dolgachov/iStock via Getty Images

Investment thesis

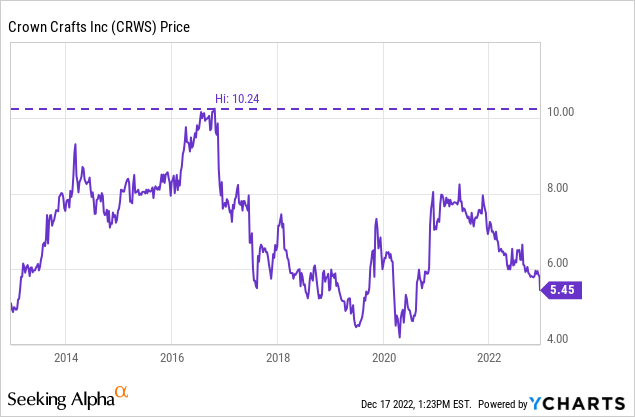

Crown Crafts (NASDAQ:CRWS) is weathering the current inflationary and supply chain pressures with great resilience. Although net sales are declining in fiscal 2023 as a result of higher-than-usual demand during fiscal 2022 due to supply chain issues caused by the reopening of the American economy after the coronavirus pandemic crisis, margins remain very healthy as the company is building up inventories. Still, the share price declined by 46.78% from decade-highs of $10.24. Inflationary pressures, which have actually been stabilizing in recent months, as well as decreasing sales, add to fears of a potential recession as a result of increasing interest rates to contain inflation. Said inflation is making itself felt in the pockets of consumers, which is producing a reduction in their spending on the company’s products as they look for cheaper alternatives.

Despite all this, I believe the the fall in the share price presents an opportunity for dividend investors with a long-term time horizon as the fixed dividend yield increased to 5.87% and the current headwinds are most likely temporary due to its direct link with the current macroeconomic context. Furthermore, cash from operations remains high and the company has no debt and pays special dividends quite regularly while inventories have increased in recent years, which will eventually be transformed into cash from operations in the short to medium term. Nevertheless, no special dividends were declared in 2023, and these could be temporarily paused due to current recessionary risks, which is the temporary pain that investors will have to assume in exchange for the current share price decline, as well as the risk that a confirmed or deeper-than-expected recession will push the share price even lower.

A brief overview of the company

Crown Crafts is a manufacturer of products for infants whose operations are mostly located in the United States. The company operates under two wholly-owned subsidiaries: NoJo Baby & Kids, Inc., and Sassy Baby, Inc., and manufactures bedding and blankets, bibs, soft bath products, disposable products, developmental toys, and accessories for the infant, toddler, and juvenile industries. The company was founded in 1957 and its market cap currently stands at ~$55 million, employing around 126 full-time workers.

Crown Crafts brands (Crowncrafts.com)

Crown Crafts’ products are mainly sold directly to retailers, and the company also supplies private labels. In my opinion, Crown Crafts represents a company that dividend investors can hold for the long term as the management makes very conservative use of the cash generated through operations thanks to special (and thus more flexible) dividends and a debt-free balance sheet.

Currently, shares are trading at $5.45, which represents a 46.78% decline from the spike of $10.24 in October 2016. This decline is due to a series of factors that are linked to the current macroeconomic context. On the one hand, the supply chain issues experienced in 2021 have promoted an inventory accumulation by customers as soon as it was possible in order to prevent said headwind from happening again. On the other, the diminishing purchasing power of consumers as a consequence of inflation, as well as more prudent spending due to growing fears of a potential recession in the coming months or years, are holding back consumer purchases.

But the temporary and particular nature of these headwinds makes me consider Crown Crafts a good bet for the future at the current share price since the potential dividend income is very large due to the current high yield on cost.

Net sales are stabilizing after a post-Covid boost

While it is true that fiscal 2022 was a good year for the company as net sales increased by 10.35% compared to fiscal 2021 after an increase of 7.86% in fiscal 2021 compared to fiscal 2020, net sales have been somewhat stagnant throughout the last decade. The Sassy Baby business segment, which was acquired in August 2017 for $6.5 million, has helped in giving a boost to sales after a first half of the past decade marked by declines.

Crown Crafts net sales (10-K filings)

But it seems that the fiscal 2022 pull as a result of the reopening of the American economy after restrictions imposed to overcome the coronavirus pandemic crisis is beginning to fade. Net sales declined by 16.04% year over year during the first quarter of fiscal 2023, and by 7.39% during the second quarter as the company’s customers have excess inventory because they bought more products than usual during the second half of fiscal 2022 to offset past supply chain issues, which is currently producing lower replenishing orders. The change in consumption habits of consumers, who are opting for products with lower price ranges is also contributing to this decline as inflation is beginning to affect their pockets.

As CEO Olivia Elliott recognized in the last earnings call:

This situation has been exacerbated by a change in consumer buying patterns whereby many consumers are now trading down to lower-priced items, buying fewer items or foregoing some items altogether due to the inflationary concerns.

CEO Olivia Elliott – Q2 2023 Earnings Call

To this, we must add that the company closed its subsidiary Carousel Designs in May 2021, which produced net sales of $4.8 million in fiscal 2020, due to high costs, declining sales, and operating and cash flow losses. This happened after acquiring it for $8.7 million, plus capital leases amounting to $845,000, in August 2017. Since then, the company has continued to focus on its core business as it has recently announced the launch of a line of Made Green toys.

Crown Crafts net sales by operating subsidiary and product category (Crowncrafts.com/investor-relations)

Currently, 51.2% of the company’s net sales are provided by the NoJo Baby & Kids subsidiary, whereas 48.1% are provided by operations in the Sassy Baby subsidiary. Most of the company’s sales take place within the United States as international sales represented only 3% of the total in fiscal 2021 and 4% in fiscal 2022, and this means that the geographical diversification of the company’s operations is very limited and, therefore, is dependent on the evolution of the US economy.

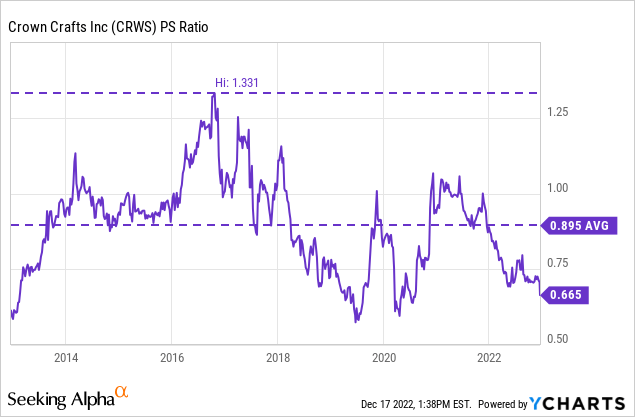

But the decline in the share price since 2016, coupled with rising net sales after that period, has produced a significant drop in the P/S ratio, which currently stands at 0.665.

This means that the company generates annual net sales of $1.47 for each dollar held in shares by investors. In this sense, investors are placing less value on the company’s sales, and this is mainly due to two factors: firstly, sales are expected to slow down as a result of overstocking by customers and prudent purchases by consumers and, secondly, profit margins have suffered in recent quarters as a result of inflationary pressures.

As a consequence, the current P/S ratio is 25.70% lower than the average of the past decade and 50.04% lower than the highest point of 1.331 of the past decade.

Margins are temporarily depressed due to inflationary pressures

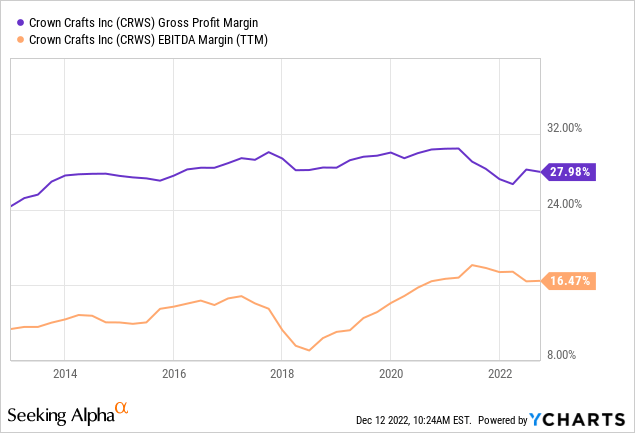

Inflationary pressures are having a significant impact on the company’s profit margins, but despite this, the company remains profitable with a trailing twelve months’ gross profit margin of 27.98% and an EBITDA margin of 16.47% as increasing production costs have partially stabilized in recent months.

Lower marketing and administrative expenses (from 15.6% of net sales during the second quarter of fiscal 2022 to 14.6% during the last quarter) are helping to maintain a more than healthy EBITDA margin, but the gross profit margin continues to be slightly depressed compared to the ~30% enjoyed a year ago.

In this sense, I strongly consider that although profit margins are in a worse situation compared to a year ago, they are still in a healthy range, and it is not so common to find a company with such a low P/S ratio and such healthy profit margins. Furthermore, the balance sheet holds zero debt, which greatly reduces risks for investors.

A safe and juicy dividend awaits long-term investors

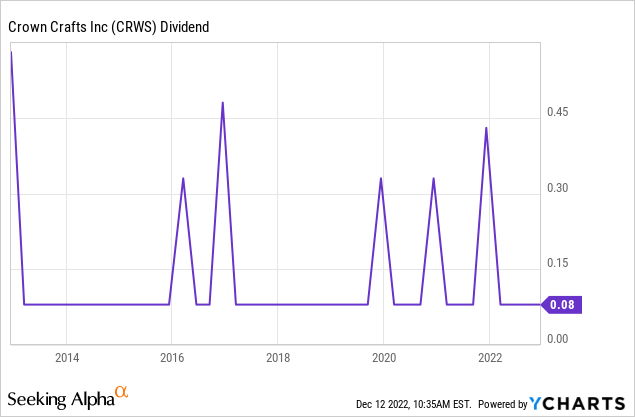

Apart from a fixed dividend, the company declares special dividends from time to time. Its quarterly dividend is fixed at $0.08 per share, and the company recently paid special dividends of $0.35 in fiscal 2022, $0.25 in 2021, $0.25 in 2020, $0.40 in 2017, and $0.25 in 2016. These special dividends have tended to be paid in December.

This means that the company pays a fixed dividend of $0.32 per share, which gives us a dividend yield of 5.87% at current share prices, to which special dividends should be added. Still, the company hasn’t declared any special dividend for fiscal 2023. Crown likely needs to retain cash in its balance sheet due to inflationary pressures and, more importantly, recessionary concerns in the short to medium term, and as an investor, I wouldn’t expect any special dividend payout until said concerns fade, although this is partially offset by the higher fixed dividend yield due to the share price decline. Below is a table with the dividend cash payout ratio of recent years that should help to determine the company’s historical ability to cover its dividends. I have used cash from operations for the calculation because in this way we can do the calculation with cash coming from actual operations.

| Fiscal year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Cash from operations (in millions) | $3.64 | $4.77 | $11.02 | $10.39 | $2.45 | $8.97 | $8.53 | $8.74 | $8.26 |

| Dividends paid (in millions) | $3.15 | $3.21 | $3.21 | $9.72 | $3.22 | $3.23 | $5.79 | $5.01 | $6.72 |

| Cash payout ratio | 86.56% | 67.25% | 29.15% | 93.55% | 131.31% | 35.97% | 67.84% | 57.36% | 81.33% |

As we can see, special dividends have created large variations in the dividend cash payout ratio over the years. This is a reflection of the flexibility that the management enjoys through its dividend policy since the fixed dividend represents a relatively low expense for the company while surpluses are distributed to shareholders through special dividends if applicable.

In short, the dividend cash payout ratio has been sustainable over the years despite special dividends, and despite having exceeded the 100% line in 2018 due to lower-than-usual cash from operations. If the cash from operations suffers significant volatility due to current and/or new headwinds, the management has the ability to regulate the cash payout ratio by adjusting the special dividend or by temporarily stopping from paying it, which increases the safety of the current fixed dividend yield of 5.87%.

But trailing twelve months’ cash from operations of $7.7 million suggest that this will not be necessary if the current headwinds do not intensify or if new headwinds don’t appear in the scene. And even if it happened, that amount of cash is currently enough to cover over two times the company’s annual dividend expenses, so the company can assume falls in cash from operations without compromising its future or the sustainability of the dividend. Furthermore, inventories increased by $3.5 million in the past year and accounts receivable by $0.9 million while accounts payable declined by $0.7 million.

During the last quarter, the company reported cash from operations -$0.8 million, but inventories increased by $1.3 million and accounts payable decreased by $2.7 million while accounts receivable remained flat, which makes me consider that it is still profitable despite the current headwinds.

A debt-free balance sheet places the company in an advantageous position

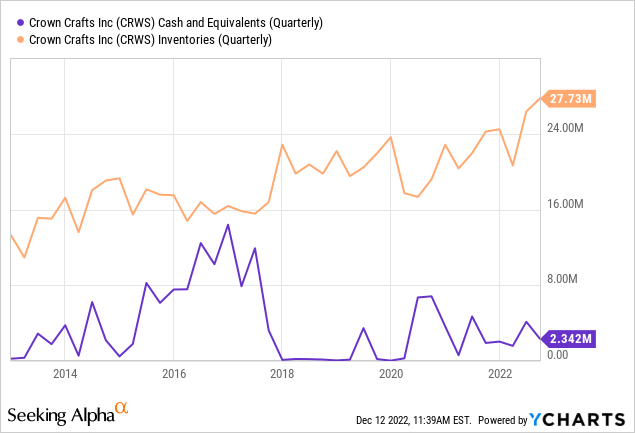

The company currently holds $2.34 million in cash on hand and $27.73 million in inventories and enjoys a debt-free balance sheet, which places it in a position where it does not have to face any interest payment at the end of each period.

Thanks to this, the company can invest all of its profits to expand its operations or distribute them among shareholders in the form of special dividends. Due to unusually high inventories, cash from operations is expected to be high in the coming quarters, which could allow for a new acquisition in order to continue increasing the company’s sales or, if the management fails to find an optimal candidate, more special dividends.

In this sense, the company enjoys enormous room for maneuver despite the current complex macroeconomic landscape, which offers, in my opinion, a lot of security to the current dividend, whose yield on cost has increased to 5.87% as a consequence of the share price decline that has taken place since 2026, which was recently accelerated by current inflationary pressures despite a recovery in late 2020 that continued throughout 2021.

Risks worth mentioning

Although Crown Crafts’ risk profile is greatly reduced thanks to the conservative use of the cash that the management makes and a debt-zero balance sheet, there are three main risks that I would like to comment on as they are very significant.

- In fiscal 2022, 52% of the company’s net sales were provided by Walmart (WMT) stores and 21% from sales from Amazon (AMZN). This means the company’s sales are heavily dependent on Walmart orders and Amazon sales, which is partly out of the control of Crown Crafts’ management. A significant reduction in the sales of one of these two customers would have a direct and significant impact on the company’s sales, which would drag down the company’s profit margins due to a high reduction in volumes.

- The company may need to provide higher-than-normal discounts in order to empty part of its inventories if it needs to make room for new and more updated products, which could translate into even lower profit margins in the short-to-medium term.

- Inflationary pressures could continue to negatively affect the company’s operations, with which profit margins would be affected for longer than expected. On the other hand, the rise in interest rates to contain said inflation could cause a recession, with which the company’s operations could be even more negatively affected than at present.

Conclusion

Crown Crafts has been operating for 65 years and nothing indicates that it will stop doing so in the coming years. Operations have been fairly stable during the coronavirus pandemic in calendar 2020, during the reopening of the economy in calendar 2021, and during the current inflationary pressures and supply chain issues in calendar 2022.

But despite this, the share price has declined by 45.70% since October 2016 driven by a series of quarters that were very negative by then (but temporary) in terms of net sales, the subsequent drop in profit margins partly as a consequence of lower-than-expected profitability in the acquired Carousel Designs subsidiary, and the current inflationary headwinds, and this share price decline has caused the current fixed dividend yield to increase to 5.87%. Furthermore, there is now the fear that a deeper recession than expected could cause profitability issues for the company in the medium term.

Still, I think this represents a good opportunity to acquire shares of the company at current prices as it keeps generating positive cash from operations (despite the -$0.8 million declared in the past quarter, which was offset by increasing inventories and decreasing accounts payable) while inventories keep growing, which suggests that it could continue paying special dividends once current headwinds and recessionary risks fade as it has done during the past decade.

Be the first to comment