solarseven

Investment thesis

CS Disco (NYSE:LAW) is a legal tech company trying to reshape the huge legal services industry. For a few quarters since the middle of 2021, it seemed that the company has shifted into a higher gear and experienced exceptionally strong revenue growth (see my previous analysis on this period and a detailed introduction to Disco’s products here). With the release of Q2 22 earnings back in August, it has been definitively revealed that this exceptional growth was partly the result of a few big-ticket deals, which hasn’t been fully communicated by management in my opinion (see my analysis on the topic here).

Recently published Q3 earnings raised even more questions, which haven’t been fully discussed by company management again in my opinion. I think with the recent two disappointing quarters, Disco shares have lost their appeal as a sound investment, especially in the light of vague communication of management. For these reasons, I change my Hold recommendation to Sell until there is no significant turnaround in sight.

Stagnant revenue growth even after one-offs

CS Disco reported results for its Q3 22 quarter recently. The results have been eagerly awaited by the investment community after the shares tanked more than 50% following Q2 results and more than 30% since then. Back then, the large drop in the share price was caused by a sudden drop in revenue growth, which manifested in an annual guidance cut of ~11% from an already ultraconservative guide. Management blamed this on the underperformance of one specific product (Disco Review, used partly for larger legal reviews), where a few big-ticket deals didn’t materialize like in the preceding quarters. Q3 numbers showed that this tendency didn’t change, and a general slowdown is possibly also impacting the business. I think investors didn’t get the full picture from the accompanying earnings call that not only the review product is suffering growth headwinds, but possibly the core business as well.

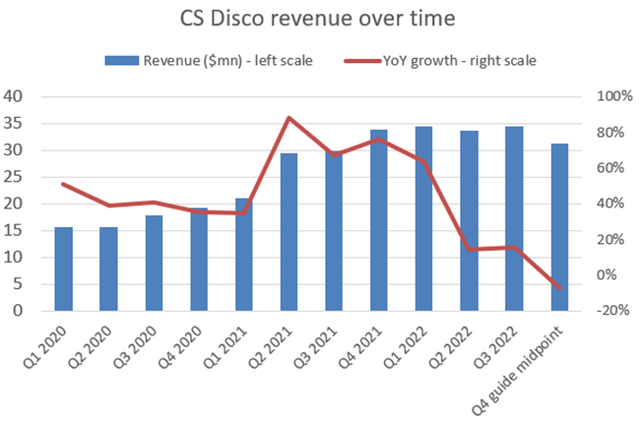

Looking at Q3 numbers, Disco reported revenues of $34.5 million, which surpassed management guidance by $1.5 million. It is important to note that the bar was set quite low previously as the $33 million midpoint of the guidance equaled to decreasing revenues by 2 percent QoQ. The current guidance for Q4 was set extremely conservative again with $31.3 at the midpoint representing -9% decline in revenues QoQ. Looking at recent revenue trends and taking all this information into account reveals a quite disappointing picture:

Created by author based on company fundamentals

Annual revenue growth of 60-80% has diminished quickly, turning into stagnation recently. Based on the Q3 earnings call transcript, management still seems to blame this mostly on the underperformance of the Review product:

“Look, I think there are some challenging headwinds in our business, the principal one being the shortfall in large review matters that began in Q2 and continued in Q3, and it’s especially challenging from a comp point of view, given that we have such elevated usage in the form of those large review matters for about a year going into Q1 of this year. That’s kind of the principal thing that we’re seeing that we did not expect.” – Kiwi Camara, CEO on Q3 earnings call

In my opinion, the problem with this is that based on Q3 numbers and Q4 guidance the flagship product of Disco, Disco Ediscovery (accounting for ~75% of revenues) is also experiencing growth headwinds. I suspect this from Q2 and Q3 revenue numbers, which didn’t include meaningful amounts from large Review deals (meaning they consisted mostly of Disco’s core Ediscovery business) but showed only 2.4% increase QoQ. Extrapolating this for a whole year would amount to annual revenue growth of ~10%, and I didn’t take the company’s conservative Q4 revenue guide of -7% QoQ into account. This would mean a remarkable slowdown from the 30%+ annual growth rate for the Ediscovery product called out by management on recent earnings calls. Unfortunately, this topic hasn’t been discussed more deeply on the Q3 earnings call. With this, I think investors may have not gotten the whole picture that beyond the Review business there could be a slowdown in the core ediscovery business as well.

During previous calls, management suggested that revenue from ediscovery solutions is not closely related to economic cycles, but currently, this doesn’t seem to be the case based on the revenue dynamics described above. Even if the company beats its largely de-risked Q4 guidance by ~10% like in the good old days, we would still see stagnant revenue growth, which doesn’t mean a good setup for 2023. Considering the fact that management will provide guidance for 2023 together with publishing Q4 numbers, I am afraid that a further significant disappointment could be in store for investors. Currently, analysts expect 17% YoY revenue growth in 2023 from the company, which seems overly optimistic in light of the revenue trends discussed above.

To highlight some positive things in Q3 earnings as well, customer count grew by 5% QoQ to 1,318, which seems to be a similar pace like in the preceding two quarters. Furthermore, gross margin improved to 76% from previous quarter’s 74%, which is also good news, but not enough at all to turn the tide in my opinion.

To sum it up, one problem at Disco is that a large and very volatile revenue component (Disco Review) diminished in the past two quarters, and no one knows what to expect on this front in the future. I believe that the current standpoint of management is that to prepare for the worst and hope for the best. The other problem on the top of that is that a slowdown seems to emerge in the core, ediscovery business. We currently don’t know much about the details, but this is increasing the uncertainty surrounding the business further.

Margins fell victim to declining revenues

As revenues turned flat in recent quarters, expenses at the company continued to grow. This resulted in growing losses and a seriously deteriorating margin profile:

SG&A and R&D expenses grew from quarter to quarter recently, resulting in a $20 million operating loss both in the Q2 and Q3 quarter.

Thanks to this, the company’s net margin suffered a significant downturn, reaching as low as -45% recently:

After the disappointing Q2 results published in August, management was still optimistic that the increased level of investments can be maintained:

“We are continuing to invest in our business and scale the organization to capture the opportunity in front of us. ” – Michael Lafair, CFO on Q2 earnings call

However, after posting QoQ flat revenue numbers again in Q3, I think management decided to dial back investments as the current trajectory of fundamentals would not have been sustainable anymore:

“As Kelly mentioned, since our IPO, we have significantly invested in the business across every major function to attain the scale we believe is needed to drive our increasing penetration of the market.

Going forward, we believe these investments give us the resources we need to achieve our growth goals. As part of our march towards profitability, we are planning for EBITDA margin improvements in 2023 and beyond. We will provide more details on this and our outlook for 2023 on our Q4 earnings call next year. ” – Michael Lafair, CFO on Q3 earnings call

As stated in the last sentence, investors will have to wait until the Q4 earnings release next year, when Disco plans to share more details on their cost reduction/margin improvement plan.

The company has $213 million cash on its balance sheet, which is enough to finance the current $10-15 million quarterly operating cash burn for a while. The business model is not sustainable in this form in my opinion, so a credible turnaround plan should be presented by the company soon.

Valuation

In light of the previous discussion on fundamentals, I think there should be less emphasis on valuation than usual, as there are basic question marks around the core business model. After the large fall in the share price in recent months, shares trade at 3.4 times 2023 expected revenues. In comparison, the S&P 500 (SPX) trades at a ratio of ~2.2, which is still 35% lower, offering a more predictable growth trajectory even under current uncertain macroeconomic circumstances.

As I mentioned earlier, 2023 revenue expectations for Disco seem currently too optimistic in my opinion. If these were reduced after Q4 earnings, valuation would deteriorate further assuming a constant share price. This makes me conclude that the current valuation is not depressed enough to reflect the uncertainties around fundamentals and my assumed lack of clear communication from management.

Risk factors and conclusion

Within a few quarters, the fundamentals of Disco materially deteriorated. Although management tried to communicate even during the good times that the usage-based nature of the business could lead to more than usual revenue volatility, they didn’t share some information with investors in my opinion that turned out to be game-changing afterwards (standalone performance of products, especially Disco Review). It seems to me that this attitude didn’t change materially since then, which poses a strong risk to investors in my opinion. I understand that there is information, which CEOs don’t like to share due to competitive reasons, but I think Disco management is pushing too hard on this front.

The combination of this, and a quickly deteriorating fundamental picture is a red flag in my opinion, even if it turns out that the company is able to achieve profitability and steadily growing revenues at the end. Currently, I think we are too far from this point, which leads me to assign a Sell rating to the stock.

Finally, the release of Q4 results and the accompanying guidance for calendar year 2023 is a further important risk factor in my opinion. Management used to guide in an ultraconservative way and if they see that revenues in the past three quarters have been flat, I think they would guide much lower than the current analyst consensus of 17% YoY revenue growth.

Due to these reasons, I think there could be still significant downside potential for the shares, especially in light that valuation is still not depressed enough. Even if some additional revenue from Disco Review would emerge during the Q4 quarter, investors couldn’t count on this for the long run, leaving them still waiting for management to shed more light on the business.

Be the first to comment