David Taljat/iStock Editorial via Getty Images

Since Our Previous Update…

If you have been an investor in the containership industry, then you know well enough how frustrating these past few months have been. On the one hand, companies in the space continue to report monster earnings, pay growing (and in some cases massive) dividends, and feature fantastic cash flow visibility ahead due to their multi-year charters that ensure their robust performance is not about to fade out anytime soon. On top of that, the underlying market conditions continue to form tailwinds that have sustained rates at record highs, meaning any new vessels coming out of the shipyard are instantly chartered at extremely profitable rates.

On the other hand, the overall sell-off in the market persists, and surprisingly enough, containership stocks have also declined substantially despite their ever-improving prospects.

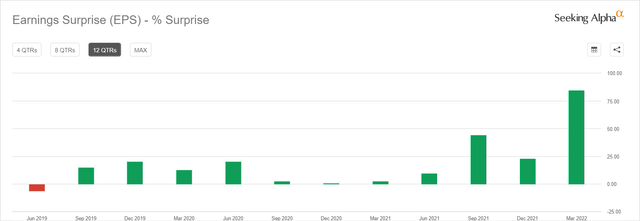

Our two favorite stocks in the space are most likely Danaos Corporation (NYSE:DAC) and ZIM Integrated Shipping Services Ltd. (NYSE:ZIM). In our previous update, we discussed why analysts’ estimates were unrealistically low and how ZIM’s massive upcoming dividend was to have an explosive effect on Danaos’ bottom line. Indeed Danaos recorded (one of) the greatest EPS surprises in years.

Danaos’ eps surprise against estimates (Seeking Alpha)

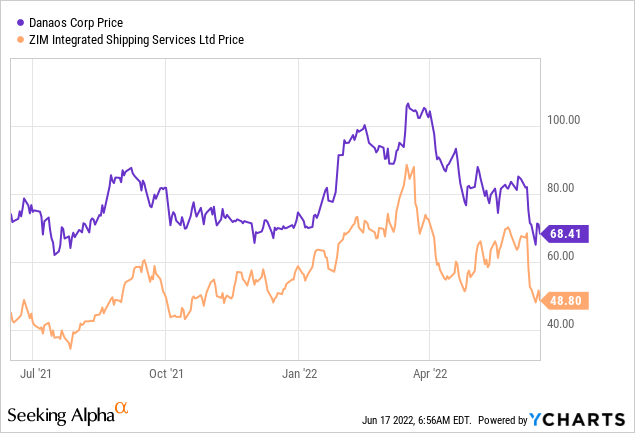

Despite Danaos’ tremendous backlog and improving financial position, as well as TCE rates remaining at record levels which should allow ZIM (which operates mostly on the spot market/shorter-term charters) to keep generating explosive profits, both companies have seen their shares decline substantially. Specifically, Danaos and ZIM trade roughly 37% and 46% lower from their 52-week highs, respectively.

Today we are revisiting Danaos’ investment case. However, besides ZIM’s upcoming dividends again presenting a stimulant to the company’s future profits, Danaos’ investors now celebrate another catalyst to support the stock’s bullish case.

In a 6-K filing that barely made any headlines, Danaos announced that its BoD has now approved a $100 million share repurchase program. Anybody who has dived into Danaos’ investment case knows how undervalued the stock is and how the stock’s performance over the past few months has mismatched the company’s book value and future earnings prospects. We have been waiting for this announcement for quite some time now, with management being rather conservative and prudent over the company’s liquidity and cash availability for future fleet expansion. With shares at such a big discount from their NAV (more on that later), Danaos’ management has likely run out of excuses to give Mr. J Mintzmyer on their next earnings call regarding the absence of a repurchase program. In any case, it’s finally here!

Latest Market Developments

The most probable reason for Danaos’ and ZIM’s share price declines over the past few months is Mr. Market’s lack of understanding when it comes to their future earnings potential. Without a doubt, the containership market can be wildly cyclical. Therefore, it may be that the market fears the present euphoria will sooner than later wear off.

However, we remind that:

- Danaos’ long-term charter contracts ensure that the company will keep generating record cash flows for years ahead, even if rates were to fall in the short term.

- Even if rates were to be halved, both companies (despite the lack of long-term charters in ZIM’s case) would still be cash cows and still undervalued on a medium-term investment basis.

- Regardless, rates have remained at record levels amid ideal market conditions.

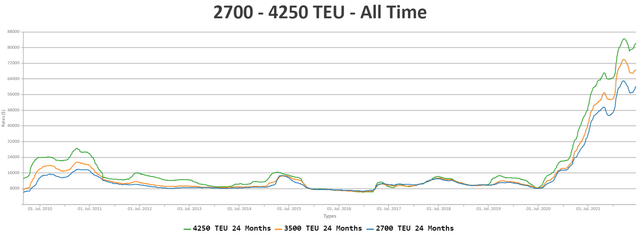

2700 – 2450 TEU rates (vhbs.de)

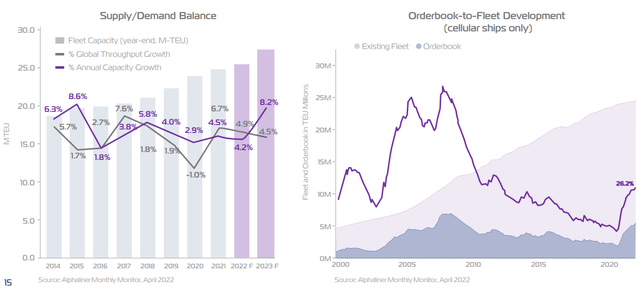

And while supply/demand dynamics are likely to normalize from next year amid a growing order book-to-fleet ratio, supply chain disruptions and pressure to decarbonize are expected to offset new-build deliveries in 2023.

Supply/demand balance (ZIM’s Q1 Presentation)

Recently there have been additional catalysts that support retention of high rates. These include port congestion in Germany due to labor strikes and ILWU’s contract expiring July 5th.

Why Danaos Is poised To Trade At $150 And Beyond

To answer this question, we have to assess two aspects. Firstly, we need to assess what is Danaos’ future earnings potential together with its stake in ZIM. Secondly, we need to assess Danaos’ current valuation based on its current book value and its future earnings potential, combined with the newly announced buybacks. Let’s go!

Danaos’ Fleet Employment

Danaos’ core earnings in the near future are going to be predominantly sourced from its long-term flee employment which provides fantastic cash flow visibility. In Q1 2022, the company reported $229.9 million in operating revenues, 6.9% higher than Q4 2020, as its previous charters rolled over the newer, higher-rate ones. This trend is set to continue.

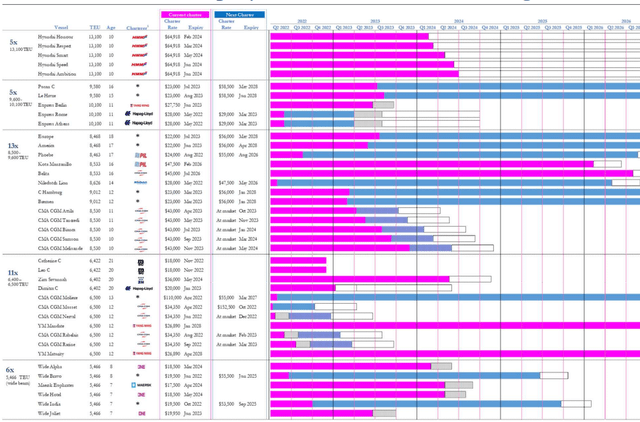

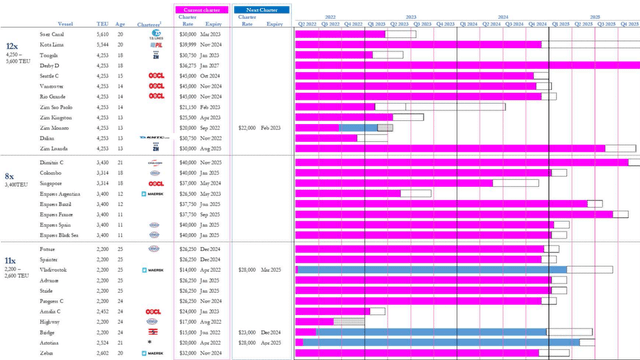

Take Danaos’ 13 8,500-9,600 TEU vessels, for instance (I have trimmed the charts for clarity. They go further out 2026). As you can see, the new charters kicking in Q2, Q3, and 2023 are, on average, around double their current ones.

Danaos’ fleet employment (Q1 Investor Presentation)

This applies to numerous other of Danaos’ vessels. Take, for illustration, the company’s 11 2,300-2,600 TEU vessels. The three new charters kicking in Q2 are at rates that are 100%, 53%, and 40% higher than their previous ones.

Danaos’ fleet employment (Q1 Investor Presentation)

In its latest results, Danaos reported an operating income of $140 million, which excludes changes in the value of the ZIM stake and dividends from ZIM. Based on its fleet’s upcoming employment roll-overs, we can reasonably assume an average operating of at least $155 million in each of the following three quarters. It could be higher based on my napkin math, but we remain prudent. This should translate to an operating income of around (or larger) $605 million for fiscal 2022. Accounting for roughly $65-$70 million in interest and other finance expenses, Danaos fleet employment alone should yield net income close to $540 million, or $26 per share this year.

Earnings From ZIM’s Dividends

In its Q1 report, Danaos shared that subsequent to the quarter-end, they sold 1,500,000 out of their 7,186,950 ZIM shares. Therefore, the company should now be holding 5,686,950 shares.

When asked regarding Danaos’ stake in ZIM in its Q1 earnings call, Mr. John Coustas stated the following:

this is not a long-term holding. But we do not have also any intention to get out of ZIM for the time being. We believe that ZIM in line with all the other liner companies is going to make fantastic results for 2022. And it’s going to deliver a significant dividend like the one that we’ve received this year. So for the time being, we are in a kind of a hold position.

Therefore, it’s fair to assume that Danaos will not be selling any more of its ZIM stake through 2022, especially considering that shares have declined substantially lately (and are quite undervalued, in our view). Mr. Coustas is also right to expect that ZIM will deliver massive dividends within 2022, as was the case with the $110 million the company received in Q1 with respect to ZIM’s Q4 2020 dividend.

For those needing a reminder regarding ZIM’s dividend policy, here it is:

ZIM intends to distribute a quarterly dividend between 30% and 50% of its annual net income to stockholders.

How It Works:

- ZIM’s dividend for each of the first three quarters of the year is going to total roughly 20% of its net income generated in each quarter.

- Each fourth quarter once a year, the company is to distribute a dividend so that the cumulative dividend amount for the year will sum between 30% and 50% of its annual net income.

Delivering on this policy, ZIM paid $17.00 per share last year, representing around 50% of its annual net income.

Analysts expect ZIM to post EPS of around $43.60. However, we once again believe that analysts are behind the curve here, and ZIM should produce EPS north of $55 for the year. But for the sake of this example, let’s agree on $50 to be conservative.

Assuming the company distributes $25 per share (50% of its net income), then Danaos should receive: 5,686,950 shares times $25 times 0.9 (to account for the 10% withholding tax Danaos records through its Singapore SPV) = $128 million in ZIM dividends.

Therefore, Danaos should record roughly $6.20 in net income per share from ZIM’s dividends this year based on these assumptions. Combined with the $26.00 per share we derived earlier from the company’s core fleet employment, Danaos should report EPS north of $32.00 in fiscal 2022, excluding any gains/losses from the movement of ZIM’s stock price.

To once again illustrate analysts being behind the curve here, Danaos’ consensus EPS estimates assume EPS of $23.84 for the year. Now that we have a better idea regarding Danaos’ net income prospects for the year let’s put that into perspective with the stock’s valuation.

The Valuation & Buybacks

First and foremost, with the stock trading close to $69.40, Danaos trades at a P/E of just over 2 based on our EPS estimates. However (and despite the fact that Danaos should enjoy record earnings for the next few years), we know that the P/E ratio is not particularly useful here. After all, based on our estimates for ZIM, the stock is currently trading at a P/E below 1, with the company having a net cash position of $780 million.

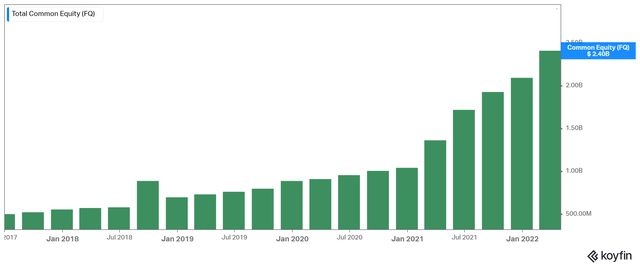

Instead, let’s consider the company’s equity value. Danaos has been generating massive profits lately, and most of it is retained in the balance sheet one way or the other. This means capital is allocated for deleveraging, purchasing additional vessels, etc., with minimal outflows as capital returns. Therefore, the equity value on the balance sheet continues to grow rapidly.

Danaos’ shareholders equity (Koyfin)

Here’s where things get interesting. Danaos featured $2.4 billion worth of equity value as of its latest results. This means that if the company were to sell off its assets, settle all of its liabilities, and distribute the cash to its shareholders, we should receive around $116 per share. The stock is thus trading at around 60% of its NAV. However, this is not entirely accurate. In fact, Danaos vessels should be valued significantly higher than their balance sheet figure since:

- Elevated rates in the market imply vessels are worth more since they can produce higher cash flows.

- Each ship comes with long-term charter contracts attached whose future cash flows are not shown on the balance sheet as an asset.

In that regard, we estimate Danaos’ NAV to be above $150, but there is room for speculation regarding that number, so we will leave it at that.

Now, let’s consider Danaos’ newly announced buybacks. You can already imagine that with the stock trading at such a discount, repurchasing shares here is going to be massively accretive for shareholders. Danaos currently has a market cap of $1.43 billion. With insiders (specifically Mr. Coustas) owning a massive chunk of the stock, only around 55% of shares are public float. Furthermore, just over 10% of Danaos’ float is currently shorted. This means that the company would be buying around 14% of the public float through its $100 million repurchase program at current price levels. The new buying volumes from repurchases alone should boost the stock higher significantly, considering the current trading volumes are relatively thin (around 440K shares/day).

So let’s summarise:

- Danaos is trading at a 40% discount against its NAV (at least)

- NAV is going to increase by roughly 40-50% this year based on prudent earnings projections (excludes outflows on dividends buybacks)

- The company is about to repurchase roughly 14% of its public float

- The dividend yield is not substantial at 4.2%, but DPS could easily grow 50%+ this year (payout ratio is below 10% of projected earnings)

By next year, we project Danaos’ NAV/share should exceed $150 this year (without any adjustments amid the value of their contracts). This figure could be higher based on how accretive the upcoming buybacks will be (i.e., by how much of a discount Danaos will be repurchasing its shares at).

Now there is an important note to make regarding NAV. Danaos’ equity/NAV value includes the stake in ZIM, whose stock price on March 31st (quarter end) was close to $72. However, the stock is currently trading at $49.60, and our above points imply a constant NAV from ZIM. Still, it’s fair to assume that by next year ZIM will be trading at least close to $72. Again, we remind its P/E is below 1 and has net leverage of 0.

Conclusion

Based on the sum of our points, we believe that Danaos can easily support a price close to $150/share by next year. And yet, shares would not trade at a premium to NAV at that price.

While Danaos’ performance (along with most stocks in the space) has been underwhelming lately, the company’s fundamentals & earnings/capital return prospects are the brightest they have ever been. At this point, the journey upward appears to be a waiting game, so patience is our best friend here.

Be the first to comment