Tryaging/iStock via Getty Images

Introduction

I have been covering shipping stocks here on Seeking Alpha for quite some time. In particular, I have written 7 bullish articles on Danaos Corporation (NYSE:DAC), and only 1 on Global Ship Lease, Inc. (NYSE:GSL) – which was also bullish. For both stocks, I could “predict” the local lows in a timely manner, as prices usually rose over the medium term after my articles were published. This is mainly pure luck, although I always try to proceed from a symbiosis of fundamental (micro), macroeconomic and geopolitical analysis. The exception is articles based on technical analysis; however, there are not so many under my authorship.

Today’s article aims to compare 2 companies – DAC and GSL, which I have not done in such a form before. I will comprehensively compare fundamentals, guidance, recent corporate events, and price actions – which when combined should provide a competitive advantage for shipping investors.

Recession or not – the demand side is strong

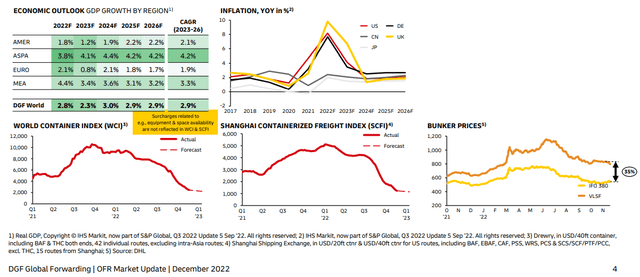

A week ago, DHL released its updated forecast for the ocean freight market in December 2022. One of the largest global logistics companies thinks that the decline in international freight rates is expected to slow and stabilize at current levels in December 2022.

DHL, report as of November 30, 2022

DHL cites the risk of a possible U.S. rail strike, which could occur on December 8 (2 days from now), as the most important event this month, after the tentative agreement negotiated by the Biden administration in September between the rail industry and labor leaders was rejected by several influential unions. In my opinion, this can be a very important catalyst to increase sea freight rates in the medium term, because this is an alternative to the railroad, which will have to be idle for some time.

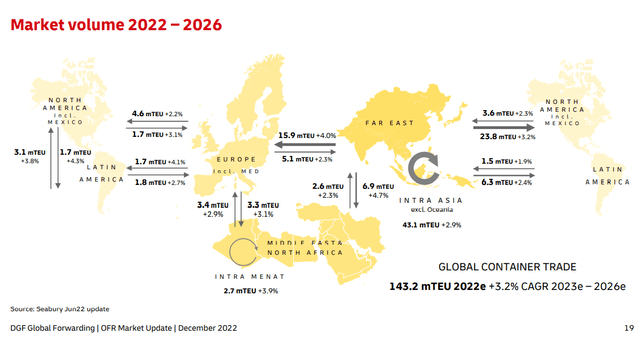

More important than this one catalyst, however, is the future growth of the shipping market. DHL forecasts that global container trade volumes will grow by an average of 3.2% per year from 2023 to 2026, with the largest growth in traffic volumes between Latin and North America and between Latin America and Europe:

DHL, report as of November 30, 2022

These forecasts include a recession in 2023 – the DHL analysts write this without understatement on page 8 of their report. I agree with their forecast – the U.S. unemployment rate is likely to rise from 3.7% in October 2022 to a high of 5.7% by the end of 2023, leading to recession and the risk of stagflation against a backdrop of slowing economic growth and an unresolved inflation problem.

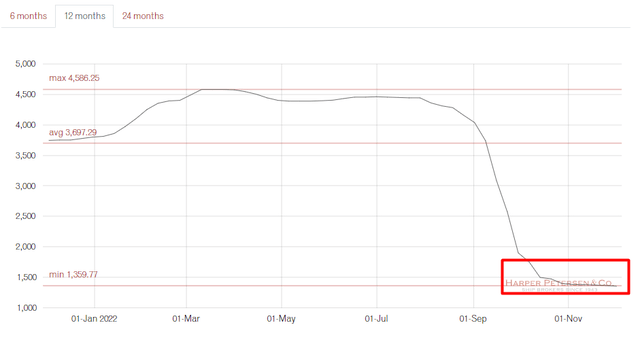

This scenario seems to be reflected in the behavior of shipping rates, which are falling for both liner shipping companies (Drewry Container Index, -70% over the past 6 months) and container ship lessors (HARPEX Index, -69% over the past 6 months).

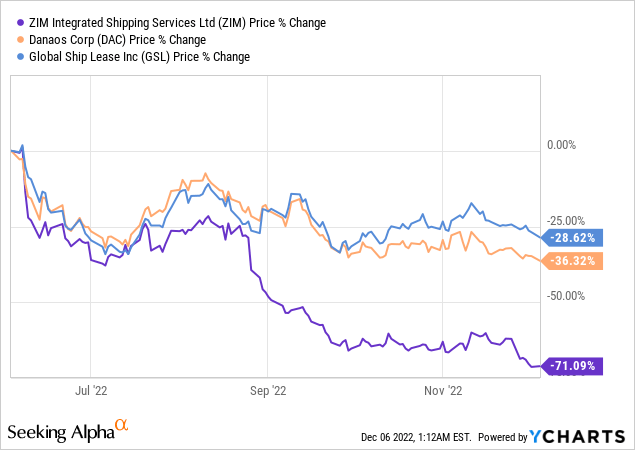

The only difference is that, unlike ZIM Integrated Shipping (ZIM), which feels such fluctuations very much, DAC and GSL are in a kind of “isolation” – they only get money from leasing their ships to companies like ZIM. ZIM and its peers, in turn, “have to pay rent” and hope that their revenues from end customers will be enough to cover those costs. This is why we see the divergence that has arisen between the stocks of GSL, DAC, and ZIM:

My main mistake in evaluating ZIM’s outlook in my many bullish articles was the focus on prospective free cash flows, which was based on my overly positive assumptions that Drewry rates would reverse. This cycle turned out to be shorter than I expected – my last article based on technical analysis was giving about 9% over the first 3 weeks since publication, but eventually became irrelevant (the lesson – it is important to have a trailing stop order).

In the case of DAC and GSL, everything should be different – the specificity of their business model offers protection to investors who are trying to focus on free cash flow. Even allowing for the decline in HARPEX, we see it’s bottoming:

DAC and GSL will likely make less money in the next few years than they did last year, but during their bull cycle they have managed to get a lot of things “entrepreneurially right” which will help them avoid the consequences of the “recessions of previous cycles.” Also, they have already dropped significantly in price over the last few months – so maybe now is a good time to look for value.

Therefore, I propose to focus on backlog, fundamentals, and valuation (and their symbiosis) as the main criteria for selecting the best company from this couple (I mean GSL and DAC).

Choosing between the two

Let us look at how companies look when we compare basic financial and operational indicators:

| Fundamentals | DAC | GSL |

| Market cap | $ 1 088.0 | $ 597.4 |

| Enterprise value | $ 1 378.0 | $ 1 460.0 |

| Revenue, 9M 2022 | $ 787.3 | $ 480.6 |

| EBITDA margin, 9M 2022 | 86.63% | 62.09% |

| Net margin, 9M 2022 | 68.53% | 43.86% |

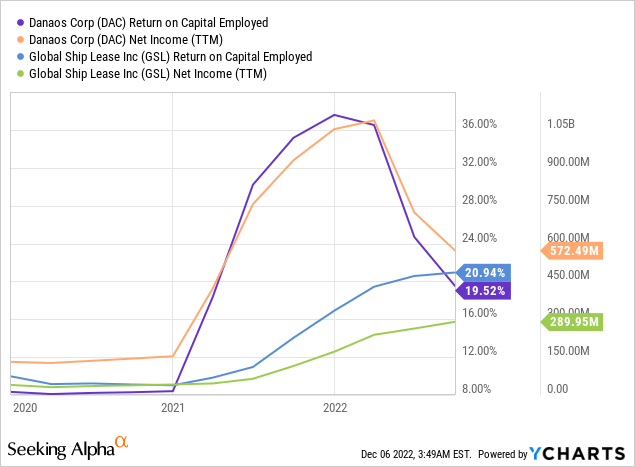

| ROCE, TTM | 19.52% | 20.94% |

| ROIC, TTM | 17.59% | 16.19% |

| Contracted revenue [as of Sep. 30-31, 2022] | $ 2 300.0 | $ 2 230.0 |

| Years of contract revenue, TEU-weighted cover | 3.5 | 2.9 |

| Debt (long+short term + lease obligations) | $ 945.1 | $ 1 176.5 |

| Net debt / EBITDA | 0.5x | 2.0x |

Source: Author’s calculations, based on YCharts and the companies’ IR materials

At first glance, it may seem that DAC is better than GSL in absolutely every way – except profitability. Both companies have amazing returns on capital – over 15%, but GSL easily outperforms DAC in this category and has done so recently. DAC’s net income started to fall sharply, which affected profitability. GSL began to show opposite dynamics in this regard, increasing profitability and absolute net profit:

The relative profitability measures of the two companies are likely to converge in the future. GSL will pay off another $50 million of its debt by the end of this year and has generated $770 million in new contract revenue in the last 9 months. DAC has $49.2 million left to pay in 2022, and it also recently issued a notice of planned repurchase of $37.234 million of its 8.500% unsecured senior notes due 2028. So the process of debt reduction is well underway at both companies.

DAC also has 2 times lower net debt to equity, which will allow it to maintain margins at a higher level than GSL.

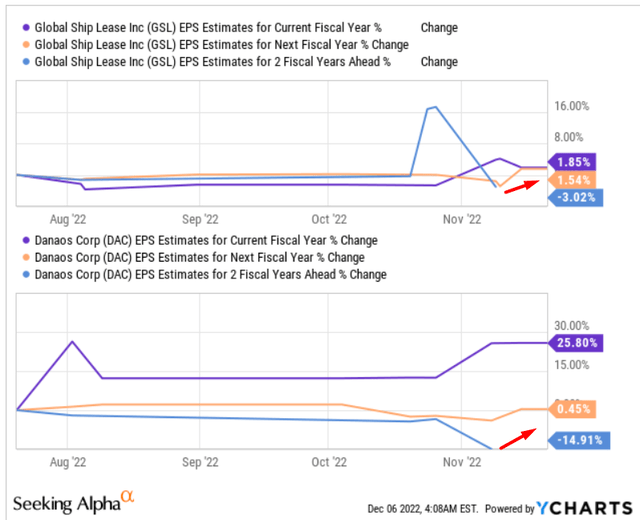

As for market expectations, we can clearly see how the few Wall Street analysts predicting the companies’ EPS numbers have revised their forecasts for this year and next (2022 and 2023) upward, while forecasts for 2024 have so far remained unchanged. I expect that shortly when freight rates stabilize – even with a high probability of recession – these forecasts (for 2024) will also be revised higher (for both DAC and GSL). However, for DAC, this revision is likely to be more dynamic, which will help the stock maintain momentum for recovery.

Overall, both companies continued to add massively to their revenue backlogs in the last quarter, which points to what I wrote above – demand for container ships remains strong, and liner companies are willing to continue paying rates above the historical averages. Therefore, the question of choosing between DAC and GSL boils down to the need to consider valuation multiples and DCF models.

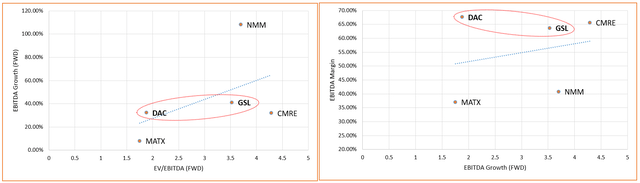

In terms of multiples, DAC looks much more favorable than GSL here if we look at both companies in terms of EV/EBITDA (FWD), EBITDA margin, and EBITDA growth:

Author’s calculations, Seeking Alpha

The reason for this most likely lies exactly in the market expectations – the fact is that the market expects GSL’s EPS to grow by 10.29% (YoY) in 2023, while DAC’s EPS is estimated to be -17.04% lower (also YoY) in the same year.

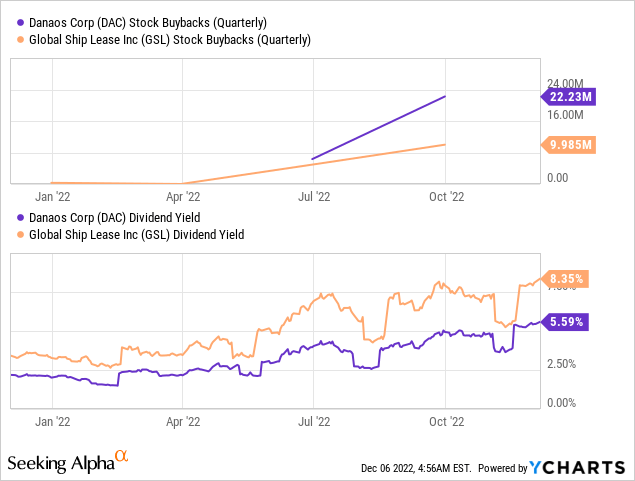

In addition, the market may like GSL more because of its understandable shareholder return policy – unlike DAC, the company buys back its shares more regularly and has a higher dividend yield.

Also, I think DAC shares had a headwind in the form of ZIM shares on the balance sheet – investors looked at ZIM’s decline and understood that DAC’s assets were declining. However, in its latest earnings release, management said it has fully divested its stake in ZIM – now DAC is independent of its market movements. That should play into its hands in the coming months because at some point ZIM will stop paying its generous dividends.

Quick Summary Thesis

The choice is very difficult – I like both companies. However, as I moved from metric to metric, it became increasingly clear to me that the DAC looks too attractive to pass by. I guess that Danaos has been given a discount by Wall Street to GSL and the rest of the market because of its position in ZIM, which no longer exists. In my opinion, upward earnings revisions will continue to rain down on the company. I am overweight Danaos, but think it would be rational to include both companies in a medium-term investment portfolio.

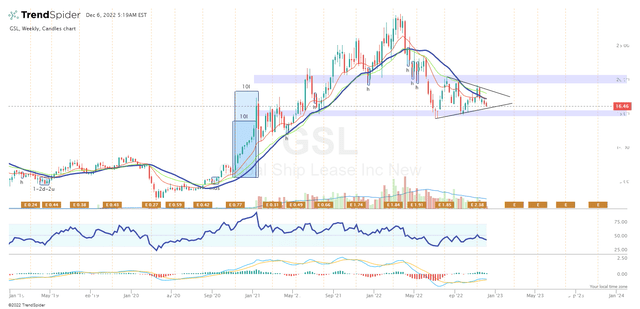

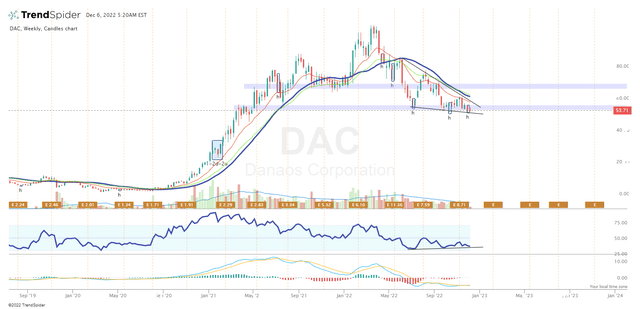

As for the technical picture, I think both stocks have now reached their local lows and are ready for at least a short-term recovery – if my fundamental theses prove true, then the “short term” may well develop into a longer time frame.

GSL stock, TrendSpider Software, author’s notes DAC stock, TrendSpider Software, author’s notes

Be the first to comment