Brett_Hondow

The Underfollowed Leader of HVAC

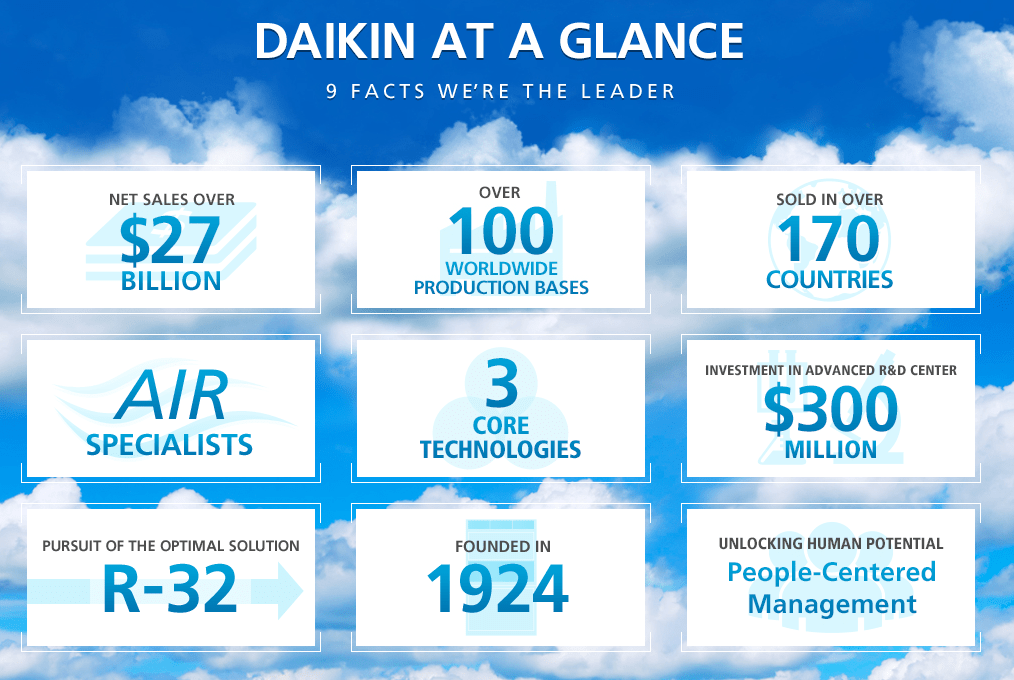

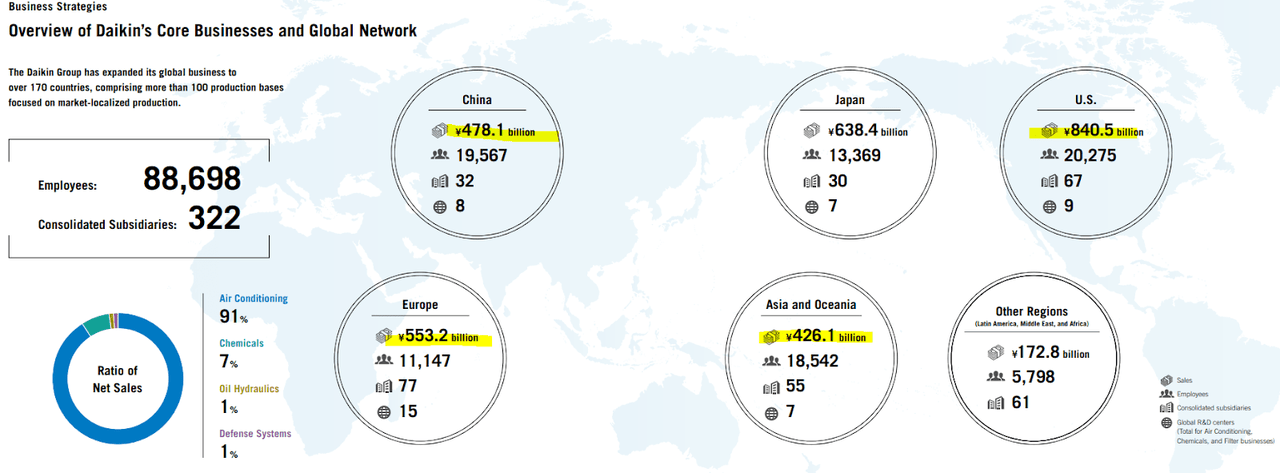

Daikin Industries (OTCPK:DKILY) has been a premier name in the world of air conditioning and refrigeration for some time. Fully integrated, the company leverages their research base in Japan to gain global revenues from higher growth markets than Japan. In 2022, foreign sales are reaching over 70% of total revenues, and this comes with strong forex benefits as the yen devalues compared to most flagship currencies. Short-term economics, valuation, and performance aside, there are many fundamental traits investors can rely on for the future.

Daikin Website Daikin 2021 Integrated Report

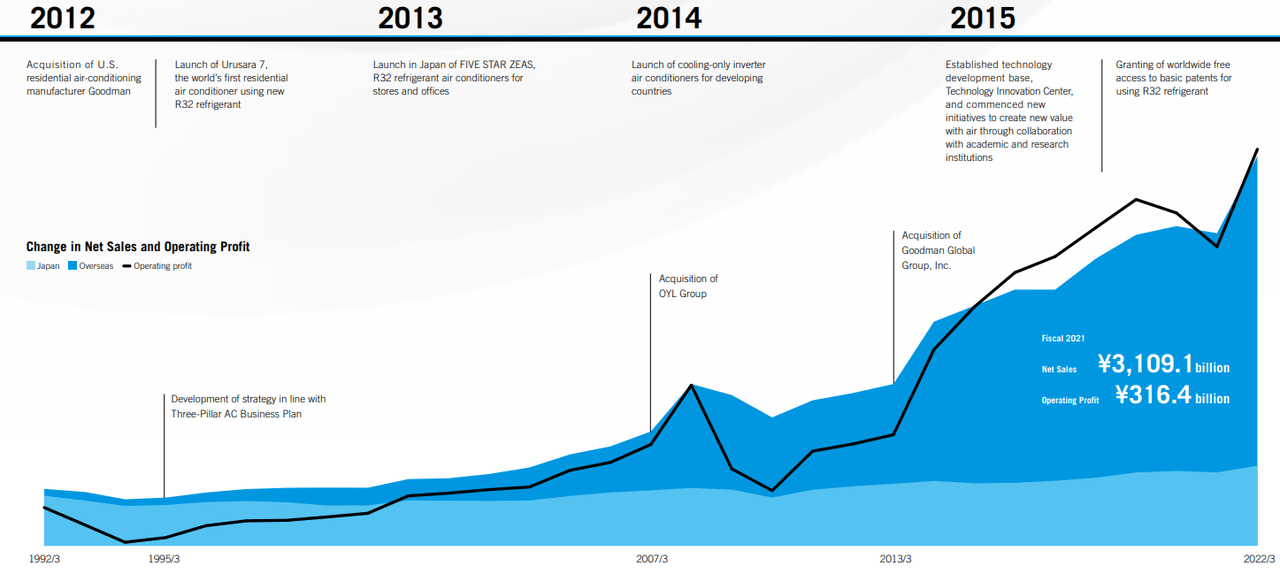

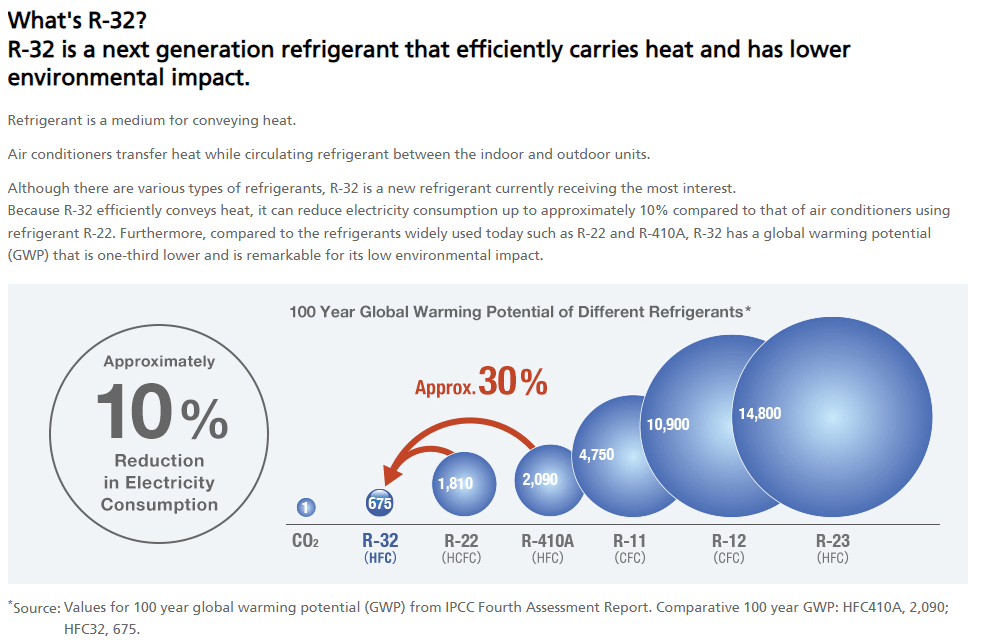

While an aging firm established pre-WWII, growth has been the name of the game over the past two decades. This is thanks to historically conservative management performing a series of investments in growth abroad. Also, the company performs significant R&D, and this has led to the creation of their proprietary high efficiency and low environmental refrigerant R-32 (R-32 has a long history, but Daikin is the first to commercialize).

While not a perfect replacement for legacy refrigerants, R-32 remains allowed by governments due to the lower impact as lower quality gasses get banned. The environmental and technological advantages held by Daikin are just one bullish factor that I will discuss later in the article.

Daikin 2021 Integrated Report

Daikin 2021 Integrated Report

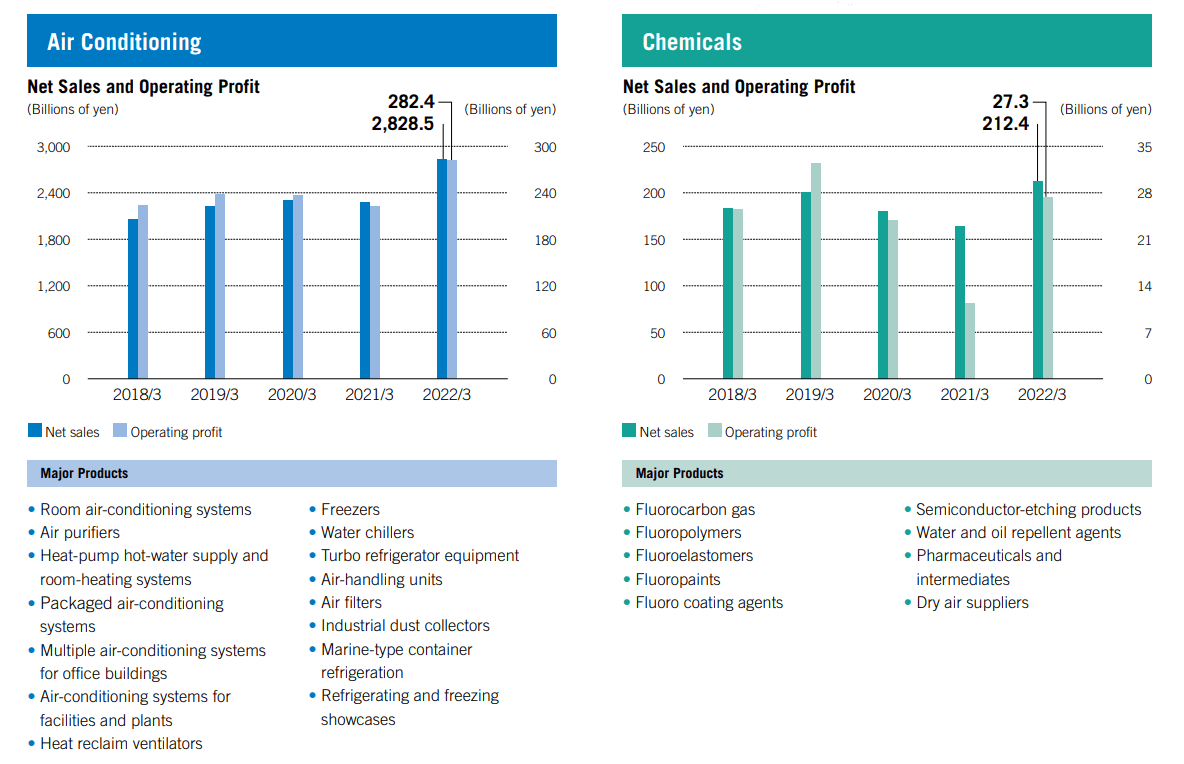

Making A/C Units is not enough to provide a competitive investment profile as consumer or business-facing companies tend to see limited growth and volatility with the broader economy. However, Daikin has a few advantages to combat these risks. First, they are diversified across the entire “air” industry, as management puts it. This includes heating, cooling, and filtration on all scales whether consumer, commercial, or industrial. The company also sees approximately 5-10% of yearly revenues from the sales of chemical products, mostly in relation to fluorocarbon products that result from their in-house R&D.

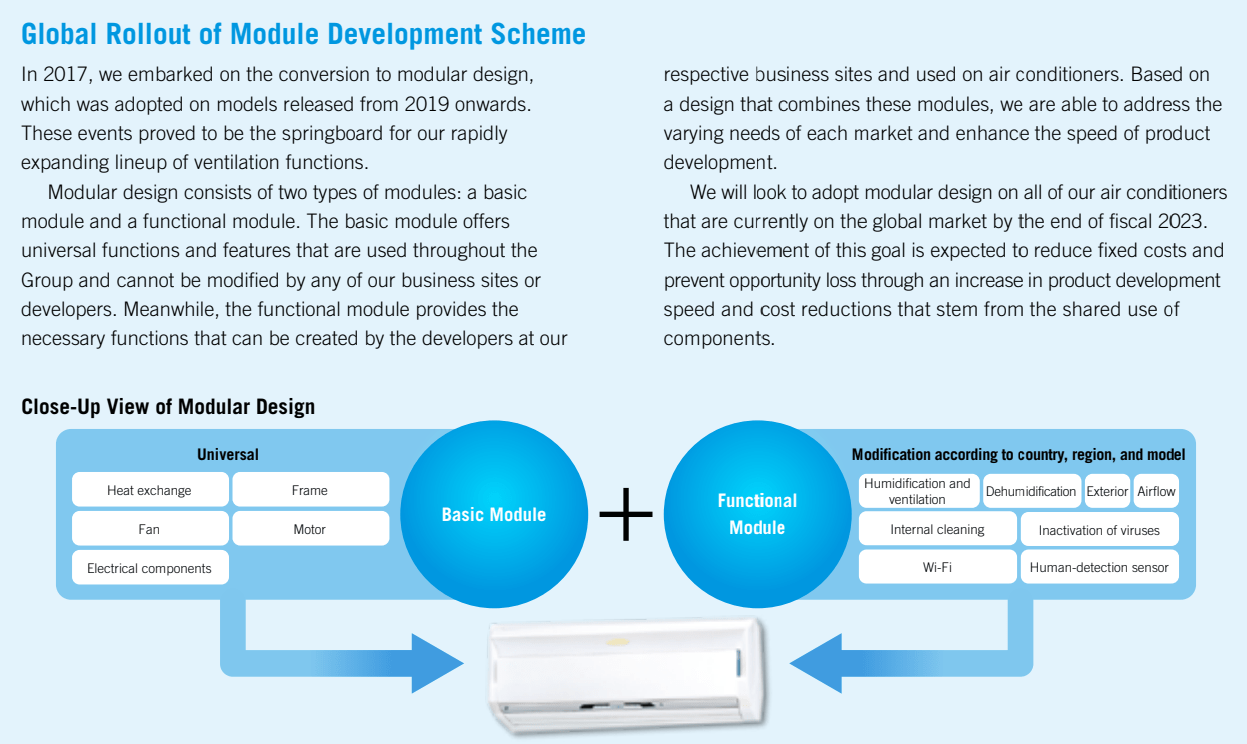

For the future, management is relying on a few key areas. This is similar to my assessment of Nippon Steel (OTCPK:NPSCY), and all relate to the rise of the emerging markets. Areas such as Indonesia, India, and the African continent see perpetual high heat but extremely low per capital A/C usage. Basing operations in these regions also has the double benefit of a low-cost manufacturing base, and new modular designs can easily be shipped around the world. Also, research and partnerships are being driven into three new areas, all of which have the potential for impacting future growth.

-

Smart city applications around the globe.

-

A/C systems for high-efficiency EV applications.

-

A/C Subscription service for low-income countries.

Daikin 2021 Integrated Report Daikin 2021 Integrated Report

Short-term Financials

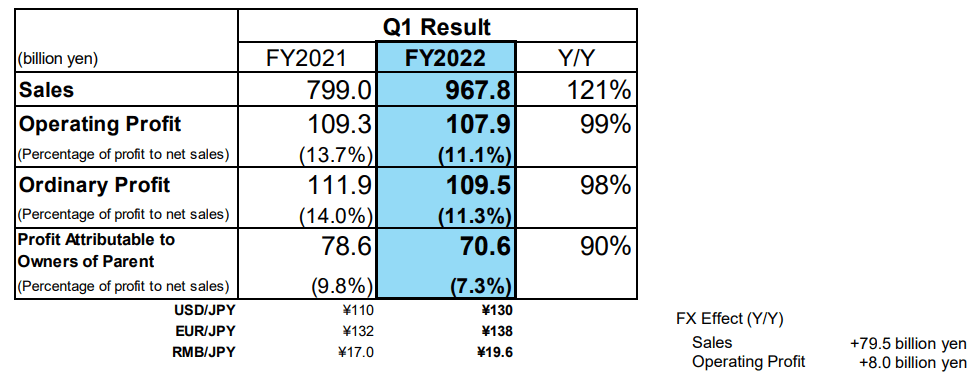

As of the most recent earnings in August, we can see that financial performance indicates a few of the important qualities of the company. First, strong growth of sales, 21% YoY, indicates a resurgence after 2021. Then we can see the flat profit margins that can be attributed to two factors: higher supply chain costs and continued investment in growth.

While margins are lower YoY, we can see that foreign exchange benefits are beginning to offset the lowered margins, and due to the prolonged period of a weak Yen, should lead to an extended period of benefit for Daikin. Even if margins stay suppressed, we can assume management is choosing to invest the extra funds on R&D and Japanese operations rather than just rake in the cash.

Daikin 1Q22 Results Presentation Daikin 2021 Integrated Report

Long-term Financials

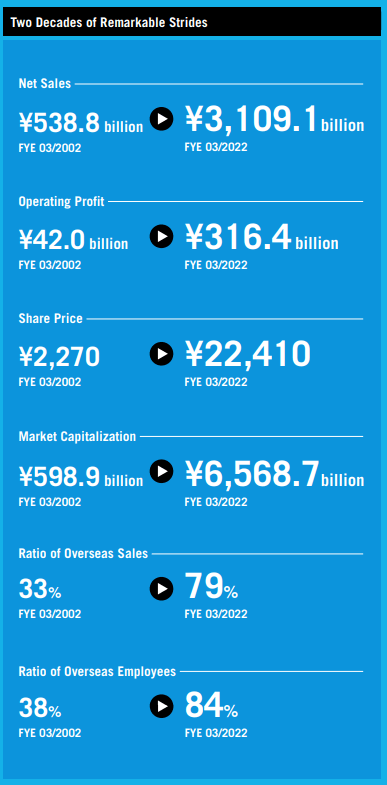

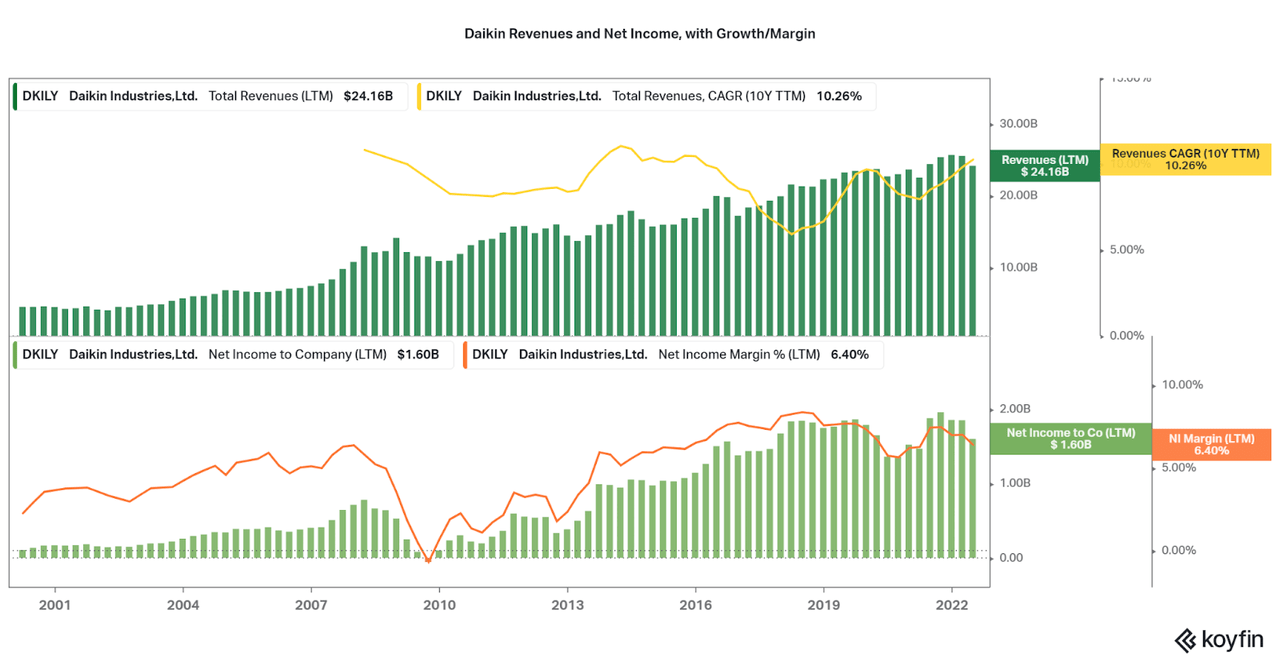

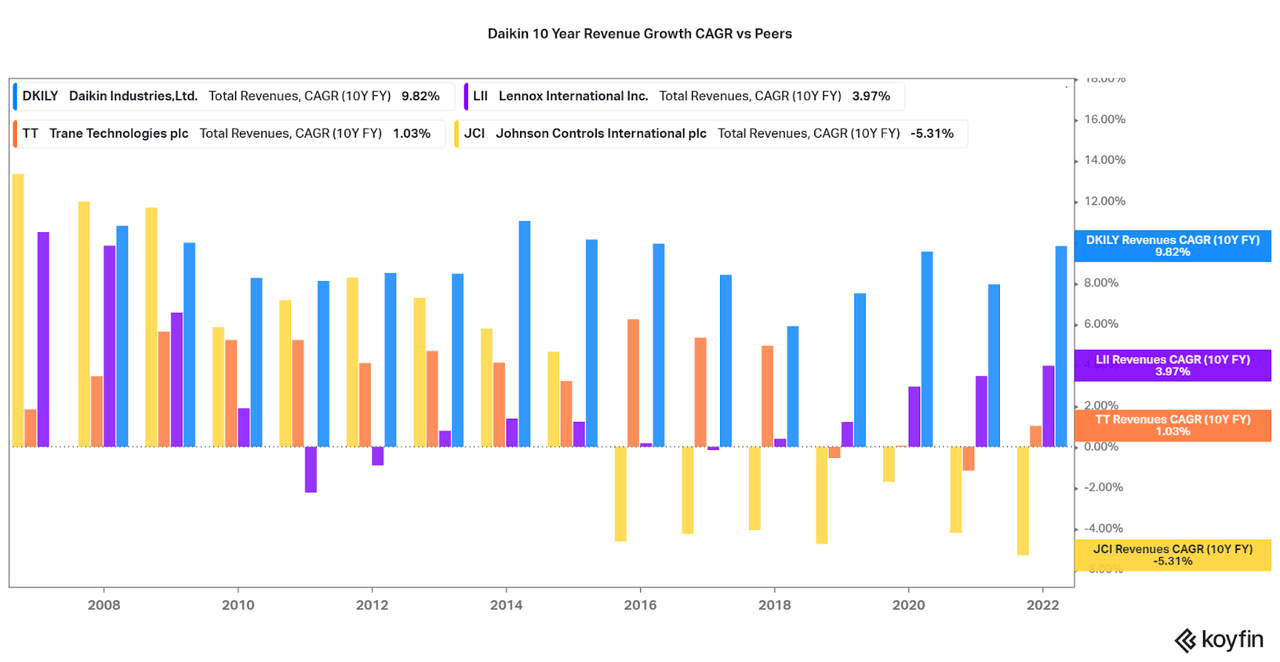

While recent changes support a growth thesis, investors may be hesitant about the longer terms trends. However, Daikin has performed well over the past two decades and changes are gradual rather than forced. Over the past 20 years, revenue growth has averaged between 5% and 10%, and the linear upward trend is rarely interrupted even during poor economic conditions. A good sign for an equipment manufacturer.

At the same time, earnings growth has been strong, rising at a faster rate than revenues. However, net income margins have been more volatile, but two patterns stand out. First, the general margin trend is upwards, indicating operational improvements and global expansion. Second, the company rarely sees negative net income, with the only exception occurring during the financial crisis. While I expect margins and growth to ebb and flow with market conditions, I do expect Daikin to continue their pattern of stability and continual improvement.

Koyfin

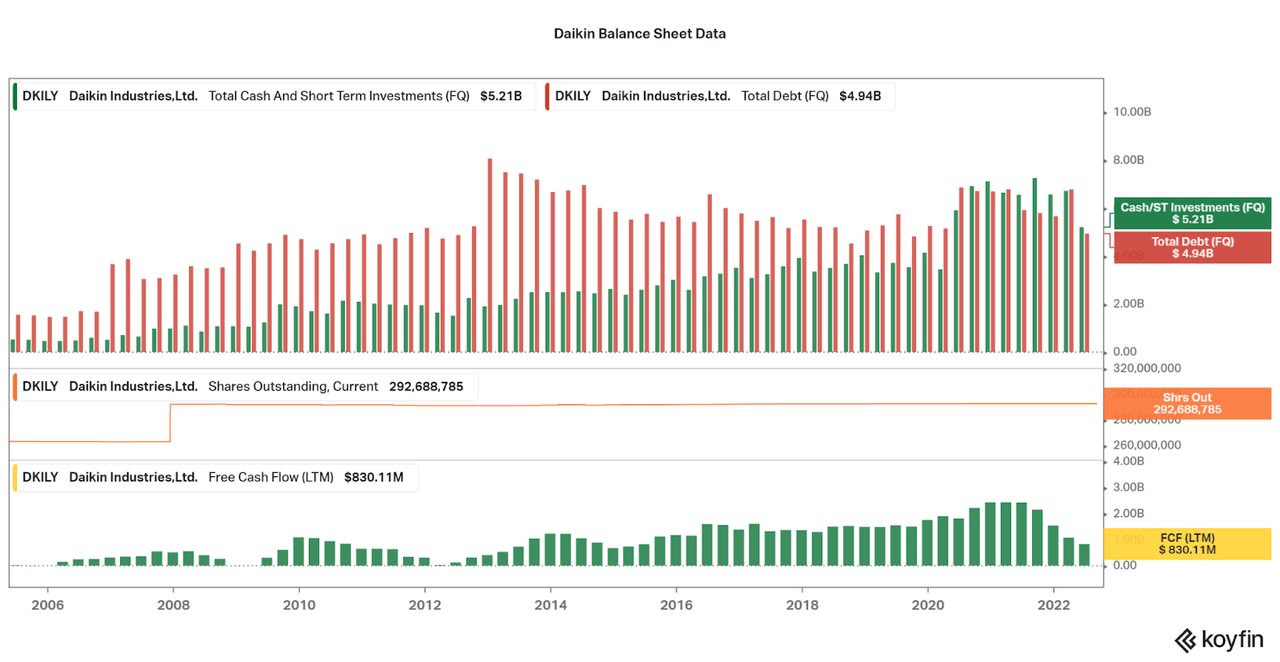

To bolster this anticipated out-performance compared to peers or the market, I will highlight the strong balance sheet. Firstly, debt is minimal in scale, and cash now exceeds or equals total debt. Then we can see that dilution is not a factor and free cash flows remain positive every year. In fact, when combined with the income performance, the Japanese Credit Rating Agency has recently upgraded Daikin to AA-positive, with an upgrade to AAA rating possible in the future. They had the following notes in regard to the upgrade:

[Daikin’s] earnings capacity and cash flow generation ability have increased. Its business foundation centering on the air-conditioning and refrigeration equipment business is becoming stronger as shown that the air conditioning business in North America, which is the key group strategy in the Strategic Management Plan “Fusion 25”, has been strengthened, and others. Although the capital investment has been on increase, the Company maintains financial soundness underpinned by the high cash flow generation ability. It will likely further expand the performance and improve the financial conditions. JCR will watch their progress. Based on the above, JCR has affirmed the ratings on the Company while revising the rating outlook from Stable to Positive.

Koyfin

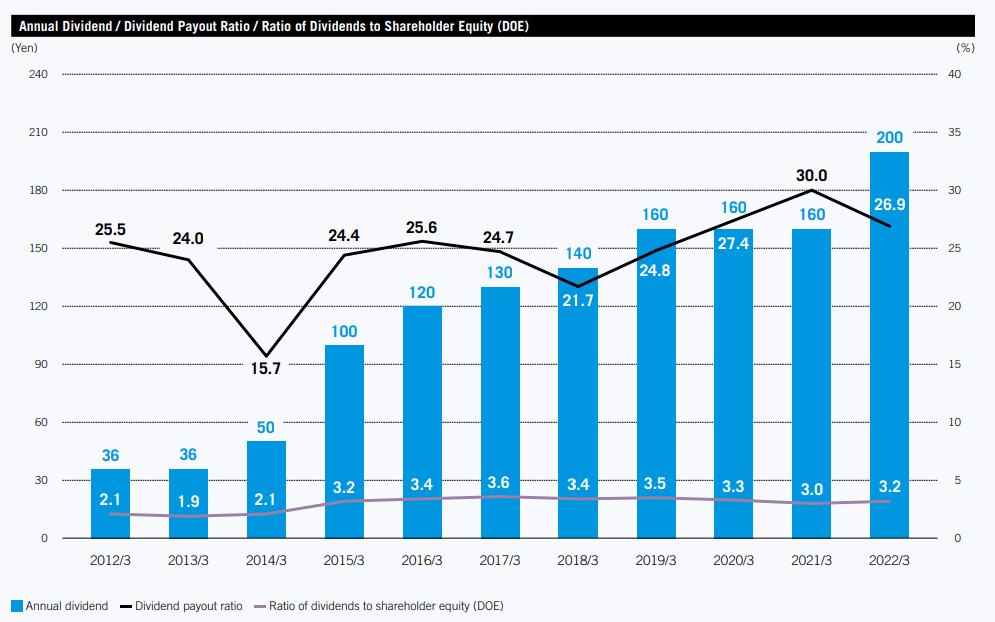

Well, if free cash flows remain positive, what should shareholders expect in terms of recycling this excess capital? We can already see that share buybacks are not the focus, and instead, we should look to the dividend (currently around 1%). As shown in the chart below, Daikin has a small, but safe and steadily increasing dividend.

Both the payout ratio and ratio of dividends to shareholder equity remain at tolerable levels with room to grow in time. However, dividends are not the primary focus for the company and investments into research, global expansion, and operational improvements will always remain the primary focuses of management.

Daikin 2021 Integrated Report

Outlook, Competitive Landscape, and Valuation

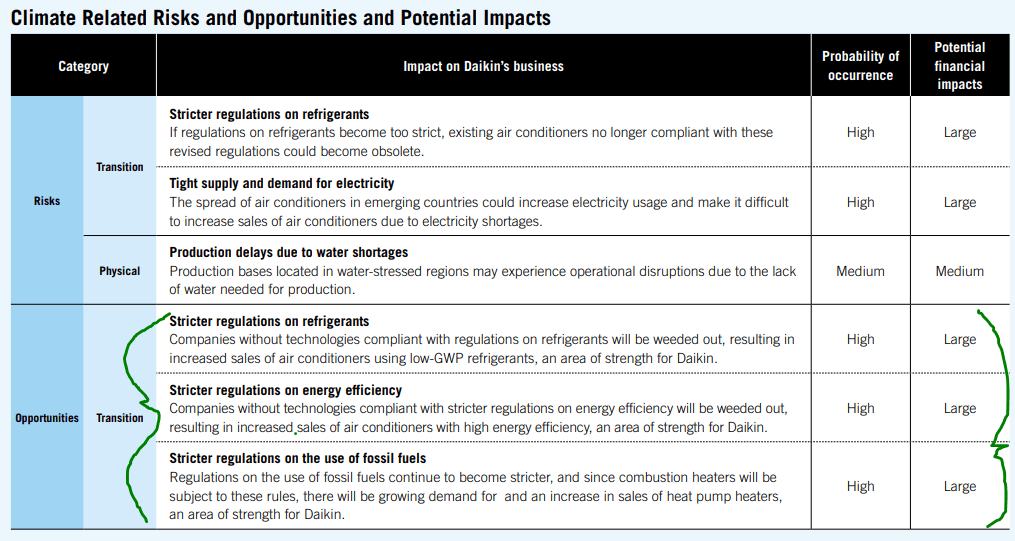

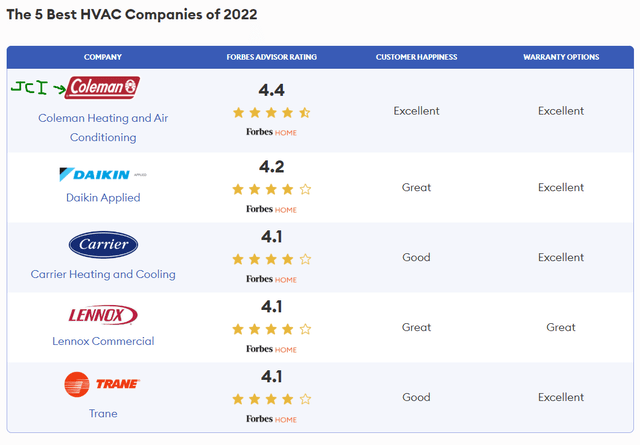

As discussed, there are a few advantages that Daikin has over peers. Many of these revolve around the fact that Daikin is both a global enterprise and offers the best environmental profile of A/C manufacturers. Regardless if there are weaknesses in energy grids, regulations on refrigerants, or increased demand for energy efficiency, Daikin is well positioned to continue leading. Especially important is the operations in emerging markets, many in hot regions of the world, and these will drive high pace organic growth.

Daikin 2021 Integrated Report

Another factor to consider is that there is significant fragmentation of the A/C market, and this means that Daikin has little competitive impediment to growth as larger firms leverage their size. Financially, Daikin has also performed far better than other peers in the industry and is another indicator that competition has little advantage. When considering the possibilities of emerging market growth and environmentally superior products, I consider Daikin the premier choice in the HVAC market.

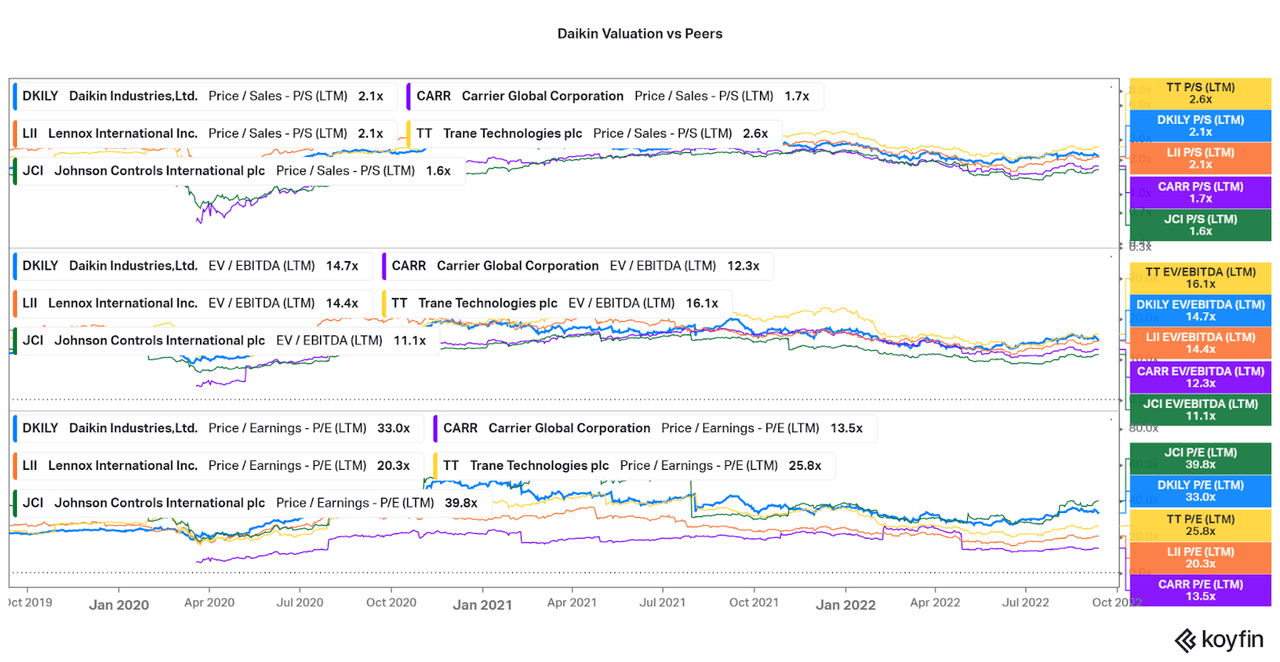

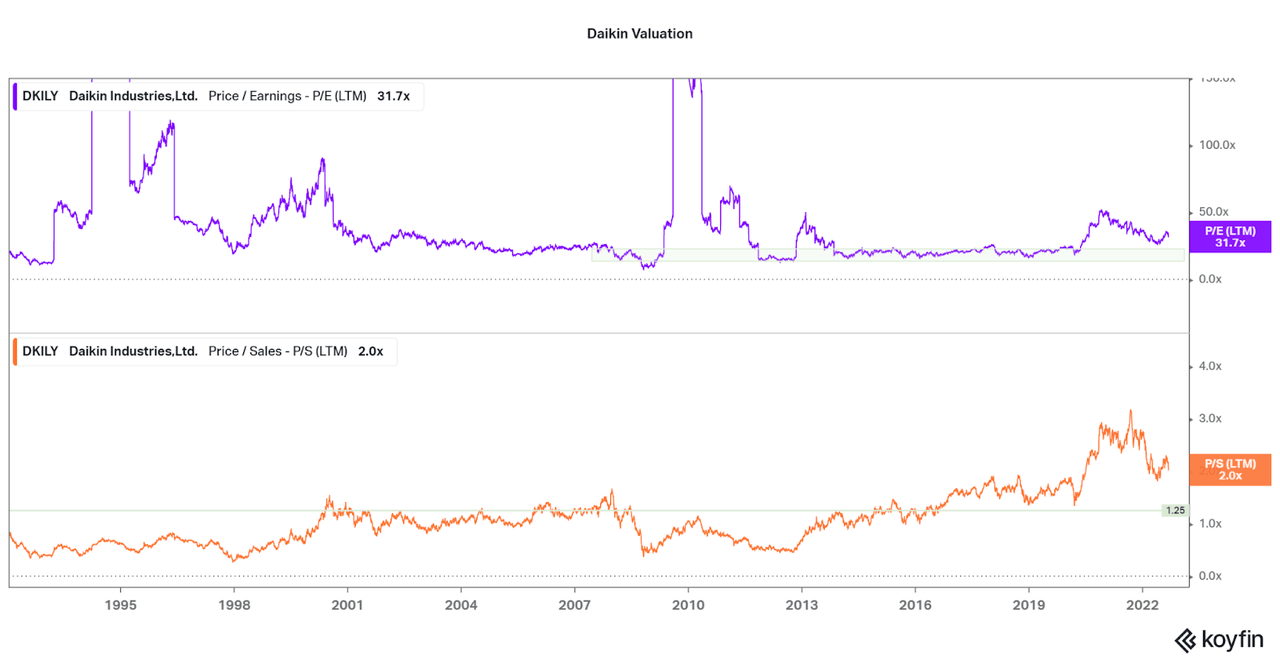

Unfortunately, the superior financial profile causes Daikin to be in a unique situation. While performance is far better than public peers Carrier Global (CARR), Lennox International (LII), Trane (TT), Hitachi (OTCPK:HTHIY), Johnson Controls (JCI), and more, Daikin also typically trades at a premium. However, based on the valuation charts below, there are times when Daikin is a steal. While right now is not a glaring buy when comparing valuations, I do expect significant upside if you set recurring investments and have a long-term mindset.

Although I wish Daikin earned a higher valuation as they should, based on years of outperformance compared to peers, being based in Japan will always be an issue. However, Abenomics helped increase operational transparency, increase accounting quality, and forced companies to reduce nepotism/corruption/bureaucratic risks and this has allowed for a resurgence in value over the last few years, in my opinion. While the country has nearly reached Western standards, investors have yet to adjust valuations accordingly.

Koyfin Koyfin

For those looking to trade the stock for the most upside potential, look for the valuation to fall in the areas indicated in the second chart below. I will also be adding more shares if that occurs. Until then, I will not assume the price will go up or down and will rely on the fundamentals to remain strong as my margin of safety.

Koyfin

Conclusion

Daikin offers rare levels of growth in a typically underperforming industry. Significant operation upgrades over the past two decades have expanded foreign exposure, and continual R&D has allowed for the company to face little environmental regulation risk. With that comes a premium price tag, but investor sentiment is hard to assess in the future. Current investors also can look forward to increased shareholder benefits as leverage is very low and either a significant acquisition, internal investments, or dividends/buybacks may be on the table. I remain excited about what the future holds and will remain bullish even during a potential recession.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment