onurdongel

Introduction and our thesis

I’m a firm believer in the growth prospects of fertilizer stocks, following the latest relevant news almost daily and trying to keep our finger on the pulse. Since the beginning of the year, many companies in this sector have risen very quickly – which is not surprising, since judging by the latest news, the world is facing the threat of world hunger.

- This year’s U.S. red winter wheat crop “was the lowest since 1963.” But in 1963, there were only 182 million people living in the U.S. – today there are 329 million;

- California’s rice crop is expected to be half that of a normal year;

- Nearly 3/4 of all U.S. farmers say this year’s drought is hurting their crops;

- Due to the endless drought, total cattle numbers in Texas, Oregon, and New Mexico are down 50%, 41%, and 43%, respectively;

- China is facing the worst drought it has ever experienced in human history, according to the Washington Post;

- India typically accounts for 40% of the world’s rice trade, but we are warned that the country’s production will drop significantly in 2022 due to “significant rainfall deficits in key rice-producing states.”

- Demand at U.S. food banks is even higher now than at the height of the COVID pandemic.

I have listed here only a part of the latest news that reaches us daily from different parts of the world. The logical question is: How can we, ordinary retail investors, profit from this horrible trend?

My answer (and also thesis) is quite straightforward – buy an American fertilizers manufacturer, namely CVR Partners (NYSE:UAN).

Why do I think so?

CVR Partners engages in the production and sale of nitrogen fertilizer products in the United States, offering ammonia products for agricultural and industrial customers; and urea and ammonium nitrate products to agricultural customers, as well as retailers and distributors.

According to ThyssenKrupp, agricultural crops may require about 20-350 kilograms of nutrients per hectare during their development. But the necessary nutrients are often lacking in the soil due to various factors.

1) They are not present in nature in sufficient quantity;

2) They are displaced by leaching or removed by harvesting.

In this case, only the supply of plant nutrients through fertilization can compensate for the deficiency and ensure future cultivation.

What CVR Partners and its peers produce is a necessity in our time – they produce a product that cannot be replaced under current conditions because nitrogen fertilizers increase the yield and quality of agricultural products.

However, the production and consumption of this type of fertilizer – nitrogen – are quite heterogeneous. On September 14, I got my hands on a study by Bank of America, which shows the actual data for 2020:

Bank of America, Global Agriculture Primer: food security at spotlight [14 September 2022]![Bank of America, Global Agriculture Primer: food security at spotlight [14 September 2022]](https://static.seekingalpha.com/uploads/2022/9/28/49513514-16643401100728672.png)

What do I mean by heterogeneous? Look at how much countries produce and consume of the total. The U.S., for example, obviously produces less than 5% because it is not listed in the chart, but it consumes about 6% of the total world production. In terms of population, that’s about the same as China, but China produces 29% of the world’s total and can be self-sufficient while exporting some of the fertilizer (about 10%, see below).

Bank of America, Global Agriculture Primer: food security at spotlight [14 September 2022]![Bank of America, Global Agriculture Primer: food security at spotlight [14 September 2022]](https://static.seekingalpha.com/uploads/2022/9/28/49513514-1664341757793021.png)

The U.S. imports 41% of total nitrogen consumption, second to Brazil (~100%), according to BofA. So what’s the application for us?

In the first chart above, you can see that production capacity in this industry is not going to grow fast enough until 2025 – we see something similar to what we have seen in the upstream oil and gas industry in recent years.

And now, with this information in mind, let us take a look at how Europe has been affected by the energy crisis this year (the infographic below was created without taking into account the recent news about the accident on Nord Stream’s main pipeline):

Sylvia Tranganida [Twitter account: @ICIS_Sylvia]![Sylvia Tranganida [Twitter account: @ICIS_Sylvia]](https://static.seekingalpha.com/uploads/2022/9/28/49513514-16643425498360326.jpg)

After recent events, Europe is “bloodless” – unfortunately, there is no other way to express it. Due to rising energy prices, the main nitrogen fertilizer production plants have been temporarily closed, as is typical for all heavy industries there. However, there are more than 750 million people in Europe who go hungry every day – a need far more important than a Netflix (NFLX) subscription or buying a new Apple Inc (AAPL) iPhone. People in the old world will be forced to pay any price to supply themselves with the nitrogen they lack, driving up prices on the world market and thus attracting export flows from countries that do not have such problems.

The flows of nitrogen will rush there, and we will most likely see a discrepancy between fertilizer prices there and in the U.S., where production is not ceasing but, on the contrary, flourishing.

Put yourself in the position of an exporter. You have 2 places to sell – one will give you $10 and the other will give you three times that (a conditional example). Which place will you choose to sell your goods? The answer seems obvious – you choose Europe.

So the U.S. is at risk of being without a significant portion of its fertilizer supply – especially if dry bulk shipping rates rise again, as they did during and post-COVID periods. And they can rise – China has every chance of lifting the lockdowns completely, and Europe will try to charter as much as possible because the number of ships is limited (you need to import what you did not produce yourself).

Thus, limited supply in the U.S. domestic market creates a favorable environment for a) growth in the volume of sales by domestic producers and b) growth in the prices of products sold, which is already happening.

Rabobank is out with a forecast that nitrogen fertilizer prices on a wholesale basis will be up 20-30% by the end of the year. Now, the headline is that “The US and Brazil can expect a Healthier Supply of Fertilizer than last year,” with the lead that potash and phosphates will be more plentiful and cheaper. Only then do they mention nitrogen. So other headlines could be along the lines of “Fertilizer prices going down,” even though they are projection the opposite for nitrogen. And even at their low end, that would put prices over last Spring’s high and up to $690 per ton of UAN and $1560 for ammonia.

While we certainly don’t need any price increases at all to get over $60 of distributions in 2023, this is the first (that I know of) investment house price deck that doesn’t have nitrogen fertilizer prices falling off a cliff starting tomorrow. I suspect that there will be more to come, albeit slowly.

Source: Publius’s recent comment based on Agriculture.com

Publius, who follows this market daily and shares his thoughts with readers of his article – there are already over 23 thousand comments – predicted a while ago that CVR Partners will probably distribute $40 per share next year, and now he gives an indication of a possible $60. This corresponds to a return of approximately 33% and 49% respectively compared to yesterday’s closing price. And if the macroeconomic developments I described above unfold, CVR Partners will likely attract enough high-yield-seeking investors to at least double in price. But why I’m talking about doubling?

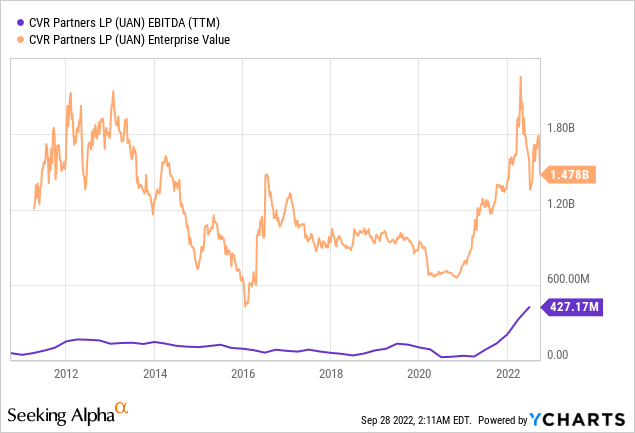

First, entering a new bull cycle, CVR Partners has generated significantly more EBITDA than ever before. At the same time, the enterprise value, market cap + net debt, is now about the same as the last favorable cycle, which I think reflects the unfairness of the current valuation.

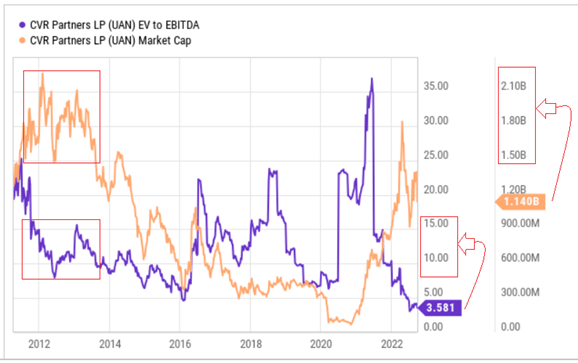

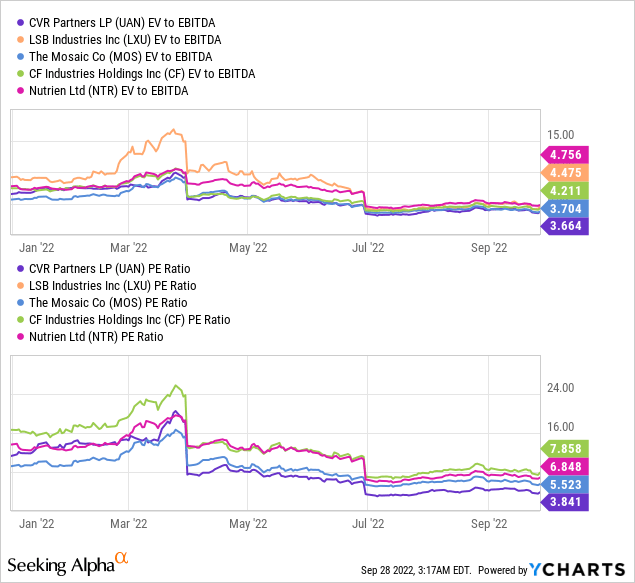

Second, my above conclusion is supported by concrete valuation multiples. At the peak of the last bull cycle, UAN was trading in the 8-16x range on EV/EBITDA (TTM), while now it is only a fraction of that (~3.6x):

YCharts, Seeking Alpha, author’s notes

Given the impact of debt, which is now twice as large on the company’s balance sheet as it was then, the enterprise value of CVR Partners should be over $2.5bn if market multiples return to their averages.

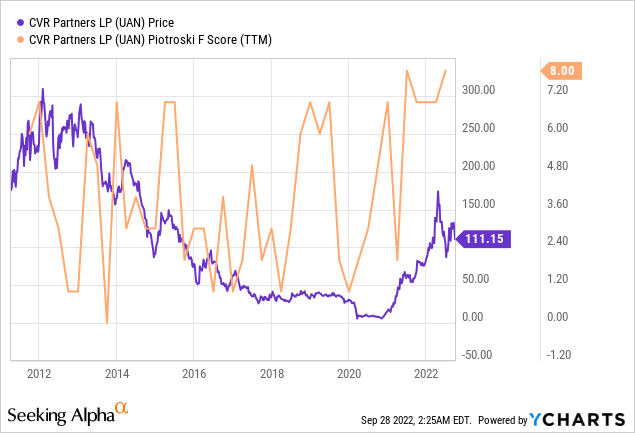

Third, CVR Partners appears to be very strong from a fundamental perspective, which is not yet reflected in its price. The Piotroski F-Score, which reflects the dynamics of profitability, creditworthiness, and operating efficiency (9 criteria in total), shows a rapid improvement since the beginning of the cycle – the company has never managed to reach today’s 8 points.

In my humble opinion, these three arguments are already enough to imagine how great the potential of this stock is.

UAN stock is up more than 30% YTD – why is it considered contrarian to buy it now?

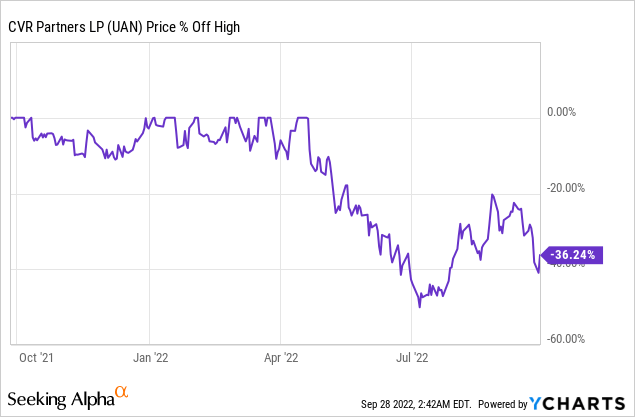

First, despite all the YTD growth, UAN has fallen 36% from its peak in 2022 – at one point, due to the panic in the stock market, some investors began to actively close their profitable positions, taking only a fraction of what is really fundamentally embedded in the company’s business.

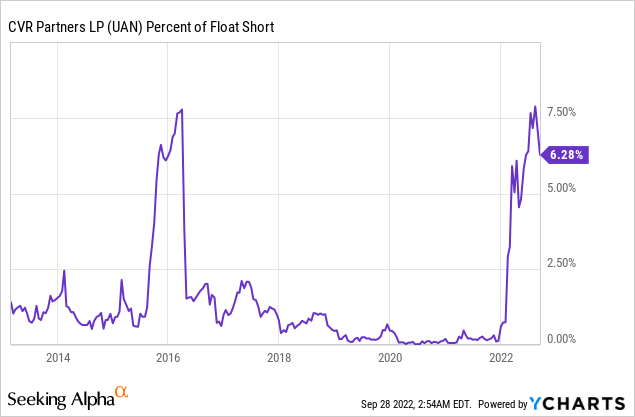

Second, the aforementioned sell-off was heavily influenced by the company’s very low liquidity. According to Investing.com, the average daily turnover is about 89k shares, which corresponds to a value of ~$9.9M. With a market capitalization of $1.14 billion, this is very weak. And by historical standards, UAN is now under very high pressure from short sellers.

It’s also worth saying that UAN has been overlooked by hedge funds – Publius recently clarified this point in more detail in one of his comments:

Most hedge funds are structured as partnerships. So they have to issue their K-1 by March 15 each year. If they don’t get K-1’s from any partnerships that they own well in advance of that, they can’t issue their K-1’s on time. That may not seem like a big deal, but it is. They can’t take the chance that their own K-1’s will go out late.

But the UBTI is an even bigger deal. Almost all hedge funds market themselves to a wide swath of investors, most importantly pension funds, but including big charities (think Harvard’s $35 billion dollar endowment). These investors will not invest in a hedge fund if there is ANY UBTI coming out of it. So the hedge funds basically can’t buy CVR, period.

Having said that, I know of at least 3 hedge funds that currently own CVR, based on private messages to me. That is a tiny number, but I just wanted to point out that there are “some.” But I would not expect hedge funds to be the ones who drive up the price of CVR. That will be family offices and retail investors.

I can only agree with him, using the example of the family office where I myself work. We hold a very large stake in UAN based on all the above factors and internal financial models that I am not allowed to make public. However, we would not hold UAN if our own calculations were not roughly in line with those who are bullish on this company.

Bottom Line

Of course, risks cannot be eliminated. The above reasons why this is still a contrarian buy idea are the main risks that CVR Partners could lose to its competitors in terms of return potential. Opportunity cost risk is high as UAN may not be the most obvious choice due to the current macroeconomic situation – it is widely recognized in the industry that CF Industries (CF) is a much more obvious and promising pick among others.

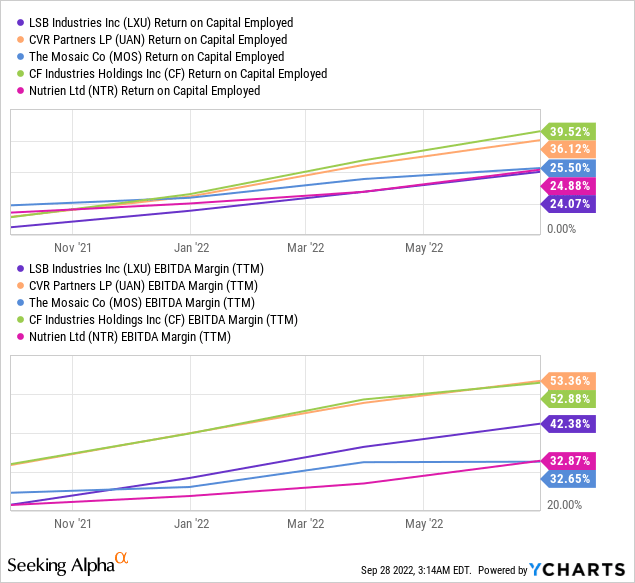

However, I like CVR Partners more because its cost structure, unlike LSB Industries (LXU), for example, allows the company to maintain a fairly high margin and thus profitability ratios.

And at the same time, UAN appears undervalued compared to other companies, including CF, in terms of EV/EBITDA and P/E metrics:

I reiterate my earlier buy recommendation I gave in early June – the share price is up only slightly in light of yesterday’s violent rally. But the dividend yield shows my recommendation in positive territory, which is good.

Seeking Alpha, my previous call on UAN [1 June 2022]![Seeking Alpha, my previous call on UAN [1 June 2022]](https://static.seekingalpha.com/uploads/2022/9/29/49513514-16644259481631985.png)

I hope there’s more to come! Would love to see what you think of this in the comments below! Thank you.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment