Peach_iStock/iStock via Getty Images

CrowdStrike (NASDAQ:CRWD) is the rare tech stock which has not seen its valuation multiples get destroyed amidst the broader weakness in the tech sector. The relative strength is understandable considering investor appetite for cybersecurity stocks, as well as the company’s strong fundamentals. While the stock is not exactly cheap, the clear-cut story and strong profit margins warrant a premium multiple. I expect shareholders to be rewarded by owning CRWD over the long term, albeit at a lower projected return than can be found elsewhere in the tech sector.

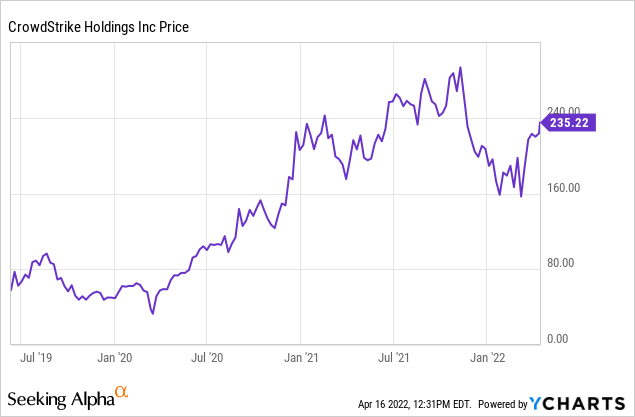

CRWD Stock Price

CRWD initially fell alongside other tech stocks, but has since rallied hard from the lows, likely due to anticipation for increased cybersecurity spending as a result of the Russia-Ukraine war.

Now trading at $235 per share, the stock is 21% lower than all time highs but the valuation multiple remains very rich especially considering the valuation reset that has occurred across the tech sector. I last covered the stock in December when I called the stock a buy on the backs of a strong secular growth story and high profit margins, which was offset by a premium multiple. Those characteristics still apply, and CRWD has since issued long term guidance which may help strengthen the premium multiple. While the valuation does not provide much in terms of a margin of safety, this top tier cybersecurity operator offers one of the lower risk growth stories available in the market today.

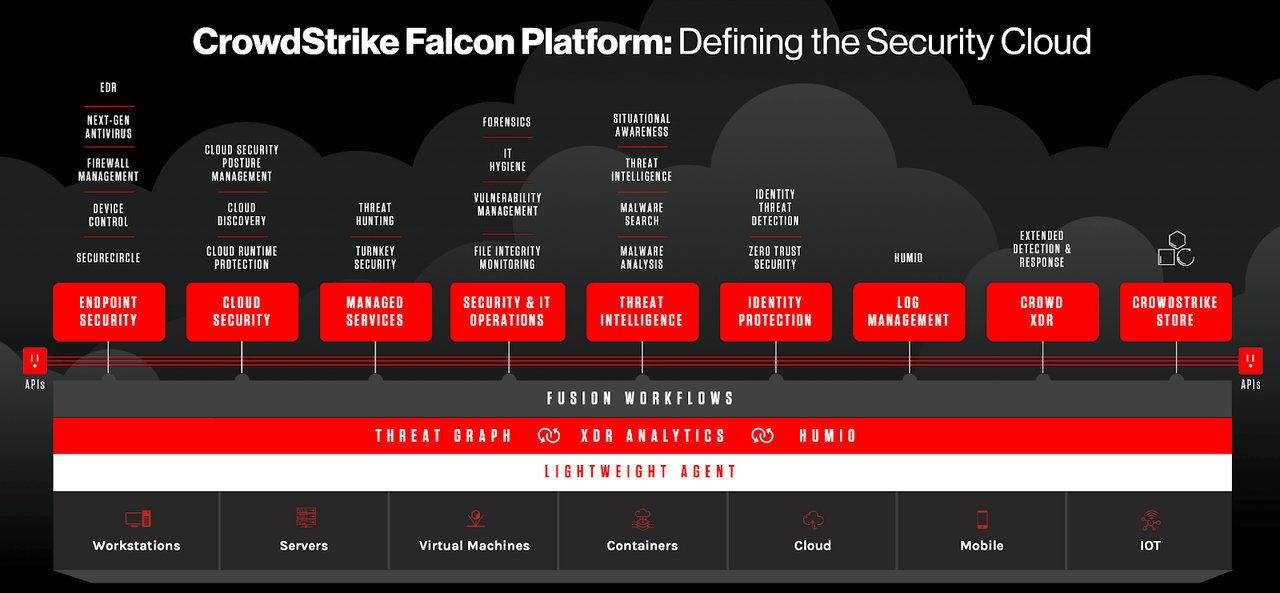

What is CrowdStrike?

CRWD is a cybersecurity company which focuses on securing endpoints. Endpoints are like cell phones, computers, and other devices – CRWD enables its customers to determine which endpoints are safe to access protected data.

CrowdStrike April 2022 Presentation

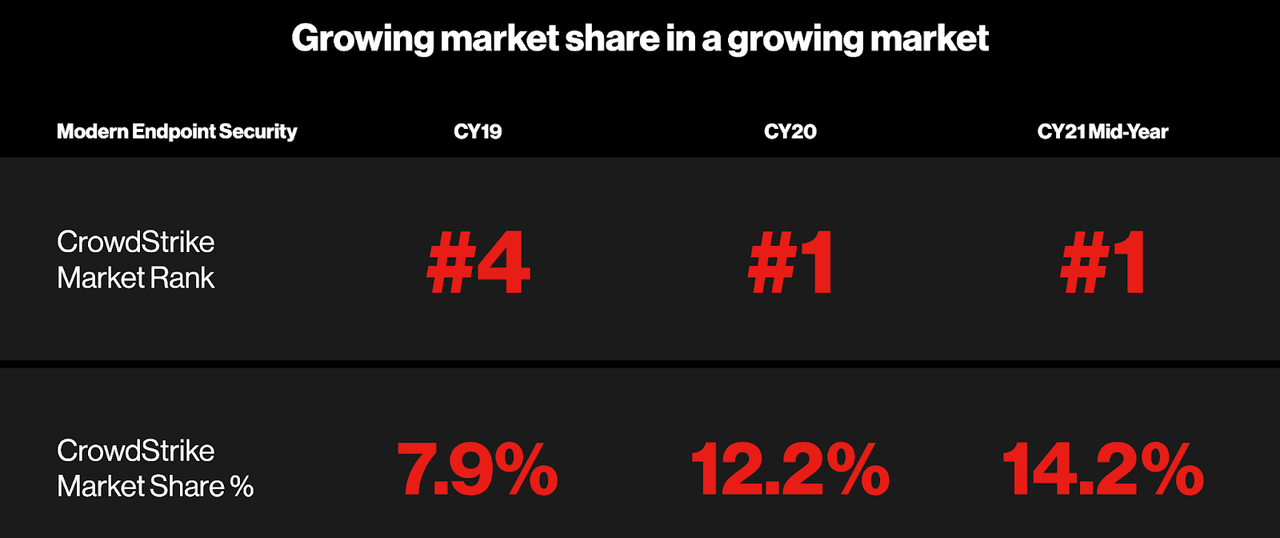

Over the past several years, CRWD has quickly become the market leader in endpoint security.

CrowdStrike April 2022 Presentation

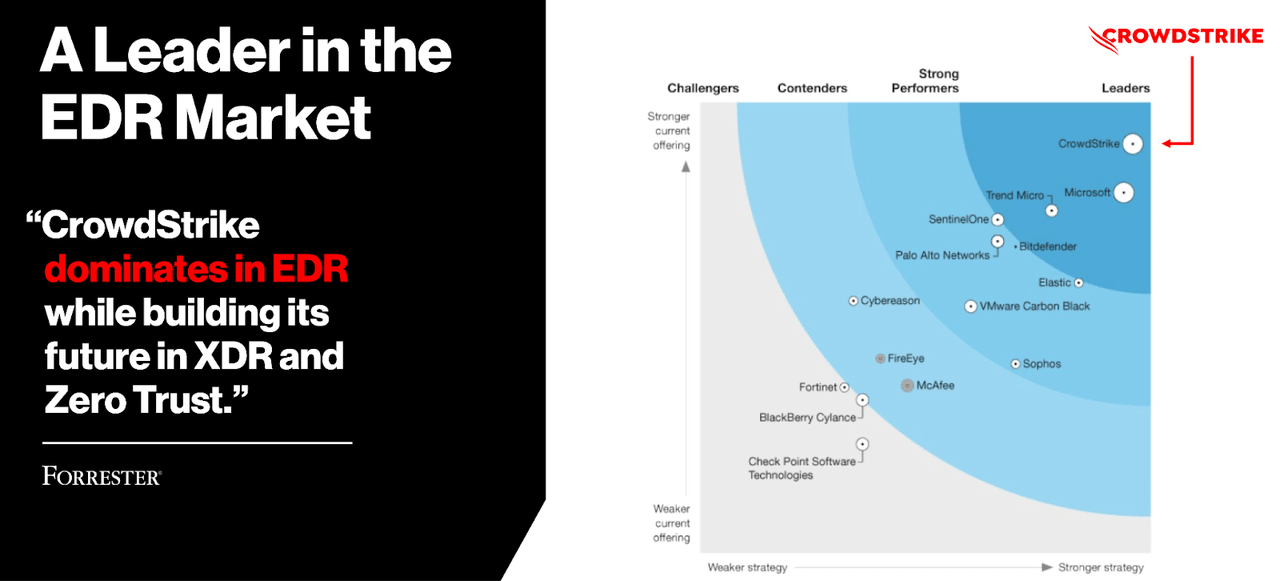

That accomplishment is no surprise considering that CRWD appears to have the best product offering. This is evidenced by the company’s high ranking by Forrester.

CrowdStrike April 2022 Presentation

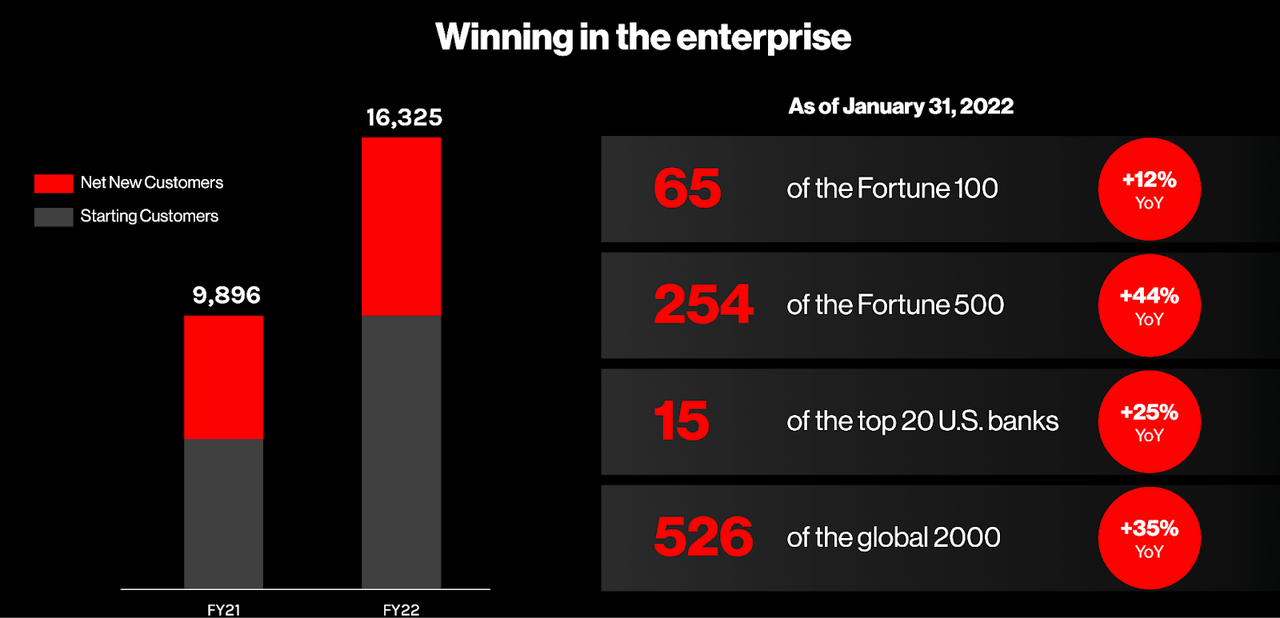

Besides that high ranking, CRWD is now building name brand recognition. The company is winning the business of the largest companies, which in turn should help it win business from smaller companies in the future.

CrowdStrike April 2022 Presentation

CrowdStrike Stock Financials

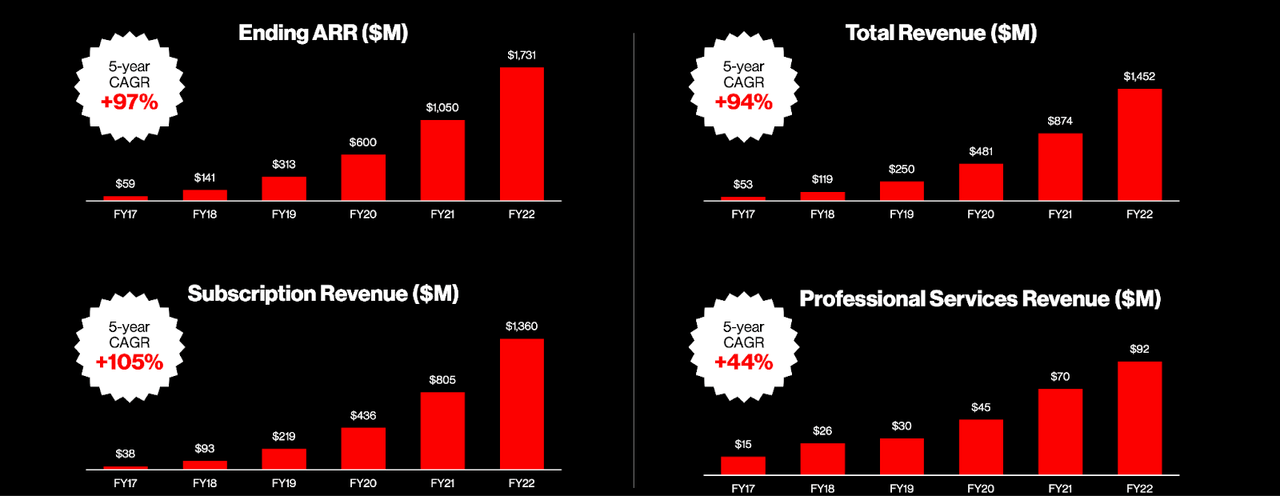

Unlike other tech stocks which saw growth decelerate rapidly in 2021, CRWD was able to grow revenue by 66% last year. Cybersecurity isn’t something that was just a fad during the pandemic.

CrowdStrike April 2022 Presentation

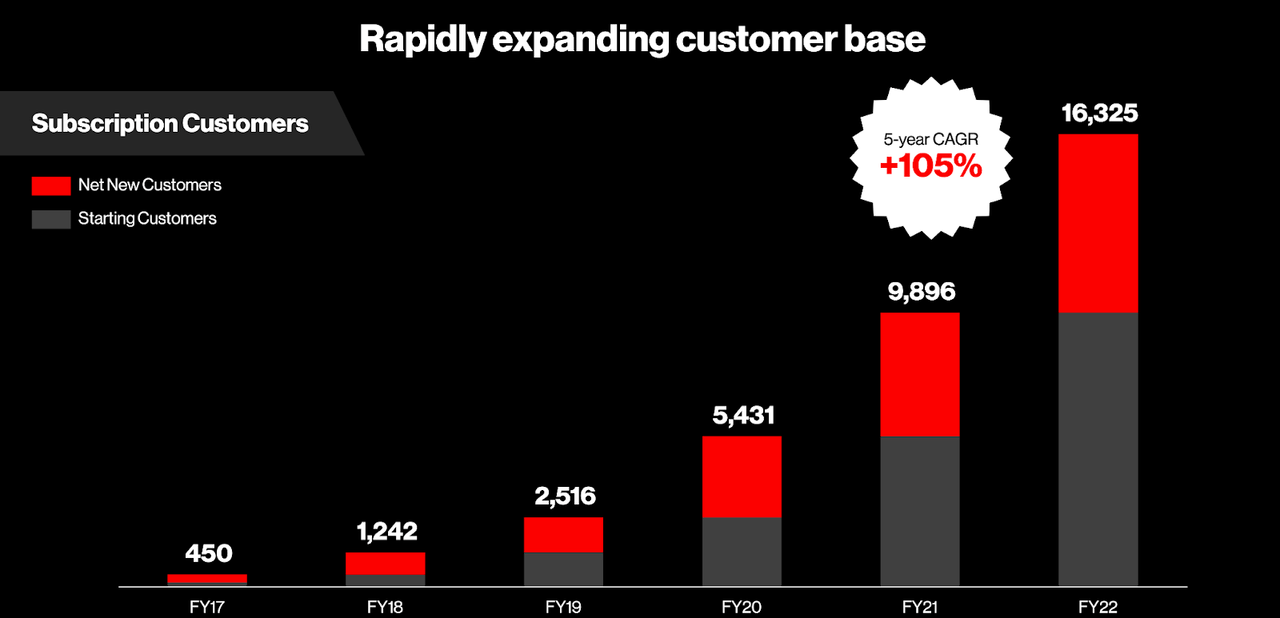

CRWD has achieved the strong growth through two factors, the first being rapidly growing its customer base.

CrowdStrike April 2022 Presentation

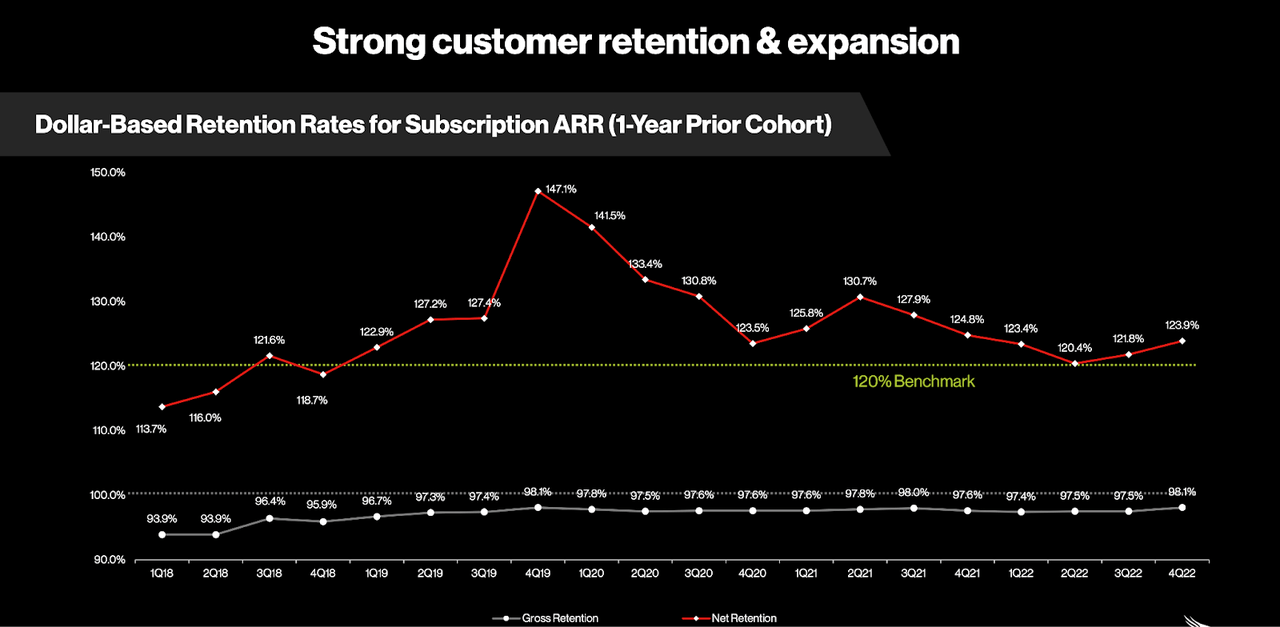

The second factor is through its high dollar-based retention rates, which have remained strong even as the company lapped pandemic comparables.

CrowdStrike April 2022 Presentation

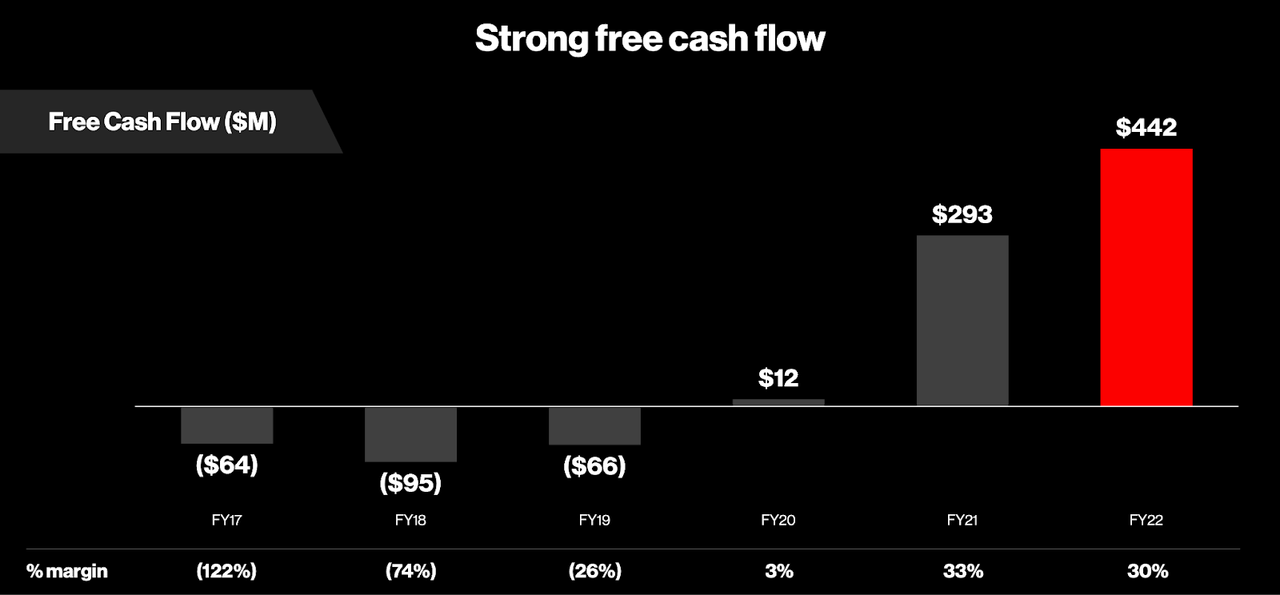

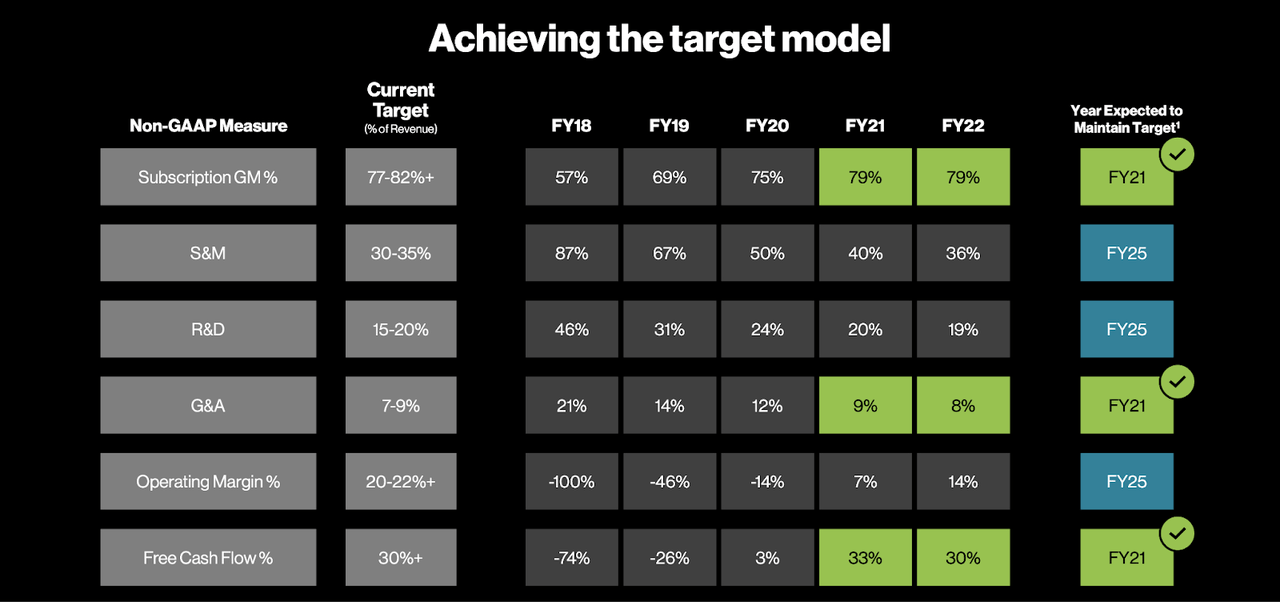

Investors are likely big fans of the 30% free cash flow margin generated by the company.

CrowdStrike April 2022 Presentation

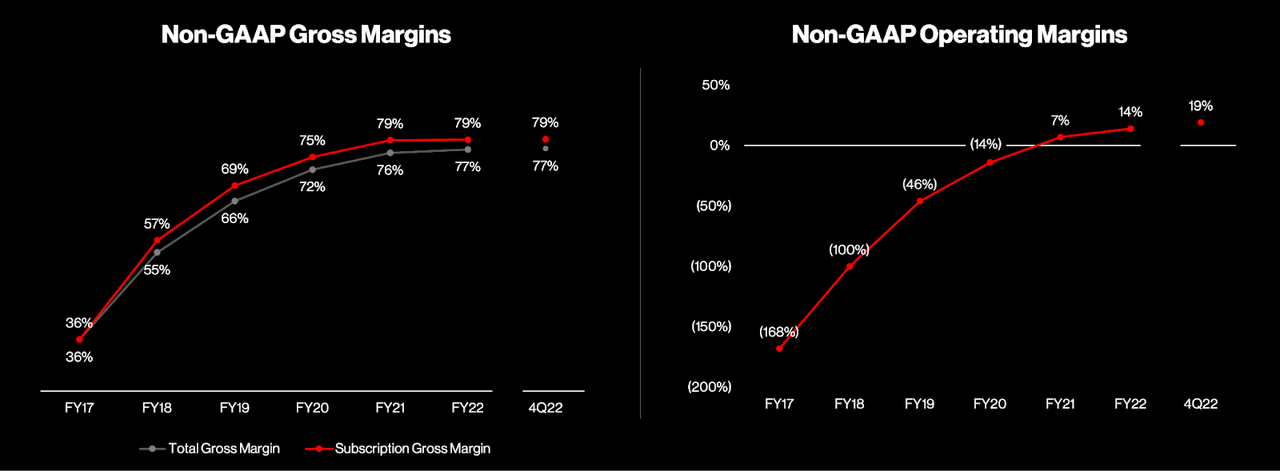

I note that because many of its customers prepay their subscription revenues in advance, this has the effect of boosting free cash flow even if the incoming cash is representative of future earned revenues. Investors may thus wish to focus instead on non-GAAP operating margin, which was still strong at 19% in 2021.

CrowdStrike April 2022 Presentation

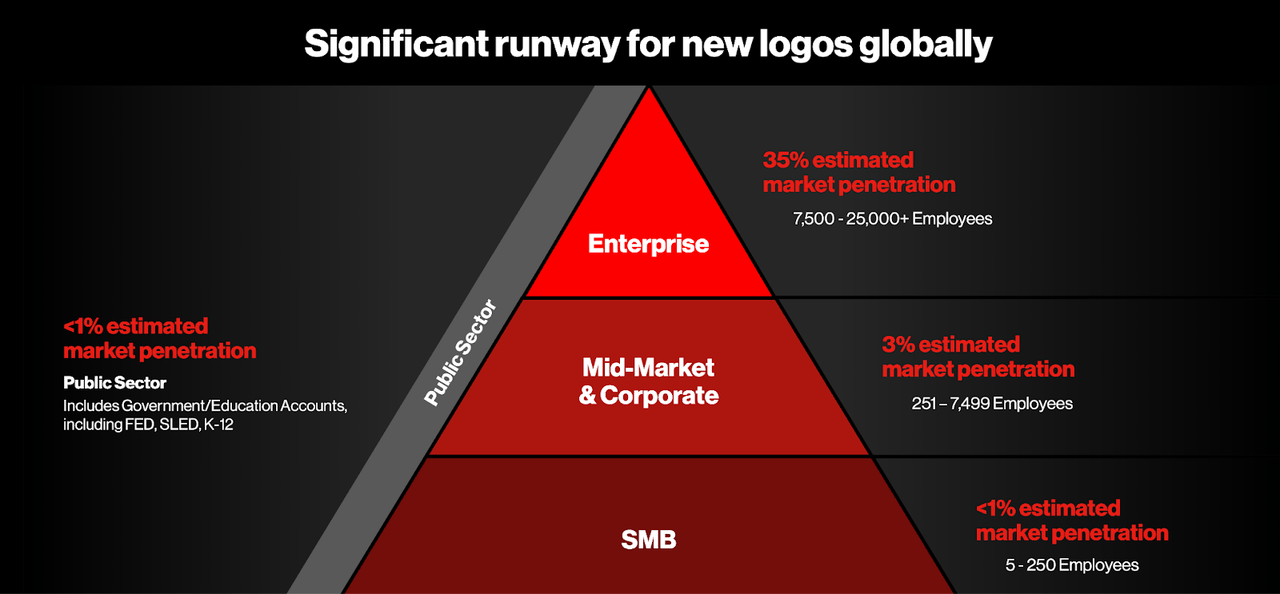

Looking forward, CRWD still has a long growth runway, as market penetration remains very low especially across smaller companies.

CrowdStrike April 2022 Presentation

Cybersecurity is a long term secular growth story – every company will likely eventually need to purchase a cybersecurity product to protect themselves from cyber threats. With CRWD positioned as the clear leader in endpoint security, it has a clearly visible runway to continue growing at rapid rates.

Is CRWD Stock A Buy, Sell, or Hold?

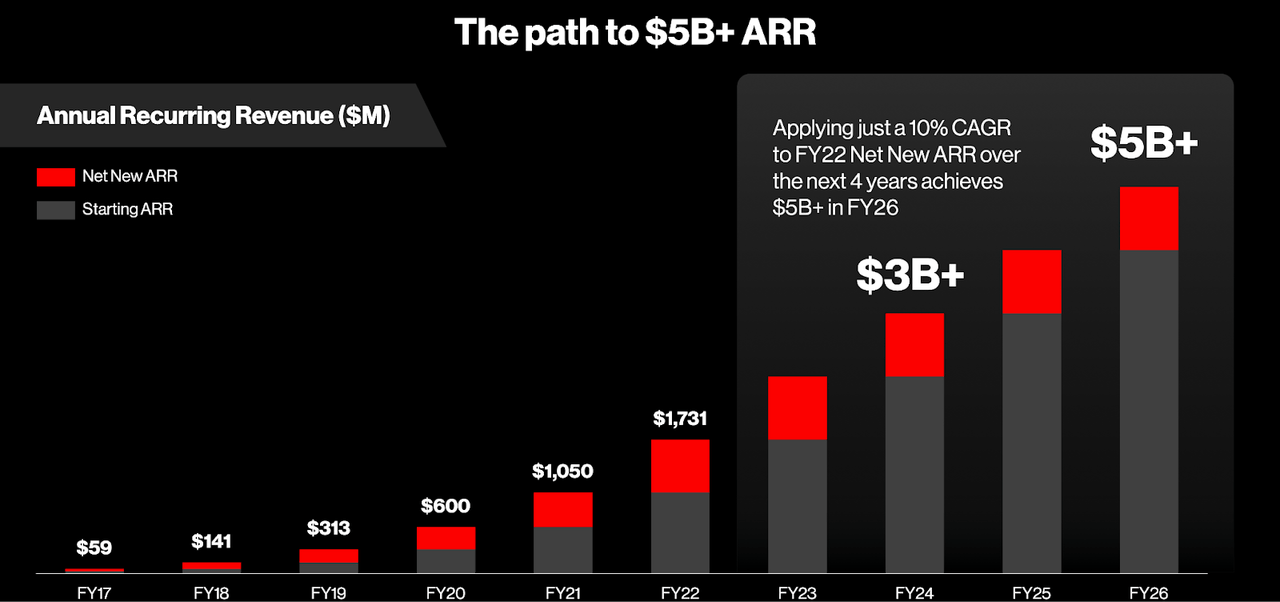

Regarding that runway, management has made it even more clear by giving guidance for at least $5 billion of revenue by 2025.

CrowdStrike April 2022 Presentation

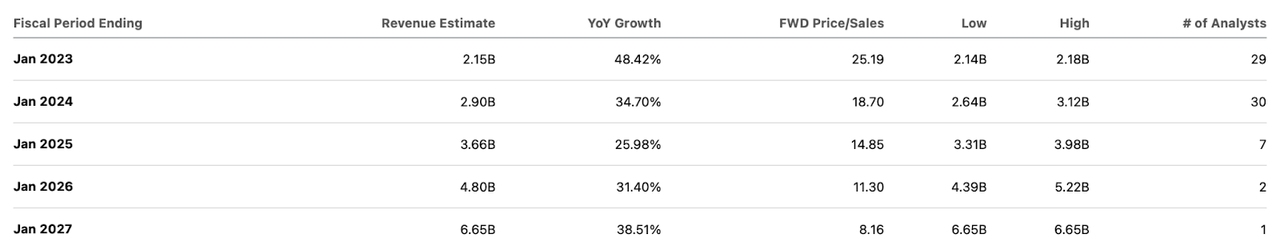

Many tech companies like ServiceNow (NOW) and Snowflake (SNOW) have given this kind of long term guidance, which typically has helped the stocks earn premium multiples – CRWD is no different. Wall Street consensus estimates surprisingly expect CRWD to underperform that guidance, earning only $4.8 billion in revenue in 2025.

Seeking Alpha

Let’s now discuss valuation. CRWD has guided for long term targets of 22% operating margins and 30% free cash flow margins.

CrowdStrike April 2022 Presentation

The company has already achieved 30% free cash flow margins, though much of that is due to prepayment of deferred revenues. I assume the company can achieve 30% long term net margins. I could see the stock sustaining a 2x price to earnings growth ratio (‘PEG ratio’) due to the cybersecurity growth story and the positive cash flow generation. Assuming a 25% exit growth rate in 2025, the stock might trade at 15x sales in January 2026. That reflects a stock price of $312 per share or upside of around 7% annualized. If we instead assume 40% long term net margins, the new target stock price would be 20x sales or $415 per share, representing potential upside of 15% annualized. While the latter assumptions may seem aggressive, I would not be surprised if Wall Street maintains a similar view on the stock considering the high current margins. Given the valuation, the main risk here is if stock sentiment deteriorates and the stock experiences margin compression. In the current environment, I could see the stock trading at a 1x PEG ratio, which would lead to a stock price of $156 per share by 2025, or 34% downside over the next 4 years. That would be a terrible return especially considering that I am using targets 4 years out. Another risk is if the company is unable to sustain its market leadership, which would lead not only to additional multiple compression but also potential inability to hit its growth targets. Based on where the stock price trades at today, I rate the stock a buy largely because of my prediction that management’s 2025 revenue guidance will prove conservative and the stock should be able to sustain its premium multiple.

Be the first to comment