jetcityimage

Last week I published an article about Walgreens Boots Alliance (WBA) in which I argued that the healthcare company is a good pick for a potential recession. CVS Health Corporation (NYSE:CVS) is the major competitor to Walgreens Boots Alliance and in the following article we will argue why CVS is also a good pick in such a scenario.

And I will not only argue why CVS is a good investment for a potential recession, but also argue that CVS is still undervalued (in my opinion, CVS is still trading for a steep discount). Additionally, we will analyze a bit how CVS can use its generated cash flow and talk about potential acquisitions but will start with the still rather negative sentiment surrounding CVS.

Negative Sentiment

After sentiment has been rather bullish among SA authors for several years, it was neutral in the last few weeks. And at least when looking at the price, CVS is not as cheap as it was about two or three years ago and hence it might seem reasonable to be less bullish about the stock. However, we are looking at a business that is still trading for extremely low valuation multiples and should therefore still be bullish (we will get to that).

SA Authors’ average rating history on CVS (Seeking Alpha)

CVS could also beat revenue as well as earnings per share estimates once again and we are looking at the 17th quarter in a row in which CVS could beat estimates for the top and bottom line. And analysts obviously continue to underestimate the business as there seems hardly any reason for CVS to trade for a lower share price in my opinion – the business is performing well, it is recession-resilient and last quarterly results were strong.

Quarterly Results

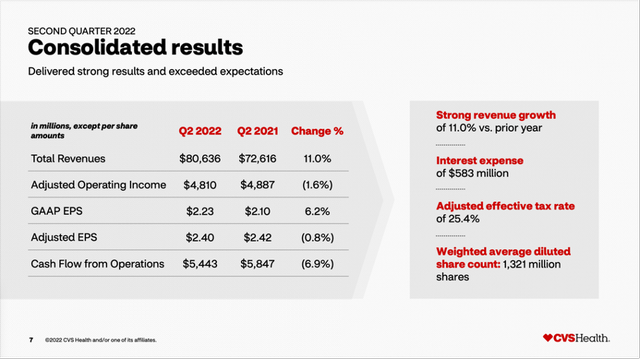

Last week, CVS reported second quarter results and it could not only beat analysts’ estimates once again, but also reported high growth rates. Total revenue increased from $72,616 million in Q2/21 to $80,636 million in Q2/22 resulting in 11.0% year-over-year growth. And despite operating costs also increasing 11.4% year-over-year (with inflation having an impact), operating income also increased from $4,326 million in the same quarter last year to $4,569 million this quarter – an increase of 5.6% YoY. And finally, diluted earnings per share also increased from $2.10 to $2.23 – resulting in 6.2% YoY growth.

And not only could CVS increase its top line in the double digits, but all three segments contributed to growth. While the Retail/LTC segment increased only 6.3% year-over-year, the other two segments increased revenue in the double digits.

Aside from increasing total revenue, the Retail/LTC segment could also increase its retail pharmacy script share about 50 bps year-over-year to 26.8% and same store sales increased 8.0% YoY. Prescriptions filed also increased 1.6% YoY to 400.8 million. When looking at the pharmacy services segment, the total pharmacy claims processed increased 3.9% to 584.3 million and specialty pharmacy revenue could grow about 21% year-over-year (which is reflecting new business wins and pharmacy claims growth). And finally, the Health Care Benefits segment could increase total medical memberships 3.8% to 24.4 million.

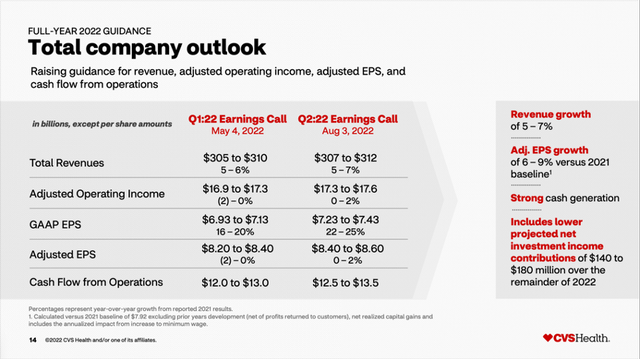

And CVS Health Corp. could not only beat estimates and report solid growth rates, but also raised the full-year guidance for fiscal 2022 once again. CVS is expecting revenue to grow about 5% to 7% right now, and adjusted EPS is now expected to be in a range between $8.40 and $8.60 – a growth rate of 6% to 9% vs. the 2021 baseline. And cash flow from operations is now expected to be between $12.5 billion and $13.5 billion.

CVS: A Cash Cow

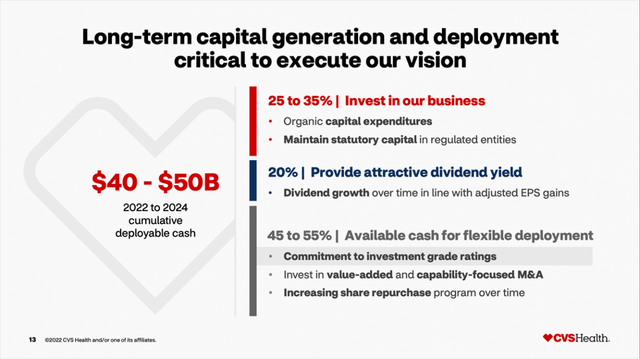

And we can expect that CVS will continue to generate huge amounts of free cash flow in the years to come. Management is expecting cash from operations to be between $40 and $50 billion in the next three years (fiscal 2022 till fiscal 2024). And of course, like any other business, CVS has capital expenditures to maintain its business – about $2.5 billion to $3 billion annually.

CVS 2021 Investor Day Presentation

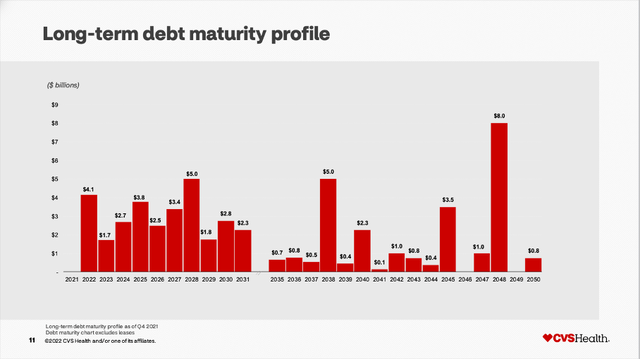

Aside from capital expenditures, CVS will have to spend about $8.5 billion to repay outstanding debt in the next three years. In my opinion, CVS Health Corporation could spend even higher amounts to reduce the outstanding debt much faster. I don’t know if CVS has plans for major acquisitions and needs high amounts of cash (we will get to that), but without it should be possible for CVS to repay about $15 billion to $20 billion in debt in the next three years.

CVS February 2022 Presentation

This would not only improve the balance sheet of CVS but could also have a huge impact on the income statement. In fiscal 2021, the company had to spend $2,503 million in interest expenses and the company’s income before tax provision could be about 25% higher without interest expenses. By reducing the debt with a higher pace in the years to come, CVS would improve its bottom line about 1-2% in the next few years.

CVS will also continue to pay a quarterly dividend and after the company kept the dividend only stable for several years in a row it started increasing the dividend once again a few quarters ago. Right now, CVS is paying a quarterly dividend of $0.55 and when taking the adjusted EPS guidance of $8.50 (midpoint) for fiscal 2022, we get a payout ratio of only 26%. When expecting CVS to increase the dividend about 10% in the next few years, the company must pay about $9 billion in dividends in the years from 2022 and 2024.

When assuming about $9 billion in capital expenditures and $9 billion in dividends and even $15-20 billion in debt repayments (which would be about twice the amount the company has to repay), CVS will still have about $10 billion left for share repurchases. However, as we learned in the last few days, CVS Health might make a few more acquisitions.

Acquisitions

In my last article about Walgreens Boots Alliance, I already talked about Amazon acquiring One Medical (ONEM) and apparently CVS Health also wanted to acquire the business. In the days following the article, it was announced (on August 5th, 2022) that CVS Health has partnered with telehealth software provider American Well Corporation (AMWL) to rollout the new virtual prime care service. This will most likely end speculations about CVS Health acquiring Teladoc Health Inc. (TDOC), which seems rather unlikely now.

Additionally, CVS also announced its interest in buying home healthcare company Signify Health (SGFY), which is currently valued for about $5 billion. And while CVS certainly needs cash to make acquisitions, we must also keep in mind $12,116 million in cash and cash equivalents as well as $2,877 million in short-term investments CVS has on its balance sheet – and these $15 billion in rather liquid assets can also be used for acquisitions. And if CVS should actually purchase Signify Health, cash and cash equivalents should be enough to pay for the acquisition.

Recession-Resilient

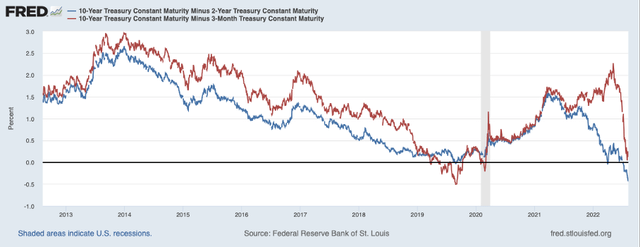

Considering that a recession in the next few quarters seems likely, we must ask if the company can generate these high amounts of cash flow in the next few years (Sidenote: While the 10-year vs. 2-year treasury yield is already negative since the beginning of July, the 10-year vs. 3-months treasury yield is only slightly above zero and if it should go below zero the yield curve can be seen as inverted and this is one of the most reliable early warning signal for a recession).

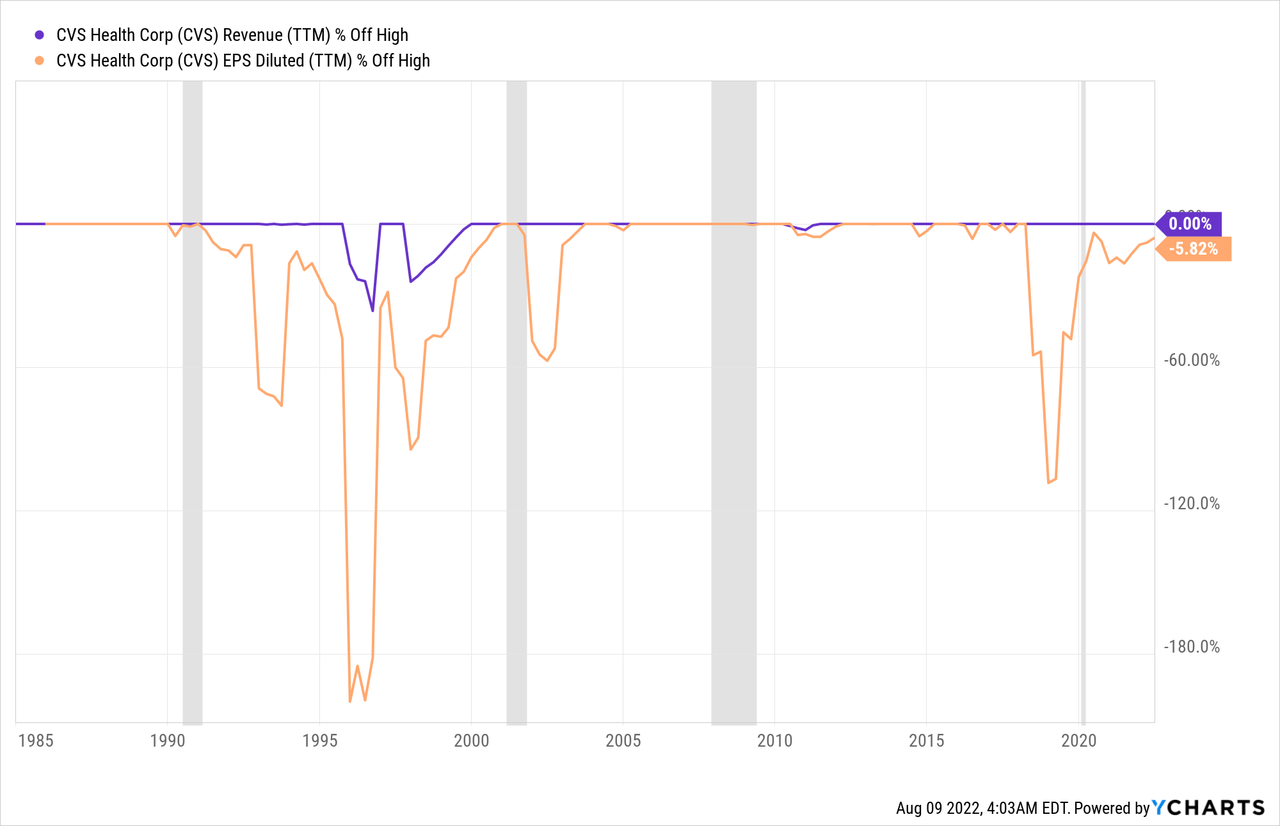

When looking at the performance of CVS during past recessions, we see revenue being extremely stable and hardly ever declining. Revenue declined once in the 1990s (but reasons might be more complex than just attributing the declining revenue to the recession) and it once again declined slightly in the years after the Great Financial Crisis. When looking at earnings per share, we see declines after some recessions. We can’t claim that CVS is completely recession-resilient, but the company should not be afraid of the next potential recession – and neither should be investors.

And when looking at CVS’ business segments, all three should perform well during a recession. All three offer essential healthcare services which are necessary in every economic environment, and it seems unlikely for CVS to experience declining revenue in the next few years.

Intrinsic Value Calculation

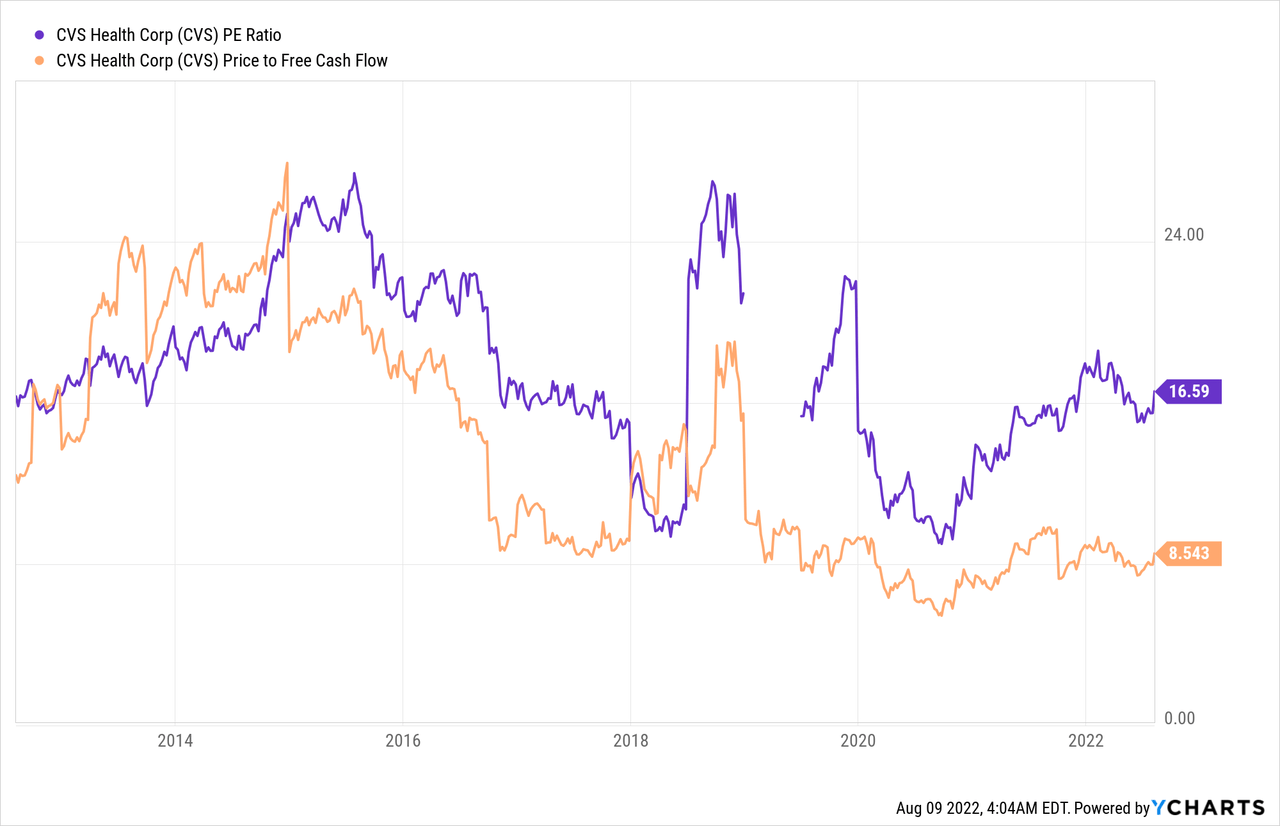

In my last article about WBA, I not just made the argument that WBA is recession-resilient but also argued that the stock is extremely cheap – and this is making WBA a good investment in my opinion with limited downside. CVS is currently trading for a P/E ratio of 16.63 and this is much higher than the P/E ratio of 6.5 for WBA. From this point of view, CVS seems rather expensive. However, when looking at the price-free-cash-flow ratio, CVS is trading for only 8.5 times free cash flow right now (compared to WBA which is trading for 9.8 times free cash flow).

CVS doubled in value in the last two years (since the COVID-19 low), and this could easily lead to the impression that CVS is not as cheap as WBA for example. But we all know this is the wrong way to look at businesses and aside from simple valuation metrics we can also use a discount cash flow calculation to determine an intrinsic value for CVS Health. In my last article I calculated an intrinsic value of $149.70 for CVS and in the following article we will determine a similar intrinsic value once again. When taking the free cash flow guidance for fiscal 2022 (midpoint will be around $10.1 billion) and assume moderate growth rates of 5% from now till perpetuity, we get an intrinsic value of $152.91 for CVS Health.

CVS 2021 Investor Day Presentation

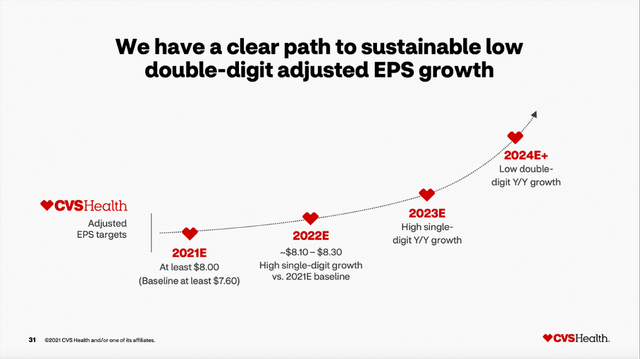

And we can make the argument, that CVS will grow with a higher pace than 5% in the years to come and can back up that claim by several different points. First, analysts are expecting CVS to grow its earnings per share with a CAGR of 7.75% in the next ten years. When looking at the last ten years, CVS Health could grow its earnings per share with a CAGR of 8.76%. And during its 2021 Investor Day, management was still confident about double-digit EPS growth rates from 2024 going forward.

When assuming CVS will growth with a little higher pace and assume 6% growth from now till perpetuity – a number that seems reasonable – we get an intrinsic value of $191.14 for CVS Health and the stock would still be extremely undervalued.

Comparing CVS to WBA

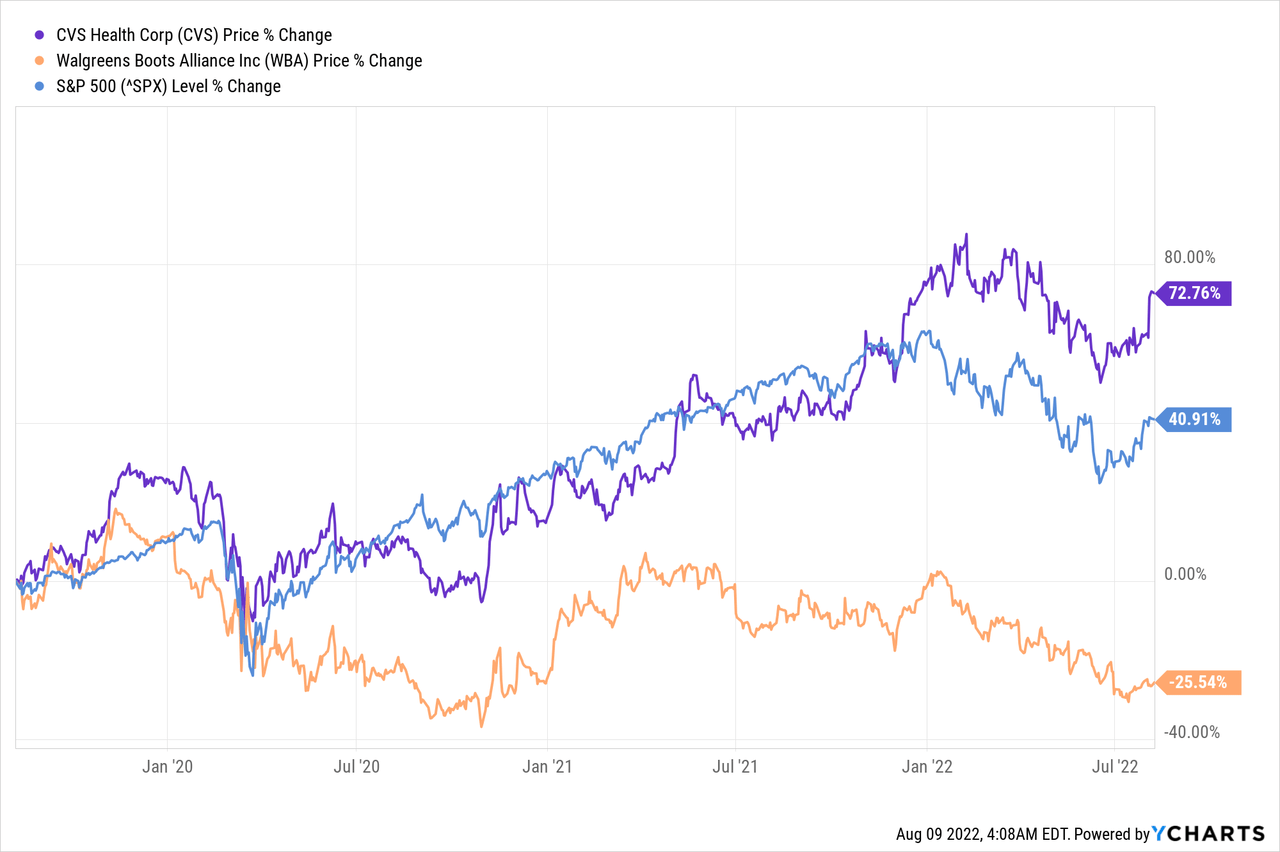

I continue to claim that CVS Health is not correctly valued – a sentence that was true for several years. And while one might argue my assessment of CVS is just wrong, I would redirect your attention to the stock price and performance of CVS in the last few quarters. Not only has CVS Health clearly outperformed Walgreens Boots Alliance (which is also undervalued in my opinion), but it clearly outperformed the S&P 500 (SPY) in the last three years – and many tech stocks and previous highflyers by the way.

Sometimes an adjustment towards the intrinsic value of a stock takes time and it might take another year or two before CVS Health can reach its intrinsic value (probably somewhere between $150 and $200).

The profits for investors in the last two or three years mostly stemmed from the valuation multiples expanding (and only in small parts from the fundamental performance). Confidence about CVS Health being a solid business returned and investors bid the stock price higher. And over the next two or three years, the same could happen to Walgreens Boots Alliance, which is still in a downtrend and trading for very depressed multiples. In my opinion, it seems likely for WBA to outperform CVS in the next few years because over the short run, valuation multiples (and the sentiment driving these valuation multiples) will have a bigger impact on the stock performance.

Over the long run, I think CVS is the better investment as I consider CVS better managed (at least right now), and I think the business model (and execution) is better. And over the long run, the fundamental business and the growth rates it can achieve have a bigger influence. And I consider it more likely for CVS to grow in the high single digits or even double digits, while I would be more sceptic if WBA can achieve similar high growth rates.

Conclusion

In my opinion, CVS is still a buy at $100 and it seems like the correction since February 2022 might be over and the stock could move higher again. The stock is still trading for an unreasonably low valuation multiple (especially the price-free-cash-flow ratio), and I can imagine the stock price to reach at least $150 in the next few quarters. CVS is a true cash cow and analysts as well as investors continue to underestimate the business in my opinion.

Be the first to comment