Vladimir Zakharov/iStock via Getty Images

Investment Thesis

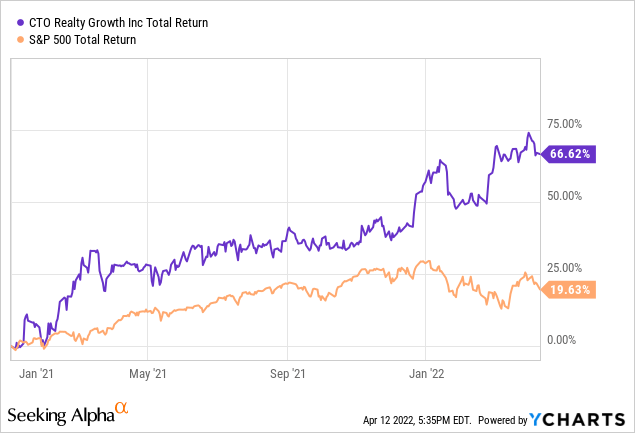

CTO Realty Growth (NYSE:CTO) is the successor of Consolidated Tomoka Land Co. after its conversion to a REIT in 2021. Since its conversion, the REIT has disposed of almost all of its legacy holding and has positively transformed itself into a completely new direction. Since then, the company has generated a substantial total return of 66.6%, including a $4 annual dividend, almost 3.5 times the S&P 500’s 19.6%.

With funds from operations (FFO) of $3.35 and adjusted FFO (AFFO) of $4.36, the company’s forward and TTM based price to FFO and AFFO ratios, along with other relevant valuation metrics, are well below the industry median, providing a good margin of safety for potential investors.

For income investors who’re looking to invest in a REIT stock with good growth potential and price returns, CTO is definitely worth a look.

Company Overview

During the pandemic, Consolidated Tomoka Land Co., over a 100-year-old landholder and real estate developer, converted into a retail-oriented REIT, CTO Realty Growth. It owns and manages 22 commercial real estate properties (9 single and 13 multi-tenant) in 10 states of the United States, sometimes utilizing third-party property management companies. In addition to property income which accounted for 72.1% of 2021’s total revenue, the company has the following 3 revenue streams:

- Management Services: Management income is generated through Alpine Income Property Trust, Inc. (PINE), where the company also holds a 15.6% stake, an investment of $41 million at fair value. Revenue accounted for 4.7% of 2021’s total revenue.

- Commercial Loan & Master Lease Investments: A portfolio of two commercial loan investments and two commercial properties, included in the 22 commercial real estate properties above. Revenue accounted for 4.1% of 2021’s total revenue.

- Real Estate Operations: A portfolio of subsurface mineral interests associated with approximately 370,000 surface acres in 19 counties in Florida. Revenue accounted for 19.1% of 2021’s total revenue.

Post-Conversion Strategic Performance

The company’s strategy departs from the usual REIT strategy of acquiring top-notch properties to maximize returns and focuses on monetizing and reinvesting low cap rates, single-tenant properties, and non-income-producing assets.

Its growth-market-oriented strategy is based on accretive acquisitions and dispositions, acquiring properties with low replacement costs in lucrative markets, and investing in them to attract tenants. Accordingly, In 2021, CTO transformed its post-conversion portfolio by selling 15 properties, mostly single-tenant, for $162.3 million, generating aggregate gains of $28 million, and acquiring 8 multi-tenant income properties in Sun Belt states for $249.1 million.

Both transactions resulted in a weighted average cap rate of 6% and 7.2%, respectively, resulting in overall accretive income growth of 1.2%. Additionally, the company’s recycling of non-income-producing properties into income-producing properties through investments is an accretive action that will generate sustainable future cash flows.

CTO expects to invest $225 million at the midpoint in 2022, more than double the $103 million in 2021, on acquisitions and structured investments with a targeted initial investment cash yield of 6.5%, generating sustainable returns toward the company’s 2022 AFFO guidance of $5.025 at the midpoint aided by a healthy occupancy rate of almost 93%, representing a 15.25% YoY growth.

Further, CTO has declared a $1.08 quarterly cash dividend for the year ($4.32 annualized dividend), representing an annualized dividend yield of 6.74% and a forward AFFO payout ratio of 86%. The REIT’s dividend is expected to grow sustainably based on its positive income and cash flow growth prospects.

Balance Sheet

CTO’s balance sheet could improve, but it doesn’t contain any material risks. Its long-term debt of $283 million comprises $67 million outstanding under its revolving credit facility, a $65 million term loan due in 2026, a $100 million term loan due in 2027, and $51 million against the 3.875% Convertible Senior Notes due in 2025.

The long-term debt to Assets ratio of 36.57% and total debt to equity ratio of 64.69% fall below the industry median of 41.38% and 93.82%. Sufficient interest coverage of 1.82 and a little over 46% levered FCF margin are also good indicators that the company has its leverage and gearing under control.

With the above metrics, it’s apparent that CTO utilizes the lower cost of long-term debt finance to build its portfolio without jeopardizing its fundamentals.

Valuation

With TTM based price to FFO and AFFO, 5.3% and 24.3% lower than the industry median and forward price to FFO and AFFO, 14.5% and 32.7% lower than the industry median, respectively, the stock appears to be undervalued. Similarly, the PS, PB, PCF, and price-to-rental revenue are all below the industry median. The amalgamate target price based on the median of CTO’s figures and industry medians comes out to be $78.14, an upside potential of almost 22%.

Based on relative valuation metrics, CTO stock is being traded at a discount and adding in the dividend yield; the total returns appear amply attractive.

Conclusion

The company has only had one full year of operating as a REIT, and consistency in its performance needs to be seen. However, CTO’s new direction appears to be taking off, and its new strategy is working out well. The company’s total returns are likely to reward the investors with growing dividend payouts and the upside price potential, especially at the current price point.

The income statement, the balance sheet, and the valuation metrics seem to favor CTO stock, making it a good buy for potential income investors.

Be the first to comment