Bitcoin, El Salvador, Ether, Litecoin, Crypto, AMC – Talking Points

- Bitcoin initially struggled following adoption in El Salvador, S&P cites credit risks

- AMC announces it will accept Ether and Litecoin at movie theaters

- SEC regulatory risk remains, Chair Gensler calls many cryptos “securities”

Cryptocurrencies appear to be moving more mainstream by the day, as additional retail chains announce they will accept cryptos as payment. AMC, the darling of many meme stock traders, recently announced that they would accept both Ether and Litecoin at its theaters, further plunging alt-coins into the limelight. AMC’s plans will see the chain accept 4 cryptocurrencies as payment, Ether (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and Bitcoin (BTC).

Bitcoin Daily Chart

Chart created with TradingView

Bitcoin notably struggled on September 7th when El Salvador officially began accepting the crypto as legal tender. S&P Global noted that the adoption by El Salvador has immediate negative implications for the struggling economy, with potential risks far outweighing the benefits. In the wake of the adoption, government bond spreads to similar US Treasury securities continue to widen as domestic credit risks become more apparent. The adoption of Bitcoin alongside the US Dollar also threatens El Salvador’s ability to source funds from the IMF, where US votes typically carry the most weight.

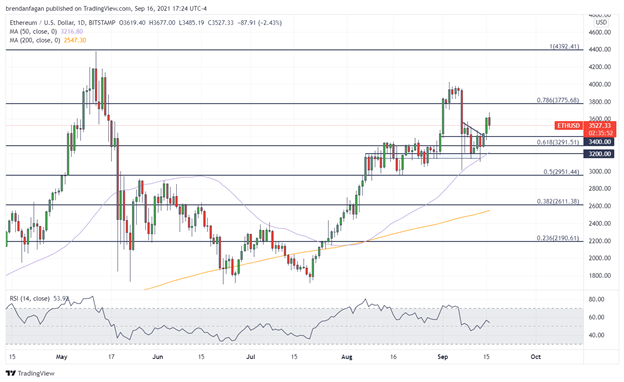

Ethereum Daily Chart

Chart created with TradingView

The regulatory risk surrounding the crypto space remains heightened, with SEC Chair Gary Gensler remaining adamant that many coins can be classified as securities, therefore placing them under the SEC’s purview. Gensler has been critical of the crypto market since joining the SEC, likening the space to the “wild west.” Crypto exchanges have also faced the wrath of Gensler and his colleagues, with Coinbase being singled out in particular. In his eyes, Coinbase meets the requirements of an exchange and therefore should register with the SEC. Coinbase’s independent status currently means that they are not subject to strict disclosure rules as other exchanges.

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

— Written by Brendan Fagan, Intern

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter

Be the first to comment