commodity and labor inflation of 6% is higher than management’s assumption of 3% inflation at the start of fiscal 2022. Yet, the company expects full year EBITDA margin growth versus pre-COVID of roughly 200 basis points by increasing pricing 3% for the year. So, this doesn’t look to be a concern as of now.

Valuation

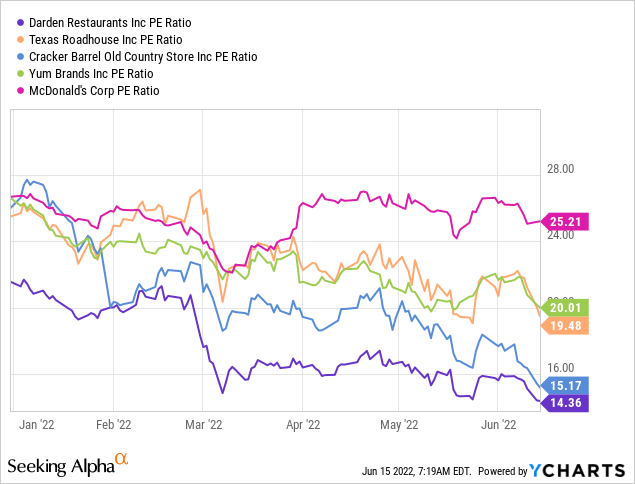

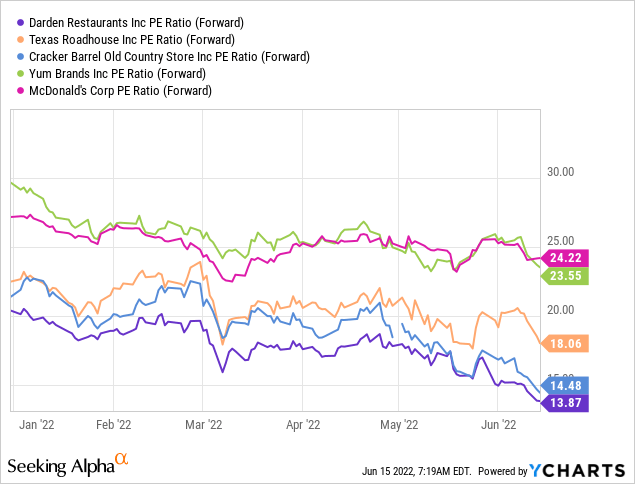

The stock is currently trading at Price to Earnings ratio of 14.4. The stock looks better priced compared to stocks of Texas Roadhouse (TXRH) and Cracker Barrel Old Country Store (CBRL). It also looks better compared to McDonald’s (MCD) and Yum Brands! (YUM).

Based on forward earnings too, the valuation looks better.

Seeking Alpha’s proprietary Quant Ratings rate Darden Restaurants as “Hold.” The stock is rated high on Growth, Profitability, and Momentum factors. However, it is rated low on valuation and revisions factors. Notably, the valuation factor provides grades relative to the broader Consumer Discretionary sector.

Conclusion

The company has good variety in restaurant entrée price points. Thus, it can cater to a large variety of audience. The valuation looks comfortable based on peer group ratios. Darden has shown steady increase in the number of restaurants over the past few years, and it has a healthy pipeline of new restaurants for 2023. Thus, the business looks poised to grow with addition of newer restaurants. Hence, we recommend a Buy.

Be the first to comment