Wirestock/iStock via Getty Images

Introduction

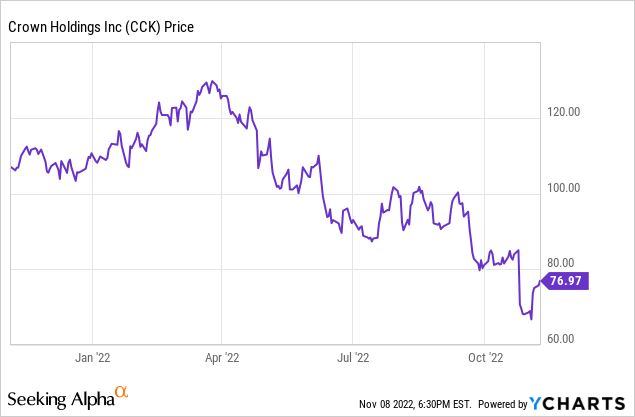

Crown Holdings (NYSE:CCK) saw its share price crumble when it announced its Q3 results and this appeared to be the apotheosis of a share price that had been moving south for quite a while. I was and still am surprised to see how harsh the market is treating Crown. Sure, the results do not live up to the expectations, but as I explained in some previous articles, there’s a difference between the relative performance and the absolute performance. From a relative point of view it’s indeed a bummer Crown Holdings missed the estimates, that’s for sure. But if you take a step back and ignore the white noise, Crown Holdings is actually still pretty attractively priced. I have been following Crown Holdings for a while now, and you can re-read all articles here.

The Q3 results were not as bad as the market reaction made you think it was

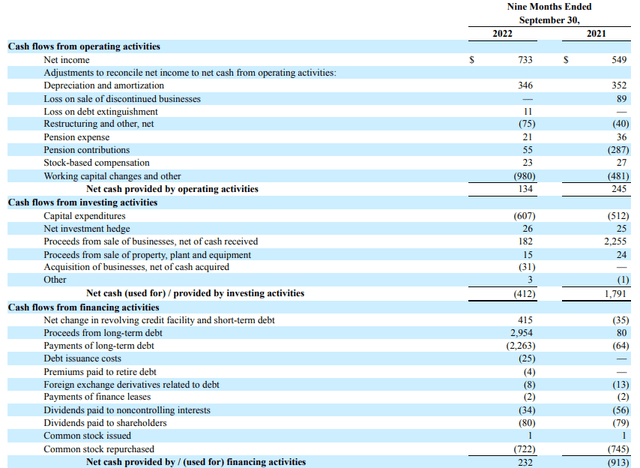

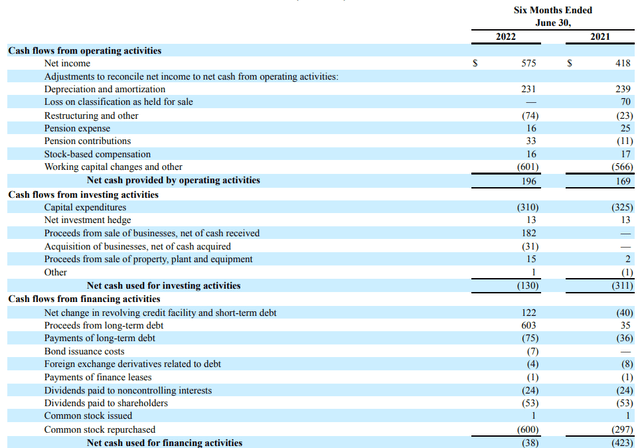

In all my previous articles I discussed and judged Crown Holdings based on its cash flow performance, and there’s no reason why I should use a different approach now. Unfortunately Crown Holdings does not publish a detailed cash flow statement for the third quarter, so the best way to isolate the Q3 results is by comparing the H1 results with the 9M 2022 cash flow statement, which you can find below.

During the first nine months of the current financial year, Crown Holdings reported an operating cash flow of $134M and adjusted for the $980M change in the working capital position and after deducting the payments to non-controlling shareholders ($34M) and the lease payments ($8M), the adjusted operating cash flow was $1.072B. The total capex was approximately $607M, resulting in a free cash flow result of $465M on an underlying basis.

Crown Holdings Investor Relations

I’m not too worried about the working capital investments as this mainly related to a build-up in the inventory levels and the receivables. And as a can is a can, those inventory levels can easily be monetized. That being said, you also don’t want the inventory levels to run up too high but at this point they represent just about two months of revenue so that’s still manageable. And it’s also important to know the inventory levels have slightly decreased compared to the end of June, so I’m not worried at all and the higher value of the inventory levels is also partially caused by the higher sales price per can.

Comparing the 9M 2022 cash flow results with the H1 cash flow results enables us to calculate the operating and free cash flow result in the third quarter of this year. The image below confirms CCK generated an adjusted operating cash flow of $772M with a free cash flow result of approximately $462M.

Crown Holdings Investor Relations

This means the Q3 adjusted operating cash flow was approximately $300M while virtually no free cash flow was generated.

Is that an issue? Yes and no. It’s always important to understand what the capital expenditures are actually being spent on. You’ll see the Q3 capex was almost $300M although the quarterly depreciation and amortization expenses are just $115M. This means the capex was almost three times higher than the depreciation rhythm and that’s obviously caused by the tail end of Crown Holdings’ committed expansion program. The capex program anticipates the opening of six new lines this year, followed by additional production growth coming online in 2023.

Crown Holdings Investor Relations

Based on the results of competitors which do break down the capex in sustaining capex and growth capex, I estimate the sustaining capex to be around 75% of the depreciation expenses, which would be around $85M per quarter. But even if I would increase this to $100M per quarter to account for inflation, it becomes clear Cork’s underlying sustaining free cash flow is still pretty robust. And if the market cannot easily absorb the increased production rate Crown will likely put additional expansion plans on hold until the situation improves. That should enable the reported capex to decrease substantially from 2024 on.

And finally, a very important element here is the fact that Crown cannot just hike prices whenever it wants. It will be able to increase prices to account for inflation, but only from 2023 on. This means Q4 will likely be relatively weak as well but as price increases kick in from next year on, we can likely expect an EBITDA boost of a few hundred million dollar per year and that will compensate for the light results in Q3 (and likely Q4) of this year.

What about Carl Icahn?

Just one week after announcing its Q3 results, Crown Holdings once again made the headlines as activist investor Carl Icahn acquired a stake of in excess of 8% in Crown Holdings. Icahn’s demands are pretty straightforward as he wants Crown to sell non-core assets and buy back its own shares.

Crown Holdings isn’t quite sure how to deal with Icahn and has adopted a shareholder rights plan. This poison pill gets triggered when someone acquires a stake of in excess of 10% in Crown Holdings.

For now, all is quiet in CCK-land but I wouldn’t be surprised if there’s a healthy discussion going on behind the scenes.

Investment thesis

The day the Q3 results were published and CCK dropped below $70/share, I wrote several more put options (with strike prices of $50 and $60 and various expiry dates). It’s now starting to look like all the options will expire out of the money but I will likely continue to write put options as it’s the best way to take advantage of the elevated volatility levels.

While I’m not thrilled by the Q3 performance of Crown Holdings, I refuse to invest in companies on a quarterly basis. I believe in the long-term value in the stock and the sudden slowdown in the demand for aluminum beverage cans will likely bring expansion projects across the world to a halt at least until the market is able to absorb the current production capacity.

Seeing Icahn taking a stake in Crown Holdings was not an important consideration at all, and I haven’t changed anything to my positions. It would be great if his activism could create additional shareholder value but I’m not banking on it at this time. I think Crown will likely post a sustaining free cash flow result of $800-900M for this year and this, in combination with the continuous decrease in the share count will keep the sustaining FCF per share higher than $7. And once it can hike its prices in line with inflation and energy price increases, I wouldn’t be surprised to see $8/share in 2023.

Be the first to comment