Amax Photo/iStock via Getty Images

Investment Thesis

Buying the shares of Daqo New Energy Corp. (NYSE:DQ) today offers a massive safety of margin because it is trading at a P/E of 2 and has a liquidation value of $30 per share. Many investors in North America are staying away from China-based companies because of the general distrust and delisting risk. However, the fact that Daqo is recognized as a world leader in the production of polysilicon by Western media should make Daqo much more creditable compared to other China-based companies.

Management can eliminate Daqo’s delisting risk by obtaining a secondary listing on the Hong Kong Stock exchange, enabling U.S. investors to exchange their shares for HK shares. For instance, Interactive Broker shows a list of China-based companies in the U.S. that are exchangeable for HK shares. According to the August 2022 Earnings Call, management has already announced that they have consulted with a few investment bankers on listing Daqo’s share on the Hong Kong Stock Exchange. They expect to complete this listing within the next six months.

Daqo has a median P/E of 10 before becoming a global leader in polysilicon production with this reduced delisting risk. We see a lot of similarities between Daqo New Energy in 2022 and Warren Buffet’s purchase of DaeHan Flour Mill in 2005. They are both foreign companies and an industry leader with significant market share. Furthermore, they traded at a low P/E of 2 and have a considerable liquidation value compared to their share price.

Our target price for the shares of Daqo is $260 based on a P/E of 10, offering a quick 250% upside over the next six months. We are happy to find such a great opportunity.

Company Overview

There are many reasons why Daqo is a Chinese company worth buying. First, Daqo has established its leadership in the production of polysilicon over the past ten years. Its leadership role is recognized by various leading solar power media, such as Solar Power World in the U.S. and EQ International in India. This global leadership position is a piece of solid evidence that Daqo is a real operating company in China.

Second, Daqo has rapidly expanded its facilities in Xin Jiang, China, which holds about 50% of the world’s polysilicon resources. In 2022, world polysilicon production is expected to reach 1 million MT, and Daqo is expected to produce 130,000 MT. This computes a global market share of 13%. The demand for polysilicon is much greater than the current world production capacity. As a result, polysilicon prices have increased by more than 200% in 2022 alone. Polysilicon prices are now at $45/Kg compared to $33/Kg in June 2022.

The use of solar energy only accounted for 3% of total energy in the world. As governments around the world take initiatives to rely more on green energy such as solar power, the demand for polysilicon is expected to increase at a rate of 13% over the next ten years.

Third, Daqo’s subsidiary Xin Jiang Daqo is listed on the Shanghai Stock Exchange, allowing Daqo access to cheaper equity because Xing Jiang Daqo is valued at a much higher P/E of 10 in China. Page 39 of the 2021 Annual Report states that U.S Daqo owns around 80% of Xin Jiang Daqo. The current market cap of Xin Jiang Daqo is $113 billion RMB or $16.2 billion. With 80% ownership, Daqo is worth at least $13 billion in market cap, or $170/share. This mispricing exists because Daqo shares in the U.S. are not exchangeable with Shanghai shares. However, Hong Kong shares are convertible with U.S. shares.

Furthermore, Hong Kong Shares are also exchangeable with Shanghai Shares via the Shanghai-Hong Kong stock connect program. As a result, we expect this mispricing to diminish once Daqo obtains its secondary listing in Hong Kong. Daqo’s founder & Chairman, Guangfu Xu, is ranked as one of the top 2000 wealthiest people in the World, and Mr. Xu was elected as a member of the Ninth People’s Congress in China. As stated on page 76 of the 2021 Annual Report, Mr. Xu’s son, Xia Xu, holds around $200 million worth of Daqo’s ADS (American depositary shares, each of which represents five ordinary shares), a strong indication that Mr. Xu and his son are on the same page as investors in the U.S. who are holding Daqo’s ADS. We believe that the management of Daqo would not forsake U.S. ADS shareholders, if they were delisted in the U.S., because they also own a significant amount of ADS.

Financial

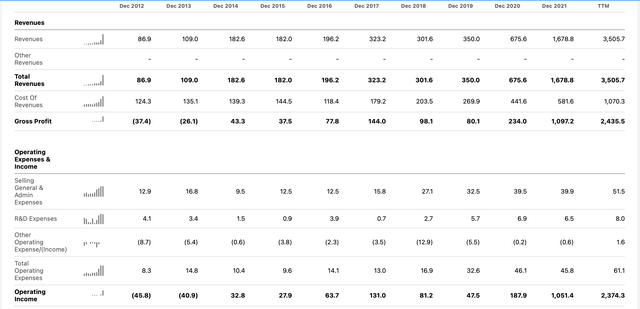

The financials of Daqo would place Daqo as the top 1 percent performer on the growth company’s horizon. Revenue has increased 40-fold over the past ten years, from $87 million in 2012 to $3.5 billion in 2022. Moreover, Net Income increased from a Negative $111 million in 2012 to $1.6 billion in 2022. As stated in the last Earning Call, Daqo’s business is highly profitable and is “one of the sectors with the highest barrier of entry.” As seen in 2022 Q2, The average selling price of polysilicon is about $33/kg, while the average cost of production is around $7.5/kg. A screenshot of Daqo’s finances is provided below.

Daqo’s Ten Years Financials (Seeking Alpha)

During the most recent earnings call, management said it expects to increase production level by 50% per year over the next three years while the cost of production is expected to decrease further from $7.5/Kg. On the other hand, the average selling price of polysilicon is expected to rise further in 2022. Then, it is likely to fall to around $29/Kg in 2023, and management does not expect the price of polysilicon to fall below $17.2/kg. A Pro-forma Income Statement is constructed below reflecting management’s cost and sale price expectations.

| 2021 | 2022 | 2023 | 2024 | |

| PV Sale Price/Kg | $8.98 | $33 | $29 | $17 |

| Total Production in Kg | 75.3 million | 130 million | 195 million | 292 million |

| Cost/Kg | $5.86 | $7.5 | $10* | $10* |

| Gross Profit | $234 million | $3346 million | $3705 million | $2044 million |

| Operating Expenses** | $45.8 million | $71.8 million | $108 million | $162 million |

| Operating Income | $118.2 million | $3274.2 million | $3597 million | $1882 million |

| Tax at 15% *** | $31.05 million | $540.24 million | $594 million | $311 million |

| Net Income | $157 million | $2734 million | $3003 million | $1571 million |

| Non-Controlling Interest at 20%**** | $31 million | $547 million | $601 million | $314 million |

| Net Income attrituble to DQ. US. | $126 million | $2187 million | $2402 million | $1257 million |

(Source: Author’s Work)

* We choose to use $10/kg because this is the highest level of production cost seen in the past five years.

** 2022 Operating expenses are based on operating expenses in the first six months, times two. For the years 2023 and 2024, operating expenses are increasing by 50% to accompany the 50% increase in production.

*** Daqo enjoys a favorable tax rate of 15% from the Chinese Government, as stated on page 20 of the 2021 Annual Report.

**** Non-controlling Interest arises due to the 80% ownership of the primary operating subsidiary Xin Jiang Daqo.

As shown above, Daqo is expected to generate $5.8 billion in Net earnings for U.S. shareholders in the next three years. This is already more than the current market cap of $4.7 billion. Even after the anticipated drop in polysilicon prices from $33/kg to $17/kg in 2024, Daqo would still be able to generate $1.2 billion in Annual Net Income. At the current market cap of $5 billion, we are still looking at a bargain P/E of 4 compared to Daqo’s median P/E of 10 in the past five years.

Valuations

There are many reasons why the shares of Daqo are in bargain territory. Daqo has a total Current Asset of $4.6 billion, a total liability of about $1 billion, and a minority interest of approximately $1.4 billion. This computes a liquidation value per share of $2.2 billion or $29.3 per share. We do not expect the share price of Daqo to drop below this liquidation value.

We could also compute the average earnings in the next three years using the figures we derived from our Pro-forma income statement. The average earnings are expected to be $1.56 billion or $21 per share. With a P/E of 10, this computes to $210/share.

We believe our target price of $210/share in Daqo’s ADS share will be reached once the company is listed on the Hong Kong Stock Exchange. We will discuss this key point regarding HK’s listing in detail below.

Catalysts

Some key events could speed up the pace of Daqo’s share price, reaching our target price of $210. The most likely case we expect is U.S. and China regulators agreeing on the Foreign Company Accountable Act issues. A preliminary agreement has already been reached. In addition, we speculate that a formal agreement will probably have to be reached before October 2022 to give inspectors from the Public Accounting Oversight Board enough time to inspect China-based companies before the deadline in 2023.

If regulators from both sides cannot agree, we believe the management of Daqo will proceed to apply for a secondary or even primary listing in Hong Kong. The requirement for secondary listing set out by the Hong Kong Stock Exchange is to have a minimum market cap of HKD 10 billion or $1.3 billion in USD and to have an Annual Revenue of more than HKD 1 billion or $160 million in USD. Daqo qualifies these criteria by having a market cap of around $5 billion and an annual Revenue of $3.2 billion in the past twelve months. During the last 5 minutes of the August 2022 Earnings Call, the management stated that they had already received a proposal from an investment banker on a primary listing in Hong Kong. They expect to complete their listing in Hong Kong within six months to protect shareholders in the U.S. Moreover, management also mentioned that a Market Cap of $10 billion to $20 billion would be a more fair market value for Daqo. This computes to $130/share to $260/share, which could be used as an estimated value of the IPO price in Hong Kong.

Last, the time to complete a secondary listing is probably much shorter than six months. Using the case of a similar size China-based company NIO Inc. (NIO), this company completed its Hong Kong secondary listing in less than two weeks. Even more impressively, the company is said to have spent less than $10 million to be listed in Hong Kong, allowing U.S. investors to exchange their shares for HK shares. We believe this is a small price to pay for Daqo to protect its shareholders in the U.S., especially when the chairman’s son also holds $200 million worth of ADS in Daqo.

Risks

There is minimal risk in purchasing the share of Daqo at a bargain price of $60 per share. Media around the World have verified Daqo’s absolute leading position as a global polysilicon producer. Furthermore, management can mitigate its delisting risk by obtaining a secondary listing in HK. Moreover, the management is showing great support in protecting U.S. shareholders by holding a sizeable amount of ADS. Last, the net income attributable to U.S Daqo shareholders is expected to be $5 billion in the next three years, which is already more than the current Market Cap.

Conclusion

The current tensions between the U.S. and China and the general distrust in Chinese companies are creating some bargain opportunities among China-based companies listed in the U.S. We believe Daqo is a trustworthy company because of its hard-to-fake leading position in the polysilicon industry, and the management of Daqo holds a sizeable amount of ADS. Moreover, the management has the incentive and is capable of being listed in Hong Kong to protect U.S. shareholders from the risk of delisting. As stated by the management, things will unfold in the next six months regarding the Daqo HK listing. For this reason, we expect the share price of Daqo to reach our target price in the next six months. Furthermore, price arbitrage differences cannot exist when shares are exchangeable from the U.S. to HK. Therefore, our price target of $210 makes the current shares of Daqo an attractive buy.

Be the first to comment