Zerbor/iStock via Getty Images

It will take at least two-three years before psychedelic drugs are available to patients; however, recent research and the evidence from recreational use are very encouraging. Early-stage clinical trials conducted so far have been unanimously successful, no psychedelic drug has so far failed any trials, and they offer a great deal of hope for treating many severe mental health conditions. Compass Pathways has moved to a phase 3 trial with the proprietary deuterated Psilocybin compound COMP360 after encouraging phase 2 data (the results of this have been recently peer-reviewed and appear better than the first release of data). MAPS has sponsored a phase 3 trial of MDMA, and I am aware of 30 phase 2 trials.

I remain convinced that Psychedelic drugs will become a significant source of revenue, and some of the companies involved will be excellent investments. I have already written positive articles about COMPASS Pathways (CMPS) and Atai life sciences (ATAI), as well as a negative one on MindMed (MNMD).

In this article, I will explain my view on Cybin (NYSE:CYBN) after reviewing an industry that seems to be heading toward turmoil.

The Industry Troubles

The nascent Psychedelic drug industry appears to be in trouble. Mind Cure Health signaled the end of operations, and it would appear that Mydecine might be about to do the same; with very little cash, its key directors resigned. (that info is from Twitter, so who knows these days).

I have been maintaining a database of Psychedelic companies, following their progress, and looking for high-return investments. In the last 12 months, I have had to remove the following from the database as they end operations.

Aion, Captiva Verde, Cypher Metaverse, Empower Clinics, Goodness Growth, Havn, High Fusion, Lattice Biologics, M2Bio, Minerco, Roadmap, and Thoughtful brands.

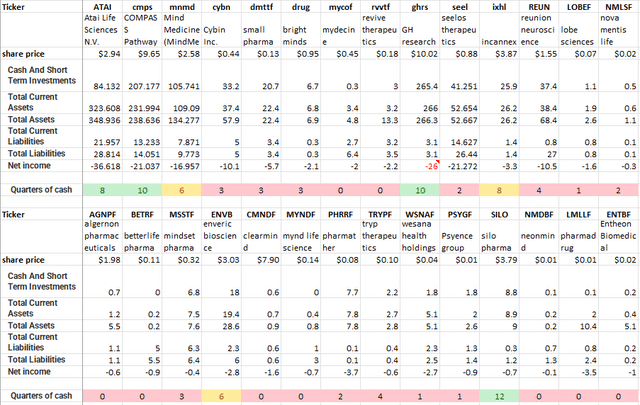

That leaves 28 companies on my tracking database. Only 4 of them appear to have a two-year cash runway. Indeed 19 of them seem to have less than 12 months of cash available. (the table below is an output from my tracking database and uses the latest quarter published for each company).

Cash Runway Psychedelic Companies (Author)

It is likely that an industry shakeout is happening and will continue in the near term. Developing drugs is an expensive business, and a relatively limited number of Psychedelic drugs are currently known, so it might be difficult for these companies to differentiate themselves. It looks like a winner takes all race to get them to market. If you are second in the race, you may well be nowhere.

On the spreadsheet, Cybin has three-quarters of cash on hand; today (Nov 5th), they released their unaudited Q2 2022 results that showed CAD$29.9 million. They also reported a cash outflow of $9 million (adjusting for one-time and prepaid expenses). Cybin had previously announced an at-the-market equity program for US$35 million; in the Q2 2022 letter, they said they could sell an additional US$29 million. That puts total available liquidity at US$86 million for a potentially available eight quarters or two years’ worth of cash.

Cybin has made some interesting moves to make the most of the shakeout that has piqued my interest. Cybin is cherry-picking some drug assets and pipelines from financially stressed competitors. That could be a great strategy, and they are the first company I am aware of to try this. Cybin has recently used its cash to acquire several drug programs from Mindset pharma and a DMT trial from Entheon Biomedical, two of the companies on my list with limited resources.

Cybin: The Drug Pipeline

After the deal with Mindset Pharma deal Cybin has more than 50 molecules, they are looking at. They seem to be concentrating on psilocybin. Cybin has suggested that the path to regulation might involve reducing the variability of the classical psychedelic compounds and improving the accessibility to these new versions. For example, If clinics prescribe psilocybin, the client will need to be in the clinic for a whole day under constant supervision from trained medical personnel. That is just not practical, so companies like Cybin are trying to increase the onset time and reduce the effect duration without reducing the drug’s effectiveness. A second problem is the nature of psilocybin; it needs to be metabolized by the body and converted into psilocin, the active compound. That conversion rate differs from person to person; hence the results of the classical drug can vary from mild to extreme. The FDA is less likely to approve a drug with high variability between patients; it is not what healthcare professionals need and is not helpful for people with mental health issues. Psilocybin has the most significant amount of research conducted on it compared to the other psychedelics; we know it is safe and effective for many people. Drug companies are attempting to modify classical psilocybin into different compounds that reduce variability, hasten onset and reduce the length of the hallucinogenic response. The potential market is enormous if this can be done and trials can be passed.

Cybin is investigating (or rather taking to trial) 3 Psychedelic molecules Psilocybin, DMT, and Phenethylamines.

Psilocybin

Psilocybin appears to be the trailblazer for the psychedelic industry. A decade ago, Colorado and Washington were the first states to decriminalize cannabis, and the same pattern may be playing out with psychedelics. In the US’s recent midterm elections, Colorado voters passed proposition 122 by 52% to 48%. The proposal decriminalizes a host of psychedelics and will create a state-regulated supervisory system for Psilocybin treatment by 2024.

Drug candidate CYB003 is a deuterated Psilocybin (similar to COMP360 from COMPASS Pathways), it has been cleared for a phase 2a trial to treat Major depressive disorder, and a pre-clinical trial for alcohol use disorder is currently underway.

A deuterated compound is when one or more of the hydrogen atoms have been replaced with deuterium, often called heavy Hydrogen deuterium is an isotope of Hydrogen consisting of one proton and one neutron. It is double the mass of the original Hydrogen, which has one proton.

Cybin and COMPASS Pathways have reported that deuterated psilocybin has a beneficial pharmacological profile compared to psilocybin. Plus, deuterated compounds are patentable, whereas psilocybin is not.

Cybin has released data showing that its drug candidate CYB003 reduces the variability of the result between 50 and 80%. Speed to onset has been doubled, and duration halved. If these results can be repeated at the 2a trial (dosing has started in this trial), a further phase 3 trial would pave the way for approval. Major depressive disorder can be a debilitating mental health condition affecting adults and children; sufferers can feel sad, fearful, hopeless, and anxious daily. They can lose interest in everything, suffer from sleeping problems, have trouble concentrating, and have frequent suicidal thoughts and tendencies. A study in 2017, funded by the Gates Foundation, estimated 163 million patients worldwide and 21% of people may suffer for some of their lifetimes.

Cybin has funded a phase 2 trial using psilocybin to treat mental health disorders in frontline healthcare workers (conducted at the UW School of Medicine).

CYB001 is also a psilocybin compound and is being tested in a phase 2a trial in Jamaica as a sublingual delivery system (placing a tablet under the tongue) versus an oral capsule.

DMT

DMT is faster acting than psilocybin, perhaps only 10 minutes, but the experience can be very unpleasant. DMT has been shown to create anxiety amongst patients. Cybin believes that it can slow down the window of effect, reducing the sudden spike and keeping the patient in the therapeutic window for longer.

Drug candidate CYB004, a deuterated DMT, is currently in a phase 1 trial, but clearance has already been given for a phase 2a trial targeting Anxiety Disorders. DMT is the active ingredient in Ayahuasca which has been a ceremonial and spiritual drink by indigenous people of the Amazon basin for centuries. DMT has not been as well studied as many other psychedelic compounds; however, MindMed and Numinous are actively researching it.

Cybin announced this month that they had been awarded a patent due to expire in 2041 that protects CYB004. In April, Cybin released results showing that CYB004 delivered by inhalation demonstrated significant improvements over DMT given by IV (DMT is not suitable for oral use). Cybin is actively investigating drug delivery methods and has applied for a patent for its inhalation method for multiple molecules.

Cybin can use the trial they bought from Entheon as part of their move to get FDA approval. It is the largest DMT trial conducted to date and is likely to accelerate CYB004 by nine months. They paid CAD$1 million for the study, and further payments will be based on performance.

Phenethylamine

Drug candidate CYB005 is a phenethylamine derivate currently in pre-clinical trials to treat neuroinflammation. Phenethylamines are a wide range of compounds that use the naturally occurring phenethylamine as a backbone and substitute one or more of its hydrogen atoms to form substances that are used for a wide range of drugs, including but not limited to stimulants, appetite reduction, decongestants, anti-depressants, and psychedelics. No data has yet been released on CYB005 so I cannot draw any further conclusions.

The Pipeline Conclusion

Cybin has more than 50 compounds in the development stage, and with 20 patents applied for, it has a solid IP base. It has completed more than 180 clinical studies and currently has three active drug programs CYB003 targetting Major Depressive Disorder and Alcohol abuse, CYB004 targetting Anxiety disorders, and CYB005 targetting neuroinflammation.

The drugs look to have good patent protection, and early results suggest that they significantly improve the classical psychedelic compounds they are based on. The frontline candidate CYB003 is similar in construction (deuterated psilocybin) to COMPASS Pathways’ COMP360 but targets different conditions.

Cybin: The People

I started this article by looking at the 24 drug companies vying to bring psychedelics to market. They are not all going to be successful. COMPASS Pathways has a head start and is at phase 3 testing already; the other companies are all at stage 2 or lower. The ability of the companies to navigate the regulatory hurdles is likely to be the critical determinant of success; we know the compounds have the potential, but who can get them to market? I think it is in this area that Cybin has an advantage.

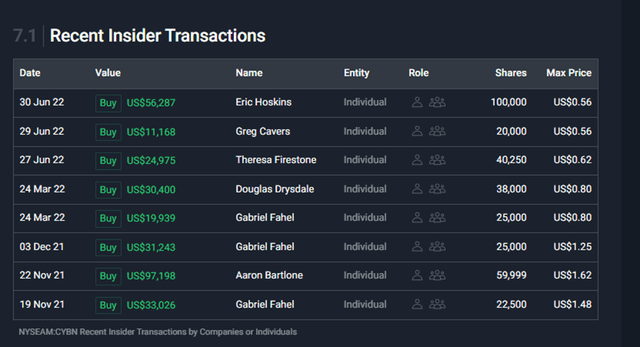

The first thing I noticed is that the insiders have continued to add to their holdings as the share price has decreased in the past 12 months; they are heavily invested in the future of Cybin, which is a great sign.

Recent insider deals (Simplywall.st)

Doug Drysdale CEO

Doug is an industry veteran; he has been involved with at least two companies worthy of mention. Both showed tremendous growth while he was at the helm. Alvogen, a generic drugs company founded in 2009 by Robert Wessman, appointed Doug as the company’s first CEO and it grew to sales of $450 million from start-up while Doug was with them. Alvogen is the parent company of Norwich Pharma, the drug manufacturing site that Doug ran before taking over at Alvogen, in 2014, CVC partners bought a controlling interest in Alvogen, and it continues to grow as a private company.

Doug left Alvogen in 2013 and became CEO of Pernix; his appointment was supported by a group of institutional investors who agreed, at the same time, to loan Pernix $65 million to provide expansion capability. In 2014 Pernix completed several takeovers of specialty drug companies, in 2016, Doug abruptly resigned his position and left the company immediately. John Sedor took over as CEO, having previously been on the board. The share price dropped immediately on the news of Doug going and never recovered. Pernix filed for chapter 11 in 2019 and John Sedor was accused of misleading the employees and shareholders to increase the stock price before he arranged an exit for Highbridge capital management.

Doug has significant and crucial experience; he has built a drug manufacturing company, been involved in successful takeovers, and delivered profits. He understands the regulatory landscape. He left Pernix abruptly, but the company ran aground shortly after that. That is a fact I won’t forget if I invest in Cybin; Doug stays when things look good and leaves when they don’t.

The Money People

Eric and Tina So own around 7% of Cybin; Eric was one of the three founders and a co-founder of Trinity Venture Partners a boutique investment bank he set up around the same time as Cybin in 2019.

The other founders of Cybin are John Kanakis (also a founder of Trinity Venture Partners) and Paul Glavine. I have tried to research investments made by Trinity in similar companies to Cybin, but nothing of real note good or bad, came to light. Still, they are investing in early-stage tech with seed money and have only been in business for three years so that is to be expected.

The Science Guy

Dr Alex Nivorozhkin is the chief scientific officer of Cybin. He is also CEO of Adelia Therapeutics and founder of C-Click inc. He remains an Adjunct Professor of Cannabinoids Research at the center for drug discovery at Northeastern University. With two pages worth of patents, Dr. Nivorozhkin is a proven developer of new drugs and uses for psychedelic compounds.

Conclusion

The Drug pipeline looks good, it is patent protected, and the scant evidence available suggests that their compounds are better than the original psychedelic drug in crucial areas that will make the finished mixture easier to get approved and more salable to the industry.

They are picking up assets from other more distressed companies that may well be a knock down price and are advancing their pipeline and speeding up the approval process by doing this.

They have a proven drug developer and pharmaceutical company manager at the helm, backed up by a small venture capital firm and an experienced and successful drug scientist.

The problem is that they are short on cash and several years from revenue generation. They can potentially tap the markets, enabling them to extend their cash runway to two years, but that is not long enough to get them any revenue. They face significant competition from COMPASS Pathways and Atai Life Sciences who are investigating similar compounds with similar mental health conditions.

If they can get an effective drug approved for one of the major disorders they are looking at, they will likely be worth billions. It might be enough to get close to approval. Any positive trial news will likely cause a significant boost in share price; however, we are probably more than 12 months away from any such data.

It is not one I am investing in just yet, but I will watch closely and may well invest in the coming months. I will update you when and if I decide to invest.

Be the first to comment