tupungato/iStock Editorial via Getty Images

Investment Thesis

Crocs (NASDAQ:CROX) is a great brand that is continuing to grow in unfavorable market conditions. The company’s profitability is fantastic. Its recent acquisition of HEYDUDE is performing above expectations.

I think that the company is undervalued at the current price. If demand holds strong, I believe that this is a great buying opportunity.

The Growth Story Carries On

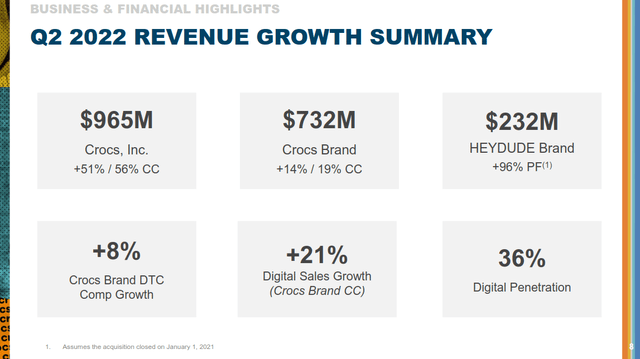

Crocs’s growth has continued to push higher, even in a weakening environment. The Crocs brand reported top line growth of 19% over the last quarter in constant currency. Sales continued to grow even as the broader footwear market stayed stagnant.

Crocs Q2 2022 Investor Presentation

It’s impressive that the company is still reporting strong positive growth. Keep in mind that these results are being compared to a tough quarter. The year ago quarter had a huge 93% year over year increase in revenue. The casual footwear industry was also benefiting from a lot of pandemic tailwinds. Stimulus checks increased consumer spending, and work from home boosted casual clothing options. That’s why it’s promising to see growth continue into 2022 without these structural advantages.

There are obviously a lot of macro concerns in this industry. Management has noted that the consumer is weakening in some areas. Food and energy inflation have slowed consumption. Because of this, the Crocs brand has reduced its short term revenue expectations.

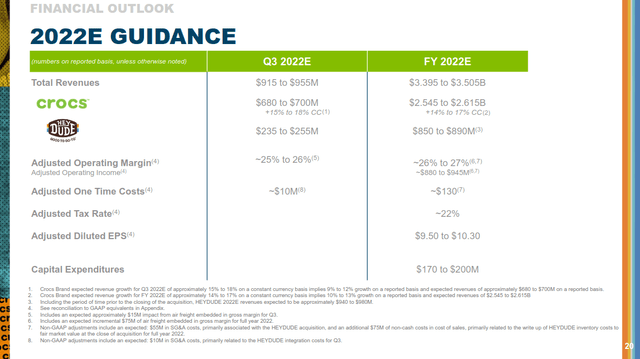

Crocs Q2 2022 Investor Presentation

But even after a minor guidance cut, the company is still calling for 14% to 17% constant currency organic revenue growth this year. This should ease concerns about recent growth being a temporary pandemic trend.

There is still some weakness in some specific areas. For example, management reported a 13% decline in their sandal segment. In the past, they’ve identified the sandal market as a major growth driver. Leadership blamed this on newness issues and a poor sandal season.

Engagement And Profitability Benefits

I’m also very impressed by the margins Crocs is able to generate. The company has consistently reported fantastic gross margins of around 50%. Over the past couple years, operating margins have expanded to around 30%.

I believe that the company is well positioned to deal with margin pressure from shipping costs and inflation. So far, management has been able to offset this inflation with price increases.

The company has also shown the ability to generate high margin incremental growth. Last year, Jibbitz shoe charms started a streak of strong performance. The segment skyrocketed by 150% during the last fiscal year. Management discussed the performance of this segment on their fourth quarter earnings call.

So Jibbitz grew for the full year, 150% or over 150% to 7% of overall sales last year, which obviously is outstanding. And I know you’re all aware, that’s obviously incredibly high-margin category. But probably more important than the margin and even the sales dollars is the consumer engagement that it creates. You see that we use Jibbitz both in our retail stores to create consumer engagement, but also on almost all of our collaborations.

I think this is an underrated part of the bullish thesis. Crocs has a strong brand that allows it to maintain its industry leading margins. Customer loyalty and collaborations are major drivers in the footwear industry. I believe that Crocs is well positioned in these areas. Last year, the company generated almost half of its sales from direct to consumer channels. During the last quarter, management reported a double digit increase in ecommerce retention and acquisition. This reduces dependence on wholesalers and should be a long term tailwind to margins.

HEYDUDE Acquisition Beats Expectations

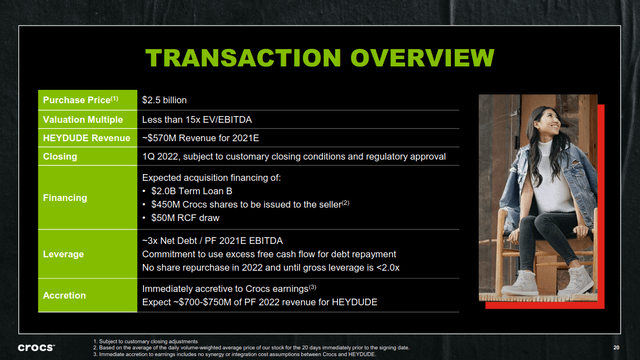

The major unknown in Crocs’s results is its acquisition of HEYDUDE. The $2.5 billion acquisition was a bold move to increase diversification in the casual footwear industry. The acquisition has been a major headwind to Crocs’s valuation.

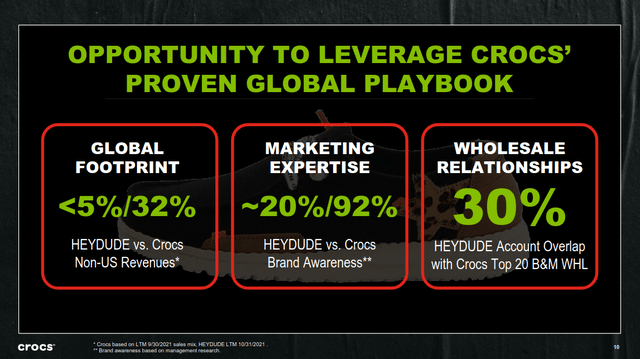

Crocs + HEYDUDE Acquisition Investor Presentation

There have been some concerns that Crocs overpaid for HEYDUDE. The company paid about 4.4 times sales and under 15 times EV/EBITDA. But the acquisition has performed extremely well. During the last quarter, the segment almost doubled revenue year over year. Management raised HEYDUDE revenue guidance even while cutting sales expectations for the Crocs brand.

Crocs + HEYDUDE Acquisition Investor Presentation

I think that there are clear drivers for further growth in this segment. HEYDUDE still has low brand awareness and little international presence. Crocs can provide a significant amount of value in these areas. I think that the company has a great opportunity to scale the brand. On their last earnings call, management provided some details on these growth drivers.

So, I would say, the door expansion opportunity is very substantive for HEYDUDE, not only the door expansion, but the assortment in those doors and the ability to turn quickly. So I think there is lots of runway there. We are taking orders for spring 2023, and hopefully, we will be able to create much more compelling assortments for our major wholesale customers early in 2023, it is really a little bit hand to mouth today…

And really the reason put out there, we just wanted people to understand this is a scale business. This is not a sport business. And we just wanted people to understand that quickly, because clearly when we bought the business, we heard from the analyst and investment community, they didn’t understand what the brand was. And we wanted to understand that this is a scale brand.

The market has not liked the acquisition, but I think it is a good move. Crocs has experience in scaling a brand that can benefit HEYDUDE. This also adds diversification to the combined company’s product lineup. It’s possible that Crocs overpaid initially. But I think the value of the purchase is becoming more and more obvious. It’s likely that the HEYDUDE brand will exit the year with a $1 billion run rate.

There are still some risks here. While the company’s brand has grown well so far, it may struggle to reach a wider audience. There’s also some integration risk. The HEYDUDE brand has been very dependent on its founder in the past. That could also cause some friction as Crocs tries to scale the brand. But I’m still cautiously bullish on the acquisition.

A Cheap Valuation With Declining Leverage

Crocs is now valued at cheap earnings multiples. Shares are trading at a forward P/E of 6.9 times and a forward EV/EBITDA of 7.8 times. I believe that this is cheap for a company with this profile. Its strong brand with consistent growth reduces the risk of this investment.

The company has been doing a fantastic job of allocating capital. Over the past year, the business has gotten a 23% return on invested capital. The company has leveraged this to generate strong shareholder returns. Since 2019, the company has bought back $1.35 billion of its own shares. These are direct shareholder returns of almost 30%.

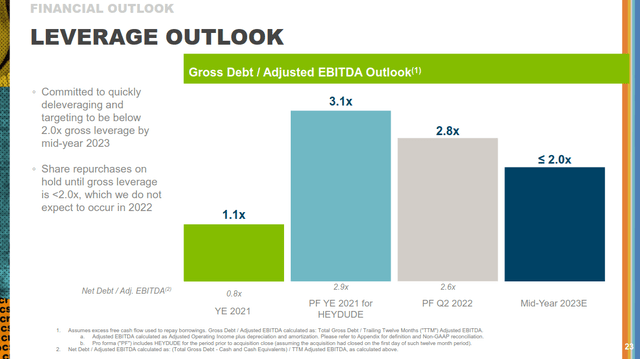

Management has suspended share repurchases for the time being. The acquisition added $2 billion of debt. This pushed debt levels above the company’s leverage target of 2.0 times gross leverage.

Crocs Q2 2022 Investor Presentation

But the company’s leverage is declining. Management predicts that they’ll reduce debt below their target threshold by the middle of next year. This will give the company an opportunity to restart share repurchases. I think the potential return of buybacks will boost the stock as the company gets closer to its target.

As I see it, the greatest risk to this investment is a drop in demand. At the current run rate, the business’s core economics are solid. The acquisition is going well, and the cheap valuation should limit potential downside.

Final Verdict

I think that Crocs is a wonderful brand trading at a cheap valuation. The greatest risk is a severe decline in demand. So far, the brand is not only holding strong but growing. The acquisition is going well, providing a solid boost to earnings and growth.

I think this is a great opportunity to buy shares. Macro headwinds may depress the share price in the near term. But I think that the company is set for long term outperformance.

Be the first to comment