Eoneren/E+ via Getty Images

Investment Summary

Sentiment has undoubtedly shifted on the outlook for CVRx, Inc. (NASDAQ:CVRX). Shares now trade around their lowest levels in 6 months. The CVRX investment debate is centered on one of possibilities versus probabilities. On the one hand, there is possibility CVRX’s Barostim Neo (“Barostim”) device will capture increasing share of the ~$3 billion heart failure (“HF”) total addressable market (“TAM”). That’s possible due to a shortage of treatment options, and potential to provide a medical breakthrough in the segment. Barostim is also backed by robust clinical evidence, that holds up well on peer review. On a long-term view, 5 years ahead, say, there are tailwinds due to Barostim’s economics.

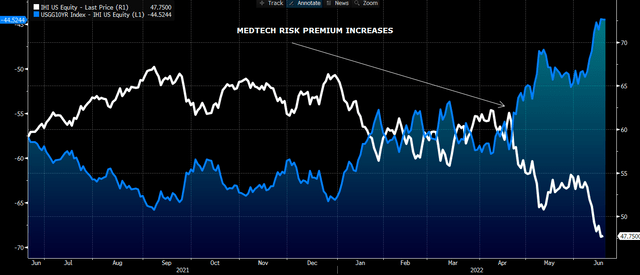

Exhibit 1. CVRX 12-month price action

Data & Image: Bloomberg

The question is, what’s the probability of this converting over into shareholder returns into the next 12–18 months? That’s imperative to know, given the current investment landscape. A deeper dive into these factors driving medical technology (“medtech”) stocks in 2022 reveals probabilities are tilted to the downside. Our findings indicate the risk/reward calculus for CVRX as an equity portfolio holding lacks conviction and capital may be best preserved for other opportunities. We are on the search for long-term cash compounders that feed high amounts of free cash below the bottom line. We haven’t found examples of this with CVRX. Rate neutral on these points.

Macro-picture illustrates headwinds for portfolio positioning

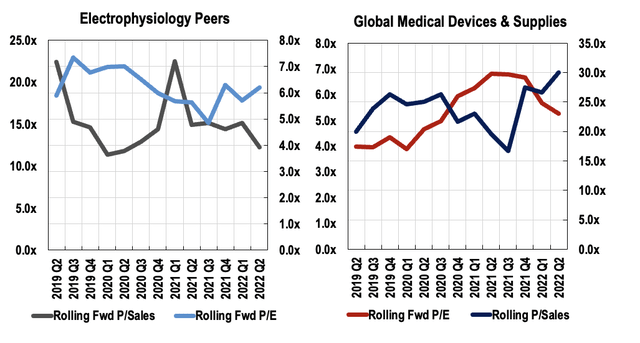

The high-beta and growth trade has unwound itself in 2022. A gathering of macro-pressures has seen a massive investor de-risking, exacerbating directional moves across asset classes. This asymmetry in risk assets has widened so far in June. Valuations have taken a further bearish stance – US medtech stocks included. The global medical devices & supplies sector is currently priced at a median 26x P/E, down from 29x in Q1 FY21 (Exhibit 2). It’s also valued at 4.6x FY22 sales estimates, lower than 6x in Q1 last year. The electrophysiology portion is trading at a median 18x P/E and ~5x forward sales.

Equity valuations in the sector are at risk from earnings and profitability standpoints. We see this at the company level. Instead of focusing on top-line growth, the priority is now on margins and growth towards the bottom line. Growing EPS and FCF is therefore paramount, we’ve noticed. However, this presents an immediate challenge. Earnings growth within medical devices and pharmaceuticals would counter the Fed’s attempts to tighten inflation. This leads to a potential virtuous cycle, where pricing power within the space could be potentially capped, directly hurting margins instead.

Exhibit 2. Sector & Sub-sector trends Q2 FY19′ – present

Note: Adjusted for exclusion/inclusion criteria. Date Q12019–20/06/2022. Data: Bloomberg, Value Line. Image: HB Insights

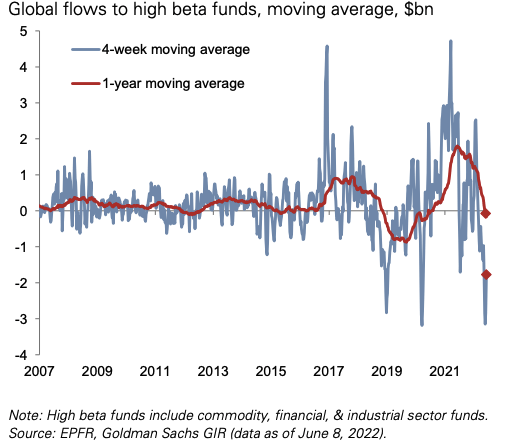

Exhibit 3.

Image: Goldman Sachs Investment Research 2022

Investors are repositioning to absorb macroeconomic headwinds, systematic risks and protect capital. Top-line fundamentals have become less important, whereas cash flow is becoming increasingly important. This is a key risk for CVRX. Its management reiterate ~55–76% growth at the top for FY22, certainly high growth for the year. However, we’ve modelled the company’s net losses to increase to $44 million in FY22 ($29 million worse than FY21). CVRX’s negative CFFO and high R&D expenditure are also constrictive to profit margins. It printed a R&D Margin of 56% on a T12M basis last quarter. We argue this stems from its concentration in one source of value. CVRX’s revenue isn’t distributed across many segments – it is concentrated in Barostim. In comparable situations (1 SKU), it requires a high speed of innovation to protect against the core product. Arguably, this is the case with Barostim, which creates the dilemma of profitability.

Market sentiment is also poor in the medtech space, with ETFs and indices tracking the sector each suffering double-digit declines in 2022. Put simply, investors have a lower appetite for longer duration and unprofitable companies at the moment, as less defensible names get pounded on the charts. Hence, we firmly believe positioning to absorb macro headwinds of inflation and duration risk is paramount.

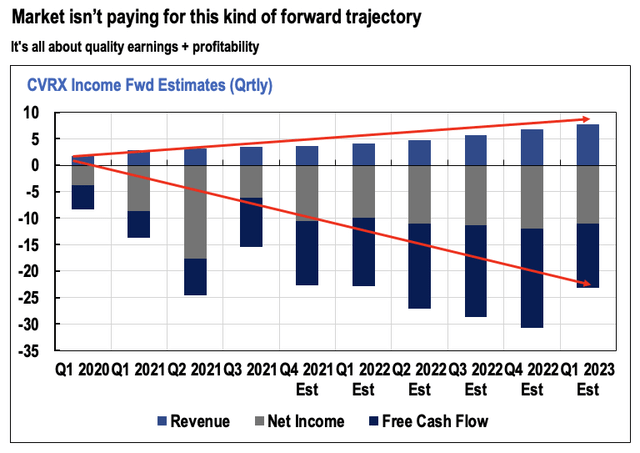

Exhibit 3.

Data: CVRX SEC Filings. Image & Projections: HB Insights

Question is, how can CVRX withstand these pressures? Can investors hedge inflation risk and lower their equity duration with CVRX? With potential pricing power in the HF segment via its Barostim business, arguably so. Procedure volumes and patient turnover have also more than normalised to pre-pandemic levels. Moreover, growth trends look to continue this way as several global markets reopen their hospital systems. In addition, the medtech industry today is far more robust and defensible compared to 2009 (last liquidity crisis). Incremental product innovation, coupled with an upward shift in standards of service delivery has seen tremendous growth in end-markets. The integration of technology and artificial intelligence into the sector has also seen cost savings at the patient and manufacturer level, fuelling additional growth.

Exhibit 4. Med-tech loses equity premium

Note: IHI vs 10-yr minus IHI spread. Data & Image: Bloomberg. Annotations: HB Insights

However, hospital capital budgeting may tighten amid the new interest rates regime. Some forecasts have budgeted a 3–6% decline YoY in outpatient volumes, 4% gain in net operating revenue and a 5% gain in operating expenses for FY22. Moreover, supply chain and inflationary impacts have yet to take full force, by estimation, and we haven’t got full gauge on how CVRX will manage these. Specifically, shortages at key points along the life sciences supply chain – such as semiconductors – have proven to be major challenges in the medtech space in 2022. Whilst CVRX re-iterated full-year guidance last earnings, this has yet to be fully de-risked from a macro-risk perspective, in our estimation.

Moreover, spiking rates will continue to hurt earnings and valuations in the space, as mentioned. With a series of negative EPS forecasts into the coming years, there’s a lack of flesh to put on CVRX’s skeleton here. CVRX’s WACC came in at 10% last quarter, largely of equity, however ROIC and ROA came in at -32% each, respectively. Its path to profitability therefore remains murky by our estimation, and what’s more, the market looks to have fully discounted any growth levers from the Barostim segment in the near term (discussed below).

In that vein, we argue that the combination of higher input costs, supply chain pressures, tightening gross–net margins and higher base rates puts a risk to CVRX’s ability to sustain margins and compound earnings growth into the future.

Barostim narrative appears well priced in

The long-term investment debate for CRVX is no doubt underpinned by the efficacy and economics of Barostim.

A quick recall: the device works by electrically activating the arterial baroreceptor (stretch) reflex to restore the autonomic dysfunction seen in patients with HF. It sends persistent electrical pulses to baroreceptors in the carotid arteries, inducing a neurological response to modulate cardiovascular function. Its effectiveness is corroborated by numerous clinical studies in improving quality of life in patients suffering from HF and other cardiovascular conditions.

In fact, a paradigm shift in resistant HF treatment has pushed therapy towards devices such as Barostim Neo. There’s a need to overcome donor heart shortages, longer transplant waiting times and transplant ineligibilities. Barostim has evidence proving its conceptual efficacy from as early as 2014. The Barostim Neo has been shown to be particularly safe and effective in patients with HF and reduced ejection fraction. Literature up until 2022 shows that Barostim reduces sympathetic neuronal activity (“MSNA”), hospitalisation rates & days, and 6-minute walking outcomes, each key outcome measures in HF treatment. There’s equally as strong evidence to suggest Barostim to be effective for lowering blood pressure in resistant hypertension (“RH”) patients with renal failure.

Exhibit 5. Barostim Neo Generation (2).

Data & Image: Groenland E & Spiering W; Current (2020); Hypertension Reports volume 22, Article number: 27 (2020)

The device is primarily marketed towards prescribers – electrophysiologists, HF specialists, vascular surgeons, and general cardiologists. However, hospitals are the main account holders, and all assessment of Barostim’s economics needs to be geared at hospital sales, budgeting, and patient turnover. Moreover, providers are incentivised to utilise the implant due to favourable reimbursement as well. We estimate that ~67–70% of the CVRX’s HF market is eligible for reimbursement under Medicare based on its clinical indication. Management notes it has focused on coverage by the CMS and continues to engage commercial payors. All auto-coverage denial policies for current PCT codes have been retired and hence hospitals can be paid for Barostim procedures. CVRX also has reimbursement in Germany and other sections in the EU.

The case therefore rests on the stock’s sensitivity around good news on Barostim and how disproportionate this upside/downside might be. To illustrate, on 9 May, the FDA and CVRX announced that Barostim received compatibility for use in MRI scan, a huge upside catalyst for the device as the ability to have an MRI greatly increases the appeal of its long-term uptake.

However, the market’s reaction was mute. No jump in the share price, or in volume. This suggests that all potential upside from Barostim has already been priced into the stock. Moreover, the larger systematic risks appear to have immediately offset the potential upside to be realised from the announcement. This brings us back to the points raised on CVRX’s unprofitability, etc. and how the market is positioning to absorb the macro-headwinds. Without the robust fundamentals to underscore its Barostim story, investors continue to overlook the name in favour of names with more favourable company metrics.

Full-year guidance isn’t fully de-risked

Q1 sales came in strong with a 43% YoY growth schedule to $4.1 million, driving a net loss of $0.49 below the bottom line. Gross margin was ~620bps higher YoY whilst net loss was ~$6 million, down from $17 million sequentially. On these results, it printed a FCF loss of $9.4 million.

Results were ahead of consensus, and with strengthening momentum management reiterated FY22 guidance. It forecasts high growth of 53–76% YoY revenue growth, calling for $20–23 million at the top. It folds in ~$5 million of Q2 FY22 sales in this outlook with FY22 gross margin of 74–76%.

On that note, we firmly believe CVRX’s FY22 guidance hasn’t correctly priced in the potential for a discount to forward earnings. Numerous systematic risks are set to impact unprofitable players in the medtech space. Without a diversified portfolio of long-term cash compounding assets, it’s also difficult to add an earnings premium to CVRX’s guidance.

Our modelling projects the company to realise a period of losses into FY26, remaining FCF negative until that time (Exhibit 3). We project CVRX to carry FY22 sales down to a net loss of $44 million in FY22 and a $46 million net loss in FY23. Whilst the forecasts for its top-line growth are noted, we also note the market has unwound its growth trade, focusing more on bottom-line fundamentals as mentioned. We also see the headwinds of cost inflation and supply chain fears (shipping, logistics and input costs) as incremental negatives to CVRX’s margins and earnings growth.

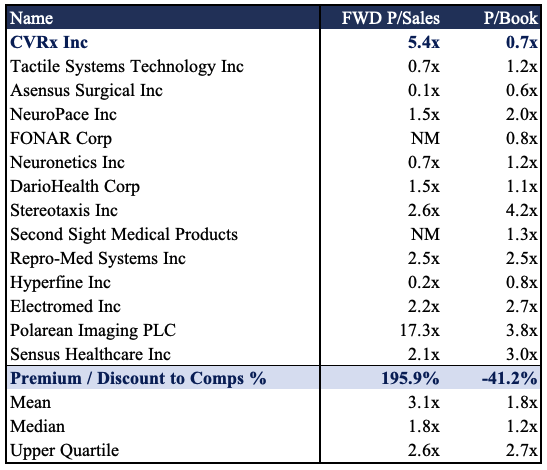

Valuation

Shares are trading at ~8.8x sales and are priced at 5.4x our FY22 sales estimates. CVRX also trades at ~0.7x book value, and trades at a discount to its GICS Industry peer median on both of these values. The debate of valuation hinges on one of tangible value, however. This is part of where the case unravels, by estimation. Shareholders claim -$41 and -$42 in CFO and FCF per share, respectively, and hence receive negative yields on both of these. The company does have $8.40 in T12M cash flow per share, and ~$7.60 in book value per share. The share is heavily overvalued on 5.4x forward sales – and that’s us pricing the stock ahead of the sell-side’s 4x FY23 revenue. Aside from this, performing a DCF on CVRX’s sum-of-the-parts valuation methodology, there’s a lack of realisable value for shareholders. However, until further clarities gained on the macro-front, this is a fruitless exercise by estimation.

Exhibit 5. Multiples & Comps analysis

Data & Image: HB Insights

The analysis is best performed on a probability-weighted basis; however, the problem is there’s any which number of variables impacting outputs 10-years, let alone 5-years down the track. It again comes back to the central theme of profitability and earnings quality, two factors in which CVRX is lacking currently. Again, the possibility of success in its Barostim segment is high; however, the probability of CVRX incurring further losses is equally as high. That’s not what the market is paying for the time being.

In short

There are more opportunistic names available within the medtech space right now over CVRX by estimation. There is long-term value in its Barostim segment; however, in terms of the current market’s demands, it doesn’t stand up by our finding. Most crucial to the debate is CVRX’s lack of profitability, and more so, the lack of visibility on how it intends to reach profitability.

Despite forecasted revenue growth, the market has stopped paying exorbitant premiums for top-line growth and is instead focused on stripping out quality names to position for the macro-climate. That’s one of higher inflation and surging rates, supply chain pressures and greater uncertainty. With that, we reckon there’s a risk CVRX management’s guidance outlook isn’t sufficiently de-risked to reflect these pressures. Rate neutral.

Be the first to comment