Anatoly Morozov/iStock via Getty Images

This is my third article writing about Daqo New Energy Corp. (NYSE:DQ) in a short time period. Largely due to the fact that the company is highly under-covered and underappreciated. Since positive catalysts are piling up massively, it is time to act now… Currently, Daqo has a weighting of 15% in my portfolio, as I am highly bullish for obvious reasons to me. I will explain everything you need to know in this article. If you have any more questions, do not hesitate to ask me in the comment section below.

Solar and wafer companies need polysilicon

The future of Daqo New Energy is almost set, in view of the fact that all of their polysilicon capacity is getting bought out. In the recent weeks, Daqo signed 5 contracts for 821,100 MT polysilicon, two contracts more than since my latest article.

On the 3rd of November, Daqo announced a fourth deal for a 5-year polysilicon supply agreement with a leading solar manufacturing company. Xinjiang Daqo and Inner Mongolia Daqo will provide the company with a total amount of 57,600 MT high-purity mono-grade polysilicon from 2022 to 2027.

On the 7th of November, the company announced a fifth deal for another 5-year polysilicon deal with a leading solar manufacturing company in China. Xinjiang Daqo and Inner Mongolia Daqo will provide the company with a total amount of 137,000 MT high-purity mono-grade polysilicon from 2022 to 2027. Currently, this is more than the production volume in the full year of 2022.

I have mentioned in my previous article that:

Polysilicon deals are flooding in, which secured almost 5 times production capacity of 2022 for the following years. You can expect more deals to come, as wafer companies are scrambling to find polysilicon.

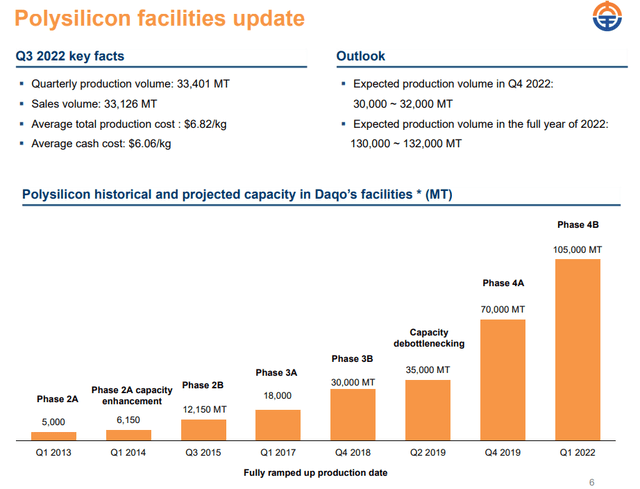

The current expected production volume for the full year of 2022 is between 130,000 – 132,000 MT. That means the company has now secured 6.3 times annual production in deals for the following 5 to 6 years. All of this further emphasizes that polysilicon is in short supply, even going into 2023. In addition, these deals protect the company from overproduction, which some investors might have worried about.

Immense Share Buybacks At An Incredible Price

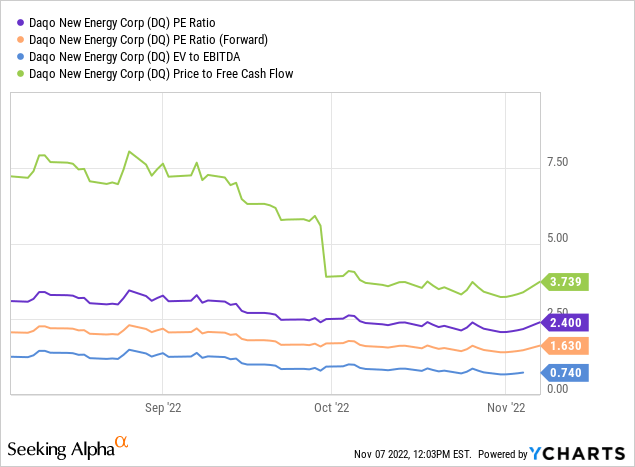

Daqo New Energy Corp. stock is trading extremely cheaply given the fact that we are talking about a company in a growing industry. Therefore, share buybacks have a higher value, better purpose, and are easier to implement than dividends. Additionally, if the company decides to pay out dividends in the future, it will have to burn less cash because there are fewer shares outstanding.

But this share buyback plan is much more special than you see on the surface. Normally, the company was waiting for a buyback announcement till Daqo’s subsidiary Xinjiang Daqo would announce their 2023 dividend. Daqo receives the dividend as a majority owner and redistributes it to U.S. shareholders through dividends or buybacks. Against all odds, Daqo’s board of directors decided to start a new share buyback program earlier, without waiting on the dividend of Xinjiang Daqo. This not only signals that the management team thinks the company is highly undervalued but also indicates that U.S. shareholders are also a priority to get rewarded.

The share repurchase program has a total amount of $700 million, representing an 18.2% of total shares outstanding at a price of $51 per share. Furthermore, this fully covers the share incentive plan which diluted shareholders in Q3. Personally, I think the share incentive plan is great to keep highly talented employees in the company. However, the outside investors should also get rewarded for the performance of the business, which is what the management has decided to do now.

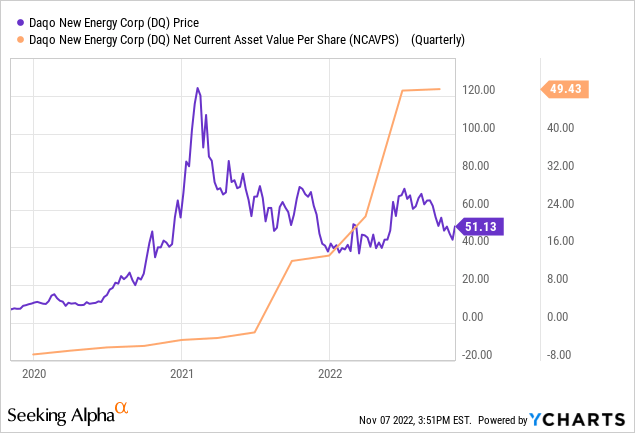

Net-Net Deal

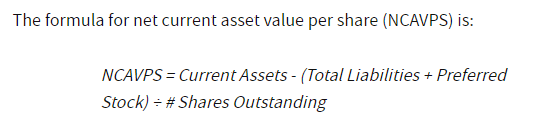

To illustrate how strong Daqo’s balance sheet is, I will perform the net-net formula on the stock. Net-net is a value investing formula developed by Benjamin Graham, in which the company’s market cap is equal to its net current asset value per share. Net-net deals are attractive since the long-term growth potential and any value from long-term assets are not priced in. The market will reassess the business closer to its fair value down the line, and investors can greatly benefit.

Investopedia

The stock is currently trading at $51 a share, while NCAVPS is around 49.43 per share.

China Auditing Risk

Unfortunately, Daqo New Energy has been identified by the SEC under the Holding Foreign Companies Accountable Act. This means the company will be delisted by 2024, if they do not show the right auditing under the rules of the United States. Finally, there has been relieving news that the U.S. and China have finished the on-site inspecting of the auditing papers of the Chinese listed companies on the U.S. exchanges. For now, there has been no information yet, but investors are speculating it will be positive as momentum reverses in Chinese stocks.

Nevertheless, the management team is working on a solution for the delisting risk. They are planning to bring Daqo New Energy to the Hong Kong exchange as a dual listing. This would mean you can convert your U.S. shares to Hong Kong listed shares, if a delisting would ever happen. Another possibility is that you sell your shares and buy them back at the same price at the Hong Kong exchange. Further, this could also bring Chinese investors on board for the cheaper shares compared to the Xinjiang Daqo listing on the Shanghai exchange. Another possible momentum catalyst.

Xinjiang Forced Labor

On top of that, Xinjiang Daqo imports to the U.S. are still banned. The revenue percentage of the United States was pretty low at the time but can impact future relations with companies that do business in the United States.

The company has opened up their factories to the public for inspection. Although, there is no evidence Xinjiang Daqo has used any type of forced labor, the full Xinjiang region is blocked from imports to the U.S. Besides, the Xinjiang forced labor issue is currently not affecting the demand for the firm’s products. The new Inner Mongolia facility might bring back deals with the United States.

For now, these risks will probably explain the reason why the valuation is so low at the moment. Solving these issues might bring more positive momentum to the stock and give the company a more reasonable valuation. Personally, I see these risks as an opportunity to build up a position in one of the polysilicon industry leaders.

Takeaway

I feel like the train is about to leave the station very soon. The $700 million buyback program will give a lot of buying pressure over the following months. As a result, the downwards pressure of shorts should fade away and a new momentum rally should be in place.

In addition, Daqo’s business performance is outstanding, to say the least, and the company has a great leadership position in the industry. Although the stock rallied 10% today, I have added to my position, because $50 per share is far from fair value. China is and will be the polysilicon leader globally for the next 5-10 years. Daqo New Energy will greatly benefit from the solar transition.

At the current stock price, average selling prices of polysilicon do not matter to me, as we are talking about a net-net deal. Daqo New Energy is growing its business and is improving the cash cost efficiency to manufacture polysilicon.

Be the first to comment